RSF, did BYD have the Atto 3 on display at the show? I sat in one at a BYD dealership in Bangkok. It looked and felt solid, well-designed and roomy. Unfortunately I didn't get a chance to test drive it, but reviews are positive and sales here in Thailand quite brisk.A few recent observations:

- Today I went to my local Tesla store (Duiven, The Netherlands) to check out the new Model S. I’m considering trading in my P100D for a Plaid. The store manager had trouble finding time for me because he was constantly helping people with their scheduled test drives of Model Y and Model 3. He showed me the agenda: ‘almost every day is fully booked’, he said, ‘it started when Tesla dropped the prices’. He managed to squeeze me in for a test drive on Thursday, one of just a few spots left.

- On my way there, going east, I saw two trailers full of Model Ys heading west. White and Quicksilver, so built in GF Berlin.

- Last Friday I visited the big Autosalon in Brussels, where almost all car brands were present. The Tesla stand was extremely crowded, already early in the morning. I checked out all the competition and saw their prices: often €10-15k more expensive. The only brand that positively surprised me with their prices (more or less equal to Tesla’s), design and quality of materials was BYD. I think these two brands might just rule the world.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

This plan doesn't work in the Supercharger desert where Superchargers are few and far between. You need far more than 20 minutes in a V2 SC to make it from Salina to Lincoln or Ardmore to Perry (Ardmore is often full with a waiting line, and there have been electrical outages at Perry and Salina that I've been caught in. Neither was the SC's fault, but still not able to charge.)At a busy station, set a time limit of 20 minutes after which the station stops shuts off and starts charging idle fees. The same comment here applies to that guy who thinks he needs to charge to 99% and spends 45 minutes+ camping the charge station when it’s slammed. When it’s busy people need to GTFO.

2daMoon

Mostly Harmless

Well…. Snap I thought those were getting built in Texas eventually. I guess the expansion in Texas is for ?? Gen 3?

Maybe they'll do both and have two Semi factories.

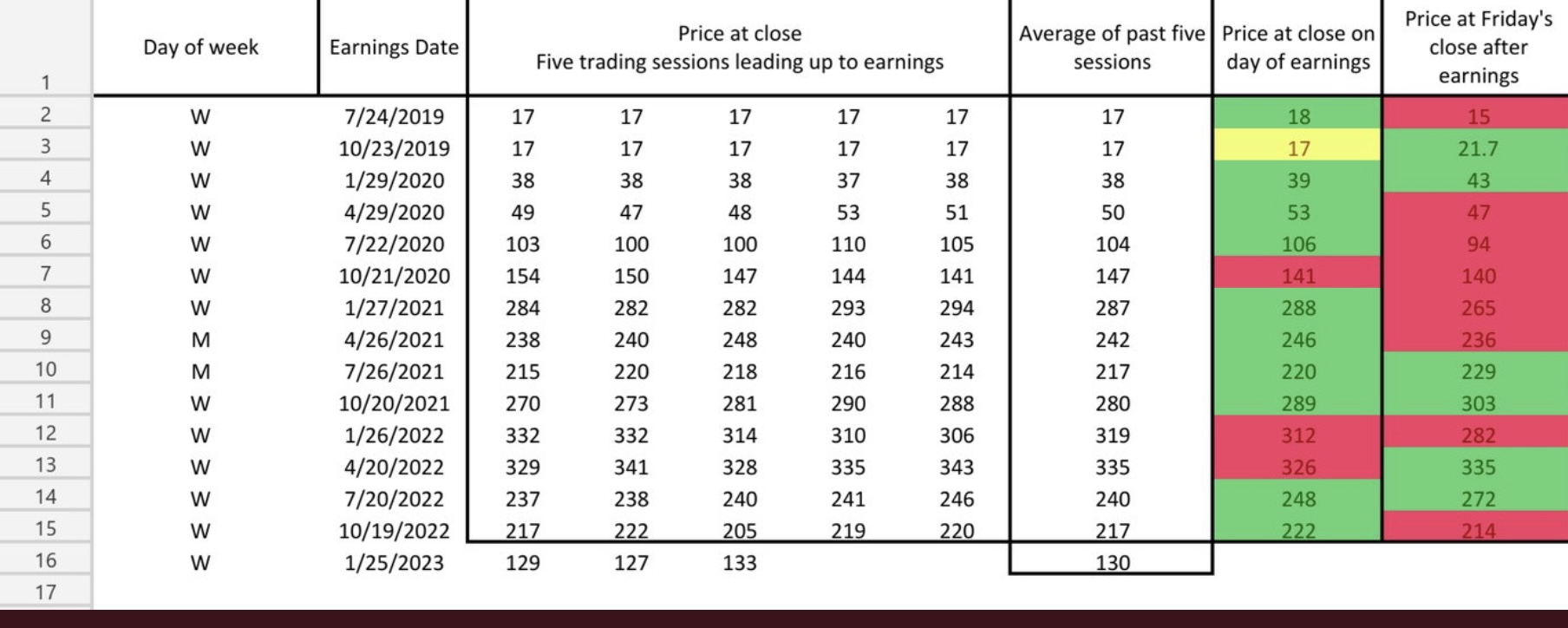

Tesla stock prices 5 days before and right after quarterly earnings report dates.

Source tweet

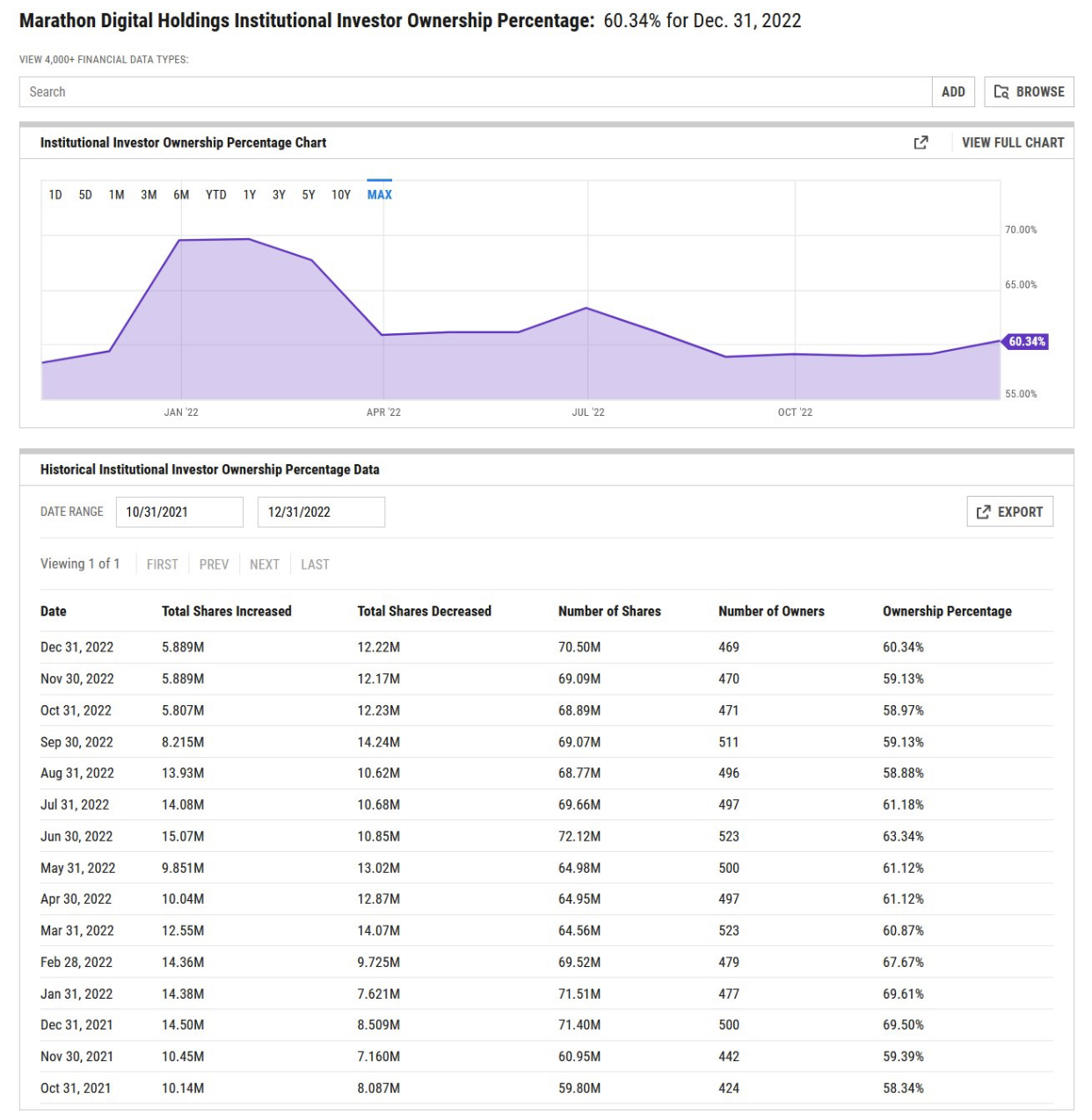

Institution investors ownership percentage holdings bottomed in August and has gone up by 1.46% since.

Tweet

Source tweet

Institution investors ownership percentage holdings bottomed in August and has gone up by 1.46% since.

Tweet

Last edited:

2daMoon

Mostly Harmless

for those who believe TA is no good:

nasdaq composite is on verge of breaking/just almost broke on heavy volume 14 month long trendline

is the bear market over? probably so

as far as TSLA, we are likely headed much higher over next several months to years

wild guess, and don't hold me to it, could be as high as $1000+ by january 2025

which would be 10X from bottom $101 or so

this view is entirely based on TA, and since we all know for sure TA is no good, this is just purely speculative opinion with zero chance of TSLA doing 10X in less than 2 years

so, back to regular programming

Well, for 10X in two or three years I'd be willing to make some offering or sacrifice to the TA gods, if that would help.

Last edited:

In Germany Tesla dropped the leasing interest rate to 0.99% for model 3/y if you take delivery until March 31st. Financing rate dropped to 1.97% for 3/Y.- Tesla’s pricing change causes commotion with the lease companies, mainly active in the company car market and 90% of the Tesla’s sold are company cars.

- The price change causes Teslas now to fit in many company car budgets,

Tweet

Europe buys 1000 cars a day. Half of them built in Germany (the more expensive ones), and there’s no stock of those. The other half arrives every ten days or so per ship. It’s ok if not all those cars are sold before they arrive, it’s only a couple of days of inventory. And the prices are going up again, Tesla does that when there’s too much demand.

And here’s a picture of that inventory (the port of Zeebrugge opened a new train sorting station yesterday in order to transport more cars by train):

One bad aspect to this news:

It means high volume Semi production is still over a year away, as it will take at least a year to build and fill out a new factory. So Semi volume will remain small for the next 1 to 1.5 years.

Artful Dodger

"Neko no me"

One bad aspect to this news:

It means high volume Semi production is still over a year away, as it will take at least a year to build and fill out a new factory. So Semi volume will remain small for the next 1 to 1.5 years.

That's not news. We've know that since Dec 8th.

That's not news. We've know that since Dec 8th.

I thought the belief was they'd build the Semi volume line in Austin? Which would be much quicker, building a production line in an existing building. Now Tesla needs to build a new building, hire people in an area where it's already hard to hire people, and THEN build the production line.

It pushes Semi volume production back farther than I was expecting. I'm sad now.

That is almost completely correct in my humble opinion.There is no reason why it should because you are right it's just squiggly lines. In a casino it's no more effective than watching the patterns in baccarat and trying to figure out the pattern on the sheet.

From a purely logical point of view. The reason why it works is because enough people believe it works. Unlike the casino example (Where it's just random), if enough traders and algorithms actually trade on these technical signs, then they have the ability to move the stock. Which is probably why technicals work during times of noise (No earnings or news, moves with macro or starts doing it's own thing) and break down when actual news comes out.

I will only add that even when TA uses the best stochastic models, by definition the models work only when past patterns are exactly the identical ones to future patterns. (That is the most basic ‘boundary condition’). In ideal conditions those can be ~60% correct. That is better than guessing, if one has no better information.

So, how does a greedy quant or the quants employers make money with such vaguely accurate tools? As you say, when they actually trade on the tools they can make inordinate profits, draw in more

As many of us have pointed out TSLA is an ideal security on which to base such efforts. It is widely held, has very active retail investors who are predominately well-educated, statistically fluent or nearly so, trust data and use statistical modeling on a regular basis. Above all, nearly all of them are fairly new to securities, having not directly experienced even 2008-2009 markets. Further many of them, as always, report successes, not failures.

That is where we are. We repeat versions of this over and over, occasionally being ridiculed by the speculators because they have superior knowledge. The prototypical highly touted technical tool is Bollinger Bands, developed by a PR maven educated at a for profit art school. His clever promotion and convincing demeanor have given him a wide following and academic honors. The problem is that they really have minimal value. Just as with astrology though, it’s useless to try to convince adherents, so most if us don’t try. This one is easy compared with, say, pointing out that the Black-Scholes model is irrelevant to us options valuation, which is anathema to the many corporations that use it for executive options valuation.

In sum ‘in the land of the blind, the one-eyed is king’ . That is why all this continues decade after decade while the false prophets gain awards, professorships and prizes. When reality intervenes they invariably are well prepared to blame other people.

Sorry for being strident. I’m always sad when people close to me walk into these disasters with unseeing eyes wide open. Yesterday I was asked to bail out a relative who lost all his wealth in these idiocies. He had been regularly telling me I did not understand, things were different now. Armed with an excellent resume, led by luminaries in ‘investment’, he utterly failed. From Tesla Economist, who admitted it, to many others I am very sorry we all could not adequately convince people to be prudent.

One bad aspect to this news:

It means high volume Semi production is still over a year away, as it will take at least a year to build and fill out a new factory. So Semi volume will remain small for the next 1 to 1.5 years.

I strongly suspect they're currently setting up a pilot line and ramping that up in order to iron out any kinks in production. By the time the new factory is built they would then be in a position to copy and paste the line and hit the ground running.

Last edited:

Sure, that's right up there next to earthquake prediction and specific weather forecasts. Every one of them shares the geophysical limitation of recognizing what is a valid signal and what is noise. FWIW, many of the financial industry modelers hold Physics PhDs. I have had a former held of exploration technology for a major oil company, a former head of fault forecasting for a major aerospace company and a former designer of nuclear warheads. The three had enormous intellect and educational backgrounds. These days many of those people also do economic forecasting.I agree. Here's the wikipedia definition of construct validity for the non-statistically minded:

Investing in general should be treated with the same rigor as any other social science like economics. There is far too much bad analysis out there which still today surprises me considering how much money is on the line in this domain. Why has every other sector of modern society received the benefits of the Scientific Revolution but not investing? Makes no sense.

This example here perfectly illustrates people taking something as a proxy variable, assuming without any proper validation that it actually correlates tightly with some other unmeasurable variable, and then acting on that assumption as if it's informative. Social science is full of surprises and counterintuitive findings. Jumping to conclusions is dangerous.

The financial industry has superb modeling technology and talent. The analogy to economics is apt, because no models in such complex and difficult-to-measure areas can account for fundamental controlling variables. Despite herculean efforts and enormous financial resources those areas remain opaque. Don't think there has been too little effort!

Tesla, as Elon points out, is superb in engineering, that includes now unknown applications. Not basic physics, though.

petit_bateau

Active Member

IndeedAnd here’s a picture of that inventory (the port of Zeebrugge opened a new train sorting station yesterday in order to transport more cars by train):

12 years,133 million euros: Zeebrugge presents its new harbour lines

A new, modernised shunting yard was officially put into use in the port of Zeebrugge this week. It is the end of a project that lasted no less than twelve years and cost 133 million euros. In total, more than eighteen kilometers of new track has been laid. According to the Belgian infrastructure...

according to IRDA they sold and shipped 24 of these. No mention of Tesla, are you saying Tesla purchased all 24 of these.You do realize that Tesla designed the gigapress in conjunction with IRDA right? They literally helped make the thing. And their metallurgy team developed a custom alloy needed to use it.

They just might have some IP and secret sauce there.

Gigapress

in this BMW video, they mention the rear is casted. I don’t know if it’s done with a gigapress, but it very well could be.

FastEddieB

Member

for those who believe TA is no good:

nasdaq composite is on verge of breaking/just almost broke on heavy volume 14 month long trendline

is the bear market over? probably so

as far as TSLA, we are likely headed much higher over next several months to years

wild guess, and don't hold me to it, could be as high as $1000+ by january 2025

which would be 10X from bottom $101 or so

this view is entirely based on TA, and since we all know for sure TA is no good, this is just purely speculative opinion with zero chance of TSLA doing 10X in less than 2 years

so, back to regular programming

The above bolded are known as “weasel words”. As far as “TA is no good” and that the above is “purely speculative opinion”, on that we can agree!

Dikkie Dik

If gets hard, use hammer

but it very well could be.

Not likely.

Gigapress and Gigacastings only make economical sense in high volume production.

We discussed this when the original Teslarati article came out. The permits for the expansion into the building in Page Avenue are for a battery test laboratory. This is only a relatively tiny space and so potentially covered by the $1.5M. There's a permit for a similar lab at Austin and Joe Tegtmeyer has pointed out the building, which is also tiny (adjacent the NE corner of the new Cathode building). Plus the building they're expanding into at Page Avenue is currenty heavily utilised as Tesla's seat factory supplying the Fremont produced cars. So no, it doesn't appear that there's any current evidence of a major battery capacity expansion at Fremont.Agreed, $1.5 million could be just for the shell of a new build (permits should tell us more). Battery production equipment would be the bulk of the capital expense, but it's the supply chain that's of interest. Where will all the raw materials be sourced?

If Fremont switches to 4680s for cylindrical cell packs they'd need ~20GWh/yr capacity (with perhaps another 30GWh/yr in LFP packs). That's about double the initially announced intention for Kato Rd capacity (which was 10GWh/yr). As usual, more questions... more questions...

Cheers!

It's possible that the $3.5B for the Semi facility could include co-located 4680 production. This would allow Tesla the flexibility to continue to use 2170 Nevada output across their existing models without needing to shift those models to 4680 to align with the Semi ramp. Or just transition existing models to 4680 in their own time without any co-dependency. It would be better to have battery output ramping at the same time as it's dedicated model than having potential issues in one ramp impacting existing scaled production.Well, lets's do some quick math: 50K Semi's per year w. 915KWh each needs about 45 GWh of battery cells. That's about the current output of Giga Nevada. Check.

I think this implies that Tesla will transition all Models 3/Y over to 4680 structural packs (perhaps beginning with Project "Highland"), and only the Semi will continue to use the 2170 cells (which fleet operators aren't concerned about).

To me, this is a major new piece of information going forward. It'll be great to simplify 3/Y production and logistics with a single architecture for both versions of the structural pack (LFP for SR's and NMC for LR's).

Not only that, but Berlin's supply of 2170s could be reallocated to a EuroSemi at some point, as could LG 2170s used in Shanghai be reallocated to a MiC Semi.

Sweet!

Last edited:

Knightshade

Well-Known Member

At a busy station, set a time limit of 20 minutes after which the station stops shuts off and starts charging idle fees. The same comment here applies to that guy who thinks he needs to charge to 99% and spends 45 minutes+ camping the charge station when it’s slammed. When it’s busy people need to GTFO.

You might wanna look up the max charge rate on cars like the bolt. 20 minutes would often not be nearly enough time to add enough range on a trip for such vehicles.

How Long Does It Take To Charge a Chevrolet Bolt EV?

We completely drain the battery of a 2017 Chevrolet Bolt EV and then record the full 0% to 100% charging session to find out how long it takes to charge.

0-25% took about 20 minutes (19)

25-50% took exactly 20 minutes

50-75% took 34 minutes.

10% to 80% took 73 minutes.

Keep in mind 100% on most bolts is only 238 miles (259 on newer ones).

So 25% is only about 60 miles of range. This might be fine for say, an apartment dweller only using the car locally with no at-home charging, to keep it charged by stopping every couple of days.... but it'd be pretty worthless for taking any sort of long trip... (and even if the attitude is oh well they bought a bolt they'll have to stop for 20 minutes every hour I guess- it ignores the fact that great as SC coverage is, it's still insufficient to support stopping every 60 miles in a LOT of places, especially if any of the trip is away from major highways)

Last edited:

2daMoon

Mostly Harmless

The above bolded are known as “weasel words”. As far as “TA is no good” and that the above is “purely speculative opinion”, on that we can agree!

So, you are implying that making cabrito or chicken soup from sacrificed animals is unlikely to increase the probability of any chances by which it could have been helpful toward appeasing the TA deities to smile upon TSLA?

What about sacrificing a weasel? Would that work?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M