Artful Dodger

"Neko no me"

How long can the stock trade sideways before we go on the next +1000% run up?

Only your broker knows how much leverage you've taken, and how long to break you.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

How long can the stock trade sideways before we go on the next +1000% run up?

Ah CNBC, keep being classy CNBC.When you have no idea what is Tesla about, and have not looked at the company in 2 years, perhaps it is best not to go on television to let everyone know your ignorance.

At 4:26 mark -

“the only 3 things that Tesla had going for it was the S&P500 inclusion and the stock split and reaching 500,000/year production. Those positives are already in the price. I don’t know what else Tesla has going for it going forward.”

CNBC today. Posted to YouTube 2 hours ago.

CNBC today. Posted to YouTube 2 hours ago.

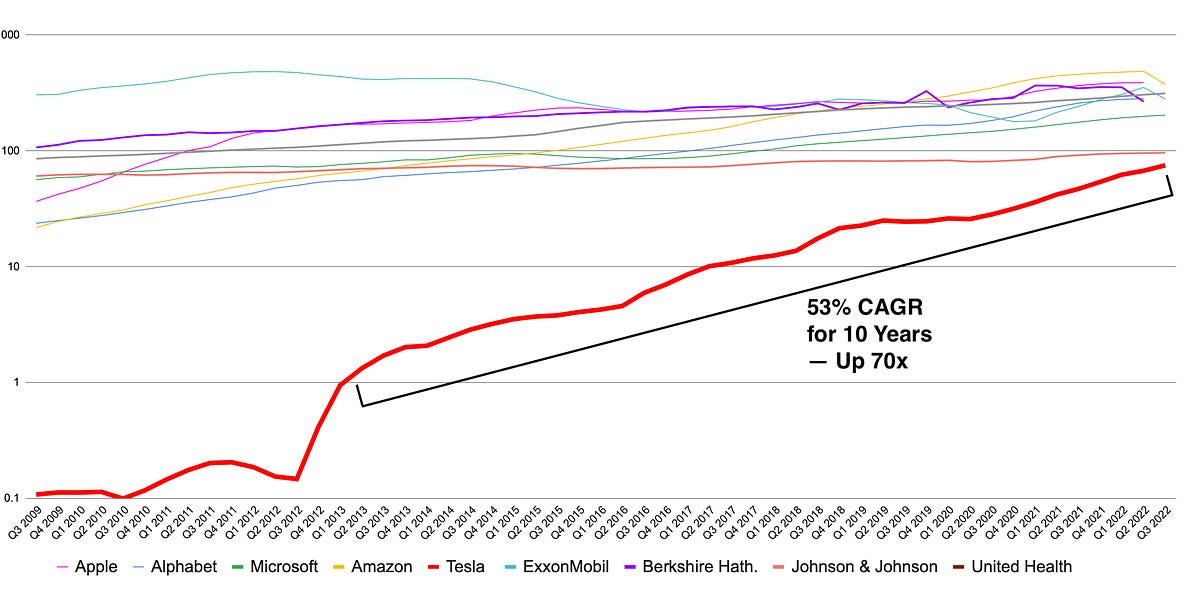

I have no idea where, but I’m going to go out on a limb and say 37% EPS growth in 2023 over 2022 is majorly underestimating what’s really going to happen.- Where do screeners get their future estimates from - analyst consensus?

- What are better ways to quantitatively compare attractiveness of TSLA SP to other companies?

Ah CNBC, keep being classy CNBC.

It may have been published this Friday but the video itself is from September! Typical CNBS.... and by turns, disingenuous:

Slamming on the brakes: Ford cuts production amid chip shortage | published by CNBC at 10 PM on a Friday nite

Chip shortage... chips... right...

/s

I was expecting much worse today, considering the reports about the exodus I read late last night at the organization we are not allowed to mention. I am now confident that we will not go down further from here.

Not sure about US, but for Europe is a nice car. Not the best one in terms of efficiency, but a nice urban car. They are selling well in Italy, of course, and it can be used for short trips in the highway too.The 2015-2019 Fiat 500e were a fun little car, not something you want to drive on the highway without a helmet, but definitely cool as a cheap town car with short range. Plenty of room for two passengers, cute look etc. Compliance car back then, is this going to be different ?

Only your broker knows how much leverage you've taken, and how long to break you.

OTThe 2015-2019 Fiat 500e were a fun little car, not something you want to drive on the highway without a helmet, but definitely cool as a cheap town car with short range. Plenty of room for two passengers, cute look etc. Compliance car back then, is this going to be different ?

Meanwhile out in the world beyond the USA, the Fiat 500 is viewed as a fantastic little car. Not necessarily highly profitable, but that's a different matter. The USA has a seriously skewed view on this sort of thing.The 2015-2019 Fiat 500e were a fun little car, not something you want to drive on the highway without a helmet, but definitely cool as a cheap town car with short range. Plenty of room for two passengers, cute look etc. Compliance car back then, is this going to be different ?

You were saying ....I don't blame people for thinking a recession is going to stop or reverse Tesla's sales growth, I just think they don't have a clue as to what is really going on in the auto market.

Even a strong and long-lasting recession is not going to stop Tesla from continually ramping production and sales. The impact will be that margins, which are currently rising, would level off or reverse course, while production and efficiencies continued to increase. Yes, Tesla would continue to improve volumes and the cost to manufacture, but they would have to lower prices to continue to sell all they could make. A really long recession could cause Tesla to slow growth of new factory construction if it were a serious enough of a recession, but that will not slow Tesla in the next three years. Even that impact would not be a given as recessions are the best time to expand production capacity.

The impact will be that margins, which are currently rising, would level off or reverse course, while production and efficiencies continued to increase.