Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

The more confused you act, the further away you are from understanding how it all works, and the less sense it makes for you to be playing in the sandbox.What is driving the automotive sector outperformance?

Lucid, Rivian, Ford, Tesla all up and Nasdaq is -1.5%

Is advice.

Krugerrand

Meow

Hock1

Member

It looks to me that the download of the "Colorizer" is more than meets the eye. Interesting that not only are there myriad colors displayed, but the choice of solid, metallic or matte make me think that, very soon, this will be the way a buyer can dial in their own new car color. Amazing, if so.BREAKING - BREAKING - BREAKING - BREAKING

Today seen in Bali - first example of a Tesla working at a significantly higher voltage.

Results of this Tesla are really shocking.

Battery type still a secret, most likely Chinese, we will have to wait for a reveal by Munro.

Apparently wrapped versions available straight from the factory.

Have no doubts my fellow investors, Tesla is still no. 1, it clearly says so!

If there is no ending of wave, then we also have ~20K? from Q3 right?I was specifically talking about production, so we are very close you and I, at 440 and 450.

If Dec Shanghai deliveries are all local, shouldn't we expect vehicles in transit to come down?

I didn't see this posted yet. They speak of a demand lever pulled by Tesla. Is that what happened? China still ramping? lol.

"We sense Tesla’s recent price cut strategy has created a negative spill-over effect where a lot of China EV brands’ order backlog has suffered significant order cancellations according to our dealership channel checks."

electrek.co

electrek.co

"We sense Tesla’s recent price cut strategy has created a negative spill-over effect where a lot of China EV brands’ order backlog has suffered significant order cancellations according to our dealership channel checks."

Tesla price cuts are resulting in cancellations for China EV brands

Tesla’s recent price cuts in China are reportedly resulting in “significant cancellations” for Chinese EV brands.

electrek.co

electrek.co

I think the market is jittery not because of rising rates but at the velocity of rate increases. High velocity induce speculation and hence why we have sky rocketing mortgage rates that have completely destroyed the refi arm of every bank and are laying off people en masse. The market can handle a 0.25 here and there and eventually gets up to X% point, however a straight line up in a short period of time will break a few things along the way.There doesn’t seem to be an appreciation here for just how much the fed is likely to be raising interest rates. Maybe a lot of people here aren’t old enough, but rates were in the 6% area in the late 1990s during the initial dot com boom and life was fine. Admittedly a lot of things are different today, like high inflation (which only makes high interest rates even more likely).

Anyways, here’s a fairly quick video warning that rates are going significantly higher. Having said that, it also points out that the US is hoovering up capital from around the world since our economy is still consuming. This will help the stock market at least not crash. And it makes an interesting prediction about Germany and possible capital controls coming in their future.

bkp_duke

Well-Known Member

I'm as baffled by today's price action as I was yesterday's . . .

B

betstarship

Guest

Call out, everyone put in their supercharger votes?

As much as many of us like this analogy, including me. there is one overwhelming difference that we usually ignore.Services $78.1B or roughly 20% of revenue but only 10% of cost of revenue. With a 72% gross profit. That's a pretty significant chunk of the difference right there. Aside from that, Tesla has a lot of assets which are right at the beginning/ expensive end of their depreciation cycle and has 2 massive facilities which are operating well below capacity.

Overall, it's pretty hard to compare the two since they are in such different industries. I do think Tesla will be more Apple like in 2-3 years once their newest factories are online. Tesla is in heavy growth stage right now so it's likely they will lag companies like Apple for some time as much of their capacity is underutilized as they are in constant ramp up mode.

Tesla and Apple do each have excellent logistics, superb engineering talent and a huge, highly profitable services business. In those respects the analogy holds, as it also does in terms of customer devotion to the 'ecosystem'. Of course Tesla Superchargers, grid services etc are not perfect analogies to App Store and device integration, but they are similar in terms of owner loyalty and margin durability.

The overwhelming difference is in vertical integration. Tesla manufactures a high proportion of its own content, while moving rapidly to reduce logistics costs by manufacturing nearer to purchasers. Obviously the world of large physical objects from Megapacks to cars is vastly more influenced by logistics costs than are electronic devices, and typically the vehicles and batteries have higher trade restrictions than do electronics. The actual assembly cost of an electronic device is infinitesimal compared to vehicles and storage batteries.

So the exact analogy isn't perfect.

Even so, as we know, Apple is perhaps the only case that presents continuing high margins in a business that is typically low margin in which several dominant leaders (Motorola and Nokia, for example) utterly failed by failing to adapt to new technology, i.e. the internet. Tesla has now a decade of dominance in expensive sedans, the Model S, and steadily expands both profits and revenue dominance in now markets one after another.

We keep making this analogy, it keeps holding up year after year and...

many people...

keep insisting that Steve Jobs is hopelessly inappropriate, unbelievably weird (I met him several times, he WAS really, really strange) but he still achieved a durable and dominating ethos. while...

many people...

keep inviting that Elon Musk is hopelessly inappropriate, unbelievably weird (yes, he too really is strange) but he still achieves durable and dominating ethos in multiple industries (searchable mapping, consumer payments, reusable rockets, electric cars, nearly instant grid services and he's not finished), so...

The Jobs achievements pale beside those of Elon Musk.

To those of us who think that Elon's distractions are debilitating keep forgetting about another thing shared between Steve Jobs and Elon Musk...

For all those flaws people carp about (and some disdain me for admitting that they exist and are problems) in both of them, they inspired people who continue to deliver astonishing success even without continuing direct presence. For every Tim Cook and Jony Ive that Steve Jobs spawned, Elon Musk has a dozen or more, all seen rarely but on display in periodic recruiting 'days'.

We all should be aware that the analogy itself seems durable, but the future of Tesla, SpaceX and maybe even Twitter will end out complementing each other just as SpaceX and Tesla have done. After all we probably would never have seen a Tesla Model X had not Falcon 1 entered orbit in 28 September 2008. The engineer Elon Musk has kept using the money he generates from one thing to advance in another one. Always engineering, always technological advances, always inspiring the very best people to carry out his visions, wildly improbable as they have been.

Any of us who are cognizant of Elon Musk's talents understand that recruiting the very best talent is perhaps his greatest talent.

Really, don't worry about idiotic statements from time to time, nor seeming political changes that really are driving him on. Just as Falcon 1 happened in response to Russian laughing at him, politicians ignoring him now will not deter him. So, chill, and enjoy the ride. O course if you're prone to 'play the market' you should be ready to cope with volatility. Just don't ever say he did not tell you about that himself.

Was wondering why we are down pre-market.

I see this nugget of poetry, now I know.

Down +2.5% my friend

Sure, but they were vegetarian hot dogs, weren't they? You did not say they would have actual animal ingredients, did you?

Zeihan is always a cheery guy.There doesn’t seem to be an appreciation here for just how much the fed is likely to be raising interest rates. Maybe a lot of people here aren’t old enough, but rates were in the 6% area in the late 1990s during the initial dot com boom and life was fine. Admittedly a lot of things are different today, like high inflation (which only makes high interest rates even more likely).

Anyways, here’s a fairly quick video warning that rates are going significantly higher. Having said that, it also points out that the US is hoovering up capital from around the world since our economy is still consuming. This will help the stock market at least not crash. And it makes an interesting prediction about Germany and possible capital controls coming in their future.

Not saying he is wrong, but if you follow him long enough you might go full prepper.

I mean, Shanghai should be producing 80k+ in addition to which there's what, a 15-20k tailwind of undelivered cars from last month? There was a holiday week but they said they were going to be working through the holiday week.

I saw someone say here that they weren't at full capacity over the holiday, which is fine. With production rumored to be 20500 per week (supported by last month's production numbers, I believe) half-production for that week should put them over 70k produced this month. And sure, there are some cars in parking lots, but I doubt all of the 15k+ overflow from last month is parked -- there's been a steady stream of outbound ships, and how big are we thinking those parking lots actually are?

Bottom line, I don't think the 70k number is a disaster, but it's less than I had expected and definitely, for me, was underwhelming.

If you told me that cars on ships don't count as wholesale sales then that would change my thinking... and I'm still willing to be surprised by the October Shanghai production numbers. But that's where I am.

B

betstarship

Guest

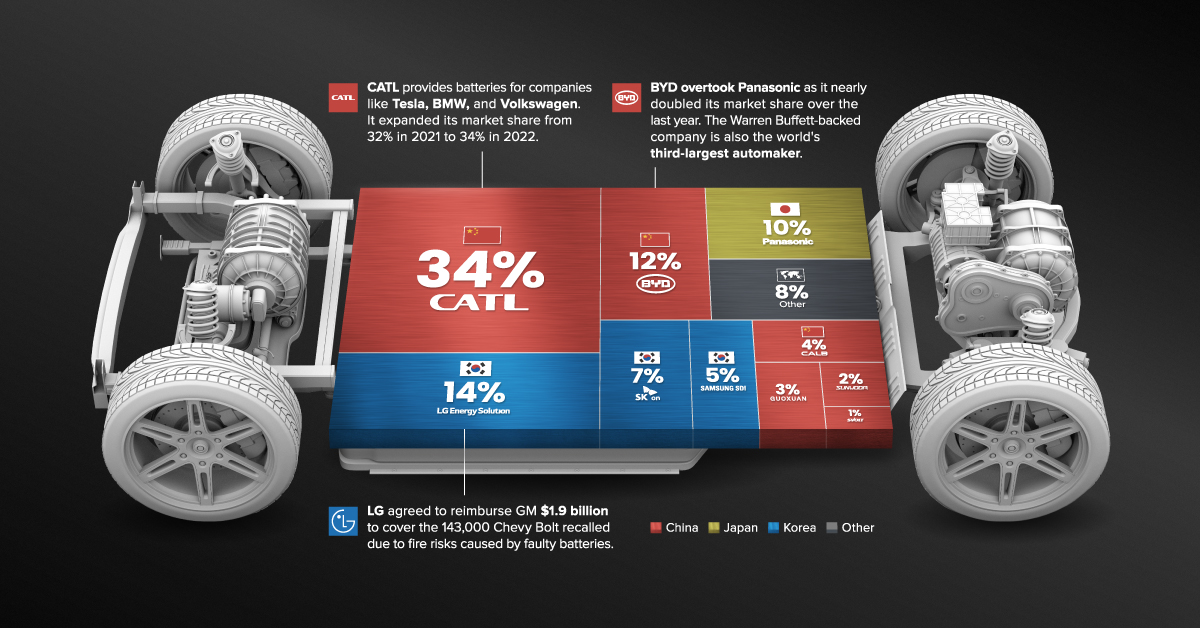

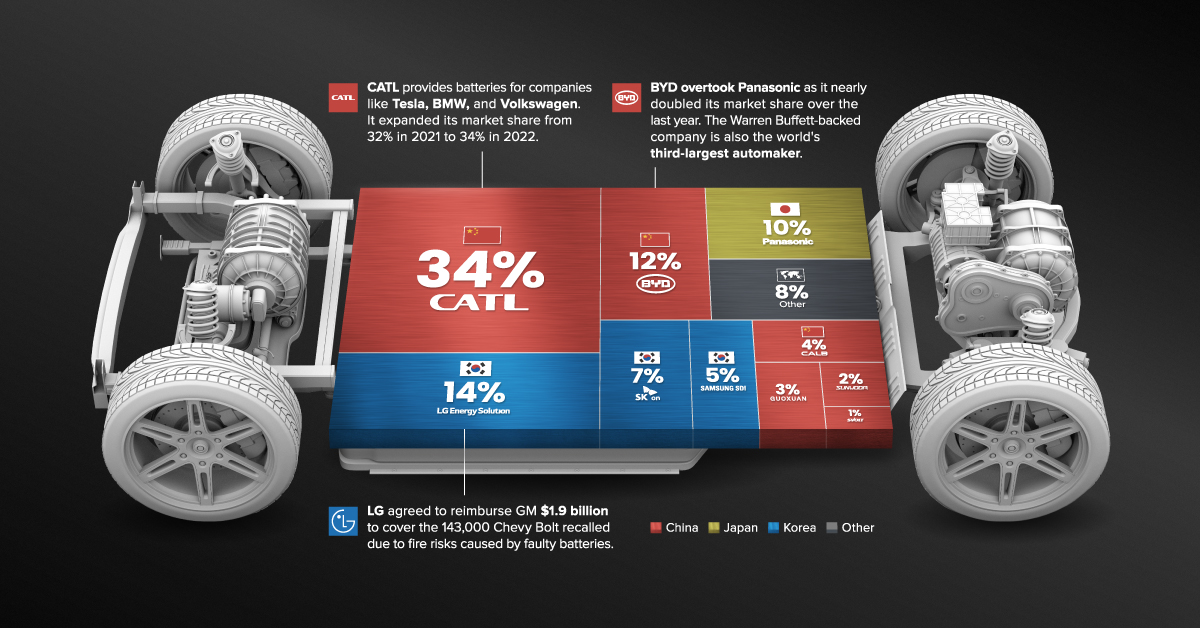

Really awesome article by Visual Capitalist

"The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028."

www.visualcapitalist.com

www.visualcapitalist.com

"The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028."

The Top 10 EV Battery Manufacturers in 2022

Despite efforts from the U.S. and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers.

www.visualcapitalist.com

www.visualcapitalist.com

B

betstarship

Guest

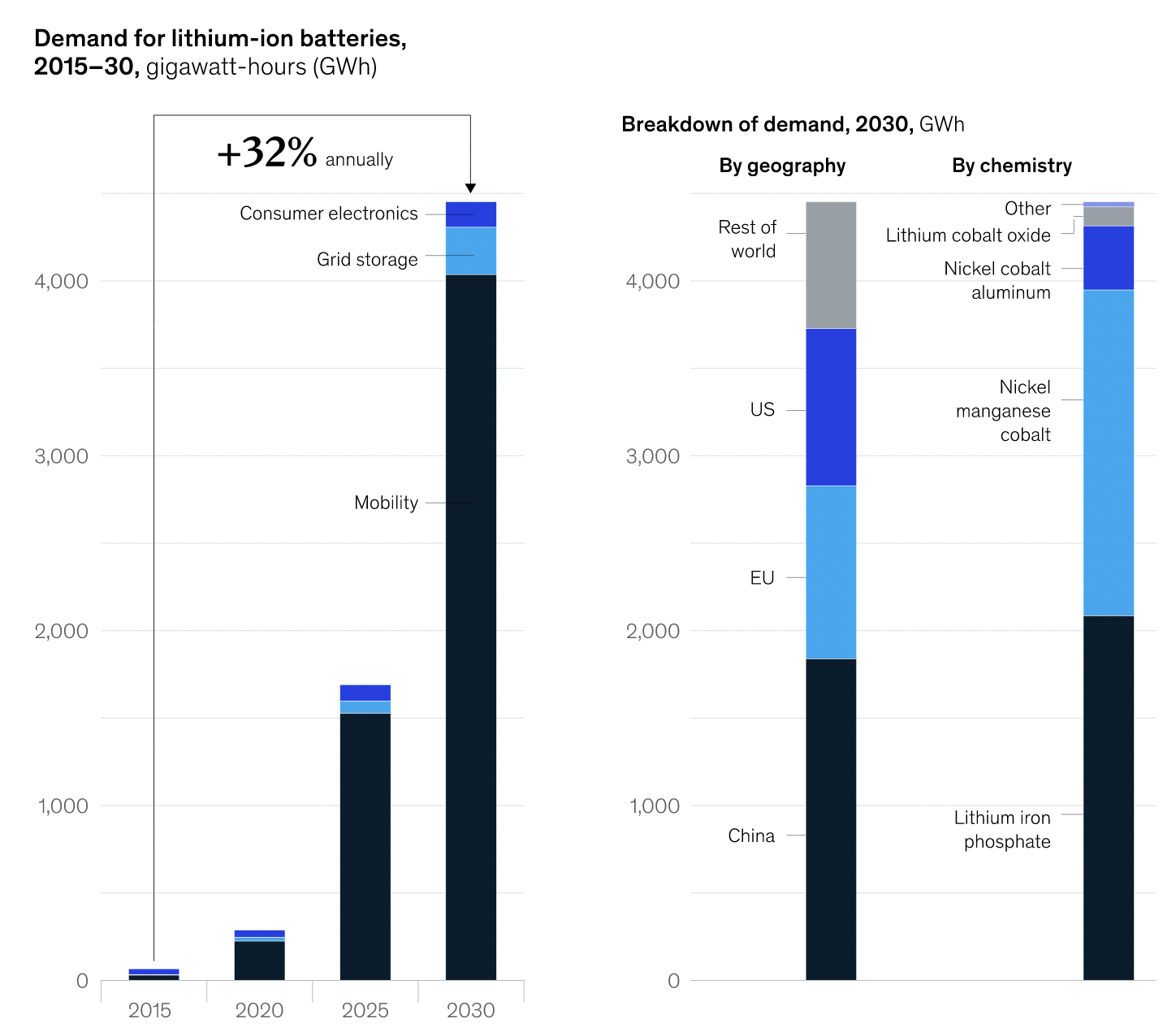

Leave it to McKinsey to have cool charts:

Andy O

Member

... Canada’s government said in a Wednesday statement that it’s ordering three Chinese firms to divest from [three junior lithium explorers] due to strengthened guidelines to protect the country’s minerals wealth. ... updated guidelines from Canada’s government, released Friday, which make it harder for foreign state-owned companies to pursue deals and investments that target critical minerals including lithium, nickel, copper and uranium

(From Canada orders three Chinese firms to divest from country's lithium miners - BNN Bloomberg)

(From Canada orders three Chinese firms to divest from country's lithium miners - BNN Bloomberg)

Last edited:

Why do you think that 15-20K tailwind of undelivered cars resolved last month? The last weeks production was almost certainly undelivered, at least most of it. The whole idea of ditching the wave is that those undelivered cars will never be resolved.I mean, Shanghai should be producing 80k+ in addition to which there's what, a 15-20k tailwind of undelivered cars from last month? There was a holiday week but they said they were going to be working through the holiday week.

I saw someone say here that they weren't at full capacity over the holiday, which is fine. With production rumored to be 20500 per week (supported by last month's production numbers, I believe) half-production for that week should put them over 70k produced this month. And sure, there are some cars in parking lots, but I doubt all of the 15k+ overflow from last month is parked -- there's been a steady stream of outbound ships, and how big are we thinking those parking lots actually are?

Bottom line, I don't think the 70k number is a disaster, but it's less than I had expected and definitely, for me, was underwhelming.

If you told me that cars on ships don't count as wholesale sales then that would change my thinking... and I'm still willing to be surprised by the October Shanghai production numbers. But that's where I am.

If you are looking for 80K per month and last month gave you 70 with one week at half production, why are you underwhelmed?

Tough crowd. Shanghai is the most profitable car factory in the world right now.

According to Rob, there are 9k left over cars sitting on lots, about to be transported, or are being transported throughout China end of Q3 out of shanghai. I don't know where people are getting this 15-20k cars from. Oh perhaps people assumed all 20k undelivered cars from Tesla's P&D were all due to shanghai for whatever reason.I mean, Shanghai should be producing 80k+ in addition to which there's what, a 15-20k tailwind of undelivered cars from last month? There was a holiday week but they said they were going to be working through the holiday week.

I saw someone say here that they weren't at full capacity over the holiday, which is fine. With production rumored to be 20500 per week (supported by last month's production numbers, I believe) half-production for that week should put them over 70k produced this month. And sure, there are some cars in parking lots, but I doubt all of the 15k+ overflow from last month is parked -- there's been a steady stream of outbound ships, and how big are we thinking those parking lots actually are?

Bottom line, I don't think the 70k number is a disaster, but it's less than I had expected and definitely, for me, was underwhelming.

If you told me that cars on ships don't count as wholesale sales then that would change my thinking... and I'm still willing to be surprised by the October Shanghai production numbers. But that's where I am.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M