I agree,

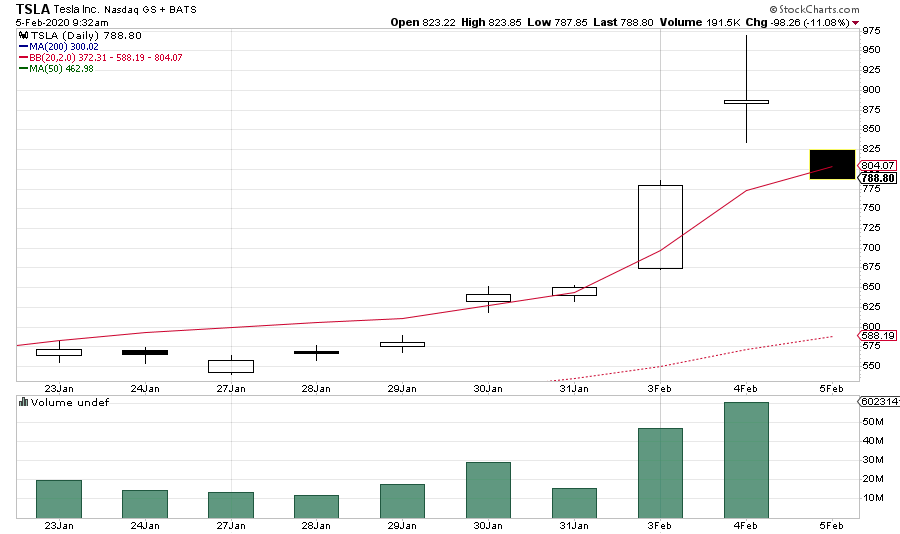

@Singuy . Though I will say I'm more comfortable with 'reasonable' volatility going forward. Meaning, now that we've touched $900, even if we drop $100 or two nowadays, I think we have forever put behind us the FUD that Tesla will go bankwupt etc. Now it's just "how big will they grow? and how fast?" and

not "will Tesla live another year?" I can live with my investment growing

reasonably.

In fact, Tesla's rocket rise is messing with my retirement projections! I was very happy when my compound portfolio gain was 10% / year, I'm getting close to living off the dividends (non Tesla since Tesla has never paid any!). But with Tesla now 20% of my portfolio, and its average

annual growth of 103% on my book value, this is making my overall growth forecast look ridiculously rosy. I can't trust growth this fast!