insaneoctane

Well-Known Member

This must be due to the poor reliability that Consumer Reports was talking about

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

This must be due to the poor reliability that Consumer Reports was talking about

I thought whenever Elon says wide release these days he is talking about Twitter employees leaving SF HQ.Tesla FSD 10.69.3.1 going to wide release now. Queue 5 different interpretations of what "wide release" means.

Tesla FSD 10.69.3.1 going to wide release now. Queue 5 different interpretations of what "wide release" means.

I think we can all agree that V11 will be the wide release candidate which will go out to all FSD buyers after it's spent a couple weeks in beta testers hands. Stil hoping it happens by end of Dec but it'll definitely be tightTesla FSD 10.69.3.1 going to wide release now. Queue 5 different interpretations of what "wide release" means.

I am a bad driver because I routinely cross yellow lines to avoid potholes and double parked cars. My car flashes red and beeps at me warning me to take control immediately! Also it will randomly light up every couple of weeks for some object that I am definitely not about to hit. And I turn aggressively. Which of course does not stop random drivers from cutting me off and trying to pass me because I am driving like grandma.I'm still waiting on the beta. So not "wide enough" in my view.

I won't defend Tim as he just never "got it". Carter Worth, on the other hand, is simply a "chartist" who is often very correct. I'm not a chart guy but I do believe in "self-fulfilling prophecy" as there are many traders out there who watch this stuff. I believe strongly in Tesla as a company and their products (2 Cars, Solar panels) but ... I'm worried about the short term. Yes, I know I shouldn't worry about it as I'm along but I've literally watched over$5 million evaporate from our portfolio over the last year .... it sucks.I don't know how these CNBC talking heads say what they say with a straight face. If we had listened to Tim Seymour when he was shorting TSLA, we would have lost our shirts when TSLA was finally being recognized as an automotive leader. Instead, we ignored him, held our TSLA shares, and have multiplied our capital more than 10X from when he thought it was a good idea to short a company executing in a superior manner.

Why would anyone with half a brain listen to him now?

Back in 2019 they had that tool idiot that said Tesla would never go over $375 pre-pre-split - $25 in today's price.When you have no idea what is Tesla about, and have not looked at the company in 2 years, perhaps it is best not to go on television to let everyone know your ignorance.

At 4:26 mark -

“the only 3 things that Tesla had going for it was the S&P500 inclusion and the stock split and reaching 500,000/year production. Those positives are already in the price. I don’t know what else Tesla has going for it going forward.”

CNBC today. Posted to YouTube 2 hours ago.

I think they could be close to releasing it to the wider fleet, of course as a Level 2 ADAS requiring constant supervision. The plan communicated to the Cali DMV (back in 2020 iirc) was to use the Beta program to refine the user experience (tracking interventions, disengagements, camera button) until it was ready for a release to the wide fleet. After that was achieved, some new iterative process would begin and continue working towards Level 3+."end of Dec"

Is this an Elon trick where the year is left out?

The upcoming economic pain is one thing, now ask Elon what he thinks is coming with China and Taiwan: he believes a conflict is inevitable and figures it would cut the global economy by 30%.Agree 100%. The current global economic situation does not give me confidence. Absolutely Tesla should be hoarding cash at this time, in my humble opinion.

The trillions spent on covid stimulus shortly after the pandemic was announced, and the subsequent massive rise in equity valuations and following sell-off reeks of Wall Street fraud of epic proportions. And governments have added so much debt to their balance sheets in the past two years, with rising interest rates, I think we're going to see defaults and margin calls soon for both governments and financial institutions. In fact, I think we're already seeing the margin calls, the FTX crash and falling stock market the early indicators. I think a 2008 style unwinding is upon us.

Don’t get me wrong, I feel as bullish as ever about Tesla and where the company is headed; indeed, I think Tesla will be much better positioned than others due to industry leading profit margins, vertical integration, pricing power, minimal debt, etc. But the astronomical rise in the dollar (DXY) we’ve been seeing these past few months is indicative of a global margin call of our over-leveraged, non-productive financialized economy, and major institutions of all colors cashing out as central banks raise interest rates into an ongoing recession. The bubble is popping. Governments/institutions simply cannot finance their debt any longer, and when one systemically important country or financial institution finally defaults, a chain reaction of defaults could occur that will drop the markets lower. FTX is a perfect example of non-productive financial wizardry gone bad, like Enron 2.0. How many hedge funds will FTX alone take down, and who is going to step in and stop the bleeding this time and how? Everyone is drowning in debt (except Tesla).

Yeah Tesla should hold on to its cash. People can shake their fists all they want at Elon, as if he and he alone is responsible for TSLA dropping so hard in 2022. But if one steps back and takes a look at how sharply everything has dropped, it seems to me that something very different is going on.

Me thinks, majority of people don't care/ever seen a crash test. Until they get a Tesla and know you have the safest car ever.OT

Yes, often these cars are advertised as “a fun little car” but the safety record is not great. People should pay close attention to NCAP Official FIAT 500 2021 safety rating but this car is nowhere near as bad as the safety record on the Renault Zoe....[/URL]

Fair point. Ok maybe not perfect analogy but making excuses for margin when growing is not a good path.This is a transient phase where Tesla has two factories in mature volume production and two that are ramping. It’s unlikely we’ll ever reach a point again where half of Tesla’s factories are new and dragging on overall margins. At some point in the future Tesla’s exponential growth rate will slow down and thus most of the vehicle production will be coming from mature facilities, as was the case in Q4 and Q1 before Ber&Tex came online with their depreciation and amortization expenses.

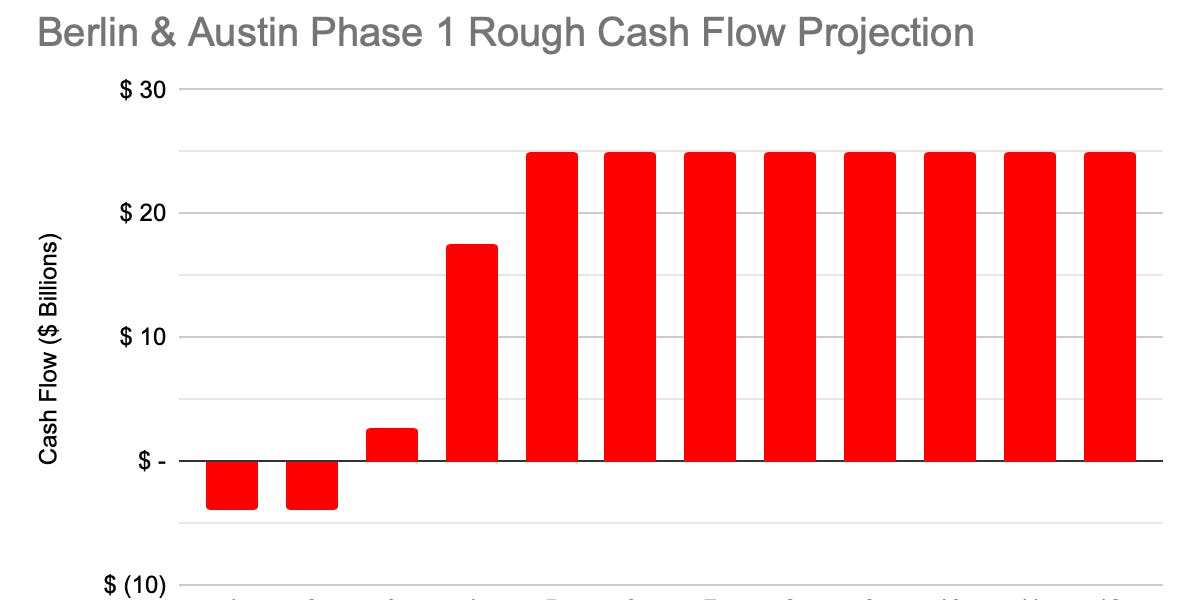

Investors (who are rational and also not shortsighted) want to know the net present value of the cash flows from each additional factory Tesla builds to estimate the return on investment, and thus it’s critical to know the gross margins for mature lines even in a rough quarter filled with headwinds. The factory is the product. I’m very glad Zach gave that info on the call because it increases my confidence in this model:

100% Annualized Return on Investment?

Stunning Gigafactory CapEx Efficiencyglobaloptimization.substack.com

Pension obligations for GM is a bad comparison because GM has those obligations irrespective of any investments in future growth. It’s a built-in part of GM’s cost structure.

I am a bad driver because I routinely cross yellow lines to avoid potholes and double parked cars. My car flashes red and beeps at me warning me to take control immediately! Also it will randomly light up every couple of weeks for some object that I am definitely not about to hit. And I turn aggressively. Which of course does not stop random drivers from cutting me off and trying to pass me because I am driving like grandma.

Four years paying for FSD, three different cars, still only get to watch it on YouTube. Don’t quite get it.

Citation needed[...], now ask Elon what he thinks is coming with China and Taiwan: he believes a conflict is inevitable and figures it would cut the global economy by 30%.

Last earnings call I heard him say it was up to the board and would make sense. I don't remember any mentioning of world stabilizationElon was asked about buybacks at the latest shareholder meeting, and his statement was that buybacks might be possible once the world has stabilized and there isn’t a force majeure hiding *somewhere*

I called my daughter Tesla a few weeks ago. Out loud in a public group.

I'm still waiting on the beta. So not "wide enough" in my view.

It’s not an excuse; it’s analysis that provides a clearer picture of Tesla’s cash flows in the long run.Fair point. Ok maybe not perfect analogy but making excuses for margin when growing is not a good path.

Yes it is an argument that supports valuation. This is mainly an artifact of accrual accounting rules where depreciation and amortization expenses are flat instead of being a function of actual production volume, which artificially makes the unit economics look worse for new factories.Especially when they need to build 2 more and retool Kato. Fast growing companies always have challenges. But saying if we were not fast growth than our margins would be super is not an argument that supports strong valuation.

No he didn’t say that, and it was in his opening remarks not in response to a question. You just made this up.Elon was asked about buybacks at the latest shareholder meeting, and his statement was that buybacks might be possible once the world has stabilized and there isn’t a force majeure hiding *somewhere*

Elon: “The -- we've debated the buyback idea extensively at the board level. The board generally thinks that it makes sense to do a buyback. But we want to work through the right process to do a buyback, but it's certainly possible for us to do a buyback on the order of $5 billion to $10 billion. Even in the downside scenario next year, even if next year is -- was a very difficult year, we still have the ability to do a $5 billion to $10 billion buyback. This is obviously pending board review and approval. So, it's likely that we'll do some meaningful buyback.”

Not to rub it in but I got FSD Beta this morning. Finally after a waiting over a year. Mobile service upgraded my cameras on Wednesday in a little less than an hour. I tested positive for Covid yesterday, so I'll have a lot of time off from work to play with it. Took it for a test drive this morning and it was a lot of fun.I'm still waiting on the beta. So not "wide enough" in my view.