Famous last words.From looking at the table so far, it seems most on this board are indeed expecting me to be "very, very, very wrong" ... gives me hope for a huge upside surprise, as I am the LOWEST estimated EPS other than the "traditional" estimate. Perhaps I should convert 10-20k shares to LEAPS based on all the smart people here estimating much higher EPS?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

???

I haven’t looked this up so I have no idea to what he is referring. But I take it as a positive sign that he is Tweeting obscure tweets today.

EDIT: book published in 1709 about right of kings and rights of people. Like I said, obscure.

Elon's a student of history. From Wikipee:

The Latin phrase Vox populi, vox Dei (/ˌvɒks ˈpɒpjuːli ˌvɒks ˈdeɪi/), 'The voice of the people [is] the voice of God', is an old proverb.

An early reference to the expression is in a letter from Alcuin to Charlemagne in 798. The full quotation from Alcuin: [quoted here]:

"And those people should not be listened to who keep saying the voice of the people is the voice of God, since the riotousness of the crowd is always very close to madness."

This passage indicates that already by the end of the eighth century the phrase had become an aphorism of political common wisdom. Writing in the early 12th century, William of Malmesbury refers to the saying as a "proverb".

Of those who promoted the phrase and the idea, Archbishop of Canterbury Walter Reynolds brought charges against King Edward II in 1327 in a sermon "Vox populi, vox Dei".

So this tweet could mean something like 'don't listen to the crowd'? Now whether that means wrt Ukraine or something else remains to be seen.

Cheers!

Last edited:

My 'learn something new every day' moment for today.Elon's a student of history. From Wikipee:

The Latin phrase Vox populi, vox Dei (/ˌvɒks ˈpɒpjuːli ˌvɒks ˈdeɪi/), 'The voice of the people [is] the voice of God', is an old proverb.An early reference to the expression is in a letter from Alcuin to Charlemagne in 798. The full quotation from Alcuin reads:This passage indicates that already by the end of the eighth century the phrase had become an aphorism of political common wisdom. Writing in the early 12th century, William of Malmesbury refers to the saying as a "proverb".Of those who promoted the phrase and the idea, Archbishop of Canterbury Walter Reynolds brought charges against King Edward II in 1327 in a sermon "Vox populi, vox Dei".

So I think this tweet means something more like 'Okay, I give up. you win. I'll do it your way'. Now whether that means Ukraine or Share buybacks or something else remains to be seen.

Cheers!

Thanks Dodger!

Chinese COVID reported death 5,226

USA COVID reported death 1.06 million.

Acting rationally , who knows.

Key word here - reported

Skryll

Active Member

Even worse, it created a demand problem. /s apparently there are signs of the referral program coming back? Also, the 80+ roadsters awarded (really that many? elektrek-fred seem to know) are quite significantly an awarding expense, no wonder they are so shy of launching the 2020 roadster to actually paying customersLooking at these estimates, sometimes I wonder if we are contributing to an earnings "miss". I fear the ramping of two factories with new technologies may be a bigger hit than we anticipate. I am glad to be wrong =).

Does Tesla have a demand problem?

Overall, no, but it is slowing from "crazy, get it at any cost" demand to more "slight nudge and promotion needed" demand. Couple of examples overall and Tesla specific:

Overall, no, but it is slowing from "crazy, get it at any cost" demand to more "slight nudge and promotion needed" demand. Couple of examples overall and Tesla specific:

- Overall used car prices drop 10%!!!

- Telsa started offereing 2019 Tesla Model 3's with FSD fo $36,000.

- Tesla has started to incentivize their leases (Model 3 for $499/month, Model Y for $789/month). In the past, loan and lease monthly payments were very similar. Now leases are significantly cheaper.

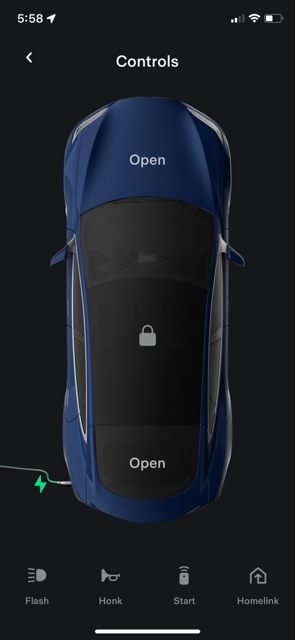

- Tesla is bring back their referral program (Teslascope and others have found it in the App code).

Knightshade

Well-Known Member

What utter rubbish. Phone as Key works off BT. Not Wi-Fi.

'It's Always Sunny in Philadelphia' actor said Tesla 'lost a customer' after his car was stuck in a parking garage for days when his key fob broke

"You guys lost a customer today. I've been a Tesla customer for 10 years," Glenn Howerton said he told a Tesla salesperson during the incident.www.businessinsider.com

As the story notes- he was trying to use the app, not phone as key. Those are different things.

It also notes the age and model of his car isn't known, so his story is 100% possible on older models with no internet connectivity available.

Here's a whole thread about how this is entirely possible on an older S for example which never had BT phone as key- so wifi with the app was the ONLY option other than the fob.

Model S 75 Phone as a key

I have a 2016 Model S 75 (just bought) and the app I downloaded connects to my car and gives me some control but the key is not an option. Am I missing something or is there a feature I need to get this to work?

Or Twitter voices, but an unlikely meaning on the same day as earnings. More likely he's talking about our estimates on TMC, or MYP Track Mode soon.Elon's a student of history. From Wikipee:

The Latin phrase Vox populi, vox Dei (/ˌvɒks ˈpɒpjuːli ˌvɒks ˈdeɪi/), 'The voice of the people [is] the voice of God', is an old proverb.An early reference to the expression is in a letter from Alcuin to Charlemagne in 798. The full quotation from Alcuin reads:This passage indicates that already by the end of the eighth century the phrase had become an aphorism of political common wisdom. Writing in the early 12th century, William of Malmesbury refers to the saying as a "proverb".Of those who promoted the phrase and the idea, Archbishop of Canterbury Walter Reynolds brought charges against King Edward II in 1327 in a sermon "Vox populi, vox Dei".

So I think this tweet means something more like 'Okay, I give up. you win. I'll do it your way'. Now whether that means Ukraine or Share buybacks or something else remains to be seen.

Cheers!

For real, I think it's Tesla sales globally and all the headlines with Tesla products at the top of the lists. The people also want a lower cost version, but that was my prediction nearly a year ago in the form of a Model 2 - way off. But what about a price drop for masses? A Thanksgiving sale! Supplier parts are coming down, 3 Robots got a job in the factory, production capacity about to go through the roof, and more EVs. Oh but that would get spun so fast as a demand issue. So maybe it's showing cost parity on batteries in '23, or something we don't have a clue about and I'm just guessing like the rest.

Or it's FSD related for a low-cost ride - somewhere. Just in, Waymo trying to front-run any Tesla FSD news today? So when people do a search... everyone's got that tech

Waymo announces robotaxi expansion to Los Angeles

After expanding outside of Arizona to San Francisco earlier this year, Waymo has announced another expansion with plans to roll out its robotaxi service to Los Angeles over the coming months. According to a blog […]

driveteslacanada.ca

driveteslacanada.ca

What utter rubbish. Phone as Key works off BT. Not Wi-Fi.

'It's Always Sunny in Philadelphia' actor said Tesla 'lost a customer' after his car was stuck in a parking garage for days when his key fob broke

"You guys lost a customer today. I've been a Tesla customer for 10 years," Glenn Howerton said he told a Tesla salesperson during the incident.www.businessinsider.com

Where was his key card?

I guess I need to boycott Always Sunny because I don't want to support anyone that stupid.I always laugh at these hot takes.........have fun dealing with the charging network for a non-Tesla EV buddy

Or Twitter voices, but an unlikely meaning on the same day as earnings. More likely he's talking about our estimates on TMC, or MYP Track Mode soon.

For real, I think it's Tesla sales globally and all the headlines with Tesla products at the top of the lists. The people also want a lower cost version, but that was my prediction nearly a year ago in the form of a Model 2 - way off. But what about a price drop for masses? A Thanksgiving sale! Supplier parts are coming down, 3 Robots got a job in the factory, production capacity about to go through the roof, and more EVs. Oh but that would get spun so fast as a demand issue. So maybe it's showing cost parity on batteries in '23, or something we don't have a clue about and I'm just guessing like the rest.

Or it's FSD related for a low-cost ride - somewhere. Just in, Waymo trying to front-run any Tesla FSD news today? So when people do a search... everyone's got that tech.

Waymo announces robotaxi expansion to Los Angeles

After expanding outside of Arizona to San Francisco earlier this year, Waymo has announced another expansion with plans to roll out its robotaxi service to Los Angeles over the coming months. According to a blog […]driveteslacanada.ca

Or a Share buy back as noted from many retail and institutional investors asking for it......

Hi, first you got to confirm that your are not the CFO of Tesla. Only then will I be forthcoming with my analysis!Lastly @generalenthu I know you often tracked deltas/open interest. Do you have numbers for this expiration? Do you see what I see?

Jokes aside, yes, I do track the deltas from open interest. I also split it up by expiry (first table), and retain the history. This script has been running thrice daily for a little over 2.5 years tracking deltas from open positions assuming all the options are opened by non market makers with MMs on the other side of the trade, staying delta hedged. This is mostly true in my opinion (despite what Dodger says about MM shenanigans with them running around unhedged somehow)

And I do agree with most of what you mention in your post.

There are a few things that are obviously wrong with this assumption. Some have been pointed out, but let me list them here.

1. People do sell options rather than just buy options

2. A lot of the volume is in the form of spreads

3. The impact from open interest is dwarfed by the daily volume of options traded

Even with these faulty assumptions there is some useful information, to be gleaned from the options positioning.

A good chunk of Tesla has been proxy owned by the investing public by way of option leaps. But shorter term, as you say, there has been a lot of hedging going on with people buying puts. So in a relatively rare occurrence, Tesla is now net shorted through the options complex. The good thing is these short options have to be closed soon which will be a tailwind for the stock.

That said these short put positions when closed, wont behave like long call options during a gamma squeeze. So their impact diminishes as stock goes up, unlike the the spiky gamma squeezes we see with call heavy positions. In other words these help us put in a base here. Not necessarily cause the stock to squeeze up.

Now if a lot of things line up, with the biggest being macro resolving and may be some of the mid term jitters going away (past November), we can expect to see some call buying to bring us back in line with historical norms. Though I am not expecting that personally, as Macro wont be resolved anytime soon.

TLDR: I expect to see a respite from this malaise in the next couple of weeks (especially after the overhang from Elon's pending sale lifts), but dont see us going back too high, i.e. near ATH in the next couple of quarters. the options positioning, while it has fueled a steep drop from ~300 to ~210 has become a bit supportive here.

So overall i guess we will muddle around 250-300 range rather than much higher or lower, which I would prefer to muddling around closer to 200.

Last edited:

Why is this topic even in the investing thread?As the story notes- he was trying to use the app, not phone as key. Those are different things.

It also notes the age and model of his car isn't known, so his story is 100% possible on older models with no internet connectivity available.

Here's a whole thread about how this is entirely possible on an older S for example which never had BT phone as key- so wifi with the app was the ONLY option other than the fob.

Model S 75 Phone as a key

I have a 2016 Model S 75 (just bought) and the app I downloaded connects to my car and gives me some control but the key is not an option. Am I missing something or is there a feature I need to get this to work?teslamotorsclub.com

If some random quasi celeb lost their key Fob for a Porsche would anyone give a damn?

You do what you do with any other car on the planet, you have a spare at home. Do you think Porsche or Mercedes have service people who fix this stuff remotely? What kind of an idiot only has a single key fob as their sole way of getting into a car?

I know you didn’t drag this inappropriately into the main thread, but you feel compelled to defend a moron in it.

Or the 3 month pause due to the tax credits in Jan while they ramp production like crazy. Sometimes I think the IRA timing was for this - said my paranoid self.Does Tesla have a demand problem?

Overall, no, but it is slowing from "crazy, get it at any cost" demand to more "slight nudge and promotion needed" demand. Couple of examples overall and Tesla specific:

Does this mean Tesla is doomed? Of course not. Does it mean they need to do some small things to spur demand with the impending recession looming? Definitely!

- Overall used car prices drop 10%!!!

- Telsa started offereing 2019 Tesla Model 3's with FSD fo $36,000.

- Tesla has started to incentivize their leases (Model 3 for $499/month, Model Y for $789/month). In the past, loan and lease monthly payments were very similar. Now leases are significantly cheaper.

- Tesla is bring back their referral program (Teslascope and others have found it in the App code).

Heaven's forbid they should stoop so low as to place an advertisement

But a Holiday sale incoming?

Or a Share buy back as noted from many retail and institutional investors asking for it......

This is the second 'learn something new every day' moment of the day for me.Hi, first you got to confirm that your are not the CFO of Tesla. Only then will I be forthcoming with my analysis!

Jokes aside, yes, I do track the deltas from open interest. I also split it up by expiry (first table), and retain the history. This script has been running thrice daily for a little over 2.5 years tracking deltas from open positions assuming all the options are opened by non market makers with MMs on the other side of the trade, staying delta hedged. This is mostly true in my opinion (despite what Dodger says about MM shenanigans with them running around unhedged somehow)

And I do agree with most of what you mention in your post.

There are a few things that are obviously wrong with this assumption. Some have been pointed out, but let me list them here.

1. People do sell options rather than just buy options

2. A lot of the volume is in the form of spreads

3. The impact from open interest is dwarfed by the daily volume of options traded

Even with these faulty assumptions there is some useful information, to be gleaned from the options positioning.

A good chunk of Tesla has been proxy owned by the investing public by way of option leaps. But shorter term, as you say, there has been a lot of hedging going on with people buying puts. So in a relatively rare occurrence, Tesla is now net shorted through the options complex. The good thing is these short options have to be closed soon which will be a tailwind for the stock.

That said these short put positions when closed, wont behave like long call options during a gamma squeeze. So their impact diminishes as stock goes up, unlike the the spiky gamma squeezes we see with call heavy positions. In other words these help us put in a base here. Not necessarily cause the Tesla to squeeze up.

Now if a lot of things line up, with the biggest being macro resolving and may be some of the mid term jitters going away (past November), we can expect to see some call buying to bring us back in line with historical norms. Though I am not expecting that personally, as Macro wont be resolved anytime soon.

TLDR: I expect to see a respite from this malaise in the next couple of weeks (especially after the overhang from Elon's pending sale lifts), but dont see us going back too high, i.e. near ATH in the next couple of quarters. the options positioning, while it has fueled a steep drop from ~300 to ~210 has become a bit supportive here.

So overall i guess we will muddle around 250-300 range rather than much higher or lower, which I would prefer to muddling around closer to 200.

Love this thread.

Gigapress

Trying to be less wrong

Last call for inputting your estimates. Step right up and give it a shot! Spreadsheet locks in 1 hour.

docs.google.com

docs.google.com

TeslaMotorsClub Investor Casual Quarterly Estimates Compilation

Q3 '22 TMC Quarterly Estimates - 2022 Q3,. .,Summary Statistics <a href="https://teslamotorsclub.com/tmc/posts/7122581/">Gigapress' post in TMC</a> TMC Username,Revenue,Auto Gross Margin Excl ZEV Creds,GAAP Earnings per Share,Non-GAAP Earnings per Share,Comment,Revenue,Auto Gross Margin Excl ZEV...

⚡️ELECTROMAN⚡️

Village Idiot

What kind of an idiot only has a single key fob as their sole way of getting into a car?

I did say I saw the fat man in a speedo with a cigar...right.Here's the main reason I do not trade Options. Whenever Market Makers interject themselves between the Company (Tesla) and the Customer (Retail), they effectively have created a hinged pendulum. That's an inherently chaotic system, unstable, unpredictable, and subject to wild swings. 10/28 is just 1 week of cushion for the SP to settle down.

Shirley you know by now that MMs aren't even required to report their FTDs for 13 days? And there's no consequences if they don't? And theymaketake more $$$ that way? IMO, that's handing them yourwallet****. MMs will do whatever they need to do to steal your money.

Options make that easy for MMs (they are the House). Shares makes that harder (you are the Boss).

Good luck!

That building permit for Fremont last Aug, it's for Cybertruck batteries to be assembled in Texas

Refers to "...the new ‘CTA Battery B-Build’ line on the second floor of the main assembly building."

driveteslacanada.ca

driveteslacanada.ca

Refers to "...the new ‘CTA Battery B-Build’ line on the second floor of the main assembly building."

Tesla Cybertruck battery packs to be made at Fremont at launch, not Giga Texas: Report

With the launch of the Cybertruck on the horizon, Tesla is reportedly planning to build one major component of the electric truck at their Fremont factory, while the rest of the vehicle will be assembled [...]

driveteslacanada.ca

driveteslacanada.ca

Cool I'm still winningLast call for inputting your estimates. Step right up and give it a shot! Spreadsheet locks in 1 hour.

TeslaMotorsClub Investor Casual Quarterly Estimates Compilation

Q3 '22 TMC Quarterly Estimates - 2022 Q3,. .,Summary Statistics <a href="https://teslamotorsclub.com/tmc/posts/7122581/">Gigapress' post in TMC</a> TMC Username,Revenue,Auto Gross Margin Excl ZEV Creds,GAAP Earnings per Share,Non-GAAP Earnings per Share,Comment,Revenue,Auto Gross Margin Excl ZEV...docs.google.com

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M