Artful Dodger

"Neko no me"

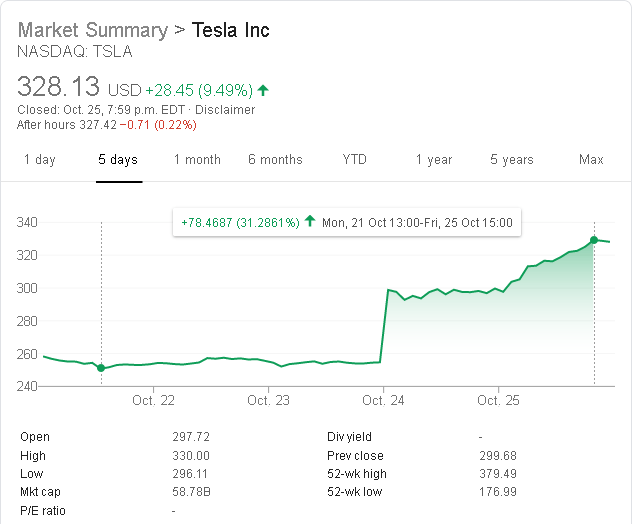

Quite a week, wot? Yeah, that's +31% intra-week:

Cheers to the Longs!

Cheers to the Longs!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I’d be surprised if all your smart, skeptical friends have turned the corner on Tesla based on just one ER and a two-day SP surge.I’m with you Tim. I have a great pension and an adequate 401k. My close friends think I’m mad for buying, holding and continuing to accumulate shares of TSLA into four figures. I try to explain how rare an opportunity Tesla presents and that shooting the moon with Elon is risky, but losing the quarter million or so I’ve invested to date would not change my life. But, if my evaluation of Tesla as an energy behemoth proves correct, then 5-10 years from now this investment will have a generational impact on me and my family. And, in no small part, it’s the collective wisdom of this community that gave me the courage to continue on this course in the face of the FUD Storm and the skepticism of my smart, but ill-informed friends. That and the experience of owning a P3D!

And now it’s funny. Over the past few days this group of friends is looking at me quite differently. It’s a seldom seen combination of envy and respect tinged with awe. I must admit, I’m enjoying the moment, but definitely not gloating. This is a long play and Tesla is sure to continue on a roller coaster ride.

I really think they have cried "wolf" a few too many times. People might be slow to catch on but they are not completely stupid! I've already noticed the hit pieces don't have much impact (like they did previously).

People are on to the fake news and now they are hungry to profit from it.

I’d be surprised if all your smart, skeptical friends have turned the corner on Tesla based on just one ER and a two-day SP surge.

Local word is that he was just a nut case who burned himself with a welder on purpose and made up stories. I talked to a few folks who knew him in the early 1970's.

This was a great Twitter reply:

Twitter reply by Ben Hallert (@chairboy)

"It's weird for someone who's lost a ton of money by following the emotion-based $TSLAQ mob... praising the group that sherpa'd him to losing most of his net worth."

"This is some serious Stockholm stuff here."

Of course as a thank-you for that valuable financial advice Ben Hallert was immediately put on the TSLAQ censorship list:

What these TSLAQ geniuses still don't seem to be realizing is that their Twitter blacklist created a self-reinforcing feedback cycle isolating them from the very investment information that could have saved their investments...

I.e. the TSLAQ Twitter blacklist by Shorty Air Force @Paul91701736 is magnifying the short squeeze.

This TSLAQ supporter's effective personal bankruptcy and the wipeout of his life savings should be a cautionary tale to Tesla bulls too: we should embrace bearish Tesla opinion as well, as long as they are not abusive.

While I have a flaw of erring on the side of Tesla hyper-bullishness, my TMC, Reddit and Twitter block lists are empty.

One thing I have been wondering - does anyone have a good explanation as to why after share price gapped up over night after the earnings report, it stayed flat over the course of the whole day yesterday only to start running up again today? To me this does not seem like an organic stock movement (or better: lack thereof), more like something engineered. Also, don´t remember having seen this before after an earnings report.

You do, but it depends what you did with the loan. If you make a purchase, you spend $50k of post tax money whether or not you used a loan to finance it. If you use it as a margin loan (and get lucky), you never spend the loan and pay it back with the pre-tax money.I thought I've read that you had to repay money you withdraw from the 401k with post tax dollars. Then when you withdraw from the 401k when you retire, you get taxed again. I could be wrong though since I never did it (even when I was tempted too during cash constrained periods of my life)

Hey guys, all I’m getting is a link to the Giphy stuff, not an embedded clip. Do I have a setting wrong? (iPad).

You don't actually have to pay it back right away, you can elect to, or you can pay monthly.I think it is the cascading leverage that really made it bad. Margin, then options, then withdrawing from your 401k where you get taxed again while paying it back. I don't know what amounts you are taking about but borrowing from your 401k is risky. If you lose your job you have to pay it all back right away. Certainly not good if your primary stock is in the dumps

Thursday looked like the response of a high-gain, critically-damped position-hold feedback system. Looks like lots of algorithms (or a few with high levels of input) were employed.Makes sense.

My question was supposed to be focused on why Thursday was completely flat though, looking at the answers I got it seems I didn´t get this across. Do you have an idea about that? With boths shorts and institutions tripping over each other to get in, you wouldn´t expect a flat day, would you? So I am thinking if market makers or anyone else with a lot of buying power might have had some interest in keeping price constant.

In the case of job loss which @thait84 was refering too, the monthly payment from paycheck option no longer exists. Longest time period for repayment post 2017 law change would be Jan 1 of year n to April 15th of year n+1(Oct 15 of n+1 with extension and late tax payment penalty).You don't actually have to pay it back right away, you can elect to, or you can pay monthly.

Me too. The service and lossless audio topics aside, he had truly insightful commentary around the industry and the business. One particular area where I am thankful he highlighted was how exceptional Elon was at cost engineering, this was years ago before the 3 was released. This quarter's results show just how prescient he was.I’m glad I didn’t hear he had sold out or I would have been tempted to do the same. He was a long-term steady bull until he started freaking out about the service issues. I got the impression that the fact you couldn’t call service was killing him, but the rest of us are comfortable using the app.

He was a super good guy and I miss him.

Is that a recent change? I've borrowed from the 401K a few times (all paid back now), and it was specifically stated thatIn the case of job loss which @thait84 was refering too, the monthly payment from paycheck option no longer exists. Longest time period for repayment post 2017 law change would be Jan 1 of year n to April 15th of year n+1(Oct 15 of n+1 with extension and late tax payment penalty).

(There is one rare corner case based on age and job situation)

Edit: and Friday looked like the system lost control authority.Thursday looked like the response of a high-gain, critically-damped position-hold feedback system. Looks like lots of algorithms (or a few with high levels of controllability) were employed.

My understanding was that Fremont needed to make additional room for seat and other part manufacturing, and that the drive unit production was moved to GF1 for this purpose.Our local Reno TV station did a piece on the Gigafactory and the following statement stood out for me:

KOLO 8: Sept 2019

"We're in the final assembly of the drive unit area so we actually make all of the drive units for Model 3 and now we're making Model S and Model X units as well...it's what gives the Tesla its signature speed, acceleration, power, and torque." said Vice President of Operations, Chris Lister....The drive unit manufacturing line is 90 percent automated. "

I've been trying to explain over on SA - what this says about Tesla. Tesla would only switch the production of drive units for the Model S/X to Sparks, Nevada - another 250 miles from Fremont - if there was a compelling reason. It has to be significantly cheaper and it has to involve components already made for the Model 3. Otherwise you'd leave it alone. And, I'd wager that the process which in Nevada is 90% automated was a much lower percentage of automation in California.

Tesla found a way to make a component for the Model S/X cheaper..and followed up. This is why COGS are down.

Tilson is not only a loser, but also a liar: his bet was "up to 10k." So on the online bet entry form, I waged $10k. On Wednesday he e-mailed me "Please send me a link so I can donate $1000 to your favorite charity." It seemed to me that he probably has a pool of $10k for all a bets, which has never been stated anywhere, anytime.

He also PSed his e-mail with this:

If it later turns out that Tesla cooked its books and was really losing money (which I don't think is likely), this all gets reversed!

SMH

Is that a recent change? I've borrowed from the 401K a few times (all paid back now), and it was specifically stated that

1. It could be paid back as a lump sum when you leave your employment.

2. You could pay it back monthly.

3. If you didn't pay it back it would be considered a withdrawal and you would have to pay the tax.