I was looking at today's volume trying to determine if buybacks had begun. Clearly somebody is buying.What's most encouraging to me in today's trading is the volume. On a day when traders are mostly thinking of turkey and football, TSLA volume is much higher than I would expect.

Cautiously (very cautiously) optimistic we could have seen the bottom.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Gigapress

Trying to be less wrong

Adam Jonas is predicting EPS contraction relative to Q3.Gary Black posted the note from Adam Jonas yesterday evening on Twitter:

Interestingly, Adam has a 330$ price target while he assumes almost no EPS growth in 2023.

He has $4.08 EPS in ‘23. Q3 was $1.05 or $4.20 annualized.

1.8M deliveries. That’s 35k/wk. Tesla is already making at least 38k/wk right now.

Elon must be buying.I approve of the price action so far today.

- That is all -

#positivity

Adam Jonas is predicting EPS contraction relative to Q3.

He has $4.08 EPS in ‘23. Q3 was $1.05 or $4.20 annualized.

1.8M deliveries. That’s 35k/wk. Tesla is already making at least 38k/wk right now.

Wow, AJ's EPS estimates are WAY below mine ($6 for 2023, $8 for 2024). And my estimates are purposefully conservative!

Trying to stay relevant, BC Hyrdro (British Columbia Electric Co) is upgrading some of their chargers to 100 kW.

driveteslacanada.ca

driveteslacanada.ca

BC Hydro doubles size of DC fast charger in Quesnel

The Quesnel site will now have a new 100-kilowatt charger and a 50-kilowatt charger which opened in January 2020.

driveteslacanada.ca

driveteslacanada.ca

Gigapress

Trying to be less wrong

This is only part of the reason why. They also had to insource because they needed a faster rate of innovation, needed the engineers next to the manufacturing operations, and needed to conserve working capital.He began vertical integration at Tesla only because high quality suppliers would not sell to Tesla.

Discussed in part of this article and in the 2016 shareholders meeting.

Burning Dumpster Fire of Stupidity

Agility, Humility, and Humor to Become Less Wrong & Convert "Impossible" into "Late"

- Thai barbecue outsourcing debacle discussed at 4:26:30 in video:

Elon: I remember having a conversation with Jason that’s like “Jason, dude, we are doomed if we do not insource the battery pack, because we have a supplier in Thailand that is great at making barbecues but not at making battery packs” and the supply chain was so long that it would take six months from when the cells were built to when the battery pack was done and in a car…

The capital cost of that supply chain was gigantic because we would have to pay for all of that inventory and process and inevitably there would be mistakes made in the design or the fabrication of the battery pack and we’d have six months worth of battery packs that didn’t work. So this was sort of like doom on a stick. And it’s like, man, even though the idea of manufacturing in San Carlos was mad, it was less mad than outsourcing to a situation that definitely didn’t work. So it was like, “Jason, we have basically months to insource this operation so that we can iterate rapidly on the battery pack design, iron out our issues, and tighten the supply chain.”

…

Jason: Extremely well-intentioned, but just absolutely no experience. The building was open to the air and so you would literally have animal droppings on the product and that’s when we were like “Alright, we gotta have a building, man, c’mon.”

Elon: Roofs are important, you know.

…

Jason: So after two years of spending—I spent personally 50% of two years there [in Thailand]; a bunch of people in this room spent as much if not more time there getting the thing running, and like you [Elon] said also, the lag: We would show up in Thailand—I don’t know if you guys know what a pelican case is, but it’s this awesome plastic suitcase and we’d show up with seven of them at the airport and these [security] guys would just look at us like “What are you guys doing?”…Anyway, we brought [manufacturing] back in January of 2008. We packed up seven shipping containers, and we reassembled that factory in San Carlos…in about five and a half months.

…

Jason: It was [a] really early telltale: vertical integration is the way to go. Some would argue we might’ve over-centered [on vertical integration] in some areas…but really we had control now. We had all the engineers right there. We didn’t have batteries on the water, not only from Thailand to England but then cars on the water from England to here.

Elon: Yeah. That’s what I meant by the six-month supply chains. So it would be like, we would only find out if there was an issue with either the design or the manufacturing of the battery pack six months after it was built. So you can imagine the insanity of having some built-in design or manufacturing flaw and have six months worth of inventory that all has that flaw.

Jason: Yeah, some of the same people we were working with building the factory in Thailand. We would do missions…to the UK to the Lotus factory again with these pelican cases full of glue and popsicle sticks and mixers, and we would do these retrofits of—I think the record was like 15 batteries in two and a half weeks, where we disassembled the whole thing, did the retrofit, assembled it. The Lotus guys thought we were insane.

Elon: Yeah they did.

Jason: They had a point.

…

JB: I think that taught us a really key lesson that is still incredibly relevant today [in 2016], which is a lot of the technology and intellectual property was actually in how we make the products and I think that’s underappreciated by a lot of people…

Svetlin

Member

Thanks for not calling it “soccer”On a day when traders are mostly thinking of turkey and football…

UkNorthampton

TSLA - 12+ startups in 1

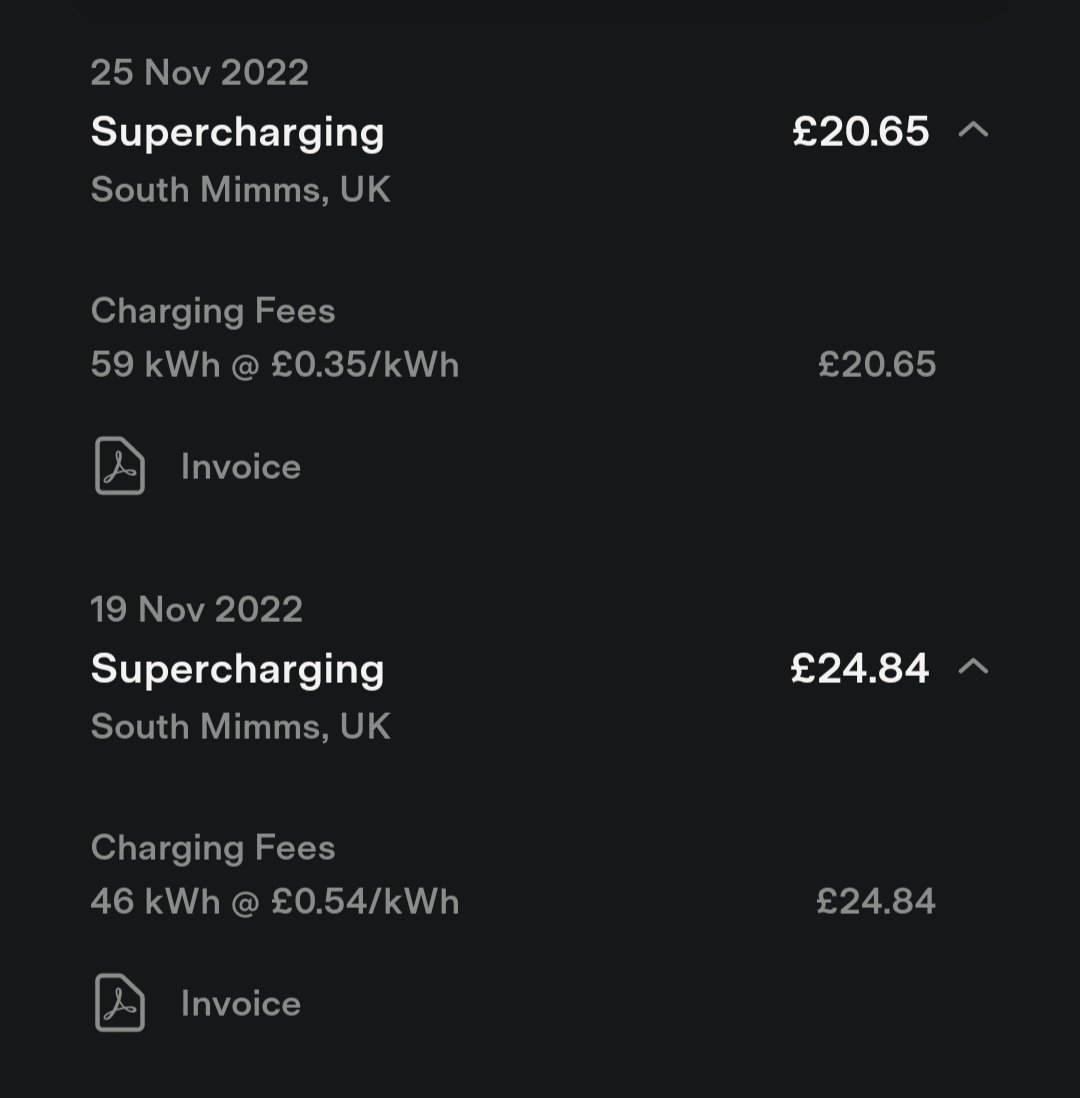

I haven't checked in my car, but report of cheaper Supercharger prices in UK - improves cost-benefit of Teslas as these prices are below many other networks, which might lead to reduced prices on other networks & spur yet more general EV interest. Especially useful for Tesla sales for high-mileage company cars.

teslamotorsclub.com

teslamotorsclub.com

Significant reduction in SC pricing

Saw on twitter, confirmed in my car. It seems that the majority of UK Superchargers have now dropped from ~66p to 40-45p peak. Off-Peak charging times also seem to have become wider (Not just late night. It's mainly 4-8 that's considered peak, if I'm reading the new display correctly), and are...

Drumheller

Active Member

How do I delete another person's post?You think TSLA will do a reverse split ?

A significant drop of the major indices from today’s highs (for a reason unknown to me), but TSLA holding up nicely for a change*. Is the market finally seeing the value of this company again?

* Knocks on wood.

* Knocks on wood.

bkp_duke

Well-Known Member

/me waits for the FED to crush the mini-rally . . .

VIX hit the 20s. I sold CCs on everything I had at that point, other than TSLA.A significant drop of the major indices from today’s highs (for a reason unknown to me)

Oh they did supply Tesla (Bosch, Conti, ZF...etc), but, and it is big but, they actually outsourced their sub-assemblies, their code and could not manage them to the speed/agility that Tesla demanded. They wouldn't even put us in contact with those partners at first...ugh.He began vertical integration at Tesla only because high quality suppliers would not sell to Tesla.

I think ZF still supplies the EPAS code and as it does not react to explicit angle disturbance, only torque.

Captkerosene

Member

There is no overhang.

No person or entity holding shares substantial enough to affect price upon dumping their position is credibly likely to make such a rash move, weighed against their deeply considered rationale for investing in the first place.

Anyone who would dump this stock at this low is a dilettante with a dismal future ahead of them.

The market is controlled by small investors ... not whales. Imagine that you are a financial advisor. Your job is to not get fired. How do you get fired? Make the customer mad. Why take the chance that your customer is a closet Elon hater and will be upset that they are "supporting" him by owning the stock ... especially if they are losing money on it? (You never want your customer thinking they're smarter than you.) So, I suspect that some FAs are dumping the stock to avoid this issue. Bitcoin is a good example of this. Would you as a financial advisor buy BTC for a customer (even if you loved it)? Would you even mention it to a customer without them mentioning it first? Too polarizing an issue.

Other things affecting price are mo-mo traders selling out and tax loss selling.

Mostly though, I blame Ryan27's wife.

I'm not into conspiracy theories, certainly not as much as Elon these days, but maybe Elon is tanking the stock to exercise his options in a far more favorable position. I'm like 81% joking with that sentence...but 19% hmmmm.

thesmokingman

Active Member

TSLA doing too good with upgrades today so, there goes CNBC with their dog and bear show, drag out all their bears...

I’ll try to explain in another fashion. The institutional investor (II) has clients: public pension funds - New York State Teachers’ Retirement System, NY City Employees’ Retirement System, (NYSTERS, NYCERS), CALPERS, MIPERS, Alaska Permanent Fund, Norwegian Sovereign Fund and many thousands of others.On the contrary, the entire financial industry is built around the well-known fact that most people are incredibly risk adverse. Mutual funds, extreme diversification, bond ratings, financial advisors, the FDIC, everything in the industry, is built around the well-known fact that people are afraid to lose their money. This is why FUD is so effective at transferring the productive wealth from main street to people in suits and ties on Wall Street.

It has semi-private funds (retirement systems for AFL-CIO, Teamsters and thousands of others).

It has mutual funds that market to hundreds of millions of individuals - possibly, now, billions.

ALL OF THESE clients and prospective clients have their own degree of risk aversion and a tedious part of the II’s marketing and portfolio-formalizing centers on each side coming to an agreeable risk balance. So it is frustrating to read “the industry is…built around most people being risk adverse[sic] “ as that is tantamount to and just as useful as proclaiming “most people prefer breathing”.

I remember that chart. I pointed out the flaw at the time. He applied Wright’s Law to the entire electric vehicle. He should’ve used at least two cost equations. One for the relatively new electric vehicle bits, and a second equation for the very mature rest of the car (suspension, tires, body, windshield…).To be fair- so have Tonys projections been wrong year after year too, just in the opposite direction. For example his charts said we should be able to buy 200 mile range EVs for 18-20k USD by roughly now.

Last edited:

Great thread, helpful to see all that info in one place.

FSDtester#1

Craves Electrolytes

Registered Investment Advisors (SEC regulated) and any Series 7 Financial Advisors (FINRA regulated) are prohibited from discussing anything regarding crypto with any clients. Which of course includes buying or selling.The market is controlled by small investors ... not whales. Imagine that you are a financial advisor. Your job is to not get fired. How do you get fired? Make the customer mad. Why take the chance that your customer is a closet Elon hater and will be upset that they are "supporting" him by owning the stock ... especially if they are losing money on it? (You never want your customer thinking they're smarter than you.) So, I suspect that some FAs are dumping the stock to avoid this issue. Bitcoin is a good example of this. Would you as a financial advisor buy BTC for a customer (even if you loved it)? Would you even mention it to a customer without them mentioning it first? Too polarizing an issue.

Other things affecting price are mo-mo traders selling out and tax loss selling.

Mostly though, I blame Ryan27's wife.

We are instructed to say, "I can't comment on any crypto".

Btw, I hold almost every Security license offered and have followed those rules that were first suggested 5 years ago and were mandated 3 years ago.

Also the reason I use an alias, I don't want these entities to know who I am.

Edit: For my clients whom I am allowed to give investment advice to, I have had clients purchase over $500K of TSLA this year so far, and will continue to do so.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K