Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TheTalkingMule

Distributed Energy Enthusiast

This has been talked to death here for months. These "environmental" delays are entirely rooted in protecting legacy domestic carmakers and to a lesser degree ICE manufacturing in general since it requires more workers per vehicle produced.Hypocrisy knows no bounds. One reason why construction of anything is slow is Green Party supported policies of over regulation. But when those same policies slow down their pet projects, well then, they must be set aside.

Regulation for thee, but not for me.

StarFoxisDown!

Well-Known Member

Haha I have no issue with being wrong but my pessimism is rooted in the fact that the stock is facing 3 significant headwinds this week -You were saying....

- 200 Day average at 842

- Max Pain is at 840 (very much think the first hour or so of trading was an attempt as capping for max pain

- Downard trend line (at about 855 today) that have acted as capping (and thus a drop after hitting that trend line) for weeks now.

I think everyone and their mom knows that if TSLA can break above that trend line, then it's confirmation a bull reversal and new uptrend. So I expect that trend line to be fought with fierce resistance. It's nice to see the stock at 857 right now......but it's not encouraging that it needed a 3.2% up Nasdaq day to do it.

If the macro's pull back some and TSLA still holds above 850, I would be super impressed.

Last edited:

That was my assumption until recently. The war might be a positive catalyst and bring that forward though. On the other hand I've gone from almost zero recession concern, to a slight concern.The longer term pattern is TSLA hovers around a price for months, before jumping 2x later in the year. Like last year where it hovered in the 600s for awhile before doubling, which surpassed the previous ATH by 30%+and doubling.

No guarantee that history repeats itself, but that’s where I’m putting a good chunk of my money.

on 3/22, deliveries to employees only? or general public?

lafrisbee

Active Member

This is good for TSLA long term.

B

betstarship

Guest

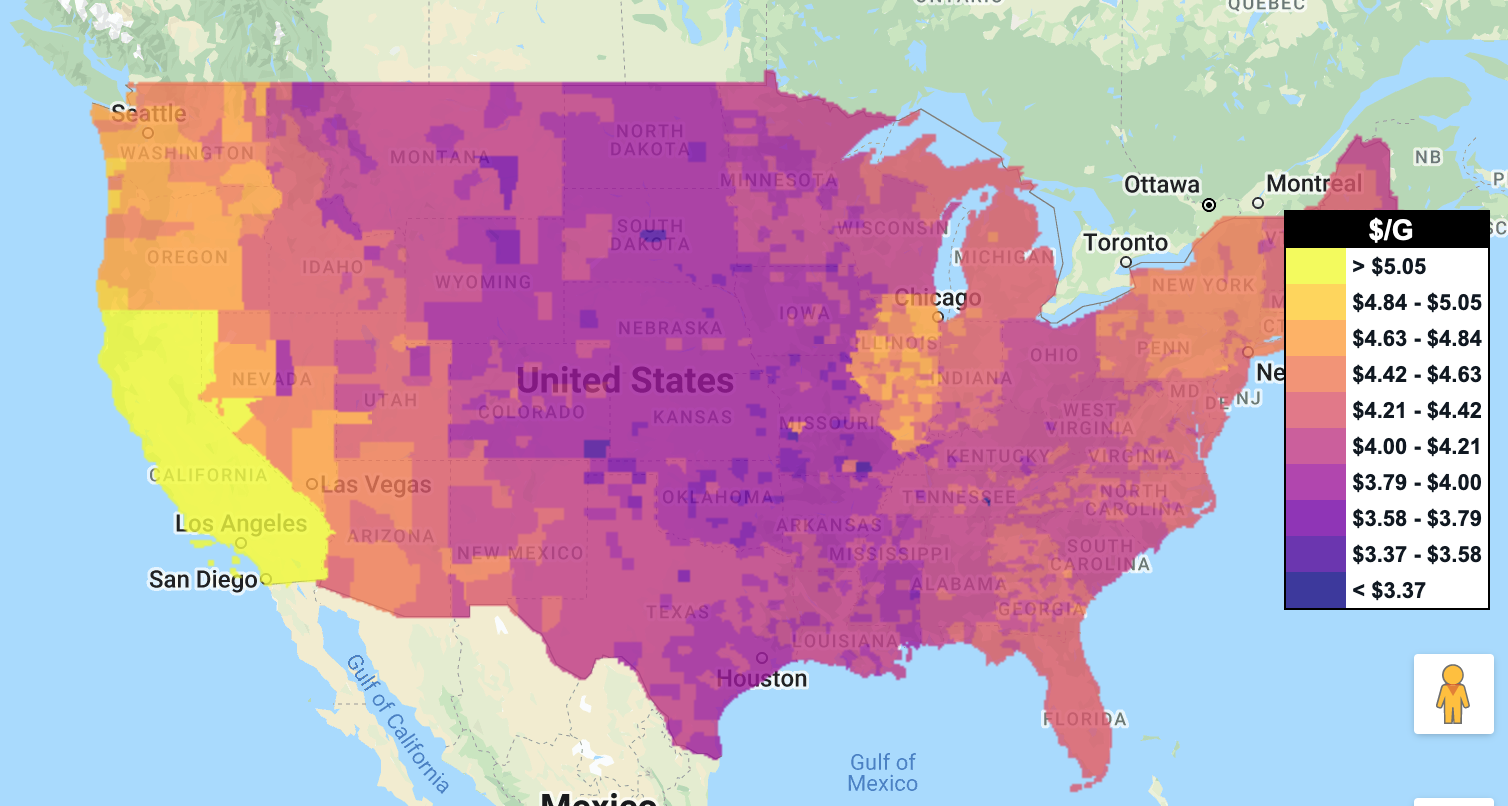

Which state has the highest penetration of EV's in the United States?

Edit: EV Registration data available here.

Edit: EV Registration data available here.

Last edited by a moderator:

Everything is a headwind for Gordo....even passing gas when its windy outside....Oh, but they have...

Those Soaring Prices for Nickel Are a Bane for EV Makers

For Tesla and other electric-vehicle makers, higher oil prices are a boon. Higher prices for nickel and other metals are a bane.www.barrons.com

Here's the quote :

Metals inflation has added roughly $2,000 to the average price of an EV so far in 2022, according to Barron’s calculations. GLJ analyst Gordon Johnson tried to quantify the hit to EV margin, writing Tuesday that nickel prices alone could be a 2% headwind to Tesla gross profit margins. Johnson told Barron’s his math is based on spot prices.

Careful. Thor got his ass kicked a few minutes later…This is good for TSLA long term.

Krugerrand

Meow

No.You don't think it's relevant when rising SP magically snap back to max pain? On a macro up day like today it can be a good moneymaker for investors who day trade.

Identify that pullback and you got yourself a quick free 1.5%. Not that I'm doing it, but it's worth identifying.

Not as relevant as ranting about the roots of German bureaucracy, but it's relevant!

Putting energy into trying to discern the illogical, unreasonable, senseless, irrational lies of the SP at any given moment with intention to financially benefit, and thus in a way support those lies, to me is kind of being ‘one of them’.

I choose the high road; buy and hold. They aren’t making money from me playing (and failing) at their cheat. Additionally, I’m not supporting the continuation of the game by participating.

Unlike you, I don’t find it a problem when topics stray. I have two working thumbs that are expert scrollers. I’ve utilized them dozens of times scrolling past your many complaint posts that to date haven’t seemed to affect any change here. Your persistence can generally be seen as a positive trait, though, so carry on with the mission.

Your first word in your response would have summed it up just fineNo.

Putting energy into trying to discern the illogical, unreasonable, senseless, irrational lies of the SP at any given moment with intention to financially benefit, and thus in a way support those lies, to me is kind of being ‘one of them’.

I choose the high road; buy and hold. They aren’t making money from me playing (and failing) at their cheat. Additionally, I’m not supporting the continuation of the game by participating.

Unlike you, I don’t find it a problem when topics stray. I have two working thumbs that are expert scrollers. I’ve utilized them dozens of times scrolling past your many complaint posts that to date haven’t seemed to affect any change here. Your persistence can generally be seen as a positive trait, though, so carry on with the mission.

insaneoctane

Well-Known Member

Many stocks up ATM. Several of the ones I watch up even 9%-10%....but vast majority with average or weaker volume.

henchman24

Active Member

I'm just being cheeky.Haha I have no issue with being wrong but my pessimism is rooted in the fact that the stock is facing 3 significant headwinds this week -

- 200 Day average at 842

- Max Pain is at 840 (very much think the first hour or so of trading was an attempt as capping for max pain

- Downard trend line (at about 855 today) that have acted as capping (and thus a drop after hitting that trend line) for weeks now.

I think everyone and their mom knows that if TSLA can break above that trend line, then it's confirmation a bull reversal and new uptrend. So I expect that trend line to be fought with fierce resistance. It's nice to see the stock at 857 right now......but it's not encouraging that it needed a 3.2% up Nasdaq day to do it.

If the macro's pull back some and TSLA still holds above 850, I would be super impressed.

Frankly, the headwinds in the macro environment are controlling everything. Any of these charts and numbers would be thrown aside in a millisecond if Ukraine and Russia came to a ceasefire. For the last couple weeks, we see Tesla holding up better than most of the market. We see Tesla having slight green times when the market is weak. We see Tesla up ~3% compared to ~2% for SPY today. Tesla is right with the other megacaps getting ready to lead the rally whenever it happens. Whatever the 200 ma is when Ukraine/Russia come to an agreement (which I think will happen sooner than people think), will be completely irrelevant. Same with the max pain. The existential risk is too strong right now, and complicated further when we have Fed decisions coming soon.

B

betstarship

Guest

I'm just being cheeky.

Frankly, the headwinds in the macro environment are controlling everything. Any of these charts and numbers would be thrown aside in a millisecond if Ukraine and Russia came to a ceasefire. For the last couple weeks, we see Tesla holding up better than most of the market. We see Tesla having slight green times when the market is weak. We see Tesla up ~3% compared to ~2% for SPY today. Tesla is right with the other megacaps getting ready to lead the rally whenever it happens. Whatever the 200 ma is when Ukraine/Russia come to an agreement (which I think will happen sooner than people think), will be completely irrelevant. Same with the max pain. The existential risk is too strong right now, and complicated further when we have Fed decisions coming soon.

The counter example that fits your thesis includes Nuclear war too...

StarFoxisDown!

Well-Known Member

Very aware of TSLA's past trending patterns.The longer term pattern is TSLA hovers around a price for months, before jumping 2x later in the year. Like last year where it hovered in the 600s for awhile before doubling, which surpassed the previous ATH by 30%+and doubling.

No guarantee that history repeats itself, but that’s where I’m putting a good chunk of my money.

Even though I might be on the bearish side short term, I'm very confident about where TSLA will be in 6 months. I do not think we get a repeat of 2021 where the stock peaked in the first month and then didn't get back up to that level again until Nov.

I did some analysis on Apple back in the financial crisis where its share price got cut in half and it only took a year for Apple's share price to recover to where it was before the crash. And once it recovered, it went up and up. Now when I go and look at Apple's revenue and net income/earnings from 2009 to 2011, you can see the effects that the Iphone and it's growth started to have on Apple's revenue/profits. That's when the stock started to take off again..........even in the face of the worse recession the world had seen in decades.

Tesla is ahead of where Apple was in terms of revenue, profits, and margins. Remember it took time, just like it's taken Tesla, to ramp margins on it's hardware (software wasn't any part of Apple's business back then, not even the App Store). Tesla's net income growth last year and this year and in 2023 will dwarf the rate of growth Apple experienced from 2009 to 2011. During that period of 2009-2011( not from the low of 2009 but from the previous high before the crash), Apple's share price doubled. Apple's net income almost tripled from 2009 to 2011. Tesla's net income will triple this year alone.

Now some people will say "But Apple had a low P/E ratio"......but that's explained by the fact that Apple already had a part of the company that was generating profits/revenue.......it was just a stagnate part of the company, Apple's legacy business. It wasn't like Apple was ramping the Iphone with no other business revenue which is why Apple's growth rate of revenue and earnings didn't really take off. Anytime you have a business with a large legacy component to it, you're going to see a distortion in P/E relative to the future. Microsoft is a perfect example of that. The Window business was stagenat and actually dropping, but it was such a large part of Microsoft's revenue/earnings that it took many year for Azure/Office to overtake it. Once they did, Microsoft's P/E tripled

If you think we're entering another financial crisis, then sure it might take a whole year for TSLA to get back up to 1200. But I personally do not think the dynamics at play today are anything like the financial crisis. Might be a bit of a recession, but even in that scenario, the cause of the recession strengthens TSLA's business and demand

Last edited:

henchman24

Active Member

If nuclear war breaks out... I think we will have much larger issues than what the Tesla stock price is doing.The counter example that fits your thesis includes Nuclear war too...

Krugerrand

Meow

I’ll confirm that later today during my video chat with Mom. She’s been ‘mum’ on TSLA lately. Could be my stern talking to she got last time -I think everyone and their mom knows…

StarFoxisDown!

Well-Known Member

So every auto stock.....ICE and EV, is up more than TSLA........right

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K