mickificki

Member

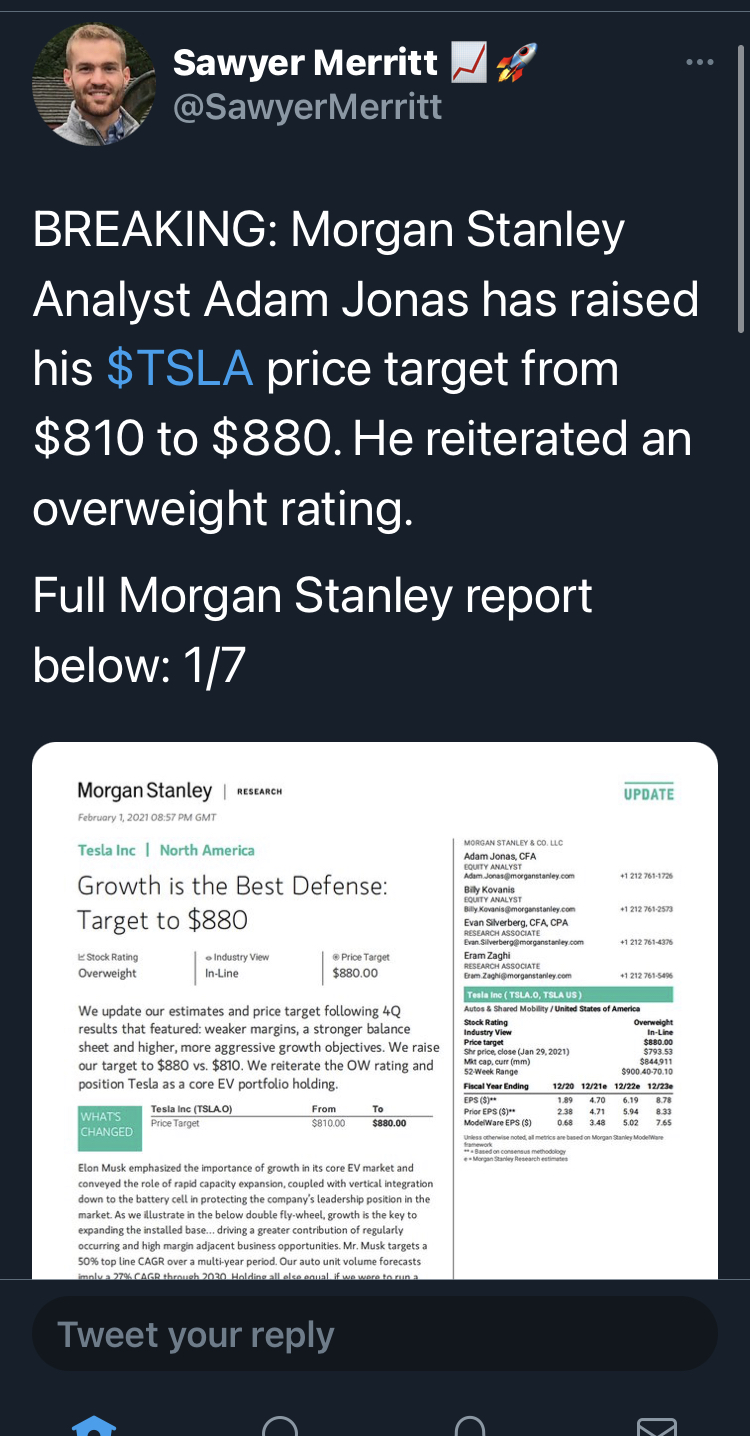

Adam Jonas raises tsla price target to $880 from $810. See link for details.

https://twitter.com/sawyermerritt/status/1356355124487217162?s=21

https://twitter.com/sawyermerritt/status/1356355124487217162?s=21

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

.You're saying that if I put the following in every post I can never be OT?

The sigh you make when reading my posts is what Tesla should use for the pedestrian-alert.

"We believe Tesla can leverage its cost leadership in EVs to aggressively expand its user base, over time generating a higher % of revenue from recurring/high-margin services revenue."

Bull Case: $1,272

Base Case: $880

Bear Case: $450

One of the best things that will happen when Berlin is chugging away is that this sort of nonsense will go away. FUD producers love to use Tesla managing supply in 3 regions with 2 factories as way to created nonsense.

I like everything about this post. The only thing I don't like is that I didn't think this nor post this myself.Here's my simple model for Tesla's Battery Master Plan v.3

View attachment 591857

- The pilot plant is a proof-of-function prototype with a single line @ 10GWh/yr

- Tesla needs to build 9 additional Bty lines per year, each with 10GWh/yr capacity

- This gets us to 100GWh capacity in 2022, and ~3,000 by about 2029

- Note: if 3rd parties are unwilling/unable Tesla can build out 20 TWh/yr in 12 yrs

Now we get to the unstated consequence of Battery Day: Tesla MUST build a tertiary layer of production to build the machines that equip the Bty Cell factories.

Tesla MUST add 9 new such Bty lines (per chart above) to achieve the arithmetic growth required by their stated goals.

It might be practical to build a single such Meta-Factory, but given the scale required (potentially ~180 lines over 12 years), I think its more practical to build THREE such Meta-Factories (one each in China, Germany, and USA).

Each of these MTBTMs (Machines-that-build-the-Machine) would each have to be sized to produce 60 bty lines over 12 years, or about 5 each per year.

Think of these MTBTMs as Grohmann clones, but specialized for battery cells.

Does anybody know where (and from whom) Coca-cola Bottlers buy there production equipment? That's the scale of manufacturing we are discussing right now.

Cheers!

Did you read the OP - we were talking about top-end German cars, not the Model 3 segment.

I'm only comparing my experience as well. As I said, the newer cars should be better, especially the MiC and pending MiG.

And I re-iterate that the *perception* of American-built car in the EU is that they're junk. It will take a lot to over-turn this. And no, I'm not equating fit-and-finish with luxury, but buyers of "top-end Audis, Mercs and BMWs" (hint - this was the original discussion) want that - fancy leather, polished wood, chrome, aluminium fittings, whatever. And they don't want it to creak and rattle as the car drives.

LOL, am I reading that right? Some guy came up to you and started telling you how the Ford is gonna be better than your car? Sounds like the stereotypical car salesman sociopath.I was at the car wash yesterday (getting some Tesla love). A guy from a Ford dealership started talking up Mach-E and how it was going to blow away the Model 3. I asked if they were available yet. He said “soon”, but by "special order" only.

I remember pics of a few thousand model 3 in china supposedly headed to europe. I wondered if we had any verification that they actually got sold. Doubt the european sales numbers (if they even break that data out) would indicate country of origin. Do they show european unsold inventory somewhere? I wondered about european acceptance of the chinese made cars. Even thought they seem to be better made than the fremont product.

PLL for me. We discuss other tech stocks here: What other tech stock to consider?A bit off topic here, but I was wondering which lithium stocks everyone here has looked into or is invested in?

And most of those are going to the EU.Hard to do when they are only going to produce like 50k?

Hmmm...covering himself so when it does reach $3k/share...he can say "I told you so'Adam Jonas raises tsla price target to $880 from $810. See link for details.

https://twitter.com/sawyermerritt/status/1356355124487217162?s=21

View attachment 633049

1. It will also reduce CoGs because there will be less wasteful outbound logistics;

2. It will also reduce SGA because the SGA system can be optimised for smoother deliveries;

3. It will also reduce inventories (i.e. fewer in avge transit), and thereby lead to a better accounts payable / accounts receivable ratio;

4. But it will mean fewer ships out of Fremont to pop some S/X on the back of, so they will have to go to part shipments to get them out there.

LOL. He was actually very complementary of my M3, and when the hand wash was done I let him sit inside and play around with the touch screen. He was a "car guy" so was just naturally into comparisons.LOL, am I reading that right? Some guy came up to you and started telling you how the Ford is gonna be better than your car? Sounds like the stereotypical car salesman sociopath.

FIFY. We're talking quality here.There is Mercedes-style luxury

View attachment 633063

and there is Tesla-style luxury:

View attachment 633065

And the same point can be made about quality. It's as much about perception as what buyers consider luxurious. Some appreciate perfect panel gaps inside and outside. For me, quality means that after 2 years ownership, the only maintenance I had was refill of wiper fluid. Instead of oil changes, I had about 50 OTA updates that made the car by leaps and bounds better than when I bought it. To me, luxury is that I can switch on AC remotely, or to always know the location of my car and (hopefully coming soon to EU) summoning it to pick me up.

Some people will never change their preferences but there are also many who experienced a Tesla in real life or simply from looking at youtube videos already did. And once they experienced the change of perspective, they won't go back to last century's definition of luxury - or quality.

Same as with other paradigm shifts, this starts slowly, almost unnoticeable until it's an unstoppable avalanche that nobody saw coming. Except some nerds at TMC maybe.