Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ZeApelido

Active Member

I sold on both dates to spread the capital gains bill over two years. I don't normally recommend timing sales for tax purposes but, in this case, it coincided with my belief that the top could probably not go significantly higher.

It was also Y2K, LOL! A lot of people were actually seriously concerned about that even though a rational analysis showed it wouldn't be anything more than a few sporadic but inconsequential minor glitches.

Listen, we all know about your Qualcomm and Microsoft boomer investing glory, but it's time to let us borderline GenX/Millenial have the spotlight.

I bought Lucid stock pre-merger (formerly CCIV) and 5x'd it in 3 weeks. Sold it exactly the day before it crashed.

Moral of my story: When a stock is worth 100 billion before even producing a single vehicle, sell it.

It was the end of the world! Until January 1, 2000 when it wasn't...It was also Y2K, LOL! A lot of people were actually seriously concerned about that even though a rational analysis showed it wouldn't be anything more than a few sporadic but inconsequential minor glitches.

We did have a nice New Year's that year in front of the fireplace though... fond memories...

StealthP3D

Well-Known Member

OT: I have the same conviction with Snowflake. Lets see if it pans out.

There are a lot of companies that will have wildly profitable returns that can't pass my criteria for having a very low probability of greater than 50% loss. It's very hard to identify that when it depends upon largely unknowable future events which is why "going all in", more than 50%, should probably be a very rare thing to not be considered a desperation move.

Hindsight is 20/20.

Just to illustrate how amazing Telsa's growth is -

Nio grew Aug sales by 86% YoY. Sounds good and all, right? Well in a vacuum, it is.

But Tesla grew Shanghai sales by 74% YoY..........at 7X the scale of sales.

When you actually do the proper math.......Nio fell way, way.........way behind Tesla's actual growth rate. Just for Nio to be keeping pace, they would have needed to grow sales to the tune of 400% YoY.

.......Good luck Nio (and competition)

Blast from the past (2021):

Tesla China’s August numbers are in, and they show that Gigafactory Shanghai is hitting its stride as the company’s primary vehicle export hub. As per data released by the Chinese Passenger Car Association (CPCA) on Wednesday, Tesla exported 31,379 vehicles in August from Gigafactory Shanghai. Together with domestic sales of 12,885, Tesla China effectively sold a total of 44,264 vehicles in August 2021, an increase of 34% month-over-month.

StarFoxisDown!

Well-Known Member

Don't worry, it won't matter. Twice now it's tried to break through 275 and it immediately gets smacked down by sell orders. There's intent to make sure it doesn't turn green todayRelax. Not saying anything today.

/s

It was the end of the world! Until January 1, 2000 when it wasn't...

We did have a nice New Year's that year in front of the fireplace though... fond memories...

graduated summer 1999, my 1st real job was during Y2K.

So much overtime for folks they were buying cars, house down payments with just their over time money

Electroman

Well-Known Member

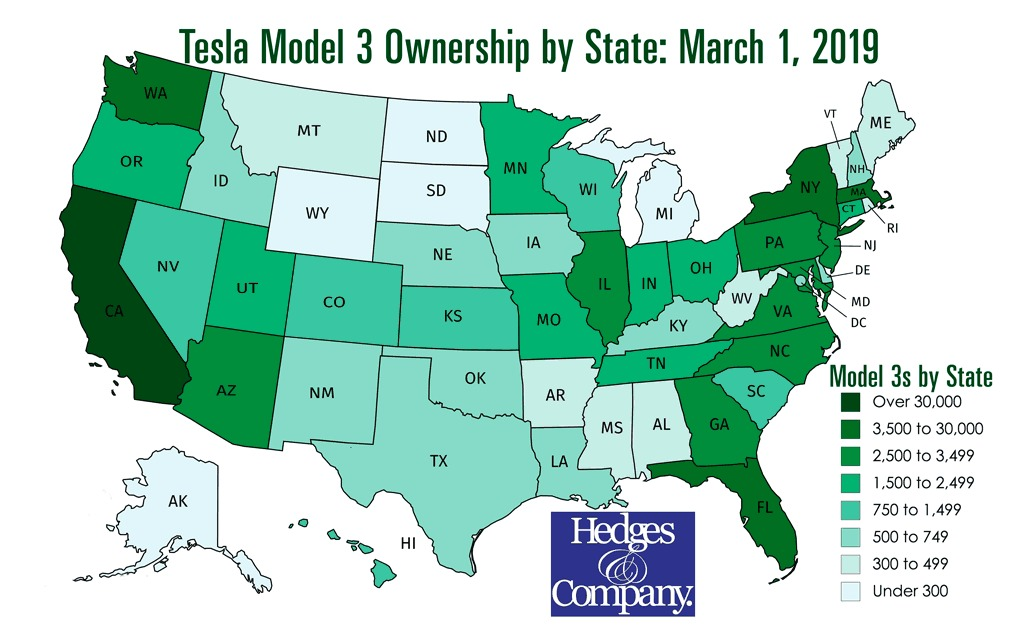

Can you guys tell me if this maps/chart is accurate? Some fossil head sent this to me with a comment, "You can clearly see a pattern of coastal elite vs Americana".

I don't think this chart is accurate. This is not ownership density (Teslas/per 1000 citizens), but total Model 3s in a state. I remember seeing another table that had FL & Texas as No. 2 & 3 close to each other.

I don't think this chart is accurate. This is not ownership density (Teslas/per 1000 citizens), but total Model 3s in a state. I remember seeing another table that had FL & Texas as No. 2 & 3 close to each other.

Last edited:

StealthP3D

Well-Known Member

I want the younger generations to have all the success they can muster and, if I can help out, even in a small way, that's good.Listen, we all know about your Qualcomm and Microsoft boomer investing glory, but it's time to let us borderline GenX/Millenial have the spotlight.

But what I see is disheartening. What is so difficult about a long-term focus? Even as a 30 year-old I could see that was the best path but all I see today is a focus on the day to day ticker and whether we are in a recession, about to enter a recession, coming out of a recession or other unknowable things like up down or sideways, all of it noise to the bigger picture, the picture that can make you wealthy, not in 3 months, not in one year but over a multi-decade period with a steady and thoughtful hand. It's called 'investing'. Because nobody knows the micro-movements of the economy in advance. Whatever happened to investing and not giving a flying F*** about market spasms and financial media "wisdom". That's not how fortunes are made, worrying about unknowable things.

Problem: I don't control the narrative and those who do, have the upper hand.

Solution: Don't let them control the narrative. Ignore them.

ZeApelido

Active Member

Can you guys tell me if this maps/chart is accurate? Someone fossil head sent this to me with a comment, "You can clearly see a pattern of coastal elite vs Americana".

I don't think this chart is accurate. This is not ownership density (Teslas/per 1000 citizens), but total Model 3s in a state. I remember seeing another table that had FL & Texas as No. 2 & 3 close to each other.

View attachment 847943

Anytime I see a non "per-capita" graph:

Oh, I thought that was her hat. It fits.I don't think they could have staged that picture any better with the Capital in the background.

Last edited:

lafrisbee

Active Member

Nothing beat the Constant call over the hospital intercom for "Doctor Payne, Please report to the ER." At my last hospital.Actually Quite A Few Doctors Are Named Lance Boyle In The U.S.... Among Others.

willow_hiller

Well-Known Member

Can you guys tell me if this maps/chart is accurate?

Not only is it not adjusted for population density, the Model 3 SR+ came out in late March 2019. So at that point, there were only more expensive LR variants and a handful of LEMRs.

dhanson865

Well-Known Member

Anytime I see a non "per-capita" graph:

errm that was a map not a graph

Choropleth maps show geographical regions colored, shaded, or graded according to some variable.

lafrisbee

Active Member

I see no use for this aspect of Tesla numbers in each state. Noone is going to redistrict The House of Representatives using it. It provides nothing usable in terms of acceptance or density.Can you guys tell me if this maps/chart is accurate? Some fossil head sent this to me with a comment, "You can clearly see a pattern of coastal elite vs Americana".

I don't think this chart is accurate. This is not ownership density (Teslas/per 1000 citizens), but total Model 3s in a state. I remember seeing another table that had FL & Texas as No. 2 & 3 close to each other.

View attachment 847943

As to your "friend/idiot", the movement(density) of the population of the USA towards seashores would predict such a graph. Another aspect is the poorer a state the less likely it heavily-populated as well as those poor consumers ain't able to buy a tesla.

There is some mixup in the RGB table of my stock ticker graph, the second component has bypassed the first, which is not the method of operation for this week

lafrisbee

Active Member

ThisStockGood

Still cruising my Model S 70 2015

Don't worry, it won't matter. Twice now it's tried to break through 275 and it immediately gets smacked down by sell orders. There's intent to make sure it doesn't turn green today

/s

thesmokingman

Active Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M