Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ZachF

Active Member

ICE, EV or both?

The overall market could drop pretty substantially, but since EVs are now in the steep part of their S curve even with a substantial drop in auto demand EV demand will still grow fast… so any pain in China will be felt in the ICE sector.

@ElectromanIt appears that AXPW has been delisted? Wow how much our dear friend, JP lose?

AXPWQ is still listed, or at least you can get a quote $0.005, with an avg vol of 55,000 !! (which doesn't seem to change)

(SA lets you keep a portfolio list they update, data may be a bit stale)

last time i looked a number of years back, i found ~$186?/share, with an exponential declining graph down to way below 1 cent, and i remember at least 3 reverse splits, 1:35 and 1:50 when i look, there seems to be incomplete data since I only find 2 splits

when you multiply those together is eyepopping 1:1,750.

(18,600 pennies for far less than 1 penny)

(Its always illuminating as an intellectual exercise in why you should HODL, (weep) to multiply todays stock price by number of splits)

TSLA 5:1 actual value ~$4,500/share

AAPL 224:1 actual value ~$39,000/share

AOL 128:1 long gone

CSCO 288:1 actual value ~$14,000/share

MSFT 288:1 actual value ~$84,000/share

IOM 3:1, 2:1 2:1 big oopsie, ouchie then reverse split 1:5, a combined 12:1 became 2.4:1

(Iomega was fun, watched in 'real time' it spike from $20 to $100 and sold as it passed ~$60 downwards at brokerage office, microseconds mattered)

AXPW Stock Split History

A stock split history for AXPW and split-adjusted CAGR.

Nah... Wall Street will compare costs of the status quo human with the Robot capital up-front costs + learning time + energy + maintenance... to prove that humans are better, faster, cheaper. They'll be correct, at first. Until someday when we think of a Robot in terms of when it works off it's cost and it's labor becomes free. So Return on Investment becomes job dependent. Bigger brain, more batteries, more learning data to process, more accessories - it all better be worth the task assigned or it's like overpaying the Robot. So then classes of Robots? Oh boy...My best hope is that what we see on AI Day or soon after is impressive enough for Wall Street and others to see some potential. I doubt the bot makes any profit for at least 5 years.

By potential I don’t mean excited, but no longer treating it as a joke. This applies to recruiting as well.I think AI Day is still about recruiting.

I seriously doubt Wall Street is going to understand a fraction of what happens at AI day. There will be all kinds of bizarro explainer articles that talk about how far ahead or behind Tesla “actually” is after the fact and they will largely miss the mark.

It’s possible there will be some FSD or HW4 news that gets Wall Street excited, but it’s way too early for investors to get super excited about Optimus as anything but a wildcard.

WADan

Member

Does Fox broadcast news? More like fake news!I really dont take much into account when it comes to ratings any more. Fox is so skewed towards much older demographic so far fewer watch via streaming. I watch a good deal of the shows in snippets on YouTube as does my family. None of us watch when broadcast.

Whole Mars Catalog exposing Dan O'Clown conflict of interest in attacking Tesla FSD, and reporting on the fatal accident caused by Green Hill's ADAS system.

But...but..."I own 3 teslas..." so that makes it ok for me to expose them...

Whole Mars Catalog exposing Dan O'Clown conflict of interest in attacking Tesla FSD, and reporting on the fatal accident caused by Green Hill's ADAS system.

Captkerosene

Member

My calculation of Tesla's costs for a Bot is as follows:Nah... Wall Street will compare costs of the status quo human with the Robot capital up-front costs + learning time + energy + maintenance... to prove that humans are better, faster, cheaper. They'll be correct, at first. Until someday when we think of a Robot in terms of when it works off it's cost and it's labor becomes free. So Return on Investment becomes job dependent. Bigger brain, more batteries, more learning data to process, more accessories - it all better be worth the task assigned or it's like overpaying the Robot. So then classes of Robots? Oh boy...

Production cost: $20,000.

Amortized over 5 years. Annual depreciation: $4,000.

Operational costs: $1/hour. (electricity, MX, degreaser

Average use: 12 hours/day. 50 weeks per year. 4,200 hours per year.

That results in an all-in cost of $1.95/hr.

There are 36,000 McDonalds restaurants in the world. If we put 1 bot in each and charged $12/hour for a fry cook, that's a profit of $42,000/year for each restaurant or $1.5 Billion total. Just for one position at one fast food franchise.

I think being a fry cook at McD's is far easier than being a chauffeur in Manhattan. Maybe 20X easier? Vector space worries, labeling, edge cases and kids dressed as orange cones on Halloween issues all go away.

Bot started as Plan B but is quickly becoming Plan A.

Last edited:

MC3OZ

Active Member

I like your numbers but...Average use: 12 hours/day. 50 weeks per year. 4,200 hours per year.

How are bots going to spend their 2 week vacation?

willow_hiller

Well-Known Member

Surprised to find a relatively objective NYT article about Tesla, Autopilot, and data collection for safety. It even exhibits a collision that happened while a car was on Autopilot (with a neat scrolling visualization), but it's pretty clear that AP wasn't at fault:

www.nytimes.com

www.nytimes.com

Can Tesla Data Help Us Understand Car Crashes? (Published 2022)

Data and video recorded by Tesla and other automakers to hone driver-assistance systems can also be an investigative tool for regulators and lawyers.

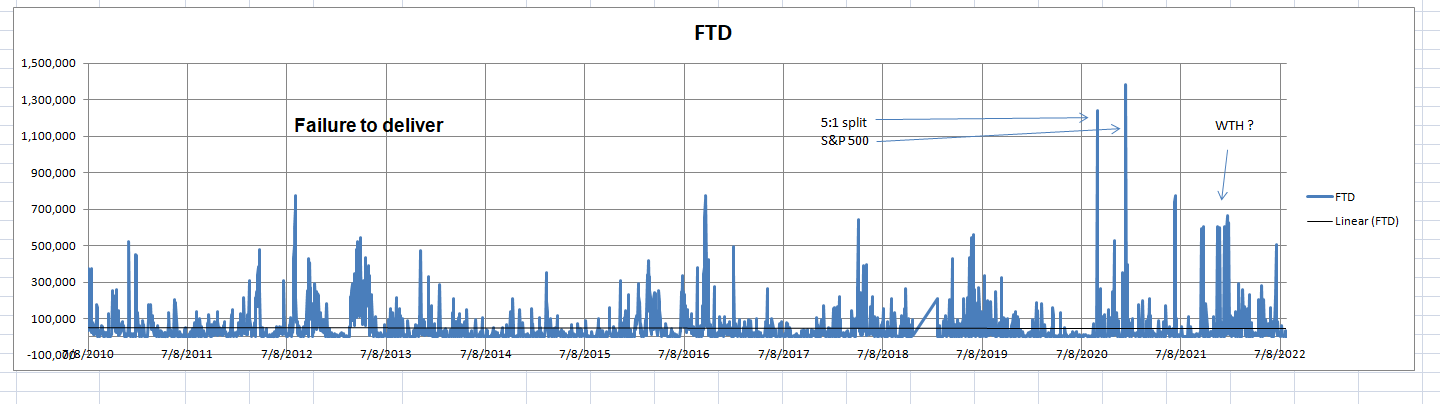

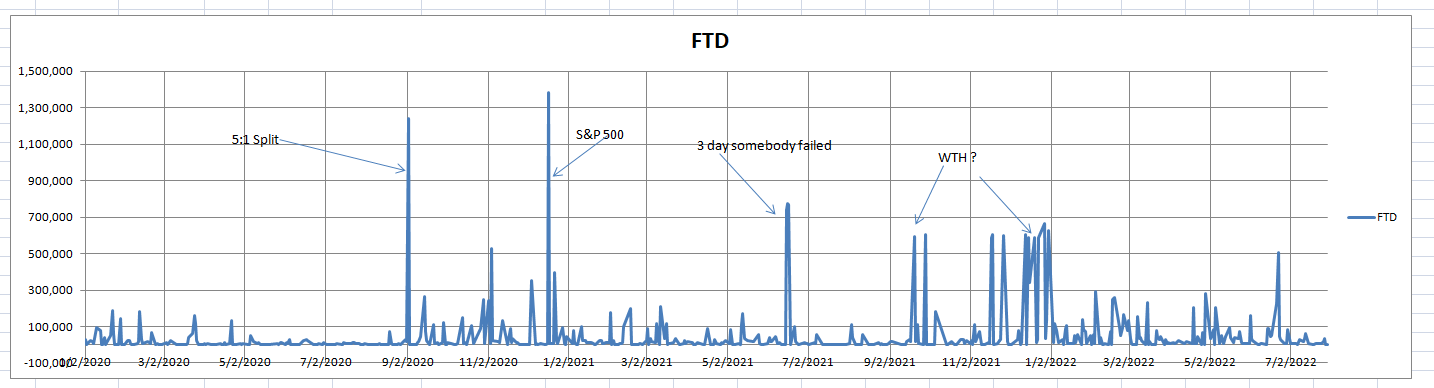

a while back some folks were following FTD, "Failure to Deliver", so I parsed all TSLA going back to 2010 thru end of July 2022

I don;t know how to interpret but there was a 'house' that failed in there around end of June 2021 IF I remember correctly

the average which may be a bogus number (or incorrect) seems to run around 49,500/day in about 2,800 data points)

zoom in

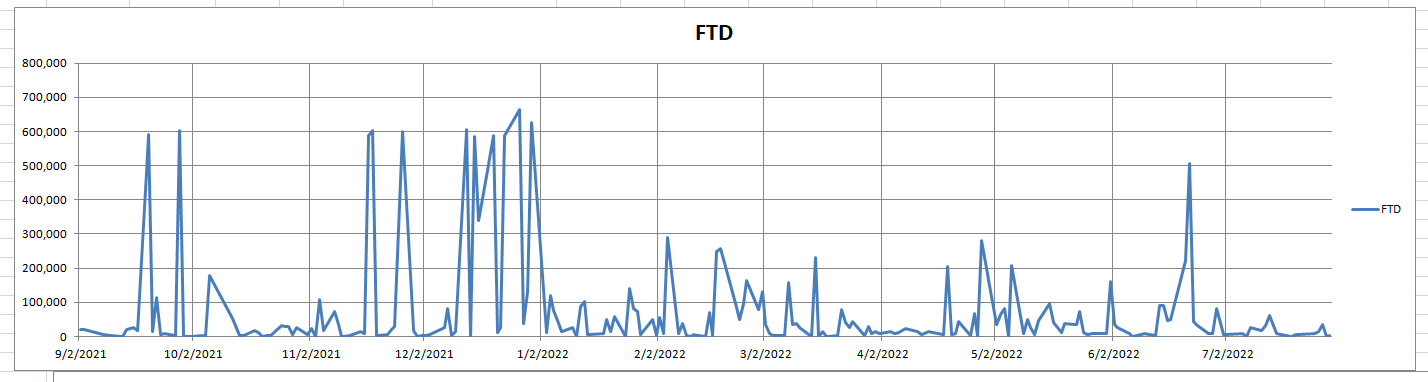

graphing the last year, the left axis goes up to 800,000 shares, like 4 "pulses", 2 in sept and 2 in late november and a large "grouping" around mid-late december 2021 (again avg is 49,500 over 2,800 data points)

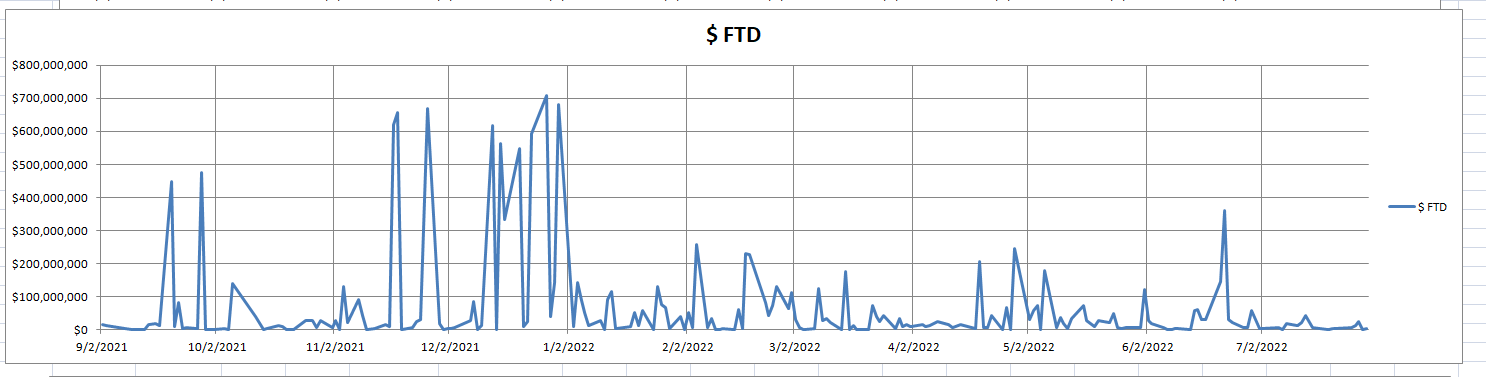

If you multiply the closing price of the day by number of shares FTD you get quite LARGE dollar amounts, especially in december 2021

if anyone wants to fiddle with those numbers I attached the excel file, hopefully the split will decrease synthetic shares

I don;t know how to interpret but there was a 'house' that failed in there around end of June 2021 IF I remember correctly

the average which may be a bogus number (or incorrect) seems to run around 49,500/day in about 2,800 data points)

zoom in

graphing the last year, the left axis goes up to 800,000 shares, like 4 "pulses", 2 in sept and 2 in late november and a large "grouping" around mid-late december 2021 (again avg is 49,500 over 2,800 data points)

If you multiply the closing price of the day by number of shares FTD you get quite LARGE dollar amounts, especially in december 2021

if anyone wants to fiddle with those numbers I attached the excel file, hopefully the split will decrease synthetic shares

Attachments

Was the other car running Green Hills Software? I hear it's sketch.Surprised to find a relatively objective NYT article about Tesla, Autopilot, and data collection for safety. It even exhibits a collision that happened while a car was on Autopilot (with a neat scrolling visualization), but it's pretty clear that AP wasn't at fault:

Can Tesla Data Help Us Understand Car Crashes? (Published 2022)

Data and video recorded by Tesla and other automakers to hone driver-assistance systems can also be an investigative tool for regulators and lawyers.www.nytimes.com

@captkeroseneMy calculation of Tesla's costs for a Bot is as follows:

Production cost: $20,000.

Amortized over 5 years. Annual depreciation: $4,000.

Operational costs: $1/hour. (electricity, MX, degreaser)

Average use: 12 hours/day. 50 weeks per year. 4,200 hours per year.

That results in an all-in cost of $1.95/hr.

There are 36,000 McDonalds restaurants in the world. If we put 1 bot in each and charged $12/hour for a fry cook, that's a profit of $42,000/year for each restaurant or $1.5 Billion total. Just for one position at one fast food franchise.

I think being a fry cook at McD's is far easier than being a chauffeur in Manhattan. Maybe 20X easier? Vector space worries, labeling, edge cases and kids dressed as orange cones on Halloween issues all go away.

Bot started as Plan B but is quickly becoming Plan A.

IF you want an obscure reference, We need a bot that can sling the drink "3 planets", thats perfetion

Captkerosene

Member

I like your numbers but...

How are bots going to spend their 2 week vacation?

Gigapress

Trying to be less wrong

Weird that in the WTH section, all the FTD peaks are almost exactly 600,000 shares. There must be a reason for that, but what?

Electroman

Well-Known Member

Isn’t the Q at the end mean they are in bankruptcy now.@Electroman

AXPWQ is still listed, or at least you can get a quote $0.005, with an avg vol of 55,000 !! (which doesn't seem to change)

(SA lets you keep a portfolio list they update, data may be a bit stale)

last time i looked a number of years back, i found ~$186?/share, with an exponential declining graph down to way below 1 cent, and i remember at least 3 reverse splits, 1:35 and 1:50 when i look, there seems to be incomplete data since I only find 2 splits

when you multiply those together is eyepopping 1:1,750.

(18,600 pennies for far less than 1 penny)

(Its always illuminating as an intellectual exercise in why you should HODL, (weep) to multiply todays stock price by number of splits)

TSLA 5:1 actual value ~$4,500/share

AAPL 224:1 actual value ~$39,000/share

AOL 128:1 long gone

CSCO 288:1 actual value ~$14,000/share

MSFT 288:1 actual value ~$84,000/share

IOM 3:1, 2:1 2:1 big oopsie, ouchie then reverse split 1:5, a combined 12:1 became 2.4:1

(Iomega was fun, watched in 'real time' it spike from $20 to $100 and sold as it passed ~$60 downwards at brokerage office, microseconds mattered)

AXPW Stock Split History

A stock split history for AXPW and split-adjusted CAGR.www.stocksplithistory.com

The irony of scums like Petersen who were predicting Tesla to go bankrupt while at the same time pumping Axion.

Like us…recharging.I like your numbers but...

How are bots going to spend their 2 week vacation?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M