Wow, what a find.

We are all in your debt.

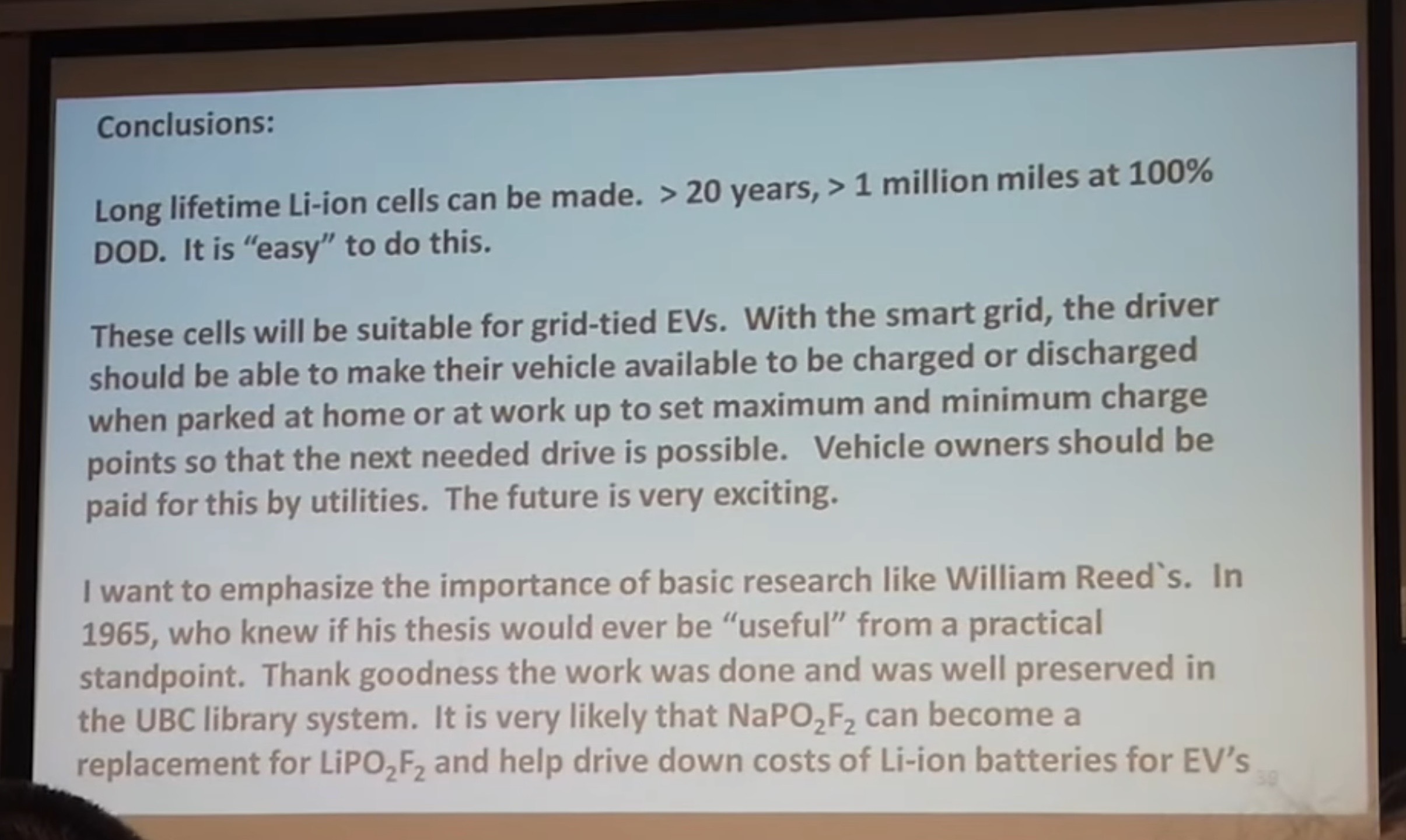

Watched the full video. Atrocious quality and difficult to listen to, but slides were essential; jaw-dropping.

Only because I have learned so much from others on this forum, I really must stomp my feet on this: it is a "must-watch" for all serious TSLA investors. It likely explains why Elon stated the following during the last conf call:

Joseph Osha --

JMP Securities -- Analyst

Further to the conversation around the cell technology, just wondering if you can comment on what the plans are for the Maxwell technology that you acquired here as a capacitor or dry cell or what have you. Thanks.

Elon Musk --

Co-Founder and Chief Executive Officer

Well, like I said, we're going to talk about this in Battery Day, which is probably April. And then a lot of these questions will be answered. I think it's going to be a very compelling story that we have to present. I think it's going to actually blow people's minds. It blows my mind, and I know it. So it's going to be pretty cool.

Source:

Tesla, Inc. (TSLA) Q4 2019 Earnings Call Transcript | The Motley Fool

Buckle up boys and girls; I think we're going for one Hell of ride in April

The only questions is: LEAPS, regular calls, or just plain old-fashioned shares?