Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I have a way too large position in 1200 und 1300 Dec '20 calls. I bought them when the stock was at the 900s and they grew like 6x. I didn't sell yet but they are now as valuable as a nice little house and they have twice the value of my portfolio six months back...

It's weekend OT. I just wanted to say this. I don't know what to too. Poor life.

It's weekend OT. I just wanted to say this. I don't know what to too. Poor life.

5k. Put that sell order in but no takers yet.

I know everyone is celebrating but I remember how happy I was when the stock popped to 945 just to see it crash down 200 bucks the next two days. So I'll be happy if this sticks. Currently some of us are on edge because of that one manipulation which was nauseating.

I will just offer a couple of points since you are comparing this to the run up in Feb.

1. %wise the stock only jumped 10% as compared to the 25% range on that historic day in Feb. I always like to look at % instead of absolute numbers.

2. Stock actually pulled back on Wednesday after multiple gap ups this week, always a healthy sign.

3. Even the run up yesterday was really good in terms of consolidation.

4. There was no S&P discussion in Feb.

IMO the stock has so much momentum right now that the only thing that was cause it to fall big time would be some negative news related to S&P inclusion or COVID-19.

Krugerrand

Meow

Then my sweetie and I will spend our declining years telling our Cybertruck to drive us between our islands, enjoying this view from the farm.

So, aquatic CYBRTRCK confirmed? Or, you’re building a bridge between your islands?

J

jbcarioca

Guest

Especially when we are all euphoric, as we are now, we do need to remember that there were years of relative stagnation in share price as well as significant periods of losses. For example if one, like me, bought TSLA on 28th Sept 2015 the closing price was $247.57. Assessing performance again on 27th May 2019 the closing price was $181.16. Factually it is entirely possible to make a case for selling. Also factually I bought on both of those dates.In my view, references to "seed money" and "today's returns" and the like are indeed stats trick. Real compounding is measured as CAGR (Compound Annual Growth Rate).

For instance, I bought TSLA shares in 2011 at under $23. Still have them. Today, the CAGR on them is just under 60%. Good, but not great.

I also bought shares at $235, which give me a better return. How? I bought them just over a year ago, so the CAGR on them is well over 500%.

What's important is the CAGR for your whole portfolio over the period of time in which you've invested.

Now back to euphoria! My TSLA CAGR from 2013 to today rests at a bit above 60%. Based on my own experience "Buy and hold" is the wisest course if, and only if, one devotes inordinate attention to fundamental value.

If ever the fundamental prospects seem questionable...sell and do not look back. As always the question is : what is fundamental value? That is simple of all else remains the same, but it doe not.

We may well see a major correction soon. After all many stocks are exceedingly frothy (in the industry how about NKLA?). It is ever thus. In the Great Meltdown of 2000 there are really solid points of commonality with today. The wiki on the subject does give a decent summary, including the triggers, all obvious at the time.

Dot-com bubble - Wikipedia

Since I spent a good part of 2001/2002 working on mop-up of dot-com corpses I am acutely aware of the numerous common elements with the present state.

The short thesis sees TSLA as one of those dot-com style almost fraudulent pitches. The fundamental analysis shows TSLA has nothing at all in common with those. The long patent list, cash-rich operations, low leverage and sound financing of industrial processes are all major points fo difference. Further high vertical integration NEVER was part of the dot-com era.

Further the net financial position fo TSLA is far stronger than most analysts see. Why?

First, the Fremont property is vastly undervalued on the financial books because the core property was absurdly cheap.

Second, TSLA is cash flow positive and hs been for some time despite very rapid growth and major factory construction, not to mention significant R&D, though they are so efficient in R&D that the costs are far lower than seem plausible, unless one sees just how SpaceX and TSLA share technology is ways not even conceivable to the competitors.

Third, the TSLA direct sales process yields vary conservative sales recognition. Specifically the vast majority of competitors are recognizing revenue when vehicles are shipped to distributors/dealers. That means the 'Days of hand (DOH)' for TSLA ought to be at least double what they are. It is quite amazing that the continuous improvement in shipping and moving towards production nearer the markets is allowing very, very low inventory.

Fourth, the manufacturing efficiency and systems integration produced by TSLA regularly amaze the most cynical and anti-Tesla people.

Fifth, then there is Tesla Energy. That is sufficiently complex to require books and books. Here mention only two things: Autobidder and Solar Roof. Those two alone are already transforming their category. Both are comparable to the Model S of 2012 in the impact they will have on perception and comparable to Model Y in their almost certain impact on their markets.

Sixth, the world seems to think all this will collapse without Elon. Without diminishing his contributions one iota I suggest the doubters should examine the TSLA senior executive ranks, full of over-achievers.

My conclusion is that TSLA remains undervalued so I will not sell, rather I will continue to buy. We will have more positive outlook with 2nd quarter results and battery day. Even more as GF-3, GF-4 et al continue to develop.

OK, there are both production and distribution problems with fit and finish, as well as continuing issues in after sales service. Those issues will certainly diminish as new production processes (including new paint shops in China and Berlin) come on line and as mobile service and service center begin to mature. These are the largest vehicle impediments, and will grow as smaller and cheaper vehicles begin to enter production.

Also, the rapid growth in utility, grid and residential/commercial TE products grow there will be more growth-related service and support issues. Those may be more easily managed than have been the vehicle ones.

The regulatory and economic factors will all be material in TSLA financial results and in market acceptance of TSLA products. That is another topic. However, the global direction favoring TSLA product categories is almost certain to be favoring growth. Individual countries, most famously the USA, may swing from positive to negative from time to time. Overall, despite setbacks, it is clear that TSLA can operate without specific 'green' encouragement, although those will be major positive forces where they exist.

On this day of euphoria I thought it wise to decide once again if I stay Long. I will do so.

I offer no advice other than that TSLA investors should do exhaustive research prior to and during investment in the company. OTOH, I recommend that for any investment. Thus, I do not diversify very much because I do not have the ability to examine more than four or five investments well enough to feel confident in my choices. This approach has up years and down ones but the former is much more common than the latter. It might not continue that way but it has done so for the last 50 years. OMG, I have been at the for 50 years? Do not accept anything I say, I am actually pre-Boomer by a few months so as a certified Geezer one should ignore my views. Follow, if you do, at your own peril.

CyberDutchie

Active Member

disagreed to clarify

margin shares are not locked up in the sense that you cannot trade them...what gave you that idea?

but they can, and likely will be, loaned out

This is not a margin loan but a line of credit.

I misunderstood the lock-up, the funds cannot be used to trade or buy securities or pay off margin debt. The shares you hold as collateral can be traded, as long as you meet the minimum collateral requirement of the pledged account (for TSLA, max loan-to-value is currently 40%). Margin and options trading is not allowed in the pledged account. The interest rate moves with the one-month LIBOR.

Great to be confident, though eventually a Black swans appears.It's better to have money set aside in the bank equivalent to whatever your payoff is. This way you have flexibility. The "nuke mortgage button" can be pressed at any time.

I deliberately have a 2nd mortgage (home equity LOC) that takes me up to 80% of my home's worth because I value the additional liquidity that costs so very little. There is zero risk of ever losing my home because with a couple of mouse clicks I could choose to pay it off. The "security" argument holds no water unless you don't trust yourself. But everyone has to make the decision they feel comfortable with.

It's funny because my wife does not understand finances very well at all but this is one thing she gets very clearly.

Make sure you have a secured roof over your head.

Stretch2727

Engineer and Car Nut

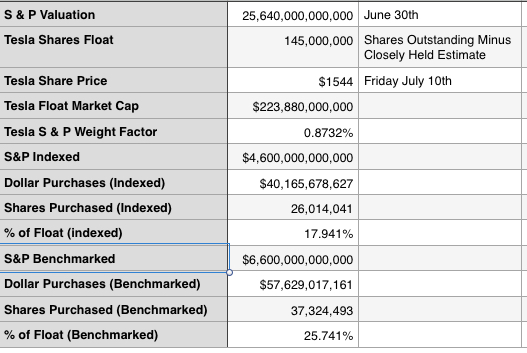

Had to put all the S&P inclusion numbers on a spreadsheet.

Some comments.

-Need to separate the benchmarked($6.6T) from the indexed($4.6T) funds. The benchmarked are larger than the indexed but there is no requirement for them to buy TSLA. Mostly they just compare themselves to the S&P 500.

-Some of the benchmarked funds have likely already started buying. Tesla will be too large a component to not hold some. Most are not constrained an it would be a smart move to buy now.

-The weighting factor will change until the decision to include if TSLA outperforms/underperforms the overall S&P 500. I believe the weighting factor is decided on the decision date. The inclusion date is the date that the index funds have to have the weighting adjusted to match the index. There is always some tracking error in S&P500 Index funds due to this.

-So until the decision date any any increase/decrease in valuation of TSLA compared to the current S&P valuation effects the weighting factor.

-The index funds could take about 18% of the current float out of the market.

-The benchmarked funds 26% if they were to choose to hold the exact weight of the index. My guess is some will hold more, some will hold none if they are more value oriented.

Some comments.

-Need to separate the benchmarked($6.6T) from the indexed($4.6T) funds. The benchmarked are larger than the indexed but there is no requirement for them to buy TSLA. Mostly they just compare themselves to the S&P 500.

-Some of the benchmarked funds have likely already started buying. Tesla will be too large a component to not hold some. Most are not constrained an it would be a smart move to buy now.

-The weighting factor will change until the decision to include if TSLA outperforms/underperforms the overall S&P 500. I believe the weighting factor is decided on the decision date. The inclusion date is the date that the index funds have to have the weighting adjusted to match the index. There is always some tracking error in S&P500 Index funds due to this.

-So until the decision date any any increase/decrease in valuation of TSLA compared to the current S&P valuation effects the weighting factor.

-The index funds could take about 18% of the current float out of the market.

-The benchmarked funds 26% if they were to choose to hold the exact weight of the index. My guess is some will hold more, some will hold none if they are more value oriented.

Krugerrand

Meow

Lets be honest, there are not many other feasible explanations for such a rise in the SP. Q2 looks surprisingly good, sure, but the company is still (and remember I'm a super-bull here, with 1,100 shares) NOT making THAT many cars. To justify the valuation, they need to have China and Berlin and Freemonet all churning out cars at maximum capacity.

This was discussed already and explained why you and a slew of others are thinking about it incorrectly.

Ford sold 1.1 million vehicles in Q2 and posted a LOSS of more than $1 BILLION (can’t remember the exact figure and I think it was actually pretty close to $1.5B).

Tesla sold 90,650 vehicles in Q2 and is about to book a PROFIT without laying a single person off, while their main factory was closed for half the quarter, and while continuing to expand their footprint.

Think about what happens when Tesla sells 1.1 million vehicles next year. And then 1.1 million vehicles per quarter in the following year or so. The kind of profit that’s going to be generated all the while growing the business. Take your time and let it soak in.

You’re not thinking big enough. You’re trying to talk yourself out of becoming stupid rich for a whole myriad of reasons, which I won’t go into. And so are a whole bunch of other people here. Y’all just can not accept your good fortune and go with it. But I get it, trying to wrap Tesla’s march to world dominance is tough. What’s happening right now, before your very eyes, has never happened before it human history and we’ve got a front row seat.

Think MUCH bigger and stop trying to neatly wrap up TSLA SP in a box based on past knowledge and data and how you think it needs to be to make sense.

Hold the bloody shares people, like your life depends on it. It’s time for the little guy to hold the wealth of the world and try our hand at doing better.

Bigger enterprises than yourself have failed , GM and GE, just to name a few recent ones.This.

I wanted to comment on a similar post a few days back, why do people want to pay off their mortgage early. We are paying 3.375% for a 30yr fixed 625K loan. That is almost free money at that rate with tax benefits plus living in a beautiful CA home. We can sell investments and pay it off, but why would we? Selling investments would incur taxes on those profits, no further tax deductions on mortgage interés every year and we lose out the growth in those investments over the next 25 years that are still left on our mortgage.

If you are someone who is simply unable to save and spends every penny of their income, paying off loans with a windfall may be a consideration. But folks here making a fortune on TSLA are clearly not this type.

Before paying off your mortgage think carefully about what that money would be worth if continued investment.

Even Boeing is in serious trouble now.

You too are vulnerable. Black swans can destroy you.

Last edited:

Happy ka-ching-up!Advice (for once) don't go out drinking on Thursday evenings and get 20 pages behind, because I'm STILL 20 pages behind ($1500 has just fallen!!)

... ...

My advice, make a decision sooner rather than later and act. Better to loose $10k than loose 100 shares at a "low price" of $1500.

Now back to catching-up.

Oh, thanks mods for banning that troll, was a lot of scrolling making my fingers tired.

P.S. I'm very happy my $1400 prediction was totally wrong - Monday's going to be interesting...

A video from Nov 2018, thought it was interesting that Citron went long around that time, did they go short again in 2019? I like how he says as a short seller you need to continue to reevaluate your short thesis. Interesting discussion about valuation and margins.

I will just offer a couple of points since you are comparing this to the run up in Feb.

1. %wise the stock only jumped 10% as compared to the 25% range on that historic day in Feb. I always like to look at % instead of absolute numbers.

2. Stock actually pulled back on Wednesday after multiple gap ups this week, always a healthy sign.

3. Even the run up yesterday was really good in terms of consolidation.

4. There was no S&P discussion in Feb.

IMO the stock has so much momentum right now that the only thing that was cause it to fall big time would be some negative news related to S&P inclusion or COVID-19.

I only compared the two ONLY because we saw someone or an institution put huge call bets with one day expiration and was completely right. If this institution found some leaked info we would know it by now like say GS upgrade. And that leaked info is required to be public on Friday to make the run possible. And since there are no leaked info, manipulation seems likely in which manipulation event also happened at the end of the Feb run up. If Fridays run up was more organic, as it wasn't predicted by anyone, then I wouldn't have made the comparison.

One possibility is that someone knew a large whale was going to make a huge buy into Tesla, but the valuation did go up 30 billion so I don't know if there are whales big enough to move the needle this much.

Like i said before ..... " I know a guy......."Where are you getting 2.5%/year?

At Fidelity, I'm seeing 4-8%, with 4% requiring a $1M balance.

I might need to have a conversation with them if there's an alternative broker with better rates.

I don't disagree with you, but that's too complicated for me. Tesla looks, to me, like it is on a run up, so I have just stopped doing any of the things that have limited upside, like selling covered calls or puts, for the time being. Pure bull, until the 22nd. Then we'll see.I think to start selling far out of the money covered calls after battery day and S&P500 inclusion. This is under the assumption that the volatility will be lower after these events have played out. If my shares get called away, it means my total net worth will have increased, so no regrets. Alternatively, taking the loss on the covered calls and move them up, and hoping the profit from when they expire worthless is more then when I have to take the loss. Ideally this should provide me with some money for living expenses, while keep roughly the same exposure.

Mo City

Active Member

Any comments on what seems to be a multi-million dollar wager on TSLA reaching $2,500 next week? Like yesterday's large bet on $1,500, seems like somebody knows something.

Is this as risky as it seems?

https://twitter.com/ValueAnalyst1/status/1281886141109751809?s=19

Is this as risky as it seems?

https://twitter.com/ValueAnalyst1/status/1281886141109751809?s=19

I beg to differ. If you look at the annual return on Amazon stock, it grew pretty spectacularly all the way from 2012 to 2020.this is silly, and not how it works. Why would the stock grow at 50% per annum?

Once they establish that they can grow at a consistent pace, it will get priced in and it won’t be a surprise.

AMZN: Amazon.com, Inc. Yearly Stock Returns

I would say the business model of Amazon had been pretty much proven by 2012, wouldn't you? Tesla will grow faster for longer than Amazon. While Amazon is a great company in every sense, its value is still primarily driven by its online sales. Tesla is a Chimaera.

The problem with the market is that it doesn't want to price in too far in the future growth when it comes to disrupters because it is much more risk averse than TSLA bulls. Market doesn't want to stick its neck out and say I'm gonna price in Tesla's 10x growth within the next 6 years. The best it's going to do is maybe ok, Tesla MAY be double its current size in 2 years. That's why it's going to keep being surprised by Tesla's increasing sales and new services, just like Amazon. That's why analysts are only willing to give out price targets 12 month out and not 6 years, like Cathie Wood did. "Crazy Cathie" will become an Oracle while even the most bullish TSLA analysts will have to keep playing catch up until Tesla has slowed down.

Last edited:

RationalOptimist

Member

I have a way too large position in 1200 und 1300 Dec '20 calls. I bought them when the stock was at the 900s and they grew like 6x. I didn't sell yet but they are now as valuable as a nice little house and they have twice the value of my portfolio six months back...

It's weekend OT. I just wanted to say this. I don't know what to too. Poor life.

Congrats. If you're thinking you want to hedge just a little but don't want the tax hit, you could consider selling some longer-term calls with similar strike prices... Whatever cash you get from that is effectively locked in profit. eg. for every 10 call options you bought, consider selling 2-5.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M