Artful Dodger

"Neko no me"

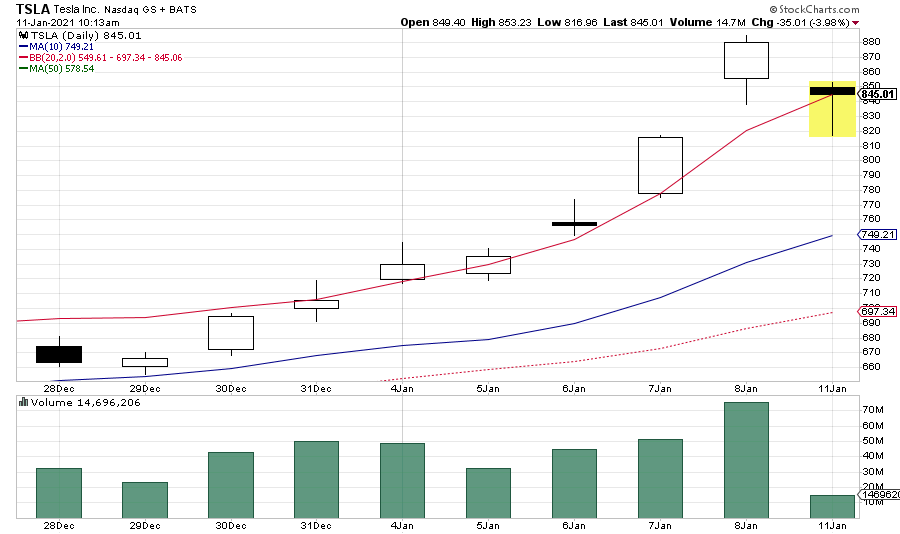

Hitting the Upper-BB just in the past few minutes triggered some small selling, which (so far) seems to have been eagerly gobbled up (sux2b shortz)

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

When will they never learn?Negative negative Will Robinson.

This kind of contradicts the news that the "Model 2" will be released in 2022 if they are just starting the entire design of the car. To make both reports true I would think they'd have to already have the sled design figured out and just need the body and interior styling figured out. That still seems like a pretty tight timeline considering lead time for stamping machines and other equipment for the line. But Tesla seems to have this whole 'building the machine that builds the machine' thing down pretty well by now so I wouldn't bet against the target date.

This kind of contradicts the news that the "Model 2" will be released in 2022 if they are just starting the entire design of the car. To make both reports true I would think they'd have to already have the sled design figured out and just need the body and interior styling figured out. That still seems like a pretty tight timeline considering lead time for stamping machines and other equipment for the line. But Tesla seems to have this whole 'building the machine that builds the machine' thing down pretty well by now so I wouldn't bet against the target date.

Was this over the wrong-way car news?

Something I remember reading is that what you describe may be the case. If they intend to use M3 front and rear castings and shorten the wheelbase with a shorter battery section for a new car. Then, just add the body work, etc. for the new, improved model whatever.

This could result in a 2 door hatchback that shares M3/MY body panels back to the rear of the front doors. Just design new from there back and roll with it. Or, make it a 4 door with a smaller cargo/trunk area.

Math doesn't lie.

I regularly sell OTM covered calls, and I add to my share base by buying more shares with the premium. Even in the epic run-up that TSLA has had, I still have not had a single share called away. If the run up is that great and a call goes from OTM to ITM, then the future calls have gone up even more (has ALWAYS been the case), and I've rolled forward and gotten some more premium in the process.

Simply put - I have MORE shares of TSLA now than I would have possibly had with just a HODL strategy.

This kind of contradicts the news that the "Model 2" will be released in 2022 if they are just starting the entire design of the car. To make both reports true I would think they'd have to already have the sled design figured out and just need the body and interior styling figured out. That still seems like a pretty tight timeline considering lead time for stamping machines and other equipment for the line. But Tesla seems to have this whole 'building the machine that builds the machine' thing down pretty well by now so I wouldn't bet against the target date.

"Stamping Machines"?

Do we know how it will be made already?

That would probably still be too wide for non-us roads to be considered a small car.Something I remember reading is that what you describe may be the case. If they intend to use M3 front and rear castings and shorten the wheelbase with a shorter battery section for a new car. Then, just add the body work, etc. for the new, improved model whatever.

This could result in a 2 door hatchback that shares M3/MY body panels back to the rear of the front doors. Just design new from there back and roll with it. Or, make it a 4 door with a smaller cargo/trunk area.

good advice ... key here is that you have accumulated your target # of shares in the given equity ... i guess this approach would work for me with AAPL .. but IMO TSLA shares are long term and I hold them with a death gripFrom your POV losing shares on covered calls can be bad, but as I’m sure you’re aware may not be bad from another. If one were retired and needed to sell shares on which to live and had thousands of shares it seems there could be the following approaches:

1. Sell a small percentage of your shares regularly regardless of share price. I believe this is what @DaveT does?

2. Maintain a buffer of years of cash. Sell on highs (either all time highs or recent highs, or gut feeling highs) to replenish the buffer, so you’re not selling on prolonged downturns. IIRC this is what @StealthP3D did. When we 1st got into the 400’s post split, the pace of the stock rise felt so rapidthat it felt like a high, that he posted he was selling some, and I felt similarly and did the same (though I bought back some of those during battery day).

3. Sell covered calls at a price for which you’re more than willing to sell 100 shares anyway. You’re generating income and if the shares are called, that’s fine as well since you’re replenishing your cash buffer at stock price highs.

4. Sell calls on a regular basis, but buy back if you risk losing the shares. Then you’re betting you will win more than you’ll lose. I.e. being the house is usually wise.

What’s risky is selling calls at a price for which you would be unwilling to sell the shares because you think you’re smart enough that the shares won’t get called.

Sure, I'm making the assumption that it won't use stainless steel panels but I think that's a pretty good assumption. If you're referring to the single piece front and rear chassis I fully expect that to be used in order to meet production levels."Stamping Machines"?

Do we know how it will be made already?

You don't *lose* any shares.....you sell them at a price you deemed acceptable, no different than putting in a GTC limit sell except that you got paid to submit the order.