People are betting on an inclusion spike and then drop?Why is my 1224C800 up 8% while all of my Jan and later calls are down?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

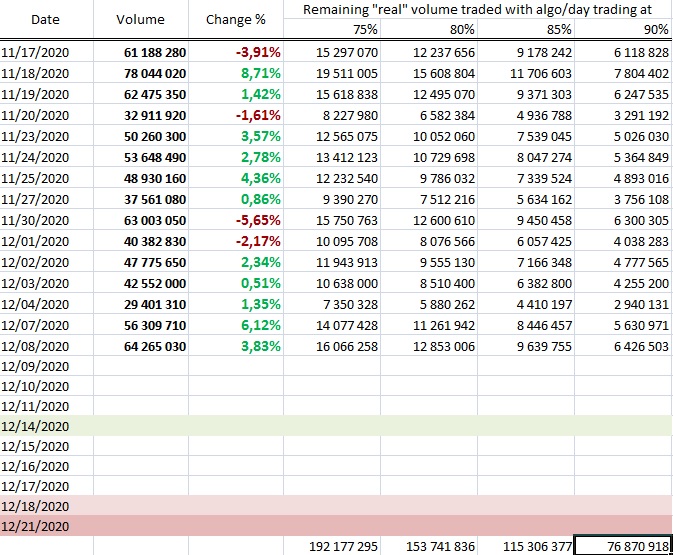

I'm trying to come up with an estimate of how much volume really traded hands since the announcement to see how much of it could have been front run already.

Would be really useful if someone had insight into Open Interest and its change over time (especially) so I could add how much of it is due to delta hedging. @generalenthu maybe?

What I have so far is just a simple excel spreadsheet with different estimates of the "real" volume according to an assumption of the portion of algo/high-frequency/day trading (haven't found any real solid numbers, just a few articles and peoples estmiates)

Would be really useful if someone had insight into Open Interest and its change over time (especially) so I could add how much of it is due to delta hedging. @generalenthu maybe?

What I have so far is just a simple excel spreadsheet with different estimates of the "real" volume according to an assumption of the portion of algo/high-frequency/day trading (haven't found any real solid numbers, just a few articles and peoples estmiates)

Exactly what happened with me, but I sold only 1/3 so far and dropped it into TSLA. The 2/3 that is on the table with QS is now house money. I do think QS is overvalued at 70, but unsure where this mania will take it. I will remaining half at 100. I just think TSLA is still the safest place to put money, I am just worried about having it all in one place. Primary reason for my getting into QS was JB as well. That can get a little dangerous, as it becomes valuable for him to lend his name, and he could be tempted by something more NKLA like.Rode QuantumScape from $23 -> $70. Took all that and grabbed 163 TSLA @ $640.

Edit: I love this thread because we have so many people paying attention to the whole competitive space. This is where I learned of QS doing their SPAC right when they announced it, and of course was confident enough to buy some shares due to JB's involvement.

StealthP3D

Well-Known Member

Is the driving layer traditionally coded or ML? We don't know. Would it make sense to have to 2 different ML-layers, one for world-view generation, and one for driving? Maybe it is legacy stuff, because the old driving software (and maybe still is) was traditionally coded.

I believe the steering behavior is far too natural on a curvy road to be traditionally coded. I'm basing this on my usage on highways with irregular curves. My best guess is, at a minimum, they used machine learning to develop some very elegant algorithms that represent the steering inputs under various parameters. I can't imagine the difficulty of coding this manually without machine learning. It's eerie how human-like it steers most of the time. It's clear to me that it's continually looking into the turn for guidance, not just following the lines as shown on the side cameras.

Being someone who appreciates skilled driving to bring more comfort on curvy roads at higher speeds, I do wish it would turn in closer to the apex on tight turns. I imagine it's not tuned to do that because it risks reducing the sightlines to the inside of the corner on extended tight turns. But, if I know how Musk and team think, this is not core to the task of commercializing FSD. It's already very good. Even though I don't have the beta re-write code, the Autopilot under these conditions exhibits a distinctly human "personality". And from what I've seen on Youtube videos of beta FSD, the "personality" is even more apparent and manifests in more obvious ways. It's almost "cute" the way it drives and tries to protect you.

I've known for a long time that FSD was not "if" but "when". But, I actually had a little doubt whether the prize for being first would go to Tesla or another effort even though Tesla had the advantage of vastly more data. Recent observations tell me it's time to realize it's almost upon us and Tesla has pulled even further ahead.

Boys and girls, we have hooked a whopper!

I think the timestamp gives it away. Can't have 2 large trades go thru the same second.

Also it looks like a roll to me. Some is rolling their 600 calls to 660 calls for the same $ amount

Woow, you are good at this!

How do these people get $62M worth of options through all in 1 trade? I think the maximum IBKR allows me to do in 1 trade is 500 contracts, and even if I could do more, I don't see how you could jam through $62M worth before options MMs significantly increase their ask.

Bullish imo. Makes it crystal clear that buying by funds benchmarked to this index will be no joke.

bkp_duke

Well-Known Member

What, is your couch located in a brothel?

Whistles.

Almost forgot they love that 'fraudulentJp Morgan's famous last words, sell Tsla and buy Nikola.

I think we need an opposite Jp Morgan Etf.

Woow, you are good at this!

How do these people get $62M worth of options through all in 1 trade? I think the maximum IBKR allows me to do in 1 trade is 500 contracts, and even if I could do more, I don't see how you could jam through $62M worth before options MMs significantly increase their ask.

In one of Dave lee's interviews with Emmet Peppers, Emmet talks about pushing through his trade by calling ibkr. He spoke with a trader who recommended he push it through in a single trade rather than spread over several orders so MM don't catch on and try to adjust the price against him. Think Emmet's order was only around 3,000+ though

StealthP3D

Well-Known Member

"From today's point of view, we will not produce battery cells for our series vehicles ourselves because the technology is in flux here. It would not be the right time to enter battery cell production now"

Translation of BMW comments:

If we don't make batteries now, we never will. Because there is no better time to develop expertise in emerging technologies than the present. But that's OK, we got by all these years leaving petroleum refining to others.

That might even sound reasonable to some people. But here's what they are missing: ICE cars never came with a lifetime of gasoline. The batteries are part of the car (and the most valuable part at that).

Artful Dodger

"Neko no me"

Yes, and that 'drop' may turn out to be a 'drip', what with record 500K deliveries being announced the day we come back in January, then record profits for Q4 on the 4th Wed of January.People are betting on an inclusion spike and then drop?

Indeed, Tesla will almost certainly have to claim their $1.8B 'Valuation Allowance' as their Auditors declare it "more likely than not" that Tesla will be profitable going forward.

Did I mention the ~$600M FSD revenue reserve on track to be released in Q1 2021?

Drip, drip...

Cheers!

StealthP3D

Well-Known Member

In one of Dave lee's interviews with Emmet Peppers, Emmet talks about pushing through his trade by calling ibkr. He spoke with a trader who recommended he push it through in a single trade rather than spread over several orders so MM don't catch on and try to adjust the price against him. Think Emmet's order was only around 3,000+ though

That's just silly talk. With the kind of volume TSLA trades at you don't need to do anything special to avoid significant price distortions on a measly 3,000 share trade. Timing is everything, not some covert action to avoid changing the price by a penny.

Anyone who’s trying to call Blink.With Blink that will never happen. I continually watch Leaf owners having to phone Blink because of non-working equipment. Also they're only going to be charging at about 15 miles an hour. Who would spend an hour at Burger King--fifteen minutes maximum.

Woow, you are good at this!

How do these people get $62M worth of options through all in 1 trade? I think the maximum IBKR allows me to do in 1 trade is 500 contracts, and even if I could do more, I don't see how you could jam through $62M worth before options MMs significantly increase their ask.

How can I view the trade in options at the detail you are seeing it?

TheTalkingMule

Distributed Energy Enthusiast

My mom just called. Couldn't take the call.

She calls immediately again. I text that I'll call her in 5 mins.

She calls immediately again. I start to get worried and pick up.

"Hey, I'm reading this Wall Street Journal article with Elon. He says the share price is too high!" [facepalm]

I'm not sure it was worth:

A) The aggravation of spending 2010-2017 demanding that she invest.

B) Her progression into an absolute Tesla nut that's been happening ever since. If my 77 year old mother shows up here one day I'm selling all shares and logging out of the Tesla Universe.

She calls immediately again. I text that I'll call her in 5 mins.

She calls immediately again. I start to get worried and pick up.

"Hey, I'm reading this Wall Street Journal article with Elon. He says the share price is too high!" [facepalm]

I'm not sure it was worth:

A) The aggravation of spending 2010-2017 demanding that she invest.

B) Her progression into an absolute Tesla nut that's been happening ever since. If my 77 year old mother shows up here one day I'm selling all shares and logging out of the Tesla Universe.

In one of Dave lee's interviews with Emmet Peppers, Emmet talks about pushing through his trade by calling ibkr. He spoke with a trader who recommended he push it through in a single trade rather than spread over several orders so MM don't catch on and try to adjust the price against him. Think Emmet's order was only around 3,000+ though

It was a single contract, not a single trade. If I remember correctly it still took about an hour to execute.

That's just silly talk. With the kind of volume TSLA trades at you don't need to do anything special to avoid significant price distortions on a measly 3,000 share trade. Timing is everything, not some covert action to avoid changing the price by a penny.

That was for > 3,000 option contracts... Not shares.

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

Tidbit: for December (8) in the Netherlands Model 3 is merely at position 1 in both the all cars and BEV rankings with only twice as many cars delivered (1055) as the runner up.

Total cars sold so far is 6055, so an 20% overall market share in 2030 is within reach.

Norway as well.... https://twitter.com/carinalarsen76/status/1336719918251831296

For Cat lovers - a veritable Glaring of Teslas

For Berlin... A Rhumba of Rattlesnakes

I so dearly want to be able to say "but Norway" & Goron to have nowhere to cherry pick that's big enough to have its own army that isn't armed with Halberds or protected by a stolen Q Bomb.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K