Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

I finally figured out why your charts bug me. You always show the percentages relative to the opening price of TSLA, but this completely ignores any gap up or down overnight... which was about 5% last night.

NASDAQ sets the zero point for the day equal to the 08:00:00 AM share price, then percentages are calculated and displayed from that point for comparison(s) to other Indices (or other equities).

You'll find that this is the way HF tradering systems (like hedge funds) are setup as well. It's quite common to see TSLA driven down suddenly at the day, only to miraculously halt it's slide as soon as the SP % change touches one of these Index lines. It's goal-seeking selling by the algorithms, but they have to know when to stop. If they set their 'zero' point to the Opening SP at 09:30 you'd see very different results.

This is the way they programmed the computers that do 90+% of the Trading on Wall St, which makes it an important metric.

This chart updates about once per min during the Pre-Market (08:00 - 09:30 ET) but has a 15-min delay during regular Market hours. The chart is near realtime again from about 4:17 pm until 8:02 pm.

Tesla, Inc. Common Stock (TSLA) Real-Time Stock Quote - NASDAQ.com

If you want to see the overnight jumps, simply select "5D" (5-day view) from the row of btns on the bottom of the Chart:

Cheers!

Last edited:

TravelFree

Active Member

Reuters - this morning: Ford’s new CEO tackles warranty costs in bid to boost profit

What is barely mentioned is that the long established automakers must pay their franchised dealerships to make warranty repairs. I once had my car recalled to have an 80-cent part replaced in two minutes. I asked the service writer how much the dealership would charge General Motors. He answered, "About $200."

Tesla circumvents this by owning its sales and service centers. And unlike its competitors, it makes many of its own parts.

While the other car companies do have to reimburse Dealers for warranty work, Tesla still has a cost of maintaining their own service centers too. They do avoid duplication of certain jobs other car dealers have such as additional administration, but facilities costs and most of the employees costs are similar. One of the biggest advantages that Tesla has in their business model is they don't spend on advertising like others. They do have a budget for marketing but it is tiny compared to what others budget for marketing.

As Tesla has more cars on the road their number of service centers will need to increase as the turn around time gets longer and longer. I got a tour of my local Tesla center and a couple of things impressed me in a negative way- The parts inventory was tiny. They said they have to order in parts which is a delay that dealers like Ford and Toyota don't have. The delays at Tesla can run 10 times what other dealers have. 2 years ago there were an average of 6 Teslas in the parking lot every day waiting on parts for repair with service tickets hanging on the mirrors. Today, the waiting lot is packed with 4 times as many. Most other dealers here have a huge warehouse of parts plus there are 4 to 5 dealers in the area that can supply with a runner van to move parts throughout the day. One day soon Tesla will need to increase it's service centers and the capability of each one to handle the load.

I once owned a Ford Escape and it was being called in for a recall almost monthly. Most were small and non-emergency. My Leaf has had two major warranty repairs. The forward camera failed and a battery cell shorted. Total wait time was 11 days and they gave us a loaner. I wonder how long a similar repair would take at the Tesla SC. I have a friend who bought a Model Y that arrived in June and it had serious body issues he wanted corrected. I think it was mid July before some of the parts came in. Then his car was in the shop for a month and he was talked into compromise that they fixed it as best they could.

I wasn't saying not to "lever up" with options - I was trying to point out the fallacy of using the excuse that it's one of the only ways to "generate cash". That is a mental mind twist that has no place in investing.

Ah yes, a voice of reason. Thank you

Mo City

Active Member

Let's hope the momentum keeps going but we know from history the Frankfurt market has little or no effect on what happens here later in the morning. High-volume pre-market trading starts at (I think) -90 mins. This is when we first get our first real clue of what the open might be like.Well, it's already over $570 US in Germany, that's kinda what I'm basing it on. Definitely didn't expect it so soon, but in this universe anything can happen... and probably will.

I'll go away now, get my 5 hours and check back ~7am CST

By holding a non-dividend bearing stock long-term, there is NO opportunity to realize cash in the short-term. You would have to sell some.

There is always a time and a place for withdrawing cash from your investment portfolio. But you are fooling yourself if you think it's somehow better to take profits from options trades than from other investments. It's all just cash gains (although tax considerations could play into it).

Let me ask you this: When you hold options that expire worthless do you immediately calculate the loss and make a cash deposit to reimburse your brokerage account? The real question here is not by which method the gains were made but whether you really want to withdraw money from your investment account. Don't get me wrong, I've been withdrawing all the money we live on plus large purchases and real estate acquisitions for over 25 years without ever adding to it (and yet it continues to grow) but it doesn't matter whether the withdrawals come from interest, options trades or stock. It's just cash. The net effect, and the largest consideration, is it reduces our investible capital and the compound returns we get with that capital.

Before you say, "wait a minute, I'm talking about making income by writing covered calls", I'll point out that you are still risking the growth of your capital. There is a cost to everything, nothing is "free" in this world. And if you don't need that cash, then you don't need to risk the growth of your capital. It's easier to spend less than it is to fool yourself that you have devised a way to cash that doesn't risk your overall returns.

I read your reply quite a few times trying to understand how it could apply to me.

I have not taken out a nickel from my investments nor put a nickel in for probably five years. They live in their own ecosystem. I don’t need much personal cash.

At one point I sold a little TSLA because I wanted to generate cash through TSLA options. They were a made-in-heaven opportunity when there was so much TSLA FUD.

I continue with that plan to a lesser extent after re-buying the TSLA. Cash is useful for opportunities if they arise.

My TSLA is long-term. It is a wonderful store of wealth. I see it as a positive force in the world, both by its products and it’s philosophy.

You have got me thinking though, about finding convenient alternatives to fiat and the market in general, except for TSLA

FS_FRA

Member

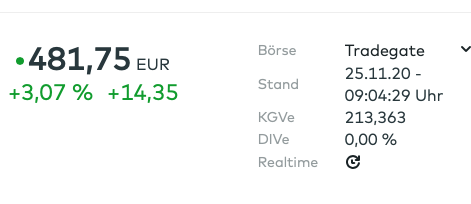

Nice open in Frankfurt for TL.0 Equal to $572

TravelFree

Active Member

Thanks! Saved me the trouble of looking. I just bumped my limit order on a few shares to sell to $650. I didn't think it would run up this much this fast. I'll keep a close watch and adjust again should it get there fast.Tesla trading at the equivalent of $572.56 early in the session at Berlin (TLO)

For those who think it's blasphemy to sell Tesla ever, I grew my position with trading around a growing core position safely. Not as dangerous as options and faster growth than buy and hold. If you disagree with that then you probably don't understand how it works.

FS_FRA

Member

I have a few shares that are short of a 100 lot, and I've set a ladder of sale points at $700, $750 and $800 for those. If we do rocket to these levels I'll pocket the cash, wait for a drop back to the $500s and rebuy TSLA.

I do expect the drop after the inclusion event is over and all the short timers are cashing in to pay for expensive Xmas gifts.

If we don't go to these levels, fine. If we do and the SP doesn't come back, I'll probably put the cash into some LEAPS (never tried that).

I do expect the drop after the inclusion event is over and all the short timers are cashing in to pay for expensive Xmas gifts.

If we don't go to these levels, fine. If we do and the SP doesn't come back, I'll probably put the cash into some LEAPS (never tried that).

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

If you disagree with that then you probably don't understand how it works.

So basically you're saying you buy when the price is lower, then sell as the price has gone up, then buy back when the price is lower again? Rinse, repeat, and voila you make more money than just buying and holding? Interesting concept, now if you could just give me a heads up every time the price is about to go down and then again in advance every time the price is going to go up, that'd be greatly appreciated. Thanks.

cyclingthealps

Member

I am still here, not posting much but grateful for all the valuable content provided here. Once more, thank you all.

My current status is that my portfolio is nearing €100.000 which is unbelievable because at the beginning of 2018 my portfolio was €6000-€10000.

My current status is that my portfolio is nearing €100.000 which is unbelievable because at the beginning of 2018 my portfolio was €6000-€10000.

I thought the peak will be before the last day of index buying. I am expecting the FOMO on the sell side, those who bought to sell at a profit, perhaps some long term holders who want to take "some" cash out.

Mind sharing your thoughts on why peak likely won't be well before last day?

I think the buying pressure will significantly outpace any selling from retail and other big funds. Just based on the volumes we are seeing I think the supply is just not there to fully satisfy the 125 million shares that need to be bought by index funds and addition shares needed by benchmark funds.

I also think from a short term gains perspective retail investors will likely not want to sell. Of course this is assuming a lot of them got into TSLA this year.

It might not be the last day of inclusion per se but close enough.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

I think the buying pressure will significantly outpace any selling from retail and other big funds. Just based on the volumes we are seeing I think the supply is just not there to fully satisfy the 125 million shares that need to be bought by index funds and addition shares needed by benchmark funds.

Indeed. I think we need to keep in mind that for all of it existence TSLA has been 1) heavily shorted and 2) heavily traded through derivatives (options). Now with the SP500 inclusion for all these funds, for which it is mandatory to own TSLA, it's not enough for them to create an "artificial" long position through buying calls/LEAPS or through selling puts - they need to actually buy and hold on the the actual underlying equity i.e. the actual stock. And those actual stock my friends are in short supply. In fact, it is not easy to get a good picture of what the true float is (and this is somewhat a moving target seeing as you'd have to assume that some investors who wouldn't dream of selling at $500 would still sell if we gap up to $1000 overnight) and it is unclear still what the actual short interest is if you take in to account all the ways in which you can create deririvative/artificial short positions with the use of different options strategies.

One more aspect to keep in mind is that forthe index funds their TSLA position is measured in % of value, not number of stock. So any sharp increase in price (squeeze dynamics) would be counter balanced by these funds automatically selling off TSLA to rebalance their position.

UkNorthampton

TSLA - 12+ startups in 1

I just don’t see us going to the 400 level even after the inclusion. This is not a VW type of squeeze. If anything the 15-20% of float(more actually) that will now be bought by index/benchmark funds which should decrease supply. I can see the shorts completely ignoring this dynamic and dig another hole but regardless I do think we establish a new base, maybe 600 or 700 but not lower than that.

I’m going to wait until the very last day of index buying to sell any covered calls and that too only if IV > 100.

Something I've wondered, don't the S&P500 Indexers lend out shares to shorts? I could see it as a way to get income when fees must be kept low to be competitive. Genuinely don't know, and I'd prefer if indexed shares are locked away.

Runarbt

Active Member

Something I've wondered, don't the S&P500 Indexers lend out shares to shorts? I could see it as a way to get income when fees must be kept low to be competitive. Genuinely don't know, and I'd prefer if indexed shares are locked away.

I think I read that they couldnt do this?

For example Vanguard has many different funds holding S&P500 equities, pure index funds, partly active funds, target date funds etc. They all rebalance at slightly different times. I think I read years ago they do rebalance internally between funds to minimize trading in the open market as much as possible..

UkNorthampton

TSLA - 12+ startups in 1

Lovely. Thanks.

The text is great too, this is just a bit, but when you read the rest... Tesla are so good, the clarity. No Pointy Haired Bosses allowed here. If I was young (and competent in whatever they need), I'd be aiming to get to Tesla. I've never had an emotional response to something like this. I'm an idiot, a fanboy, hopeful and I love it.

"Tera is the New Giga

To achieve the transition to sustainable energy, we must produce more affordable EVs and energy storage, while building factories faster and with far less investment. The key to this is terawatt-scale battery production and far more affordable battery cells.

At Tesla, we build cars and factories from the ground up. Now we do the same for batteries. Join us to solve the next generation of materials, mechanical and charging challenges ahead—all from one vertically integrated team."

...

"Build the next electrode and cell machines in our Terafactories. Design and implement the best high-speed, continuous-motion, precision-manufacturing equipment in the world in a tight-feedback loop with product and manufacturing teams."

Tslynk67

Well-Known Member

I'm going to start posting periodic "keep it rational people" comments before we get too crazy.

It's super likely that further appreciation is coming, but that doesn't mean traders and MM's won't let the SP run up a bit then sell calls and short the stock before inclusion. These people don't care about Tesla as much as we think, most of them don't care at all. They simply want to make money.

This ultra-transparent opportunity based on what amounts to mandatory buying in a very well defined window is open for ALL MARKET PARTICIPANTS to leverage. These guys will take those 32 days to maximize their profits in whatever manner works. Logically that means there will be some pretty big swings both up and down.

None of us should be surprised to be sitting right at $520(or lower) on December 16th when the theoretical buying window opens. No one is selling.....but who exactly is going to be buying at $570 next week? We could be ripe yet again for manipulation with the goal of taking weekly call buyer's premiums. My guess is more like $650 on Dec 16th, but you get the point.

There's an idea - why don't the manips just sell naked short shares to the indexes, then Tesla could invoke their joker-split card and we can infinity squeeze the banks/hedge-funds, the S&P will get bigly %age gain and we can start squabbling about which planet to buy...

Tslynk67

Well-Known Member

This might actually work. I found a free GIF app to put together the last four IO charts.

Looks like Puts are more numerous than Calls at the $500 strike as of close yesterday. There are not many Puts selling above that tho which is odd? All we get is a few $520s? Definitely seems like a push down is coming. We shall see tomorrow. Maybe with the jump today THEY are going to throw in the towel. Looks like $550 was going to be a line in the sand. THEY might not get their way this week.

View attachment 611552

Well, an impressive pre-market walk down to start proceedings - was $575 in Frankfurt earlier...

I still don't get why THEY wouldn't just delta-hedge every call bought from this moment. Hell, the two big players, Citadel and the other one I can remember, have gazillions of shares already. Let it side, guys!

Green Pete

Active Member

Well, an impressive pre-market walk down to start proceedings - was $575 in Frankfurt earlier...

I still don't get why THEY wouldn't just delta-hedge every call bought from this moment. Hell, the two big players, Citadel and the other one I can remember, have gazillions of shares already. Let it side, guys!

Looks more likely related to macros cooling off.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M