Vanguard is giving me a sneak peak to 2025. When my 5x shares are worth 2200 a piece.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

It was interesting watching Cathie Wood try to defend her "portfolio management" strategy of keep no stock above 10% on any real basis.

I found this Warren Buffett video:

In which he says:

Of course, Buffett himself completely missed TSLA, because it's something he doesn't understand. That's OK, we understand.

I guess I am complety missing the point of your post. Which “defense” of Wood’s strategy are you referring to? Link?

I’m a bit confused about the attacks on ARK recently. It’s as if they are being derided because of TSLA success. They were pumping TSLA six years ago. Their strategy is to foster investment in the NEXT TSLA.

Why would ARK continue to load up on TSLA? People (us) can invest directly if they want.

You might want to check the returns of the non-Tesla ARK funds over the last six months (ARKG and ARKF). Not too shabby.

And seriously, if you want to follow Buffet strategy, invest in Apple, Bank of America and Coca Cola.

Why would I pay Kathy a fee to manage my money if the entire fund was just Tesla? I would be best served to just buy TSLA myself. I buy the fund for diversification.It was interesting watching Cathie Wood try to defend her "portfolio management" strategy of keep no stock above 10% on any real basis.

I foMEDIA]

In which he says:

Of course, Buffett himself completely missed TSLA, because it's something he doesn't understand. That's OK, we understand.

engle

Member

Speaking of Bloomberg FUD, Hana Dull seems to think that pigs are primates and Neuralink is Tesla.

Twitter link

I met Hana Dull years ago (~1999). At the time she was working for the local rag covering the Fremont (yes - that Fremont) Fremont Unified School District school board and the city council. She struck me as one of the dimmest bulbs in the barrel back then, too.

Last edited:

Why would I pay Kathy a fee to manage my money if the entire fund was just Tesla? I would be best served to just buy TSLA myself. I buy the fund for diversification.

Well for people that can't invest in TSLA directly in their retirement accounts, that would be a valuable option.

MC3OZ

Active Member

. Elon's teams have just begun. Buckle up.

My key expectation out of Battery Day is the following problems are essentially solved:-

- Scaling cell production with vehicle production (assuming sufficient raw/recycled materials)

- EV price parity with ICE.

My hunch is 2-3 million per year by 2022, perhaps more.

Following that hunch, I would expect Tesla to kick off construction of around 3 new factories in 2022.

Existing factories, in particular Berlin and Austin would still have some runway.

Of that 2-3 million per year, perhaps 2+ Million Model 3/Y combined, perhaps the worldwide market is for Model 3/Y is 2-3 Million per year.

One of the new factories could be 3/Y, perhaps in China, Korea, or Mexico, but squeezing a bit more production out of the existing factories makes more sense.

But I would predict one new factory in China for the Compact Chinese model and one new factory in Europe for the compact European Model.

If we consider the use of extensive casting in these compact models that reduces build costs and capex,and also vesicle weight. IN term of profitability compact cars I expect EVs will have a significant edge over ICE especially with 2022-20023. For an EV lower weight means a smaller battery pack and motors, which in turn means lower weight and lower cost. The combination of nippy performance, good handling and reasonable city range for a lower price isn't hard to hit probably even with an LFP based pack. Throw in a higher end nickel based pack on the performance models, great performance and good touring range is also possible.

But I don't think they can start building a new car factory until the design is final, so again the compact models would need to be reveal later 2021 or early 2022 for a 20202 construction start.

While this is a lot of speculation, it is also perhaps why Tesla will be doing vehicle design in multiple locations, with all o ther problems solved this could be the rate determining step.

If the US design team isn't the primary lead on the compact models, they can be designing other things like more cyber models, vans and whatever other opportunities exist.

Short term if the US team designs 1-2 new vehicles they can probably be built and Austin building these new designs overseas could be the next wave on expansion 2024-2025.

Building compact models in multiple locations could also be part of the next wave 2024-2025.

While this is a lot of speculation and guesswork we can identify the key consideration, (assuming now issue with battery raw materials)that is designing a new model and building that model at production scale in one factory. Once that step is achieved building that model in multiple factories to meet the global demand is not overly difficult..

.

smorgasbord

Active Member

I guess I am complety missing the point of your post. Which “defense” of Wood’s strategy are you referring to? Link?

I’m a bit confused about the attacks on ARK recently. It’s as if they are being derided because of TSLA success. They were pumping TSLA six years ago. Their strategy is to foster investment in the NEXT TSLA.

Why would ARK continue to load up on TSLA? People (us) can invest directly if they want.

You might want to check the returns of the non-Tesla ARK funds over the last six months (ARKG and ARKF). Not too shabby.

And seriously, if you want to follow Buffet strategy, invest in Apple, Bank of America and Coca Cola.

1) For the Cathie Wood defense of her Portfolio Management strategy, look upthread a day or so for a post from @Artful Dodger

2) Not attacking ARK, just point out that how her firm manages portfolios may not be optimal. It depends on your goals, objectives, and risk tolerance, among other things. Remember, I said "interesting" - I was hoping to spark further discussion on portfolio management, not that she is wrong.

3) Just because they load up on TSLA doesn't mean their portfolio wouldn't have some value. Since they understand the business so well and have multiple analysts looking at it daily, they might be able to spot trends, hiccups, roadblocks, or new opportunities faster than an individual investor.

4) You're wrong that "following Buffett's strategy" means investing now in the same companies he has in the past. His STRATEGY is to invest in businesses you understand, that are resilient to competition, etc. As I clearly pointed out, the companies HE understands are different than the companies WE understand.

Why would I pay Kathy a fee to manage my money if the entire fund was just Tesla? I would be best served to just buy TSLA myself. I buy the fund for diversification.

See point #3, above. I'm not saying her entire fund should be Tesla. I'm not even saying she should change her firm's rules. I'm saying that maybe those rules aren't optimal, and providing opinions from another successful investor as counterpoint.

MartinAustin

Active Member

New Shanghai production video from Tesla

https://twitter.com/teslacn/status/1299752012473491456?s=20

https://twitter.com/teslacn/status/1299752012473491456?s=20

Words of HABIT

Active Member

Sunday is (hopefully *knocks on wood*) going to be an epic day for SpaceX. In the morning at 14:12 UTC there's a Starlink launch. In the afternoon at 23:18 UTC the SAOCOM 1B satellite will be launched. Then sometime during the day, Starship SN06 will make a 150 meter hop!

Edit: It should be said that the weather is really not great. There's a pretty decent risk of a scrub or two.

The free Apple App called Night Sky whereby pointing your iphone in any direction gets an accurate image of all the celestial bodies in relation to where you are standing, from stars, mapping of constellations, planets, space junk and satellites. By clicking on the icons there is statisitcal information abound. Almost any direction you hold the iPhone now shows Starlink Satellites by SpaceX. Quite amazing that there are hundreds of these orbiting the Earth now and many more to come. It is out of this World what Elon and company are doing. Images below are from the Night Sky App taken this evening.

On another note, an hour ago I promised the family that I would go a full week without looking at the Tesla ticker and TMC, and pay them $50 if they caught me. We'll, I'm writing this post and low and behold I hear a shreek, "Daddy's on Tesla". I tried to explain that I was writing about SpaceX, but no no avail, so I'm down fifty buckeroos already. With the stock split revised pricing, S&P inclusion potential and continued amazing progress of the Gigas, I have a feeling this may be a very expensive week coming up for me. I have set aside some cash provisions to cover my projected losses. : (

Have a great week everyone!

engle

Member

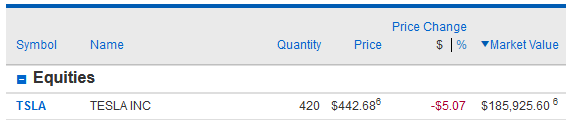

I didn't plan one of my accounts this way LMFAO:

Now that there are no trading commissions, I bought all of the positions in all of her ARK funds excluding TSLA in a $40K rollover IRA and another account. I created a spreadsheet (yes, I was bored that day) so I could weight it properly. This way I can see the impact of individual names over time - I didn't do this to save on ARK's fees. I bought these on 7/13/2020:

So far, I have an almost 5-bagger from one of the biotechs held in a different account that has smaller initial investments:

What I did is combine the holdings in all ARK funds and add them up if the same stock was held in more than one fund. Then I eliminated TSLA, and calculated the weight of each one. Then I purchased all of them. I plan to "rebalance" every quarter. However, if a stock is outperforming, then I will leave it alone and not sell any of it.

Why would I pay Kathy a fee to manage my money if the entire fund was just Tesla? I would be best served to just buy TSLA myself. I buy the fund for diversification.

Now that there are no trading commissions, I bought all of the positions in all of her ARK funds excluding TSLA in a $40K rollover IRA and another account. I created a spreadsheet (yes, I was bored that day) so I could weight it properly. This way I can see the impact of individual names over time - I didn't do this to save on ARK's fees. I bought these on 7/13/2020:

So far, I have an almost 5-bagger from one of the biotechs held in a different account that has smaller initial investments:

What I did is combine the holdings in all ARK funds and add them up if the same stock was held in more than one fund. Then I eliminated TSLA, and calculated the weight of each one. Then I purchased all of them. I plan to "rebalance" every quarter. However, if a stock is outperforming, then I will leave it alone and not sell any of it.

SunCatcher

Member

Yes, it would be a humane act of mercy to put them out of their misery, no?We need more FUD. Short sellers are smokers in an ammo depot. You need them to light the dry powder.

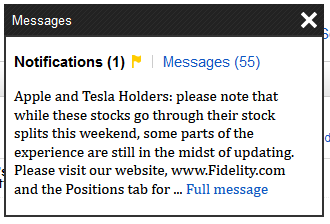

you’re right! i think brokers are lucky that it was the weekend this happened for both aapl and tsla

the amount of customers holding these 2 are tremendous and handling, posting, reconciling stock and derivatives for both events for everyone at the same time is an operational challenge

It was interesting watching Cathie Wood try to defend her "portfolio management" strategy of keep no stock above 10% on any real basis.

I found this Warren Buffett video:

In which he says:

Of course, Buffett himself completely missed TSLA, because it's something he doesn't understand. That's OK, we understand.

Warren buffet also said you only need to buy 5 stocks in your life to become a successful investor.

I have bought TSLA, AAPL, looking for the 3 others.

Mod: edit at member request.

Last edited by a moderator:

engle

Member

It's about as hard as learning how the City of Freemont, CA is spelled, amirite?

Fremont is actually named after the explorer "John Fremont".

When I moved to San Francisco from Nashua, NH in 1983, I thought "San Ho-say" was pronounced "San Joe-say" because I took Latin and French instead of Spanish in 7-12.

Sure, but that isn't the service they sell. Just like any of hundreds of other actively managed funds.Well for people that can't invest in TSLA directly in their retirement accounts, that would be a valuable option.

Bet TSLA

Active Member

k

Wow, they sure move fast in Shanghai! China speed!New Shanghai production video from Tesla

https://twitter.com/teslacn/status/1299752012473491456?s=20

engle

Member

I think Fidelity must have been getting a lot of phone calls. Now they posted this pop-up when you log in:

the most up to date and accurate information. Your Todays Gain/Loss, Total Gain/Loss and Cost Basis information on the Positions tab will be fully up to date by Tuesday at market open.

So that is what investing in equities is, "the experience", like "$TSLA: The Experience". Brokers are simply providing us, bored consumers, with "an experience". I guess I should go back to my Fortnite game then since it is a better "experience".

$TSLAQ people must really enjoy their masochistic experience! I think the incredible rally we've seen recently will attract a whole new generation of $TSLAQ shorties. Should be fun to watch!

the most up to date and accurate information. Your Todays Gain/Loss, Total Gain/Loss and Cost Basis information on the Positions tab will be fully up to date by Tuesday at market open.

So that is what investing in equities is, "the experience", like "$TSLA: The Experience". Brokers are simply providing us, bored consumers, with "an experience". I guess I should go back to my Fortnite game then since it is a better "experience".

$TSLAQ people must really enjoy their masochistic experience! I think the incredible rally we've seen recently will attract a whole new generation of $TSLAQ shorties. Should be fun to watch!

Last edited:

Bet TSLA

Active Member

Now my E*Trade account page is showing 5x the positions at the old prices, so lots more money! I think they'll get it right before Monday.What I'm seeing at E*Trade is that if I look at my account I see all my positions correctly with pre-split numbers. If I look at the summary page for all accounts, the numbers reflect zero value for TSLA options. So about 70% of my account value is gone at the moment, at least on the summary page.

My key expectation out of Battery Day is the following problems are essentially solved:-

So the short term question is:- How quickly can Tesla scale vehicle production at Fremont, Shanghai, Berlin and Austin?

- Scaling cell production with vehicle production (assuming sufficient raw/recycled materials)

- EV price parity with ICE.

My hunch is 2-3 million per year by 2022, perhaps more.

Following that hunch, I would expect Tesla to kick off construction of around 3 new factories in 2022.

.

I'm thinking Tesla's next factory will be purely for Tesla Energy, maybe to make both batteries and power pack products. Located in Europe, possibly UK. Maybe combined with solar roof products.

MC3OZ

Active Member

I'm thinking Tesla's next factory will be purely for Tesla Energy, maybe to make both batteries and power pack products. Located in Europe, possibly UK. Maybe combined with solar roof products.

Yes, I also think that for the UK, India and Australia.... at least for energy storage batteries...

Additional solar production is possibly slightly more likely in China.

What specific energy storage battery factories will do is free up other cell production for use in vehicles.

Long term Nevada might be mainly energy storage production..

I was focusing mainly on vehicle production as I was following on from 2 earlier discussions.

- How quickly can EVs render ICE obsolete. at least for new car sales.

- The economics of the compact models.

A compact 20-25K EV is where these 2 disruption steams merge, after that there are very few niches left where ICE production can hide from cheaper and superior EV competition...

Putting it all together, Tesla is just getting started, on EVs and energy...

.

I've always expected the ICE age to end quickly.... change happens rapidly when the price and product are right.... there is sometimes a long runway getting to right... getting to the tipping point can take a decade or more... completing the transition when all factors align can be much quicker.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K