⚡️ELECTROMAN⚡️

Village Idiot

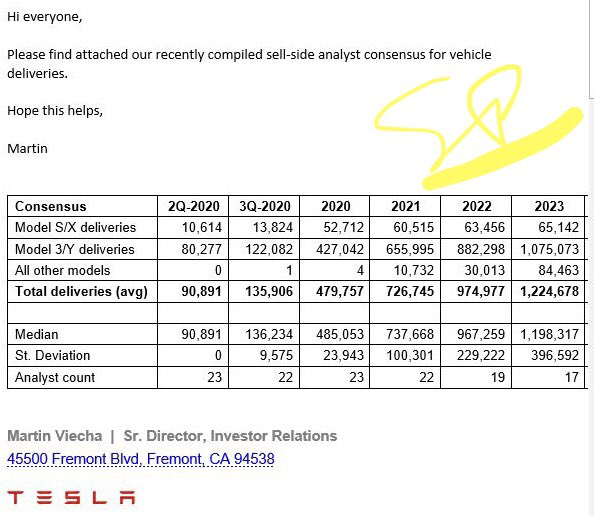

Yes I bought a few, but mine are up only 18% and I don't know what a good strategy is. These are the first options I have ever bought.Did anyone buy 500 calls expiring oct 30? Mine are up 40%...thinking of selling, but also want to gamble for good delivery #s for tomorrow. Thoughts?!