Lol. Yes the gains this (pandemic) year have been pathetic.I don't know about you, but we've had so many "wonderful" and "fabulous" opportunities to buy TSLA that I'm literally (yes literally) out of dry powder.

Time for some good news in Mr. Market's eyes.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

It's only mind-blowing to real investors and engineers. It means less than nothing to Wall Street traders and Hedge Funds. This is pretty much the same as my ignorance and superstition is just as good as your science."In 12 months we will produce roughly 5% of the worlds batteries and 20% of what we outsourced last year. By 2030 we will produce 10x what the entire world produced last year. Last year we made zero batteries. These will be less than half the cost of current batteries"

I don't know how that's not mind blowing.

Artful Dodger

"Neko no me"

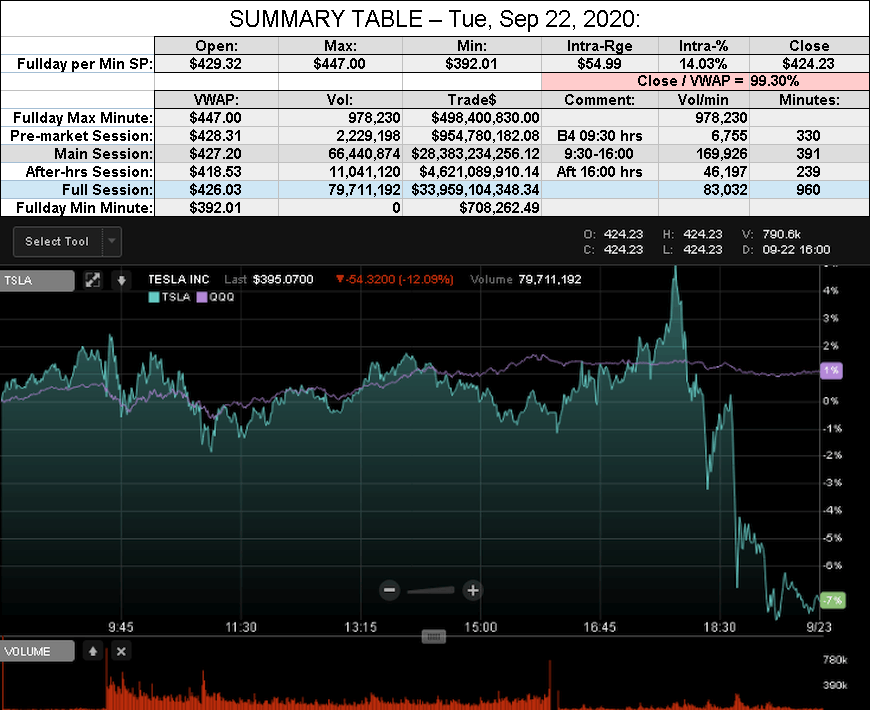

After-action Report: Tue, Sep 22, 2020: (Full-Day's Trading)

Headline: "Bears Sell-the-Rumor, Sell-the-News"

TSLA 1-mth Moving Avg Market Cap: $393.45

TSLA 6-mth Moving Avg Market Cap: $226.87

Nota Bene: 3rd tranche of CEO comp. unlocked as of Fri, Sep 04, 2020

'Short' Report:

Comment: "Bears pin TSLA to the Mid-BB; then dump A/Hrs"

View all Lodger's After-Action Reports

Cheers!

Headline: "Bears Sell-the-Rumor, Sell-the-News"

Traded: $33,959,104,348.34 ($33.96B)

Volume: 79,711,192

VWAP: $426.03

Close: $424.23 / VWAP: 99.30%

TSLA closed BELOW today's Avg SP

Mkt Cap: TSLA / TM = $395.301B / $189.691B = 208.39%

Volume: 79,711,192

VWAP: $426.03

Close: $424.23 / VWAP: 99.30%

TSLA closed BELOW today's Avg SP

Mkt Cap: TSLA / TM = $395.301B / $189.691B = 208.39%

TSLA 1-mth Moving Avg Market Cap: $393.45

TSLA 6-mth Moving Avg Market Cap: $226.87

Nota Bene: 3rd tranche of CEO comp. unlocked as of Fri, Sep 04, 2020

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 57.3% (57th Percentile rank FINRA Reporting)

FINRA Short/Total Volume = 38.6% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.45% of Short Volume (45th Percentile Rank)

FINRA Short/Total Volume = 38.6% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.45% of Short Volume (45th Percentile Rank)

Comment: "Bears pin TSLA to the Mid-BB; then dump A/Hrs"

View all Lodger's After-Action Reports

Cheers!

Last edited:

floydboy

Member

Isn't the idea of a roadmap, telling us how they plan to get from here to there? Now that I see the way, I'm glad they didn't keep their mouths shut.Apple also kept their mouths shut on new technology until you could actually buy it.

Last edited:

llirk

Member

...calmly takes off call selling hat and puts on put selling hat...

Bring on tomorrow!

(leap buying hat may need to be worn as well)

Bring on tomorrow!

(leap buying hat may need to be worn as well)

anthonyj

Stonks

It’s very very simple. Half of Tesla’s mission is to save the environment. The other half is to make Elon as wealthy as possible, so that he can blow that money on Mars missions which is his main fixation. He wants, no, he needs to be a Trillionaire, and cornering the auto market is the “easiest” way to get there because competitors can’t innovateI don't think Elon's comment on valuation or profitability was the problem per se.

But very objectively watching the presentation, you don't get the sense that this is a company that necessarily wants to return money to its shareholders (eventually -- over whatever horizon). At the end of the day, if people believe a company will develop incredibly valuable technology and then recycle all profits therefrom in the name of a dream without a tangible return then they will not -- cannot -- pay for the technology what it is worth.

For a long time, companies like Amazon and Apple managed incredible market values without returning any capital to shareholders because they weren't run by people with ambitious visions of going to Mars or bringing about a sustainable future and could only hope to reinvest profits into further profit generating ventures. This isn't a bearish comment on Tesla at all. Just that the unreferenced emphasis on a sustainable future is not necessarily comforting for many investors.

Andy O

Member

What about shingling? One image of the new battery cell showed what looked like a spiral of shingles, not a spiral of continuous material, and the teaser image on the shirts and on the cover of the meeting announcement also showed these shingles. Where do they come in? Are they one of the other things they will explain in upcoming days?

jebinc

Well-Known Member

Good R&D progress, disappointing afternoon.  So much for getting a TSLA bump up after Shareholder and Battery Day, 'nuff said....

So much for getting a TSLA bump up after Shareholder and Battery Day, 'nuff said....

They said they left some things out. It appeared (to me) that without the shingling the material would have to be folded, which is problematical at very high speeds.What about shingling? One image of the new battery cell showed what looked like a spiral of shingles, not a spiral of continuous material, and the teaser image on the shirts and on the cover of the meeting announcement also showed these shingles. Where do they come in? Are they one of the other things they will explain in upcoming days?

Very good post. One correction, battery plants are 200 gwh per year not 20. A single line will be 20.Notes from Battery day:

(everything I thought was significant in one post, to avoid clutter)

### General note: The presentation was extremely information dense, which in my opinion has caused the "nothing new" sentiment that some are expressing here, because there isn't one shiny thing as a takeaway. I hope this is useful in digesting the new info. ###

Presentation:

- Long Term: 10TWh global annual battery production needed for transition to sustainable transport, additional 10TWh/y for energy storage

- Current Tech: 135 Giga Nevada's, $2T investment, 2.8M people needed for this goal => drastic improvement in efficiency needed

- Plan to halve the cost per kWh (!)

- not dependent on a single innovation => no single point of failure- Tabless cell => improved charge rate vs. cell diameter curve

- 5x shorter electrical path- 4680 cell

- 20% higher power density due to tabless

- 16% higher range from form factor alone

- 14% $/kWh reduction from form factor+tabless

- Kato Road pilot plant has 10GWh design capacity, to be reached in about a year

- Production plants to be ~20GWh/y

- Dry electrode process

- 10x footprint reduction- 20GWh/y per line, 7x increase per line

- 10x energy reduction

- "close to working" => does work, currrently poor yield

- "Tesla is aiming to be the best at manufacturing of any company on earth", manufacturing as long term competitive advantage

- Formation 25% of CAPEX

- 86% CAPEX reduction- 10x production density increase *across plant*

- 75% footprint reduction

- 75% CAPEX reduction *across plant*

- Tesla goals:

- 200Gwh/y in 2022, 100GWh internal- Formation+dry electrode: 18% $/kWh reduction

- 3TWh/y in 2030

- Raw Silicon anode

- Ion polymer coating, integrate with binder- Zero Cobalt

- design for expansion, don't fight it- 20% range increase

- 5% $/kWh reduction

- 15% $/kWh reduction on cathode level- 3 battery cathode tiers:

- LFP, NMx (33% Manganese, 66% Nickel), Nickel, depending on application- Cathode production *very* complicated, in part due to organic process/supply chain growth => potential

- metallic Nickel, no sulfate- 33% reduction in lithium cost

- 66% less CAPEX

- 76% less process cost

- no wastewater

- simpler recycling

- 80% less miles travelled

- 12% $/kWh reduction

- Tesla to use Lithium clays in Nevada (rights secured by Tesla), acid free saline extraction

- TWh scale supply secured- 100% cell recycling *today* by third parties, in house recycling starting to ramp up next quarter at Giga Nevada

- (No Lithium coup in Bolivia?! I'm shocked I tell you, shocked!)

- Front and rear of the car single-piece cast, connected by a structural battery pack

- no modules- Grand Total (POTENTIAL, not currently realized):

- non cell portion of pack "has negative mass" because of mass savings in other parts of the vehicle

- pack is a "honeycomb stucture between face sheets" => exremely high stiffness, higher than normal car

- better volumetric efficiency => cells more in the center of the vehicle => less chance of cell puncture during side impact

- 10% mass reduction (of pack or vehicle?)

- 14% range improvement opportunity

- much simpler vehicle production

- 54% range increase- Long term: 20M car sales per year

- 56% less $/kWh (pack level)

- 69% less CAPEX per GWh (cell level)

- start seeing benefits in 12-18 months

- full potential probably achieved in about 3 years

- 3 years from compelling $25k car *at a profit*

- PLAID:

- <2 sec 0-60, <9 sec quarter mile, >1100hp- No mention of energy density on cell or pack level, only range increase potential, likely to keep OEMs guessing as to where the range improvements come from exactly (eg cell vs pack level)

- "best track time of any production car ever"

- preoders open now, available end of 2021

- 520+mi range, 200mph

- 140k

Q&A:

- Cell production in Berlin confirmed

- HVAC a "pet project" of Elon

- Direct sales in Texas will "hopefully be cleared up in the future"

- Stationary storage is a 25 year asset or greater => essential for storage cost, environmental concerns

- "could overdo cell production and supply to others", but already going as fast as possible on cell production

- no direct intention of supplying other OEMs, will be done if Tesla has a production capacity surplus (ie if they can scale beyond their needs reasonably)- approach to potential Nickel shortage: powertrain efficiency improvements to make LFP viable => limit Nickel consumption

- "presenting a model to other maunfacturers on how to vertically integrate cell production" and battery architechture/chemistry across product stack

- V2G possible through software in Europe, need addtional hardware in the US (due to Plug differences), limited opportunity, want to keep storage and automotive mostly seperate, may still be done at some point, not a priority

- ~3 years until cost/feature parity between Tesla and ICE in the $25k market segment, already there in higher priced segments

- "massive problem[...] need everybody's help[...] It's everyone's planet" (from employee)

Username checks out.

Last edited:

bkp_duke

Well-Known Member

What about shingling? One image of the new battery cell showed what looked like a spiral of shingles, not a spiral of continuous material, and the teaser image on the shirts and on the cover of the meeting announcement also showed these shingles. Where do they come in? Are they one of the other things they will explain in upcoming days?

Those are called "tabs". Imagine that all the current of the battery had to run through ONE of those (that is how current 18650 and 2170 cells work).

Now, imagine that you are "tabless" and the current runs through ALL of those to get out. It's more efficient from a performance standpoint, an electrical standpoint, and a production standpoint. Win, Win, Win.

The only reason they still look like "tabs" is because you roll up a long sheet to get to them, and because you are doing that the edge of that sheet has to be cut so that they roll properly to fold down over the top.

If you haven't, go watch the entire presentation. It's chocked FULL of juicy tech details like this.

Those who are disappointed by the AH price action: I'm curious to know what you think the market was expecting to see today vs what we actually saw.

The market is clearly valuing TSLA on future potential not current fundamentals yet when part of the basis of that future valuation is laid out, the market bails. Go figure.

I think the market was looking for simpler and more immediate gratification and that's OK ... leaves the long term value untapped for those who can see it.

Notes from Battery day:

(everything I thought was significant in one post, to avoid clutter)

### General note: The presentation was extremely information dense, which in my opinion has caused the "nothing new" sentiment that some are expressing here, because there isn't one shiny thing as a takeaway. I hope this is useful in digesting the new info. ###

Presentation:

- Long Term: 10TWh global annual battery production needed for transition to sustainable transport, additional 10TWh/y for energy storage

- Current Tech: 135 Giga Nevada's, $2T investment, 2.8M people needed for this goal => drastic improvement in efficiency needed

- Plan to halve the cost per kWh (!)

- not dependent on a single innovation => no single point of failure- Tabless cell => improved charge rate vs. cell diameter curve

- 5x shorter electrical path- 4680 cell

- 20% higher power density due to tabless

- 16% higher range from form factor alone

- 14% $/kWh reduction from form factor+tabless

- Kato Road pilot plant has 10GWh design capacity, to be reached in about a year

- Production plants to be ~20GWh/y

- Dry electrode process

- 10x footprint reduction- 20GWh/y per line, 7x increase per line

- 10x energy reduction

- "close to working" => does work, currrently poor yield

- "Tesla is aiming to be the best at manufacturing of any company on earth", manufacturing as long term competitive advantage

- Formation 25% of CAPEX

- 86% CAPEX reduction- 10x production density increase *across plant*

- 75% footprint reduction

- 75% CAPEX reduction *across plant*

- Tesla goals:

- 200Gwh/y in 2022, 100GWh internal- Formation+dry electrode: 18% $/kWh reduction

- 3TWh/y in 2030

- Raw Silicon anode

- Ion polymer coating, integrate with binder- Zero Cobalt

- design for expansion, don't fight it- 20% range increase

- 5% $/kWh reduction

- 15% $/kWh reduction on cathode level- 3 battery cathode tiers:

- LFP, NMx (33% Manganese, 66% Nickel), Nickel, depending on application- Cathode production *very* complicated, in part due to organic process/supply chain growth => potential

- metallic Nickel, no sulfate- 33% reduction in lithium cost

- 66% less CAPEX

- 76% less process cost

- no wastewater

- simpler recycling

- 80% less miles travelled

- 12% $/kWh reduction

- Tesla to use Lithium clays in Nevada (rights secured by Tesla), acid free saline extraction

- TWh scale supply secured- 100% cell recycling *today* by third parties, in house recycling starting to ramp up next quarter at Giga Nevada

- (No Lithium coup in Bolivia?! I'm shocked I tell you, shocked!)

- Front and rear of the car single-piece cast, connected by a structural battery pack

- no modules- Grand Total (POTENTIAL, not currently realized):

- non cell portion of pack "has negative mass" because of mass savings in other parts of the vehicle

- pack is a "honeycomb stucture between face sheets" => exremely high stiffness, higher than normal car

- better volumetric efficiency => cells more in the center of the vehicle => less chance of cell puncture during side impact

- 10% mass reduction (of pack or vehicle?)

- 14% range improvement opportunity

- much simpler vehicle production

- 54% range increase- Long term: 20M car sales per year

- 56% less $/kWh (pack level)

- 69% less CAPEX per GWh (cell level)

- start seeing benefits in 12-18 months

- full potential probably achieved in about 3 years

- 3 years from compelling $25k car *at a profit*

- PLAID:

- <2 sec 0-60, <9 sec quarter mile, >1100hp- No mention of energy density on cell or pack level, only range increase potential, likely to keep OEMs guessing as to where the range improvements come from exactly (eg cell vs pack level)

- "best track time of any production car ever"

- preoders open now, available end of 2021

- 520+mi range, 200mph

- 140k

Q&A:

- Cell production in Berlin confirmed

- HVAC a "pet project" of Elon

- Direct sales in Texas will "hopefully be cleared up in the future"

- Stationary storage is a 25 year asset or greater => essential for storage cost, environmental concerns

- "could overdo cell production and supply to others", but already going as fast as possible on cell production

- no direct intention of supplying other OEMs, will be done if Tesla has a production capacity surplus (ie if they can scale beyond their needs reasonably)- approach to potential Nickel shortage: powertrain efficiency improvements to make LFP viable => limit Nickel consumption

- "presenting a model to other maunfacturers on how to vertically integrate cell production" and battery architechture/chemistry across product stack

- V2G possible through software in Europe, need addtional hardware in the US (due to Plug differences), limited opportunity, want to keep storage and automotive mostly seperate, may still be done at some point, not a priority

- ~3 years until cost/feature parity between Tesla and ICE in the $25k market segment, already there in higher priced segments

- "massive problem[...] need everybody's help[...] It's everyone's planet" (from employee)

Great notes! He did mention energy density during the Q&A, said they might reach 400 kwh per (I know, I butchered the units), implying that it was going to be lower initially. I think it was during the question that included electric airplanes.

FYMR

Member

DITTO. No money to spare.I don't know about you, but we've had so many "wonderful" and "fabulous" opportunities to buy TSLA that I'm literally (yes literally) out of dry powder.

Time for some good news in Mr. Market's eyes.

I simply do not understand the logic of day traders. I really don’t.Good R&D progress, disappointing afternoon.So much for getting a TSLA bump up after Shareholder and Battery Day, 'nuff said....

For the people complaining about $TSLA SP dropping AH....do y'all remember just 2 weeks ago we hit a AH low of $308? Let that digest for a little while.

It’s very very simple. Half of Tesla’s mission is to save the environment. The other half is to make Elon as wealthy as possible, so that he can blow that money on Mars missions which is his main fixation. He wants, no, he needs to be a Trillionaire, and cornering the auto market is the “easiest” way to get there because competitors can’t innovate

It's not obvious that he needs to be so rich to accomplish this. An irony of the fact that Tesla and eventually SpaceX are self-financing and will never be bankrupt is that no external pressure can get in the way of his accomplishing Mars missions and a sustainable future (to the extent either is possible). This was not the case a few years ago and was not the case when the company was worth 10 percent of what it is now (due to his margin loans)

Mike Smith

Active Member

Russ Mitchell thinks that in battery manufacturing 3 terawatt hours of annual production is the minimum threshold for volume production.

'At the event, Musk undershot expectations, announcing what amounts to a pilot project he suggested could reach volume production by 2030. “There’s still a lot of work to do,” he said. “We’re not saying this is completely in the bag.”

-Russ Mitchell,

LA Times

'At the event, Musk undershot expectations, announcing what amounts to a pilot project he suggested could reach volume production by 2030. “There’s still a lot of work to do,” he said. “We’re not saying this is completely in the bag.”

-Russ Mitchell,

LA Times

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M