You know something is worng when you are looking forward to the weekdayssame here, screenshots of all positions. IBKR is not even letting me log in today.

Only 41 hours of waiting left before Frankrurt will give us the first indication.

My name is .... and I’m a TSLAholic.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

MTL_HABS1909

Active Member

engle

Member

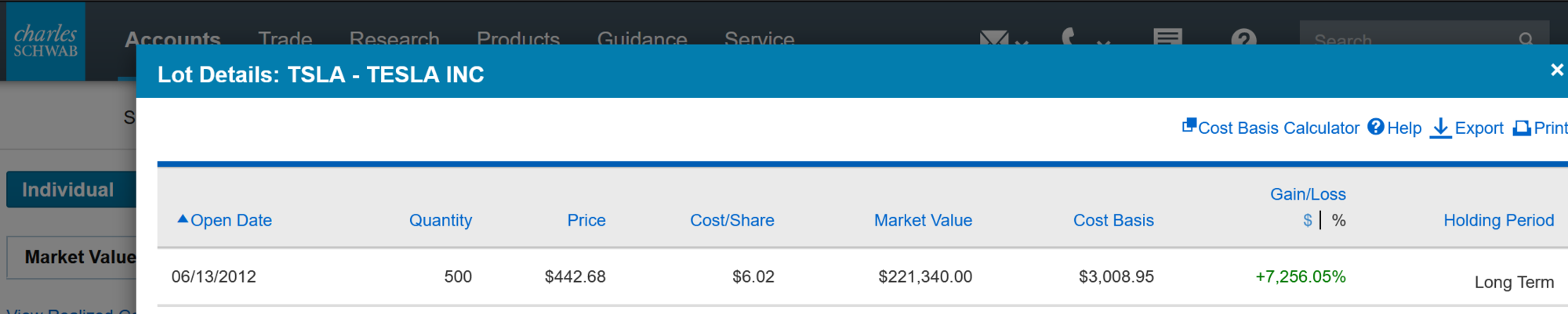

Charles Schwab is now reflecting the stock dividend properly. I love the new $6.02 cost basis on my first TSLA purchase there:

It's in my son's account. The occasion was about 3 weeks before his 17th birthday. Every year since birth, my mom sends each of her grandkids a check for $1,000 in their birthday cards for investment. I added $2K that year so I could buy a round lot of shares for him. Good thing I did! Because of later add-ons, TSLA is now 80.92% of his portfolio which I know is horrible diversification. But that is what happens when the next-highest percentage gainer is GOOG +488% since 7/16/2007. Now that he is a young adult, I have had the "pre-marital property" discussion with him several times already!

It's in my son's account. The occasion was about 3 weeks before his 17th birthday. Every year since birth, my mom sends each of her grandkids a check for $1,000 in their birthday cards for investment. I added $2K that year so I could buy a round lot of shares for him. Good thing I did! Because of later add-ons, TSLA is now 80.92% of his portfolio which I know is horrible diversification. But that is what happens when the next-highest percentage gainer is GOOG +488% since 7/16/2007. Now that he is a young adult, I have had the "pre-marital property" discussion with him several times already!

Last edited:

same here ... with Fidelity ... once i clicked on individual accounts updates were made to reflect the split adjusted price and total values ... i was a multi-teslaniare for a few minutes this AMI see the same. I use Vanguard.

Nuclear Fusion

Banned

Does anyone have a link to some detailed analysis of what Tesla is likely to do post split?

TD Ameritrade had this note :

Please note: Cost basis for AAPL and TSLA will not update on this page until Tuesday, Sept. 1. To see it updated on Aug. 31, go to cost basis

Please note: Cost basis for AAPL and TSLA will not update on this page until Tuesday, Sept. 1. To see it updated on Aug. 31, go to cost basis

So um....I know this is my hold no matter what account, but maybe I should sell right now.

Creekstalker

Member

Anybody care to tally up how much further ahead ARK Invest would be if they didn't sell their TSLA? Please don't feed me their 10% limit b.s. That's for adding more shares. No such rule for holding. They just like to attract money with there 'outsized' gains compared to the S&P 500. 17% now? 20%? Wot?

Finally! A post about TSLA investing instead of gambling!

When I first invested in TSLA back in 2013 I considered it a gamble with about 5% of my portfolio. TSLA is now around 75%, outstripping the 401K and Roth index funds that I've been contributing to monthly for over 20 years. Never sold, only added to my TSLA position. That story isn't unique here.

I invested in ARKK (the big one, which includes TSLA) after being against the idea for years (for the reasons you, Dave, and Warren outline). Here's why. First, the "all eggs in one basket" insecurity. Bankruptcy isn't even a blip on the radar anymore, but as we've seen, this world has a way of surprising us. So I started thinking about the "next TSLA" and figured I'd start throwing my extra pennies at that.

Here's where the problem arises. I can't find anything that makes more sense than TSLA, even at $2,000 plus. At $1280, I bought more TSLA instead of the top stocks on my watchlist (Roku, Square, etc.). Part of it, also, is that I don't have the time or will to follow these others the way I follow TSLA. I'm incapable of cheating on my wife, it seems. Then I noticed that my watchlist matched up pretty well with ARK Innovations top holdings. Their analysts seem pretty smart and thorough, so I just decided to pay them to do the research for me.

So I'm not selling my TSLA, but ARKK gives me a little more TSLA and others that I'm too chicken to invest in myself. Plus, they will occasionally take gains, which I'm also to chicken to do myself. So yeah, my ARK investment would've been better invested in TSLA during the recent spike. But when TSLA hits a bump in the road, ARKK will be buying and one of those other growth stocks might be catching fire.

Anyway, that's my thought process. It looks stupid during a TSLA spike but letting Cathy Wood & Co. diversify and make moves for me makes me comfortable, even if it's an irrational comfort.

TL,DR: I'm happily married, but using ARK as an escort service. I'll probably regret it.

been thinking about taking a position in ARKK myself ... you have summarized the rationale floating around in my head pretty well ... will probably wait for next macro downturn .. but seems like a smart way to add some more TSLA and diversify a bit .. TSLA is approaching 30% of my portfolio ..... in the past i would be totally uncomfortable with this situation ... not with TSLA as the future looks very brightFinally! A post about TSLA investing instead of gambling!

When I first invested in TSLA back in 2013 I considered it a gamble with about 5% of my portfolio. TSLA is now around 75%, outstripping the 401K and Roth index funds that I've been contributing to monthly for over 20 years. Never sold, only added to my TSLA position. That story isn't unique here.

I invested in ARKK (the big one, which includes TSLA) after being against the idea for years (for the reasons you, Dave, and Warren outline). Here's why. First, the "all eggs in one basket" insecurity. Bankruptcy isn't even a blip on the radar anymore, but as we've seen, this world has a way of surprising us. So I started thinking about the "next TSLA" and figured I'd start throwing my extra pennies at that.

Here's where the problem arises. I can't find anything that makes more sense than TSLA, even at $2,000 plus. At $1280, I bought more TSLA instead of the top stocks on my watchlist (Roku, Square, etc.). Part of it, also, is that I don't have the time or will to follow these others the way I follow TSLA. I'm incapable of cheating on my wife, it seems. Then I noticed that my watchlist matched up pretty well with ARK Innovations top holdings. Their analysts seem pretty smart and thorough, so I just decided to pay them to do the research for me.

So I'm not selling my TSLA, but ARKK gives me a little more TSLA and others that I'm too chicken to invest in myself. Plus, they will occasionally take gains, which I'm also to chicken to do myself. So yeah, my ARK investment would've been better invested in TSLA during the recent spike. But when TSLA hits a bump in the road, ARKK will be buying and one of those other growth stocks might be catching fire.

Anyway, that's my thought process. It looks stupid during a TSLA spike but letting Cathy Wood & Co. diversify and make moves for me makes me comfortable, even if it's an irrational comfort.

TL,DR: I'm happily married, but using ARK as an escort service. I'll probably regret it.

2

22522

Guest

Finally! A post about TSLA investing instead of gambling!

When I first invested in TSLA back in 2013 I considered it a gamble with about 5% of my portfolio. TSLA is now around 75%, outstripping the 401K and Roth index funds that I've been contributing to monthly for over 20 years. Never sold, only added to my TSLA position. That story isn't unique here.

I invested in ARKK (the big one, which includes TSLA) after being against the idea for years (for the reasons you, Dave, and Warren outline). Here's why. First, the "all eggs in one basket" insecurity. Bankruptcy isn't even a blip on the radar anymore, but as we've seen, this world has a way of surprising us. So I started thinking about the "next TSLA" and figured I'd start throwing my extra pennies at that.

Here's where the problem arises. I can't find anything that makes more sense than TSLA, even at $2,000 plus. At $1280, I bought more TSLA instead of the top stocks on my watchlist (Roku, Square, etc.). Part of it, also, is that I don't have the time or will to follow these others the way I follow TSLA. I'm incapable of cheating on my wife, it seems. Then I noticed that my watchlist matched up pretty well with ARK Innovations top holdings. Their analysts seem pretty smart and thorough, so I just decided to pay them to do the research for me.

So I'm not selling my TSLA, but ARKK gives me a little more TSLA and others that I'm too chicken to invest in myself. Plus, they will occasionally take gains, which I'm also to chicken to do myself. So yeah, my ARK investment would've been better invested in TSLA during the recent spike. But when TSLA hits a bump in the road, ARKK will be buying and one of those other growth stocks might be catching fire.

Anyway, that's my thought process. It looks stupid during a TSLA spike but letting Cathy Wood & Co. diversify and make moves for me makes me comfortable, even if it's an irrational comfort.

TL,DR: I'm happily married, but using ARK as an escort service. I'll probably regret it.

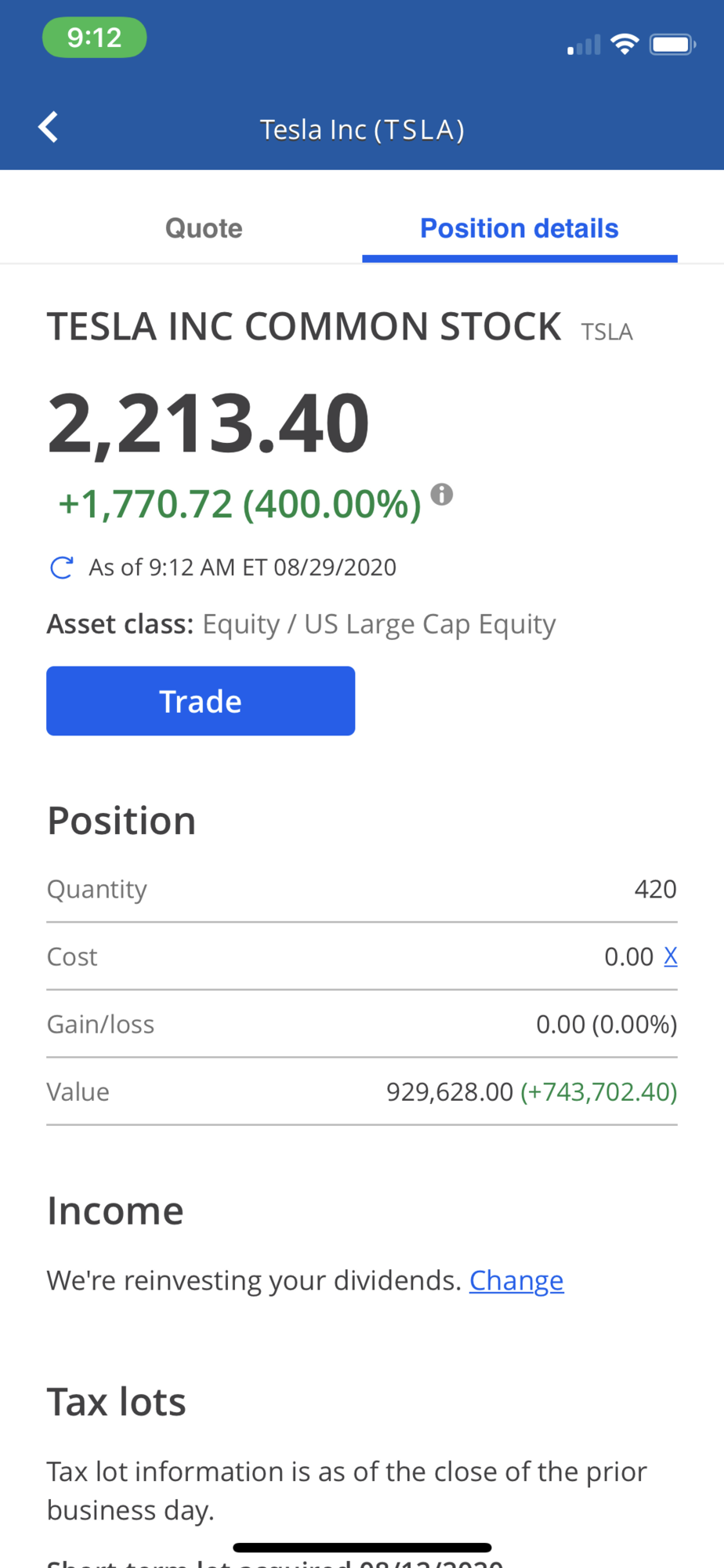

It is important to think of what could be. As I looked at my accounts this morning, I saw just that - an account balance as if Tesla went up by a factor of 5.

Just that visualization could make more people hold through the split. A stiff response of no-one selling next week because of broker provided visualization assistance may drive the split adjusted price to near $600 next week (not an advice).

This is precisely the tactic that legacy auto has been trying to use over the years. They announce that they have cars coming out soon with Tesla beating specs, hoping that people will delay buying a Tesla. Of course these cars are either then continuously delayed or their specs never even come close to a Tesla when they are actually released.

Yep, I've grown tired of debating trolls on Electrek every time an auto manufacturer would announce a new car with Tesla specs. They would say Tesla is finished, and I would try to argue that the latest Tesla killer (with obviously bad aerodynamic styling) would probably have about 1/3 less range when it actually got released. So far I've been right 100% of the time.

No changes in my account yet... Bwah, I want my fwee shares!!!

I did, at least, take screen-shots at close yesterday, in anticipation of a cock-up...

What if you logged in and the pop up said "Great job on practicing on your paper money account! Do you want to start investing in your money account?"

been thinking about taking a position in ARKK myself ... you have summarized the rationale floating around in my head pretty well ... will probably wait for next macro downturn .. but seems like a smart way to add some more TSLA and diversify a bit .. TSLA is approaching 30% of my portfolio ..... in the past i would be totally uncomfortable with this situation ... not with TSLA as the future looks very bright

I believe ARK’s goal is to CONSISTENTLY (every year) outperform other funds.

That wouldn’t be possible if they held more TSLA as a percentage. Just imagine if ARK had TSLA as 90% of their fund last year and then being deep in the red compared to S&P. People would pull their money in a heartbeat.

So, ARK can still be bullish on Tesla but they realize there will be bumps along the way.

That being said, I’m almost all in on TSLA and own 0 ark. Because unlike them, I don’t have to worry about getting a black eye if TSLA has a down year. I’m not nearly as visible as they are.

Dancing Lemur

Hoopy Frood

Dancing Lemur

Hoopy Frood

Yep, I've grown tired of debating trolls on Electrek every time an auto manufacturer would announce a new car with Tesla specs. They would say Tesla is finished, and I would try to argue that the latest Tesla killer (with obviously bad aerodynamic styling) would probably have about 1/3 less range when it actually got released. So far I've been right 100% of the time.

Lucid looks legit so far. A decade behind Tesla, perhaps, but on the right track. They may even have the best specs after they reveal the production Air (but only for 13 days).

I guess the average joe doesn’t understand what edge 15 years of battery engineering Tesla has in front of others car manufacturers.Yep, I've grown tired of debating trolls on Electrek every time an auto manufacturer would announce a new car with Tesla specs. They would say Tesla is finished, and I would try to argue that the latest Tesla killer (with obviously bad aerodynamic styling) would probably have about 1/3 less range when it actually got released. So far I've been right 100% of the time.

Well, an EV is just a car with a battery and an electric motor. Those have been around for over 100 years. Anybody can put them together.... /sI guess the average joe doesn’t understand what edge 15 years of battery engineering Tesla has in front of others car manufacturers.

Knightshade

Well-Known Member

Went to look at my account this morning after seeing all the extra faux millions everyone else was getting- oddly it says:

So Monday morning my shares will be post-split but apparently my options won't yet be.

It also mentioned options won't be tradable online 8/31, and to call them if you want to trade options that day.

Weird.

Broker said:Effective Aug. 31, Apple (AAPL) stock will split 4-for-1, and Tesla (TSLA) stock will split 5-for-1. Equity holdings will be adjusted pre-market on Aug. 31; options holdings will be adjusted pre-market on Sept. 1.

So Monday morning my shares will be post-split but apparently my options won't yet be.

It also mentioned options won't be tradable online 8/31, and to call them if you want to trade options that day.

Weird.

Sudre

Active Member

Majority BEV sales is incredibly optimistic.

Seba said 100% cars,trucks,Semis, Municipal Buses would be electric by 2025.

That starts in 4.25 years.

I don't see 80M unit sales holding off for years until BEV supply catch up.

Nor do I see robotaxi making up the difference.

I have to agree here simply because I can not figure out how that many EVs would get built. Even if new sales drop to 60 million world wide.

Lets just say Tesla sells:

2020 500K a year

2021 1M a year

2022 2M a year

2023 4M a year

2024 8M a year.

2025 16M a year

Where are the other manufactures building the battery factories to cover the rest?

Where are the mines bringing out the ore for the extra battery factories?

Other car makers EV production averaged out of 60 manufactures owned by 14 companies that will be needed:

2021 40K EACH (we are not at this point yet per 60 auto makers but I guess they will catch up QUICK)

2022 80K (seriously don't see the other 60 car makers doubling EV production every year but if you say so)

2023 160K

2024 320K

2025 640K

There are about 60 other vehicle and truck makers in the world according to Google. That adds 38 million more EVs for a total of 54M. Robotaxi better REALLY cut into the new car sales.... except even with Robotaxi you still have to make the taxis and get governments to approve them. Also lets be clear. NO OTHER car maker is going to double EV production every year. And remember.... Robotaxi is first going to cut into the current Taxi and Uber type services.

The point is, I am being very generous on the other car makers in the world catching up to Tesla's production YOY increases... ALL OF THEM. Doing that we do not get to the 80M. I agree !IF! Robotaxi gets approved in all countries (it won't) there will be a significant drop in new cars sales. I do not see Robotaxi being approved by all States in the US much less all countries by 2025. Heck Tesla still can't sell cars directly in some states and you think those states are going to let Tesla's drive autonomously?

It's great news for Tesla since they have the lions share of sales but the other car makers better step up real soon if your dream is to hit those numbers (60M) by 2025. Will someone please think about how many battery factories will need to be built each year... again not by Tesla, they are on it. By the other OEMs.

No one is showing numbers. Just disagreeing.

MTL_HABS1909

Active Member

Lucid looks legit so far. A decade behind Tesla, perhaps, but on the right track. They may even have the best specs after they reveal the production Air (but only for 13 days).

The problem is that literally anybody can produce a $150K+ EV. The challenge is getting it down to a price point where people can actually afford it.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M