Is this true? I'm not an accountant nor do I play one on TV

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

lafrisbee

Active Member

I am publicly stating, "I will accept a Valantine from Elon On February 14th" ......if he Opens either Gigafactory on that day.

StarFoxisDown!

Well-Known Member

He's leaving out the fact that Tesla paid off debt to the tune of 1.4 billion for Q2, Q3, and Q4. That's roughly 4 billion in debt payoff throughout 2021. That's not going to continue considering the fact that Tesla only has like 1.4 billion of debt left.Is this true? I'm not an accountant nor do I play one on TV

Someone correct me if I'm wrong on how he's estimating FCF there.

Total Debt went from $6.29 billion after Q4 of 2020 to $1.39 billion after Q4 2021

Last edited:

Artful Dodger

"Neko no me"

Man I waited all weekend for this BS stock price movement. Come on go up or down! I got to feed my addiction.

The 2021 Annual report (10-K) has this to say: (selected quote)

The trading price of our common stock is likely to continue to be volatile

- The stock market in general, and the market for technology companies in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

- In particular, a large proportion of our common stock has been historically and may in the future be traded by short sellers which may put pressure on the supply and demand for our common stock, further influencing volatility in its market price.

Cheers!

P.S. Volatility is not Risk.

TheTalkingMule

Distributed Energy Enthusiast

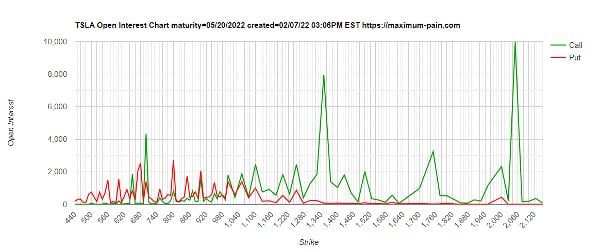

May 20th should be interesting. The highest open interest call is at $2,050. Weird.

UnknownSoldier

Unknown Member

Pretty sure those are LEAPs and they will expire worthless unless something crazy happens between now and May.May 20th should be interesting. The highest open interest call is at $2,050. Weird.

View attachment 766075

Likely a hedge or a spread trade, e.g. ratio spread +4x1350/-5x2050 it looks on this diagram. The remaining short leg potentially covered by shares.May 20th should be interesting. The highest open interest call is at $2,050. Weird.

View attachment 766075

Without having research the price history of this particular strategy:

This ratio spread might have traded at a very low price and might thus provide a very high return if the stock trades higher than $1,350 on May 20. Stockprice doesn't even have to get close to $2,050 for this trade to pay off 2x + if the timing of entry was somewhat opportune

Last edited:

ZeApelido

Active Member

Man I waited all weekend for this BS stock price movement. Come on go up or down! I got to feed my addiction.

Addicted and want to take action when the stock is flat?

If only there were financial instruments and a thread for that...

Wiki - Selling TSLA Options - Be the House

Was looking to open a few more BPSs for Friday, but premiums are terrible. Less than 20% OTM 750/650 is less than 50 cents....

[ducks]

Man I waited all weekend for this BS stock price movement. Come on go up or down! I got to feed my addiction.

Meh. Would've preferred it stayed where it was.

StarFoxisDown!

Well-Known Member

Didn't you hear? The ethical MM's moral conscious decided that TSLA was wildly overvalued at 945 and deserved to be at 907Meh. Would've preferred it stayed where it was.

Spy got rejected at 450 2nd time today which caused a major downward push near the end of the day.Does anyone understand the price action today? Steady slow walk down are they really going to try to get a sub 900 close today?

Low volume. Looking at a -1.8% close. What gives?

StarFoxisDown!

Well-Known Member

That had absolutely zero to do with TSLA's trading today. TSLA had a swing of 4% today............which coincided with a certain videogameSpy got rejected at 450 2nd time today which caused a major downward push near the end of the day.

Max Payne®

Max Payne is a man with nothing to lose in the violent, cold urban night. A fugitive undercover cop framed for murder, hunted by cops and the mob, Max is a man with his back against the wall, fighting a battle he cannot hope to win. Max Payne is a relentless story-driven game about a man on the...

store.playstation.com

(Mods I'll stop now

Knightshade

Well-Known Member

TSLA today pretty clearly was just following the macros... QQQ shows the same dump starting around the same time (insert normal beta disclaimer here)

QQQ, Tsla, Spy (and pretty much most stock) had a dump right when Spy got that hard rejection at 450. Tesla pretty much followed macros after the dump post 940 rejection.That had absolutely zero to do with TSLA's trading today. TSLA had a swing of 4% today............which coincided with a certain videogame

Max Payne®

Max Payne is a man with nothing to lose in the violent, cold urban night. A fugitive undercover cop framed for murder, hunted by cops and the mob, Max is a man with his back against the wall, fighting a battle he cannot hope to win. Max Payne is a relentless story-driven game about a man on the...store.playstation.com

(Mods I'll stop now)

StarFoxisDown!

Well-Known Member

A stock's trading action can mimic the QQQ's and not mimic it at the same time.QQQ, Tsla, Spy (and pretty much most stock) had a dump right when Spy got that hard rejection at 450. Tesla pretty much followed macros after the dump post 940 rejection.

Not sure why this is even a discussion. It's been shown time and time again that MM's drive the stock down harder when the macro's, including the QQQ, drop and then cap on the way up. On the surface it looks like TSLA follows the QQQ's, but when you look the percentages, it's being amplified on the way down with little recovery.

Sure, you however are explaining the rise (or lack there of). I was explaining the drop...like what triggered a sharp macro retracement.A stock's trading action can mimic the QQQ's and not mimic it at the same time.

Not sure why this is even a discussion. It's been shown time and time again that MM's drive the stock down harder when the macro's, including the QQQ, drop and then cap on the way up. On the surface it looks like TSLA follows the QQQ's, but when you look the percentages, it's being amplified on the way down with little recovery.

TheTalkingMule

Distributed Energy Enthusiast

Looked to me like TSLA shot up above max pain and was brought back down via MM's MMD, then QQQ all got pushed down in the last 30 minutes.

I still say there's a big bull/bear QQQ battle going on. TSLA China deliveries should be out this week. Nvidia earnings next Wednesday!

I still say there's a big bull/bear QQQ battle going on. TSLA China deliveries should be out this week. Nvidia earnings next Wednesday!

StarFoxisDown!

Well-Known Member

Yeah sorry, I misinterpreted what you were saying in the wrong way in the cause of the macro movements.Sure, you however are explaining the rise (or lack there of). I was explaining the drop...like what triggered a sharp macro retracement.

Looked to me like TSLA shot up above max pain and was brought back down via MM's MMD, then QQQ all got pushed down in the last 30 minutes.

I still say there's a big bull/bear QQQ battle going on. TSLA China deliveries should be out this week. Nvidia earnings next Wednesday!

A lot of the macro movement today and probably Tues/Wed is jockeying for position in front of the inflation number that comes out this week which will have a significant impact on what the market overall does going forward

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M