Can't even get a leather steering wheelCongrats to the crazy ones on a big score.

We aren’t out of the woods Yet. Don’t go buy any fur coats for the wives yet.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

This P&D is pretty much in line with what I expected, but it takes some uncertainty off the table, because now we know for sure.

Besides that, I'd say the best piece of information here is actually that only 7% of M3s were leases. I was expecting 11%, so that difference boosts Q4 revenues by ~$200M and profits by ~$40M in my model.

Demonstrated production of over 3k / week in China is also nice, but kind of outweighed by the fact that they only produced ~1000 units so far in my opinion. It seemed like they had produced a few thousand already based on drone footage.

Besides that, I'd say the best piece of information here is actually that only 7% of M3s were leases. I was expecting 11%, so that difference boosts Q4 revenues by ~$200M and profits by ~$40M in my model.

Demonstrated production of over 3k / week in China is also nice, but kind of outweighed by the fact that they only produced ~1000 units so far in my opinion. It seemed like they had produced a few thousand already based on drone footage.

well that helps set the stage

we could see some instability with escalation in Iraq, and who knows where it will go next...but even if tsla gets rocky for a bit, we should be fine through the coming quarters.

if the MIC pricing and ensuing (seemingly) sellout of all they can produce, for at least the time being, can carry some of the weight in Q1, that will go a long way to brush off any 'seasonality' and tax cliffs for other demo's. im happy if we can tread above prior highs ranges and solidify the new range during turbulent times. that kind of strength alone will attract new buyers

by then, maybe we can get some Y prod and delivery and find a nice balance in late Q2-Q3

we could see some instability with escalation in Iraq, and who knows where it will go next...but even if tsla gets rocky for a bit, we should be fine through the coming quarters.

if the MIC pricing and ensuing (seemingly) sellout of all they can produce, for at least the time being, can carry some of the weight in Q1, that will go a long way to brush off any 'seasonality' and tax cliffs for other demo's. im happy if we can tread above prior highs ranges and solidify the new range during turbulent times. that kind of strength alone will attract new buyers

by then, maybe we can get some Y prod and delivery and find a nice balance in late Q2-Q3

tinm

2020 Model S LR+ Owner

davepsilon

Member

The S&X numbers look encouraging - should be high revenue and decent margin to contribute to financial results. Sales trending up since raven refresh, but might just be seasonality.

The Accountant

Active Member

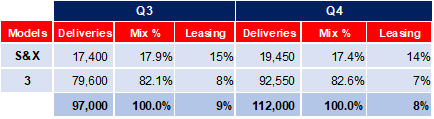

The following information bodes well for the Q4 financials to be released later this month:

- S/X models still account for over 17% of Sales

- Leasing averaged 8% in Q4 vs 9% in Q3 (lower leasing is better for sales)

See Q4 vs Q3 info below:

- S/X models still account for over 17% of Sales

- Leasing averaged 8% in Q4 vs 9% in Q3 (lower leasing is better for sales)

See Q4 vs Q3 info below:

The strong MS/MX sales bode well for profits this quarter and beyond. Unlike last year, it’s hard to believe that demand will fall off a cliff because an $1800 credit is no longer available for a $70,000+ car.

Remember that they produced more cars before they hit the salable level of quality. So more experience and run rate data than the 1,000 number would indicate. May also be linked to government approval dates.This P&D is pretty much in line with what I expected, but it takes some uncertainty off the table, because now we know for sure.

Besides that, I'd say the best piece of information here is actually that only 7% of M3s were leases. I was expecting 11%, so that difference boosts Q4 revenues by ~$200M and profits by ~$40M in my model.

Demonstrated production of over 3k / week in China is also nice, but kind of outweighed by the fact that they only produced ~1000 units so far in my opinion. It seemed like they had produced a few thousand already based on drone footage.

Also, they are using up their supply of GF1 packs as they phase in GF3 ones, so they need to monitor that inventory. At 3k a week, they would have run out in two weeks based on the Carson rumor of 7k packs.

davepsilon

Member

Should we start focusing on S&P addition now

no, too heavy a lift unless they play games with FSD revenue recognition. So far they've been very conservative on that front.

The biggest question in my mind for S&P inclusion timing is whether Q1 is profitable - should become clearer in the coming months. Of course macro events could also derail it.

floydboy

Member

Man, 112,000 deliveries! I wondered why I was seeing kitchen sinks in the back of car carriers. They must have sold everything that wasn't bolted down!

Krugerrand

Meow

Safe to say the Iran news has not tanked the market.

Further developments could change that, but for the moment I am satisfied that the assassination in and of itself will not affect the market drastically.

The news did make me cringe though when it first broke, and I feared a worse reaction would already be priced in by now; looks like we're good.

I also thought Trump impeachment would negatively affect the market. I was also sketched out for a little while regarding the way China was slowly/confusingly issuing seemingly redundant permits for GF3 (I just didn't understand Chinese bureaucracy).

None of those concerns turned out to be a big deal, so I am apparently bad at identifying true "bad" news these days.

Cheers to a continuation of blue sky breakout

Pretty common trait and reaction of people in general; something to do with being survival hardwired. That’s also where negativity comes from. People can always come up with the worst case scenario in seconds and then hyper focus on it. Some people spend their entire lives honing the skill.

You can, however, learn to at least subdue that inherent tendency, but first you have to recognize it in yourself.

One way of combatting a tendency to negativity and overreaction is to not put yourself into situations that can threaten that which you consider a requirement to survive.

Case in point — if money is important to you, don’t risk that which you feel you can’t comfortably afford to lose. It’s really that simple.

If your constant worry that the market may dip based on events you have no control over, well — you’ve got too much invested in that venue for your current hardwiring and thought processes.

Webeevdrivers

Active Member

Congrats to the crazy ones on a big score.

We aren’t out of the woods Yet. Don’t go buy any fur coats for the wives yet.

Soooo, how do you know I have 3 wives? Can you prove it?

Krugerrand

Meow

That held for an entire 13 minutes.

Fact Checking

Well-Known Member

The S&X numbers look encouraging - should be high revenue and decent margin to contribute to financial results. Sales trending up since raven refresh, but might just be seasonality.

S/X deliveries of 19.5k are fantastic, because they did this with just a single shift AFAIK - i.e. roughly half of the workforce. This means that capacity utilization and fixed cost leverage should be near or at record levels.

Todd Burch

14-Year Member

Man, 112,000 deliveries! I wondered why I was seeing kitchen sinks in the back of car carriers. They must have sold everything that wasn't bolted down!

Better than I expected - and reflective of the only real negative I see (Fremont M3 production growth wasn't that great; they managed this feat through inventory, which is a one-time trick).

On the other hand, I love this: "excluding local battery pack production which began in late December." No local Tesla-owned cell production yet, of course.. But that'll come!

And as everyone else is noting, those S&X numbers are superb. Now just wait for Plaid next year

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K