Tslynk67

Well-Known Member

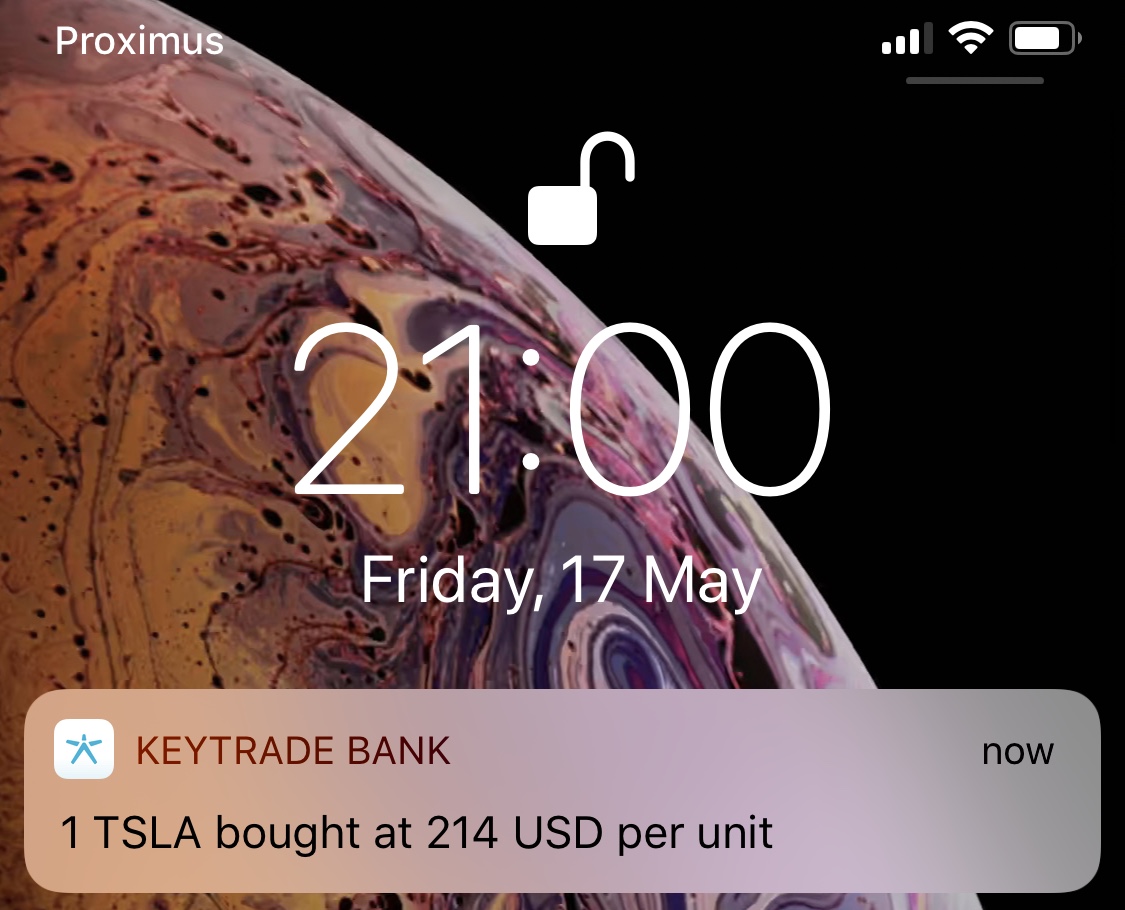

It dropped enough that I could grab one measly share with the cash I had in my trading account...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I'm hoping to hit the Lottery tonight so I can buy $100 million of TSLA on Monday. This price action is completely insane without any real justification. Any other auto company said they were going to watch expenses after having just raised $2+ billion and the SP would be going vertical.

Please explain (perhaps in an AP related thread) what you think a 'true' autopilot does.That's why you don't call it "autopilot" when it's at 10% of true autopilot capabilities.

That sounds really creepy.As if you're old enough to be their grandfather creepy. But hey, they're dating you. So maybe they have more financial sense than you're giving them credit for.

It is a mindset that most people just can't understand. I now have more money than I ever dreamed of but I still irrationally worry if there will be enough for my kids. I clip coupons for stuff I already have too much of. Some people who didn't have all that much growing up just don't like seeing unnecessary waste. Elon is just irrationally over-reacting and unfortunately the SP will temporarily take a hit as FUDsters spin it as "the end is nigh".Good old elon exaggerating urgency to prove his point. Just like how Tesla was "weeks" from bankruptcy but somehow they managed to always have at least 2 billion dollars in cash every earnings report. ....

I just don't think we have enough money, assuming people like Ellison don't pony up along with us. He could drop another 500 million and not feel it. So either he isn't worried about the company going down and/or doesn't want to increase exposure.I have a dream (pipe dream and it'll never happen). We small retail investors who intend to hold all the way to 0 become large enough to hold a large enough fraction of TSLA (along with Elon and his other faithful) that the institutions that are just gaming the system are locked out. We are also have to stop loaning to shorts. If that were to happen, there would be no need to go private.

Sadly it's a poor name choice not because it's inaccurate, but because people in general are uninformed and assume it means more than it does.Please explain (perhaps in an AP related thread) what you think a 'true' autopilot does.

There are true autopilots that do not handle speed, only heading. Some handle heading and altitude.

In a Tesla: altitude is handled by the road and suspension. Heading is handled by Tesla's AP along with speed.

Airplane autopilot does not classically have any accident/ object avoidance capability. Tesla does.

Autopilot Basics - AOPA

I have a dream (pipe dream and it'll never happen). We small retail investors who intend to hold all the way to 0 become large enough to hold a large enough fraction of TSLA (along with Elon and his other faithful) that the institutions that are just gaming the system are locked out. We are also have to stop loaning to shorts. If that were to happen, there would be no need to go private.

UP, skyward, to the moon, Ludicrous. Hell I'd settle for Insane since that is what this is.Well, it IS going vertical; this sure ain't horizontal!

Elon is a control freak right?It is a mindset that most people just can't understand. I now have more money than I ever dreamed of but I still irrationally worry if there will be enough for my kids. I clip coupons for stuff I already have too much of. Some people who didn't have all that much growing up just don't like seeing unnecessary waste. Elon is just irrationally over-reacting and unfortunately the SP will temporarily take a hit as FUDsters spin it as "the end is nigh".

Sure, it's definitely a possible concern that they are going on a big cost-cutting drive now, and Musk's poor explanation quoted by Electrek could be cover for some other bad news.

That's not what people are looking for when they make $40,000+ purchases. Just tell them even if Tesla does go bankrupt, someone will come along and buy them out?

Not just many cars on the road. Tesla owners LOVE their cars, and Tesla has amazing technology. The brand has crazy high brand name recognition globally.Hell, it's what happened to GM -- went bankrupt, was recapitalized. And Chrysler (multiple times). And Renault. People still seem to buy from these companies.

Once there are enough cars on the road, support is forever. A company with this many active, valuable assets is NEVER shut down. Liquidiation only happens when the company's product is worthless.

Bankruptcy is the worst case for the *stockholders* (and one which I believe will certainly not happen). But it is an absolute certainty that even if, worst case, the stockholders were wiped out, the company would keep on going under new management -- car owners have absolutely nothing to fear. The Gigafactory alone is a massively attractive asset to any buyer, since there's a world shortage of lithium-ion battery production.

Unfortunately the ideal times to trade options are completely counter-emotional to what you want them to be. Dips like this are the worst time to be selling covered calls since everything is down, even though this is when we all want to scrounge up as much of a silver lining as we can.

You can get more for your calls if you go longer-term, but you'll still be getting pennies on the dollar since options are leveraged on the way up and the way down.

This is an ideal time to be buying calls or selling puts, but it's hard to double-down when you're in damage control mode.

I just saw on a Model 3 Facebook group that all factory tours have been cancelled. The cost cutting is real.