There's still a pretty massive difference between Troy's educated guesses/extrapolations, and the random non-sense you see from "analysts" that are paid to come up with the correct number, and trade on it.Not sure why you would take Troy's estimate of 2021 as anything other than a wild guess. He has literally no insight that far out from his data gathering method and has no information that we don't have when it comes to Tesla's production ramp for Giga Berlin and Austin, as well as Giga 3 Phase 2. He has no knowledge of any upcoming price drops(which I do think will happen as MIC Model Y and then Berlin Model Y being production).

In fact as I'm writing this and thinking out loud, there's really no purpose to Troy putting out a 2021 estimate, zero. I'm surprised anyone here would actually view his 2021 estimate and have it affect/alter their own opinion or view. It's just a wild guess

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StarFoxisDown!

Well-Known Member

There's still a pretty massive difference between Troy's educated guesses/extrapolations, and the random non-sense you see from "analysts" that are paid to come up with the correct number, and trade on it.

For sure, Troy's estimate is still higher than most analysts by quite a margin. I'm just a bit surprised by those taking this estimate to heart and lowering their expectations(not just here, on other platforms like twitter and FB groups too). All of us here are pretty will informed and while Troy's estimate is more accurate than what analysts are currently projecting, it's still very much below what the production capacity Tesla themselves have stated they're going to be at.

willow_hiller

Well-Known Member

I'm glad we're up slightly after hours. It means the news reading algo-bots have gotten a bit more intelligent with Tesla FUD.

"Model Y Recall" being plastered all over Reddit... Turns out that with the Tow Package enabled, the brake lights weren't working correctly. Tesla started fixing the issue a month ago OTA, but also filed with the NHTSA because it involved safety lights.

"Recall" just doesn't seem like the right word when owners can have the issue fixed without ever realizing it.

Tesla Model Y recalled for wonky trailer brake lights - Roadshow

"Model Y Recall" being plastered all over Reddit... Turns out that with the Tow Package enabled, the brake lights weren't working correctly. Tesla started fixing the issue a month ago OTA, but also filed with the NHTSA because it involved safety lights.

"Recall" just doesn't seem like the right word when owners can have the issue fixed without ever realizing it.

Tesla Model Y recalled for wonky trailer brake lights - Roadshow

Mo City

Active Member

I'll eat my hat if Austin produces <10K CTs in 2021.And OMG please faster with the Cybertruck!

Reductionist

Member

Does anyone know TeslaRay@Raymathd? He has some interesting tweets about FSD:

View attachment 600276

View attachment 600277

Never heard of him before. In any case, there's almost nothing we can deduct from these tweets wrt the capability of the rewrite, even if this is genuine. I would recommend waiting a day or two for youtube videos to show up. Then we can judge for ourselves how good the new software is.

Ultimate flex if Tesla picked people with actual good record of driving based on the data they collected including those who looked straight while EAP is on or not.Does anyone know TeslaRay@Raymathd? He has some interesting tweets about FSD:

View attachment 600276

View attachment 600277

bkp_duke

Well-Known Member

I'll eat my hat if Austin produces <10K CTs in 2021.

Quoted for posterity.

If they do produce more than 10k, we want to see this on video please.

kengchang

Active Member

Quoted for posterity.

If they do produce more than 10k, we want to see this on video please.

He's saying if Tesla makes less than 10K CT..

Mo City

Active Member

What bugs me the most about Troy-2021 are the numbers for Fremont. His are over 150K below capacity. Unlike Berlin and Austin, Fremont for 2021 should not be a wild guess.For sure, Troy's estimate is still higher than most analysts by quite a margin. I'm just a bit surprised by those taking this estimate to heart and lowering their expectations(not just here, on other platforms like twitter and FB groups too). All of us here are pretty will informed and while Troy's estimate is more accurate than what analysts are currently projecting, it's still very much below what the production capacity Tesla themselves have stated they're going to be at.

I assume he has a rationale.

bkp_duke

Well-Known Member

He's saying if Tesla makes less than 10K CT..

Drat, I was looking forward to that video . . .

StarFoxisDown!

Well-Known Member

What bugs me the most about Troy-2021 are the numbers for Fremont. His are over 150K below capacity. Unlike Berlin and Austin, Fremont for 2021 should not be a wild guess.

I assume he has a rationale.

Right, that's where I have an issue with this estimate. Troy is effectively saying Tesla won't have enough demand to keep Fremont running at max capacity when Giga China and Giga Berlin come online. I think that's a fundamentally flawed logic.....mainly because I see Tesla dropping the price of the Model 3 and Y in the US once they achieve cost reductions through the start of/ramp up of local production at China/Berlin and will spread those cost savings with price drops across many territories, which will as Tesla has shown, open up Tesla vehicles to new consumer thresholds that are exponentially bigger with each price threshold Tesla breaks through.

bkp_duke

Well-Known Member

Right, that's where I have an issue with this estimate. Troy is effectively saying Tesla won't have enough demand to keep Fremont running at max capacity when Giga China and Giga Berlin come online. I think that's a fundamentally flawed logic.....mainly because I see Tesla dropping the price of the Model 3 and Y in the US once they achieve cost reductions through the start of/ramp up of local production at China/Berlin and will spread those cost savings with price drops across many territories, which will as Tesla has shown, open up Tesla vehicles to new consumer thresholds that are exponentially bigger with each price threshold Tesla breaks through.

It's all complete guesswork, but I believe that looking through these "estimates" through the demand lens is the wrong way to go about this.

Tesla is most likely to still remain battery supply constrained in 2021, and a 60% increase in production given that constraint is probably optimistic, not pessimistic.

StarFoxisDown!

Well-Known Member

It's all complete guesswork, but I believe that looking through these "estimates" through the demand lens is the wrong way to go about this.

Tesla is most likely to still remain battery supply constrained in 2021, and a 60% increase in production given that constraint is probably optimistic, not pessimistic.

Idk, I don't think Tesla is battery supply constrained to hit 1 million in 2021. We'll see on Wednesday. If they continue to guide to 500k for 2020, that means they have the battery supply to make 180k vehicles right now, this quarter. If they can hit that, they'll have enough battery supply to go from 180k to an average of 250k for each quarter in 2021.....which of course is an average. I see them starting 2021 at 200k vehicles forQ1 and ending somewhere around 300-325k during Q4 2021.

Artful Dodger

"Neko no me"

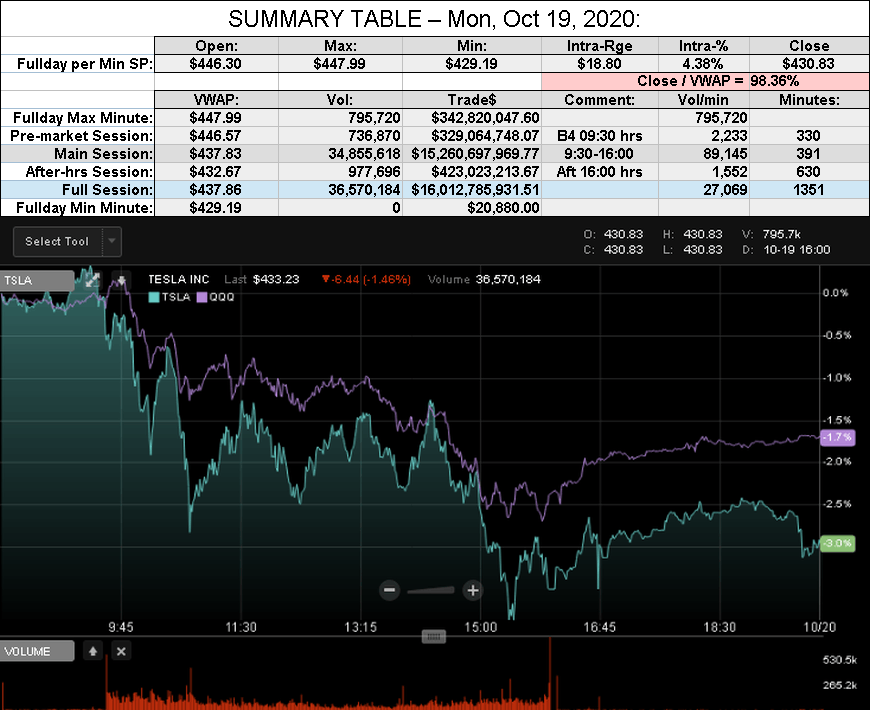

After-action Report: Mon, Oct 19, 2020: (Full-Day's Trading)

Headline: "Slow Fade on Macro Uncertainty"

CEO Comp. Status:

TSLA 1-mth Moving Avg Market Cap: $399.66

TSLA 6-mth Moving Avg Market Cap: $270.04

Nota Bene: 4th tranche of CEO comp. likely unlocked Oct 06-07

'Short' Report:

Comment: "TSLA capped at previous Close; fades over last hour"

View all Lodger's After-Action Reports

Cheers!

Headline: "Slow Fade on Macro Uncertainty"

Traded: $16,012,785,931.51 ($16.01B)

Volume: 36,570,184

VWAP: $437.86

Close: $430.83 / VWAP: 98.15%

TSLA closed BELOW today's Avg SP

Mkt Cap: TSLA / TM $401.451B / $181.454B = 221.24%

Volume: 36,570,184

VWAP: $437.86

Close: $430.83 / VWAP: 98.15%

TSLA closed BELOW today's Avg SP

Mkt Cap: TSLA / TM $401.451B / $181.454B = 221.24%

CEO Comp. Status:

TSLA 1-mth Moving Avg Market Cap: $399.66

TSLA 6-mth Moving Avg Market Cap: $270.04

Nota Bene: 4th tranche of CEO comp. likely unlocked Oct 06-07

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 51.9% (51st Percentile rank FINRA Reporting)

FINRA Short/Total Volume = 37.1% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.28% of Short Volume (43rd Percentile Rank)

FINRA Short/Total Volume = 37.1% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.28% of Short Volume (43rd Percentile Rank)

Comment: "TSLA capped at previous Close; fades over last hour"

View all Lodger's After-Action Reports

Cheers!

Thanks @FrankSG!

> The 50x EBIT multiple is simply something I've used, usually to look at options

SP @50x EBIT is a/the key factor in evaluating if it's right time to buy options?

You can read My TSLA Investment Strategy for more details, but it's a valuation I've been comfortable 'betting' on with options for a year or so. Obviously TSLA is valued much higher right now by the market.

I might be going on a tangent here, but related to the topic of the expected SP trajectory (barring S&P factor), do you see IV (on LEAPS) coming down even further from here, considering the current IV is high historically speaking?

I'm not sure about IV. Presumably if the stock remains less volatile for longer, that will impact options IV, but there should be a number of other factors impacting IV. I don't really make predictions on where IV will go.

StarFoxisDown!

Well-Known Member

Here's Troy's main flaw, at least in my opinion, when it comes to his estimate. In a couple tweets he clarifies why his estimate is low:

https://twitter.com/TroyTeslike/status/1318340018386182149

He's essentially saying that you can't take Q4 production/delivery rates and apply it to the whole year because of seasonality. The flaw with this is Tesla doesn't really observe seasonality and Troy's being duped because of the history over the past 2 years which was

Beginning of 2019 - Delivery logistics nightmare and affects of the tax credit expiring. Remember throughout 2019 Tesla was continually wanting to get to higher production rates but was dealing with Panasonic constantly not expanding at the same rate as Tesla.

Beginning of 2020 - Tesla was unable to deliver the cars it planned on delivering because of Covid. Tesla even said they were on track to have an all time high quarter.....not just all time high Q1, but all time high of any quarter before Covid started shutting things down. Both Q1 and Q2 2020 would have beaten Q4 2019 had Covid not been a thing.

Seasonality exists, but Tesla has enough demand to not see any impact from it like other auto makers....that are working within a addressable market that has fully matured.

https://twitter.com/TroyTeslike/status/1318340018386182149

He's essentially saying that you can't take Q4 production/delivery rates and apply it to the whole year because of seasonality. The flaw with this is Tesla doesn't really observe seasonality and Troy's being duped because of the history over the past 2 years which was

Beginning of 2019 - Delivery logistics nightmare and affects of the tax credit expiring. Remember throughout 2019 Tesla was continually wanting to get to higher production rates but was dealing with Panasonic constantly not expanding at the same rate as Tesla.

Beginning of 2020 - Tesla was unable to deliver the cars it planned on delivering because of Covid. Tesla even said they were on track to have an all time high quarter.....not just all time high Q1, but all time high of any quarter before Covid started shutting things down. Both Q1 and Q2 2020 would have beaten Q4 2019 had Covid not been a thing.

Seasonality exists, but Tesla has enough demand to not see any impact from it like other auto makers....that are working within a addressable market that has fully matured.

Don't recommend hat eating.I'll eat my hat if Austin produces <10K CTs in 2021.

I tried Lodger's...yuck!

gabeincal

Active Member

Well there's one aspect seasonality to Tesla and that is they build inventory in Q1 and sell more than they produce in Q4. This has been pretty consistent.Here's Troy's main flaw, at least in my opinion, when it comes to his estimate. In a couple tweets he clarifies why his estimate is low:

https://twitter.com/TroyTeslike/status/1318340018386182149

He's essentially saying that you can't take Q4 production/delivery rates and apply it to the whole year because of seasonality. The flaw with this is Tesla doesn't really observe seasonality and Troy's being duped because of the history over the past 2 years which was

Beginning of 2019 - Delivery logistics nightmare and affects of the tax credit expiring. Remember throughout 2019 Tesla was continually wanting to get to higher production rates but was dealing with Panasonic constantly not expanding at the same rate as Tesla.

Beginning of 2020 - Tesla was unable to deliver the cars it planned on delivering because of Covid. Tesla even said they were on track to have an all time high quarter.....not just all time high Q1, but all time high of any quarter before Covid started shutting things down. Both Q1 and Q2 2020 would have beaten Q4 2019 had Covid not been a thing.

Seasonality exists, but Tesla has enough demand to not see any impact from it like other auto makers....that are working within a addressable market that has fully matured.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M