I am sure S had small castings from day 1. Are you not uncertain this is the large 1 piece one?I was just looking at the Model S on the Tesla website and it clearly shows that the current production has the rear casting.

View attachment 650932

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Your former company is doing fine:Go for it!

That's pretty much what I did last month. Gave ~30 days notice and walked away after 24 years of being the sole IT person for a small company. The daily grind was weighing on me. I've now gone two weeks without having to ask anyone, "Did you turn it off and back on again?"It is quite refreshing.

After doing loads of research I realized that even if I hadn't reached my retirement goal quite yet I could live off of cash from margin (plus Social Security) while preserving chairs and HODLing TSLA for another two to three years. This scheme allows for 10% higher spendable income than the job I left. It was a risk I was willing to take. In a couple of years things may be quite peachy.

Now, the toughest part of retirement is adjusting to life without the daily obligation of working at a job I no longer enjoyed.

I remember a few years ago they asked for tips for locations in Norway. So I guess they do this when they need some more ideas for locations.Is this new? Tesla solliciting locations for superchargers just like they did for destination charging: Host worden van een Supercharger | Tesla

Huh, I didn’t know that adapter shown at the beginning of the video was a thing. Tesla-to-J1772, I guess.The competition........

Last edited:

MartinAustin

Active Member

690 was the pre market opening quote. Anything less than 700 after that monster report is too good a deal to pass up. We are still a hair under 700 as I type this.first quote from premarket: $701. Falling slightly but stable ~690.

View attachment 651028

(10-sec-candle-chart right after open)

I think today will be good.

The thing that strikes me is that liquidity is low after index inclusion and this move may have legs with demand from option / leap hodlers coming in, in the coming days / weeks, and the gamma from all of that giving a bit more kick.

StealthP3D

Well-Known Member

The competition........

It's not clear how Mach-e owners are not openly revolting. How do they deal with the charging circus? That would drive me nuts!

I've never had an issue in either of our Model 3's, just plug in and go get a drink or something to eat. It's usually done before I am. Hopefully Ford fixes this quickly or there will be thousands of new EV owners who think travelling in an EV is a pain in the butt.

Na dann such dir doch halt nen vernünftigen BrokerYeah! Bunch of greedy hoarders! We in Deutschland are left out in the cold because of closed trading platforms. Disgusting!

Ich kann normal traden an der NASDAQ

(for non-natives: litte teasing that he has the wrong broker not allowing him to trade in the US

Todd Burch

14-Year Member

Did you catch also that the navigation doesn’t take elevation into account? At the top of a pass the nav said he would arrive with 2% left but arrived with 24%. Tesla’s route planner has always been within a few % for me.It's not clear how Mach-e owners are not openly revolting. How do they deal with the charging circus? That would drive me nuts!

I've never had an issue in either of our Model 3's, just plug in and go get a drink or something to eat. It's usually done before I am. Hopefully Ford fixes this quickly or there will be thousands of new EV owners who think travelling in an EV is a pain in the butt.

Another good choice Tesla made IMO is to NOT have any displays on the chargers. Unfortunately these will probably get vandalized or become inoperative, and I’m betting Electrify America won’t keep up with maintenance.

This needs to improve quickly or Mach E customers will start getting really frustrated.

Supercharging and Tesla software still appear to be two very large moats...

LiveLong&Profit

Member

Cannot help but wonder if there is a sinister agenda here: Is having badly done charging the latest line of fall-back 'defense' for traditional auto/big oil?That was painful to watch. Good thing the host is mild-mannered, tech savvy, and patient--I would've thrown the charging connector through the windshield in frustration. The average car owner would've struggled to figure out what to do if their new EV didn't charge at a charging station. They would've had to contact Ford tech support, or call AAA for a tow to the nearest dealer.

Us Tesla owners are really spoiled. I didn't realize there could be so many different problems charging, from the station to the car to the phone app. I suppose fast charging doesn't matter much to many because road tripping isn't something commonly done, but I would never put up with the shenanigans the host went through, especially for the kind of money the Mach-E costs. After one road trip I would've returned the car.

Tesla has a lot of advantages over other EVs, but their charging experience alone knocks it out of the park. Seriously. I'm a fairly computer-illiterate person, stay away from tech as much as I can, so if I can get a Tesla to work anyone can. Tesla's brilliance is that they've made their EVs almost totally idiot-proof.

I'm embarrassed to say it, but I'm not smart enough to own a Mach-E; I wouldn't be able to figure out how to charge it.

Their message could be something like this: "Sure EVs can sorta work, but charging on the go is a big problem. It's just not worth it ... come back to our nice ICE cars over here. Drop these annoying EVs."

If not for Tesla superchargers, the message might work!

And perhaps it does, for a lot of people not knowing anything about Tesla, either first or second hand.

and the gamma from all of that giving a bit more kick.

this is something I'd like to see discussed a little bit more.

as far as I understand, if the stock substantially gaps up above a call wall (e.g. 700 for this week), and MM's don't manage to push the price down, they might feel a higher urgency to hedge the calls having gone ITM? And because ATM options have the highest gamma, that could provide some fuel for an upwards rise?

Looking at https://tsla-oi.s3.amazonaws.com/index.html for this and next week's expiration (H/T to @generalenthu) -- it seems that a jump from 661.80 to 711.80 would increase hedging requirements by (3,278,000-276,000) + (3,045,000- -1,680,000) = ~7,727,000 shares. That would be ~20% daily volume of pure buying pressure?

And a jump to 761.8 would mean an increase of (5,704,000-276,000) + (8,121,000- -1,680,000) = ~15,229,000. That would be ~50% daily volume of pure buying pressure?

Starting from what numbers can we expect the options hedging flywheel to become self-sustaining?

Buckminster

Well-Known Member

Artful Dodger

"Neko no me"

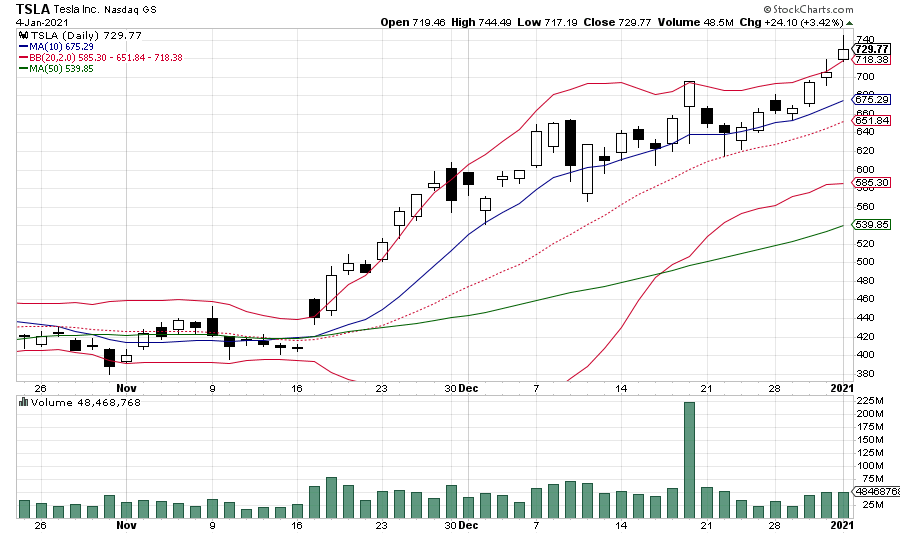

Reminder: here's where TSLA was 90 days ago:

If we somehow magically Open at $719.46 today, we'll be back exactly to where we were 1 quarter ago, after the Q4 P&D report.

Of course, if you assume TSLA should have a 50% CAGR, then that's a growth rate of about 10.7% per quarter. So the underlying value of the SP might be closer to $800 now.

But that's too far above the Upper-BB to be supported as a SP right now, but Earnings is just 13 sessions from today, so plenty of time to 'drag' the technicals upwards towards fair value. That $500M GAAP profit will help.

Cheers!

If we somehow magically Open at $719.46 today, we'll be back exactly to where we were 1 quarter ago, after the Q4 P&D report.

Of course, if you assume TSLA should have a 50% CAGR, then that's a growth rate of about 10.7% per quarter. So the underlying value of the SP might be closer to $800 now.

But that's too far above the Upper-BB to be supported as a SP right now, but Earnings is just 13 sessions from today, so plenty of time to 'drag' the technicals upwards towards fair value. That $500M GAAP profit will help.

Cheers!

Artful Dodger

"Neko no me"

Well, MarsCoin, obviously.If you still believe in the company and you sell, where do you put your money afterwards? Ten year T bills?

Cheers!

j6Lpi429@3j

Closed

I have not sold a single share, but the huge growth has given me confidence to spend other money elsewhere, and not put even more into shares. So as a result, I intend to build a 1MW solar farm. Its close to work starting, I'm literally waiting for a new company bank account to be open (hopefully tomorrow) so I can make the first paymentSo all you guys having been in TSLA for the last 5-10 years, what are some things you’ve done with your gains?

Have you cashed some out and bought homes, cars, islands, etc? Or still HODL on all shares you’ve accumulated?

⚡️ELECTROMAN⚡️

Village Idiot

Most expensive shares purchased coming up in two minutes.

At least it’s +7.34% before walk downAnd as its walked down tomorrow to red, be prepared to see 20 posts about MM and manipulation.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M