Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

EV Promoter

Member

tempted to add...OK... soooo who's buying this dip?

Gosh, Nasdaq under 7000..

Tesla under 460...

dhrivnak

Active Member

I am. The world has gone crazy. Nothing fundamentally has changed with Tesla or the move to EVs.OK... soooo who's buying this dip?

Artful Dodger

"Neko no me"

REPOST - Circuit Breaker rules (next trigger is at -13%)

Circuit Breaker rules:

Level 1 halt (on -7%)

Level 2 halt (on -13%)

- Trading will halt for 15 minutes if drop occurs before 3:25 p.m.

- At or after 3:25 p.m.—trading shall continue, unless there is a Level 3 halt.

Level 3 halt (on -20%)

- Trading will halt for 15 minutes if drop occurs before 3:25 p.m.

- At or after 3:25 p.m.—trading shall continue, unless there is a Level 3 halt.

- At any time during the trading day—trading shall halt for the remainder of the trading day.

Has anything fundamentally changed about Tesla’s long term value?

Will COVID ruin the global economy on a long term basis?

If you answer no to both, this may be a great buying opportunity.

I might have to pull out those $5

Other people who understand the virus crisis better than me ( @Fact Checking @KarenRei ) might think differently, but the way I personally look at it is that it could affect Tesla in 3 major ways:

- Supply disruption. There could be disruptions to supply chains, but because Tesla is very vertically integrated, its risk should be smaller than that of other auto manufacturers. Furthermore, there's nobody I trust more than Elon and Tesla's employees to solve supply chain issues like this swiftly, or even creatively if necessary.

- Government shutdowns. Factories and/or delivery centers could be shutdown by governments. However, these should all be temporary. I can't see a shutdown lasting much more than a month in an absolute worst case scenario. I'm sure the market would react in a very bad way, especially if it was the Fremont factory, but fundamentally it shouldn't be the end of the world. Same thing as happened in Shanghai, production/deliveries should return to normal after it ends.

- Drop in demand. Global auto demand will be impacted, it's only a question of by how much. Fortunately enough, we're all invested in the only auto manufacturer that is currently supply constrained, and most likely quite severely considering Tesla has not pulled any sort of demand lever for over 6 months and increased prices more than once. They're also expanding their product line-up with Model Y and cheaper MiC Model 3s, so they could further fine-tune supply to match demand by slowing down the ramp up of production a little bit. Last but not least, battery storage supply constraints have been most severe of all. If vehicle supply outpaces demand, I'm sure Tesla's energy storage business will rejoice and happily take advantage of extra battery cells finally becoming available.

DragonWatch

Small FootPrint

I am looking forward to seeing a Model Y on a street near me.

FreqFlyer

Active Member

Conclusions of Goldman Sachs Investee call where 1,500 companies dialed in. The key economic takeaways were:

50% of Americans will contract the virus (150m people) as it's very communicable. This is on a par with the common cold (Rhinovirus) of which there are about 200 strains and which the majority of Americans will get 2-4 per year.

70% of Germany will contract it (58M people). This is the next most relevant industrial economy to be effected.

Peak-virus is expected over the next eight weeks, declining thereafter.

The virus appears to be concentrated in a band between 30-50 degrees north latitude, meaning that like the common cold and flu, it prefers cold weather. The coming summer in the northern hemisphere should help. This is to say that the virus is likely seasonal.

Of those impacted 80% will be early-stage, 15% mid-stage and 5% critical-stage. Early-stage symptoms are like the common cold and mid-stage symptoms are like the flu; these are stay at home for two weeks and rest. 5% will be critical and highly weighted towards the elderly.

Mortality rate on average of up to 2%, heavily weighted towards the elderly and immunocompromised; meaning up to 3m people (150m*.02). In the US about 3m/yr die mostly due to old age and disease, those two being highly correlated (as a percent very few from accidents). There will be significant overlap, so this does not mean 3m new deaths from the virus, it means elderly people dying sooner due to respiratory issues. This may however stress the healthcare system.

There is a debate as to how to address the virus pre-vaccine. The US is tending towards quarantine. The UK is tending towards allowing it to spread so that the population can develop a natural immunity. Quarantine is likely to be ineffective and result in significant economic damage but will slow the rate of transmission giving the healthcare system more time to deal with the case load.

China’s economy has been largely impacted which has affected raw materials and the global supply chain. It may take up to six months for it to recover.

Global GDP growth rate will be the lowest in 30 years at around 2%.

S&P 500 will see a negative growth rate of -15% to -20% for 2020 overall.

There will be economic damage from the virus itself, but the real damage is driven mostly by market psychology. Viruses have been with us forever. Stock markets should fully recover in the 2nd half of the year.

In the past week there has been a conflating of the impact of the virus with the developing oil price war between KSA and Russia. While reduced energy prices are generally good for industrial economies, the US is now a large energy exporter, so there has been a negative impact on the valuation of the domestic energy sector. This will continue for some time as the Russians are attempting to economically squeeze the American shale producers and the Saudi’s are caught in the middle and do not want to further cede market share to Russia or the US.

Technically the market generally has been looking for a reason to reset after the longest bull market in history.

There is NO systemic risk. No one is even talking about that. Governments are intervening in the markets to stabilize them, and the private banking sector is very well capitalized. It feels more like 9/11 than it does like 2008.

Will be interesting to see the fallout from all of this six months from now when we look back. Its funny to see the world portrayed by the media and the contrast I see with my own eyes when it comes to people behavior. After a week of social quarantining, no sports, no entertainment, etc. we will see how the populace responds.

corduroy

Active Member

Got in right after the halt. I'm in for the long haul so I'm not worried it it goes a little lower this week. It's not often you can get TSLA on sale like this.

Krugerrand

Meow

It's just a general hysteria.

Understatement.

Sean Wagner

Member

OK... soooo who's buying this dip?

Madadayo (まあだだよ, Mādadayo, "Not Yet") is a 1993 Japanese comedy-drama film. It is the thirtieth and final film to be completed by Akira Kurosawa.

Can't see the whites in their eyes yet. Seesaw will not be over tomorrow.

Buy in tranches over the next months [sic] whenever you like.

Remember that very sadly, triage will become a fact of life, as expected quite a while ago.

Fingers crossed, but I'd prefer ample supplies of hand sanitizer to be available here in Switzerland [epic fail].

Taiwan based their response on sound advance planning and not trusting China [they learned that from SARS].

It has worked very well for them up to now.

Charts that Matter | Corporate bonds

US investors brace for ratings downgrades as turmoil deepens

About $300bn of bonds rated triple B trade with junk-like yields above 6 per cent

Joe Rennison in London 10 HOURS AGO

As the coronavirus outbreak rips through credit markets, US companies from Occidental Petroleum to Ford are being treated by investors as though they will soon lose their coveted top-quality credit ratings, sending their debt tumbling into the drawer marked “junk.”

...

Subscribe to read | Financial Times

Edit: cough, cough: "sending their debt tumbling" ...

The volume is still pretty low, which tells me there is more manipulation going on. I don’t think this is panic selling. At this price everything is priced in lol. It gives me a chance to average down. I’m going to wait to pull the trigger though. Who knows how low they can manipulate this thing.

JusRelax

Active Member

445.46 and seems a halt has been triggered, @Artful Dodger can you confirm?

No second market halt yet. We got somewhat close to the 13% trigger but never hit it.

So all in all, I'm not super worried this is going to impact Tesla in 1 or 2 years from now. I think Tesla's growth might be slowed a little bit in 2020, and perhaps 2021, but previously I could not imagine Tesla delivering anything less than 570k vehicles in 2020, so I'm still quite confident they should be able to deliver 500k+ vehicles this year, in spite of the virus-crisis.

Thank goodness for the capital raise or this might be an existential risk for TSLA.

As it stands though, I have a small business and a Model 3. The next months are likely to set me back a year or two from a personal wealth perspective. The debt I'm going to need to take on to sustain myself during this upcoming time will likely take the Model Y I'd been planning on in 3-4 years off the table. Small business are the engine of the economy and I can imagine a lot of people in my position won't be able to make up lost ground very quickly.

I can see very large headwinds coming for the entire economy, not from the virus, but from our (necessary) responses to it. Tesla should be well-positioned to charge into the future, but it could be a rough few years.

Other people who understand the virus crisis better than me ( @Fact Checking @KarenRei ) might think differently, but the way I personally look at it is that it could affect Tesla in 3 major ways:

So all in all, I'm not super worried this is going to impact Tesla in 1 or 2 years from now. I think Tesla's growth might be slowed a little bit in 2020, and perhaps 2021, but previously I could not imagine Tesla delivering anything less than 570k vehicles in 2020, so I'm still quite confident they should be able to deliver 500k+ vehicles this year, in spite of the virus-crisis.

- Supply disruption. There could be disruptions to supply chains, but because Tesla is very vertically integrated, its risk should be smaller than that of other auto manufacturers. Furthermore, there's nobody I trust more than Elon and Tesla's employees to solve supply chain issues like this swiftly, or even creatively if necessary.

- Government shutdowns. Factories and/or delivery centers could be shutdown by governments. However, these should all be temporary. I can't see a shutdown lasting much more than a month in an absolute worst case scenario. I'm sure the market would react in a very bad way, especially if it was the Fremont factory, but fundamentally it shouldn't be the end of the world. Same thing as happened in Shanghai, production/deliveries should return to normal after it ends.

- Drop in demand. Global auto demand will be impacted, it's only a question of by how much. Fortunately enough, we're all invested in the only auto manufacturer that is currently supply constrained, and most likely quite severely considering Tesla has not pulled any sort of demand lever for over 6 months and increased prices more than once. They're also expanding their product line-up with Model Y and cheaper MiC Model 3s, so they could further fine-tune supply to match demand by slowing down the ramp up of production a little bit. Last but not least, battery storage supply constraints have been most severe of all. If vehicle supply outpaces demand, I'm sure Tesla's energy storage business will rejoice and happily take advantage of extra battery cells finally becoming available.

Fiat has closed 4 factories in Italy, I wonder how much impact this will have on the payments Tesla expects from FCA?

2

22522

Guest

I don't see drop in demand. I would expect a rise in demand.

Tesla has long stated that Americans do not like to ride together. That is why they don't design for car pools. People don't do it.

On a China business call a coworker stated that the US does not have a lot of mass transit, so there is already more social distance than most places. Tesla vehicles provide even more social distance as they avoid gas stations by charging in the garage.

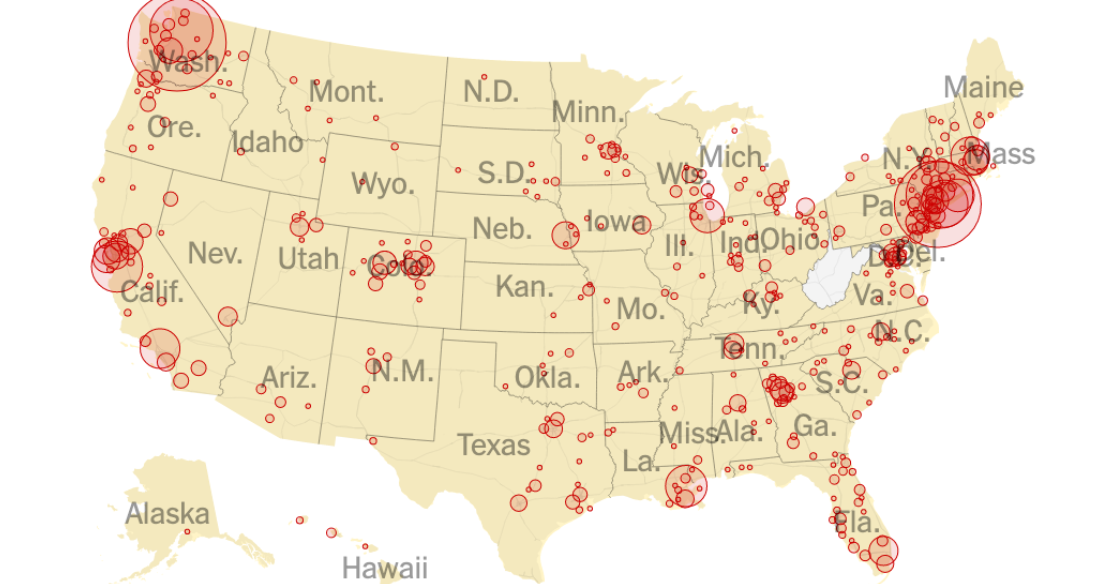

I looked at this picture after listening to the coworker talk about mass transit:

Tesla's strategy seems sound in an ever more dystopian world.

Tesla has long stated that Americans do not like to ride together. That is why they don't design for car pools. People don't do it.

On a China business call a coworker stated that the US does not have a lot of mass transit, so there is already more social distance than most places. Tesla vehicles provide even more social distance as they avoid gas stations by charging in the garage.

I looked at this picture after listening to the coworker talk about mass transit:

Tesla's strategy seems sound in an ever more dystopian world.

ZeApelido

Active Member

OK... soooo who's buying this dip?

I just added 50 shares. 4 digits achieved.

Vines

Active Member

I rode this right back to my buy point, but no longer have any appetite to be in while this market tanks. I sold most of my position, call me crazy that's fine. I still believe in the company, but I don't believe in wall street SP.

You are welcome, if the recovery of Tesla SP starts now.

You are welcome, if the recovery of Tesla SP starts now.

Wooloomooloo

Member

The volume is still pretty low, which tells me there is more manipulation going on. I don’t think this is panic selling.

Your second sentence is true, your first is paranoia. Low volume and low price just means bids are low but no one wants to sell, which tells you long/medium term value is higher than current trading price. "Manipulation" implies something else.

TSLA hugely outperformed the market prior to this crisis, so it's hardly a surprise it fell harder during.

ZeApelido

Active Member

FWIW looks like Model Y search frequency is going to surpass Model 3 pretty soon (in the U. S) . Model 3 has dipped a bit last 3 months.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K