If you have an after hours order sometimes you can score.The after-hours Tesla T

edit: seriously-- it happens fairly frequently.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Favguy

Member

Possibly $5,000-$8,000 by end of next month if S&P reduces float like I expect it to

Get out!!! Are you trying to give me a cardiac infarction, I can barely cope with where we are at after hours!

ZeApelido

Active Member

Possibly $5,000-$8,000 by end of next month if S&P reduces float like I expect it to

Artful Dodger

"Neko no me"

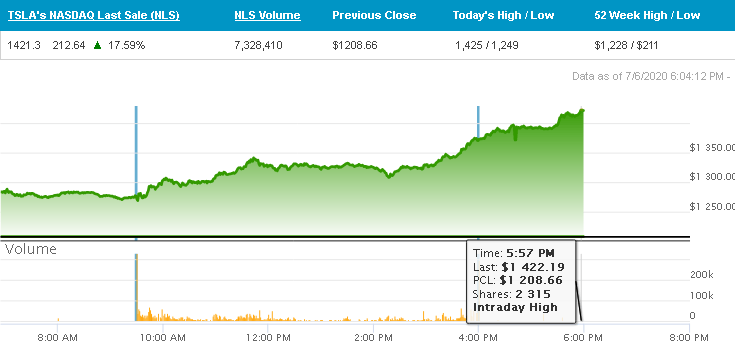

TSLA After Hours High:

$1,425.00 (17:59:19 PM)

$1,436.94 (18:06:39 PM)

*Note: Real-time Chart (link above) stops updating at 18:00 hrs ET.

Cheers!

$1,425.00 (17:59:19 PM)

$1,436.94 (18:06:39 PM)

*Note: Real-time Chart (link above) stops updating at 18:00 hrs ET.

Cheers!

Last edited:

TrendTrader007

Active Member

007

@TrendTrader007

$tsla i am not selling out i am buying in (not really-actually holding all my calls) only the strong survive

Damn, take a little break to catch up on emails and return to find out the sugar has hit the fan (in an upwardly motion) upon your return!

What's gonna happen next?

What's gonna happen next?

TSLA has been 100% of my stock portfolio since 2013. I've been an uber-long and have held through the nastiest of TSLA drops and have never played with options.

I only have 2 regrets:

1. I should've gone in more at the beginning and stuck even harder with my conviction.

2. I shouldn't have held through the Q1 and COVID drops.

Had I chosen (1), I'd be a multi-millionaire right now.

Had I chosen (2), I'd be a multi-millionaire right now.

Instead, despite being one of Tesla's earlier customers (Model S 1653) and a die-hard long, I'm still a few hundred grand short of $1M. I really feel left out when some of you say you only bought a year ago and have now pulled in a couple million! Haha don't I get some sort of consolation prize for being an uber-long?

Glass half-empty:

I could have cashed out when we hit $420.

Glass completely empty:

I could have been a TSLA short.

Glass completely empty and broken:

I could be a highly public TSLA short with public pictures of me brushing my teeth on the toilet with a laptop.

The long wait for my Model 3 reservation was what got me hooked on to TMC and while here I stumbled on to the investor thread, Thanks to the wisdom from all the folk here such as yourself I started investing in TSLA mid 2017. I started buying in the 300 range and kept adding all the way down to the 180's. Like youself, my position in TSLA is a few hundred grand short of $1M but I think I am OK with it as I was not comfortable placing all my eggs in one basket regardless of my conviction level on TSLA. I think the Elon is the main reason for Tesla's success but he is also the biggest risk to Tesla as the "key person risk". This is what gives me pause from having more exposure to TSLA. Unless he can grow more leaders like Jerome under him I will stick to my current position and let it grow.

dc_h

Active Member

Up 220 in one day! Amazing. Up 60+ after hours & 162.

Spreading wrong info Sir ....

UnknownSoldier

Unknown Member

Yep, I do work a day job and I"m aware of the safe harbor rule. I don't pay a state income tax in WA which is nice. I would like ideally pay nothing as my AGI last year was under $150,000 which is one of the few stipulations of safe harbor besides working your day job and having your income withheld every paycheck.Do you work a day job and have withholdings deducted from your paychecks? If so, look into safe harbor rules for the IRS and your state taxes with respect to estimated tax payments and windfalls. (For example, if memory serves correctly in California you have safe harbor from quarterly estimated tax payments if you make below a certain amount per year and your withholdings are at least 100% of the prior year's withholdings. I believe IRS rules are similar.)

You may want to consult a tax advisor.

However, I would like to ask a tax advisor to be certain. Does anyone here have any recommendations for tax advice?

"Don't get cocky, kid!" -- Han Solo.

Yep! 420? Not gonna happen. Now over 3 times that amount!I remember when stock hit 300. It was huge. 400 was tough....

The times they are a changin'

I have been on this forum for a fair amount of time. I generally try to contribute more than I get.

By any measure, I can't claim that here.

My sincere thanks to you all...

No, I'm not going anywhere - it just needed to be said.

By any measure, I can't claim that here.

My sincere thanks to you all...

No, I'm not going anywhere - it just needed to be said.

I was expecting maybe a bit of a breather tomorrow, but it appears that might not happen. AH just print my 45 bagger.

I legitimately think we might end at $1,600 on Friday, with a brief stop at the high $1,600s along the way.

UnknownSoldier

Unknown Member

Looking at this after-hours activity, it's pretty clear right now that brokers are forcibly redeeming some margin accounts. I have never gotten a margin call because I trade out of a boring cash account, I wonder what those are like. Probably not fun.

Causalien

Prime 8 ball Oracle

To the many posters thinking about quitting. It is safe to quit whwn you are able to convert the winning into steady low risk investments that spills out income. When these income reaches 2x your current salary. It then makes perfect sense to quit.

For me thus transition took 3 years as you need to factor in the tax hit and think deep about the portfolio's composition.

To expand on this into a math formula. Assuming that the eventual ROI of your investment properties are 5%.

X= current income that equates to good enough lifestyle

Y= TSLA stock sale Profit after tax

Y = 2*X*100/5

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M