Tslynk67

Well-Known Member

This is awesome. But we're skipping an important element ... the entertainment factor of checking frequently

Yeah, and doesn't work if you're playing with short term options...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

This is awesome. But we're skipping an important element ... the entertainment factor of checking frequently

Interesting excerpt from this book:

One example within the book deals with separating noise and signal (meaning) within investing. Let’s say you have a dentist that can invest with a 15% average annual return with 10% annual volatility. For reference, the S&P 500 index has a ~10% average annual return and ~14% average annual volatility. The dentist has good thing going, with the portfolio doubling in value every 5 years on average.

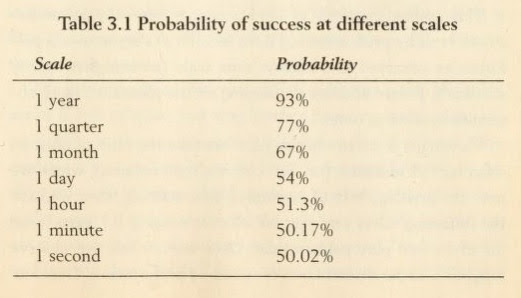

An unexpected factor in his success is the frequency upon which he looks at his portfolio balance. Here’s a chart from the book showing the probability of a positive change in value based on how often the portfolio is checked.

If he were to check his portfolio every minute, he would only see a positive return 50.17% of the time. That is basically indiscernible from a coin flip. The problem is loss aversion.

Being emotional, he feels a pang with every loss, as it shows in red on his screen. He feels some pleasure when the performance is positive, but not in equivalent amount as the pain experienced when the performance is negative.

At the end of every day the dentist will be emotionally drained. A minute-by-minute examination of his performance means that each day (assuming eight hours per day) he will have 241 pleasurable minutes against 239 unpleasurable ones. These amount to 60,688 and 60,271, respectively, per year. Now realize that if the unpleasurable minute is worse in reverse pleasure than the pleasurable minute is in pleasure terms, then the dentist incurs a large deficit when examining his performance at a high frequency.

Again, this doesn’t go away even if you know about the phenomenon:

Regardless of what people claim, a negative pang is not offset by a positive one (some psychologists estimate the negative effect for an average loss to be up to 2.5 the magnitude of a positive one); it will lead to an emotional deficit.

Now, if he were to check that same portfolio only when his monthly statement arrives, he would see a positive return 67% of the time (2 out of 3). Finally, if he has the patience to check only once a year, she would see a positive return 93% of the time. The time scale matters.

Thought i'd share this with TMC......

Walking around GF3 in the air\Tesla gigafactory 3 in shanghai

You try getting through 2013-16 without a guy in his mom's basement to hold your hand and tell you everything's gonna be ok!So this board is basically an emotional support group with some business intelligence sprinkled in.

Sounds about right.

You know Smeigal?You try getting through 2013-16 without a guy in his mom's basement to hold your hand and tell you everything's gonna be ok!

I have found that big up days are a big drain on my energy. Not at all fun, to be honest. This is a bit of a head-scratcher. More money is more fun, right?

Perhaps on big up days, I check the price very often. Even on big up days, the quote is a down-tick only slightly less than an up-tick.

On a big down day, I can just tune it all out and not check the ticker. So big down days are, perversely, more enjoyable for me.

I did not make an argument for more cash.Sorry, now I’m lost more than ever. Not your fault, so can you clarify please?

I thought you’re original point was an argument for more cash on hand. I asked how much you felt they needed. You said 4 billionish. I said but they’ve already got 8.6 billion. Now you’re talking about 8.6 minus a ‘reserve’. I’ve no idea what that means.

All I was asking was how much in total you felt they should have on hand, since you felt what they currently have (8.6) isn’t enough. Do you mean they should have 4 billionish more making a grand total of 13 billionish? That’s the amount you’d be comfortable with them having on hand?

So this board is basically an emotional support group with some business intelligence sprinkled in.

Sounds about right.

I did not make an argument for more cash.

I did try to state that Tesla has a lot of known projects going on that require a lot of cash.

I tried to male the point that Tesla should maintain a reserve to survive a down turn. That reserve should cover anticipated SG&A plus debt obligations and thinking about it payments due to survive the down turn.

I also think competition is coming and Tesla needs to figure out if they should be adding even more capacity.

These are all very strategic questions and so far Elon and Zach are doing a very good job making them.

Anyone want to buy a July 31st $2500 call? Low mileage, original owner. Paid $876, will sell for $500 firm. May consider parting out.

Watching these factory construction videos -- especially once they get past the foundation work -- will never get old.

EDIT: Also, for those interested in such things, a close above $1478 would set a bullish technical signal -- .

I am wondering if today's SP movement is signaling the start of slow and methodical accumulation by the bigger players...

Watching these factory construction videos -- especially once they get past the foundation work -- will never get old.

EDIT: Also, for those interested in such things, a close above $1478 would set a bullish technical signal -- so I find it interesting that the high for the day is right around that mark. Obviously, a close below the mid-BB ($~1410) would be a bearish signal and I would expect (though no guarantees, of course) that TSLA would break down lower if it closes below that point.

So those are the two levels I'm watching today.

Marques Brownlee - Friday: