Probably killing some time before his yacht gets cleaned up and only half of the girls showed up.What is a guy with $80,000,000 doing on a chatboard?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

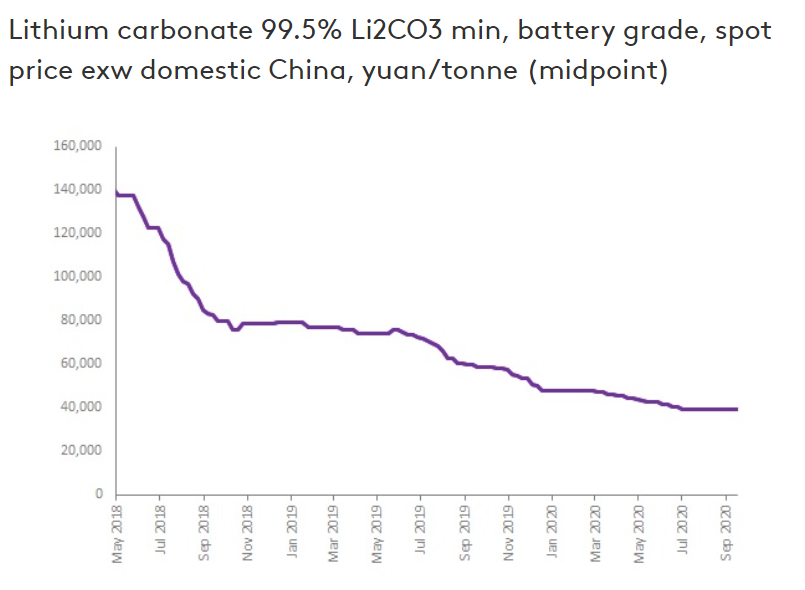

This chart is interesting (from Lithium price spotlight - Weekly price updates | Fastmarkets). If battery demand keeps rising, why is lithium price dropping? Are lithium miners doing that good a job at increasing capacity?

This chart is interesting (from Lithium price spotlight - Weekly price updates | Fastmarkets). If battery demand keeps rising, why is lithium price dropping? Are lithium miners doing that good a job at increasing capacity?

View attachment 591777

hmm...commodities speculative trading doesn’t always correlate to S/D curve

That's 208 (+/-) semi loads every week. Does that sound about right? Does anyone know if Tesla uses railroad for this at all?Yeah, and he's floating adift in his own fact-free dream world too.

Fremont receives about 5,000 tones of finished Bty Packs from Giga Neva PER WEEK.

But we'll just ignore the effort, capital investment, and contractual obligations that makes that possible.

And then ASSume the unfinished Pilot Plant in Fremont will have priority for Model 3/Y...

Sometimes, a Picard 'facepalm' emoji just is not enough.

Cheers!

ZeApelido

Active Member

Upgraded my laptop with Bose speakers. Now I can listen to Wham! while I trade Tesla.

Nice oscilloscope you got there.

smorgasbord

Active Member

To help put yesterday's bear attack on TSLA in perspective, I found this article from Feb 2014: Tesla's Gigafactory: The next step in Musk's domination of the battery-powered world - ExtremeTech

But, Mr. Market didn't like it. The article quotes Merrill Lynch’s John Lovallo: “Gigafactory investment will translate to even more capital intensity and add further pressure to margins and returns.”

And today we have Morgan Stanley worried about Tesla needing to spend about $50 Billion. They don't realize that's only $5 Billion per year (about a day's volatility, lol; or an easy cap raise as was just done), but mostly they don't realize this is what Tesla needs to be the #1 volume automaker in the world. They don't really realize that expensive as this is, it's 69% less capex than anyone else in the world will need to do to scale their EV production up.

TSLA should go down if Tesla wasn't planning like this. Mr. Market was stupid yesterday. It's further evidence of the old adage:

Those who can, do.

Those who can't, teach.

Those who can't teach become Wall St. Analysts.

BTW, kudos to the article's author, Bill Howard, who said in 2014: That still leaves room for a Tesla Terafactory in the future.

Tesla plans to build a battery “gigafactory” (its name, not ours) that by 2020 will have the capacity to produce 50 times the amount of batteries shipping in Tesla cars last year, 20 times the sales of all electric vehicles last year. Those are orders-of-magnitude increases when most automakers would kill to show a 10% increase in sales.

But, Mr. Market didn't like it. The article quotes Merrill Lynch’s John Lovallo: “Gigafactory investment will translate to even more capital intensity and add further pressure to margins and returns.”

And today we have Morgan Stanley worried about Tesla needing to spend about $50 Billion. They don't realize that's only $5 Billion per year (about a day's volatility, lol; or an easy cap raise as was just done), but mostly they don't realize this is what Tesla needs to be the #1 volume automaker in the world. They don't really realize that expensive as this is, it's 69% less capex than anyone else in the world will need to do to scale their EV production up.

TSLA should go down if Tesla wasn't planning like this. Mr. Market was stupid yesterday. It's further evidence of the old adage:

Those who can, do.

Those who can't, teach.

Those who can't teach become Wall St. Analysts.

BTW, kudos to the article's author, Bill Howard, who said in 2014: That still leaves room for a Tesla Terafactory in the future.

Last edited:

Maybe yesterday's news, but California seems to understand Battery Day. Their goal was zero emissions by 2045, so this recent change for no ICE vehicles by 2035 is welcome news and communicates urgency. Right after BDay, I love it!

I never used to get why Cal would have all these environmental rules around carburetors or paint products... They knew all along.

Governor Newsom Announces California Will Phase Out Gasoline-Powered Cars & Drastically Reduce Demand for Fossil Fuel in California’s Fight Against Climate Change | California Governor

I never used to get why Cal would have all these environmental rules around carburetors or paint products... They knew all along.

Governor Newsom Announces California Will Phase Out Gasoline-Powered Cars & Drastically Reduce Demand for Fossil Fuel in California’s Fight Against Climate Change | California Governor

humbaba

sleeping until $7000

With respect to the volatility that others have noted I believe this is due to the collective market's uncertainty as to the proper valuation of Tesla, and that such volatility will only increase as $TSLA goes higher until this uncertainty is resolved.

One of the long standing objections to Tesla's valuation has been that it is overvalued as car maker and as the market valuation increases to eclipse the valuation of all other manufacturers this is increasingly evident. True, some of that is the others losing value to Tesla so it isn't as simple as Tesla having a higher valuation compared to the others, but it seems to me that this objection is incontrovertibly true: no one can really claim that Tesla is valued solely as an automaker.

But how to value Tesla Energy? ARK doesn't even though they throw around some pretty high numbers for the unproven autonomous market. And talking about ARK there is extreme volatility in their own valuation of Tesla (comparing with/without autonomy). So it is easy to see how any fluctuation in sentiment can have such large influence.

Now with Tesla getting into manufacturing their own batteries -- especially with new techniques -- that only increases the uncertainty. And Tesla will also be mining their own lithium so that must be considered -- but again, they will be using new techniques which makes it more difficult to value.

The only way I see volatility being reduced is by Tesla's innovation slowing because that -- the rapid innovation -- is at the heart of the uncertainty. There are simply too many unknowns and -- especially when scaling rapidly -- minor deviations have large effects. Its like trying to guess just where are you are at during the beginning of S curve -- being a little wrong increases a large error.

One of the long standing objections to Tesla's valuation has been that it is overvalued as car maker and as the market valuation increases to eclipse the valuation of all other manufacturers this is increasingly evident. True, some of that is the others losing value to Tesla so it isn't as simple as Tesla having a higher valuation compared to the others, but it seems to me that this objection is incontrovertibly true: no one can really claim that Tesla is valued solely as an automaker.

But how to value Tesla Energy? ARK doesn't even though they throw around some pretty high numbers for the unproven autonomous market. And talking about ARK there is extreme volatility in their own valuation of Tesla (comparing with/without autonomy). So it is easy to see how any fluctuation in sentiment can have such large influence.

Now with Tesla getting into manufacturing their own batteries -- especially with new techniques -- that only increases the uncertainty. And Tesla will also be mining their own lithium so that must be considered -- but again, they will be using new techniques which makes it more difficult to value.

The only way I see volatility being reduced is by Tesla's innovation slowing because that -- the rapid innovation -- is at the heart of the uncertainty. There are simply too many unknowns and -- especially when scaling rapidly -- minor deviations have large effects. Its like trying to guess just where are you are at during the beginning of S curve -- being a little wrong increases a large error.

bkp_duke

Well-Known Member

To help put yesterday's bear attack on TSLA in perspective, I found this article from Feb 2014: Tesla's Gigafactory: The next step in Musk's domination of the battery-powered world - ExtremeTech

Tesla plans to build a battery “gigafactory” (its name, not ours) that by 2020 will have the capacity to produce 50 times the amount of batteries shipping in Tesla cars last year, 20 times the sales of all electric vehicles last year. Those are orders-of-magnitude increases when most automakers would kill to show a 10% increase in sales.

But, Mr. Market didn't like it. The article quotes Merrill Lynch’s John Lovallo: “Gigafactory investment will translate to even more capital intensity and add further pressure to margins and returns.”

And today we have Morgan Stanley worried about Tesla needing to spend about $50 Billion. They don't realize that's only $5 Billion per year (about a day's volatility, lol; or an easy cap raise as was just done), but mostly they don't realize this is what Tesla needs to be the #1 volume automaker in the world. They don't really realize that expensive as this is, it's 69% less capex than anyone else in the world will need to do to scale their EV production up.

TSLA should go down if Tesla wasn't planning like this. Mr. Market was stupid yesterday. It's further evidence of the old adage:

Those who can, do.

Those who can't, teach.

Those who can't teach become Wall St. Analysts.

BTW, kudos to the article's author, Bill Howard, who said in 2014: That still leaves room a Tesla Terafactory in the future.

Just curious, did Tesla execute on the predictions made in that article? I.e. how close did they come to what they said they were going to do? Did we hit 20X on EVs between 2020 (predicted) and 2014? 50X on batteries?

My gut tells me yes, but I don't know where to look this up, besides a generic google search.

Furthermore, legacy auto has billions of dollars of locked up capital dedicated to old outdated technology that either nobody wants, or that is being banned by governments the world over; that unproductive capital will soon turn into stranded assets that weigh on balance sheets.

Though, to what extent is that really true? When VW had unwanted ICE vehicle factories, they didn't "strand" them or write them off, but instead converted them to EV factories. I assume even ICE engine factories could be converted to manufacture something EV-related. It's not clear to me that the investment in converting an old ICE factory is any greater than creating a new factory from scratch like Tesla does, so I'm not sure how much credit to give this "locked-up capital/stranded assets" argument. (Outside of oil, where you really can't convert underground reserves to solar panels no matter what you invest.)

Drumheller

Active Member

Confucius, is that you?

Ya, they do innovation well and I still have to look or use the ICE in my garage on occasion. Maybe I should consider used until I get the good stuff. There has to be a devaluation somewhat of all those tiny batteries out there as of this week... (that generate heat from those stupid Tabs and are so heavy!) Just like pre Oct 2016 FSD missing some cameras.

Sorry about the OT re my life choices. But I do think this Osborne thing is important and could still bite Tesla, or delay growth that could unwind dramatically once available. And the whole reason the 1M mile battery mention was absent on BD.

If you wait for Tesla's next tech, you will always be waiting. Also, while it has been better lately, Musk has a history of being overly optimistic with timelines.

I bought a June 2013 p85+ used in January 2016. No autopilot, no cameras, no parking sensors. And it has been the best vehicle I have ever owned. I originally planned to get a new model s at some point and hoped to add a roadster 2 to thr garage. Then I saw the cybertruck and decided to change the future model s for a cybertruck instead.

Recently I decided to order a base model y to replace my 2013 model s and use the Y until my truck is ready. That's an extra vehicle purchase added just because I'd like a newer tesla and the stock has done well enough I am fine if I need more funds, though I intend to keep all my shares and have a car payment again.

As my portfolio has grown, but I'm reluctant to take money out due to expected future growth, the question I am trying to sort: how to balance enjoying life as I go while also being prudent with my investments for the future.

Depending on your situation, would replacing the murano now with a model y add enough quality to your life to justify the expense? Obviously only you can answer that. I think it's a question worth asking.

That's 208 (+/-) semi loads every week. Does that sound about right? Does anyone know if Tesla uses railroad for this at all?

Something like that (is GFf1 still doing drive units also?). No railroad, lots of semi runs. Thus the incentive to develop the internal semi fleet for millions in savings. We ran numbers on the semi thread...

Artful Dodger

"Neko no me"

Lol, LG Chem, Samsung SDI, and SK Innovation Co Ltd all down at the Close today on the Korean Stock Exchange:Guessing LG Chem. Can think of no other significant Korean battery companies.

KRX: 051910 - LG Chem Ltd (-3.02%)

KRX: 006400 - Samsung SDI Co Ltd (-6.07%)

KRX: 096770 - SK Innovation Co Ltd (-6.42%)

Cheers!

jhm

Well-Known Member

What part of "We're building 3 TWh in 2030 at less than half the cost $/kWh using 69% less capital" does Wall St not understand?To help put yesterday's bear attack on TSLA in perspective, I found this article from Feb 2014: Tesla's Gigafactory: The next step in Musk's domination of the battery-powered world - ExtremeTech

But, Mr. Market didn't like it. The article quotes Merrill Lynch’s John Lovallo: “Gigafactory investment will translate to even more capital intensity and add further pressure to margins and returns.”

And today we have Morgan Stanley worried about Tesla needing to spend about $50 Billion. They don't realize that's only $5 Billion per year (about a day's volatility, lol; or an easy cap raise as was just done), but mostly they don't realize this is what Tesla needs to be the #1 volume automaker in the world. They don't really realize that expensive as this is, it's 69% less capex than anyone else in the world will need to do to scale their EV production up.

TSLA should go down if Tesla wasn't planning like this. Mr. Market was stupid yesterday. It's further evidence of the old adage:

Those who can, do.

Those who can't, teach.

Those who can't teach become Wall St. Analysts.

BTW, kudos to the article's author, Bill Howard, who said in 2014: That still leaves room for a Tesla Terafactory in the future.

Rumor is the man that was interviewed lived long enough and picked up his Y this week!

Local Tesla fans get a close look at Model 3 | wfaa.com

Local Tesla fans get a close look at Model 3 | wfaa.com

What part of "We're building 3 TWh in 2030 at less than half the cost $/kWh using 69% less capital" does Wall St not understand?

Just curious, did Tesla execute on the predictions made in that article? I.e. how close did they come to what they said they were going to do? Did we hit 20X on EVs between 2020 (predicted) and 2014? 50X on batteries?

My gut tells me yes, but I don't know where to look this up, besides a generic google search.

The specific 2020 target numbers in the article (from which the factors were calculated based on 2013 results) are: 35GWh cell production, 50GWh pack production and 500k cars to be sold in 2020. I believe they are pretty much on track for these numbers this year.

jhm

Well-Known Member

Are you claiming that VW's accountants failed to impair tooling specific to ICE manufacturing?Though, to what extent is that really true? When VW had unwanted ICE vehicle factories, they didn't "strand" them or write them off, but instead converted them to EV factories. I assume even ICE engine factories could be converted to manufacture something EV-related. It's not clear to me that the investment in converting an old ICE factory is any greater than creating a new factory from scratch like Tesla does, so I'm not sure how much credit to give this "locked-up capital/stranded assets" argument. (Outside of oil, where you really can't convert underground reserves to solar panels no matter what you invest.)

corduroy

Active Member

What a bunch of crap: The Stock Market Has a Tesla Problem

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K