StealthP3D

Well-Known Member

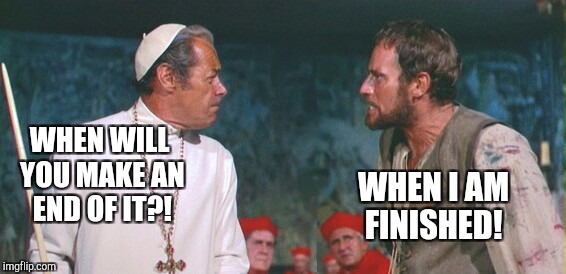

Lol. Market: "When will you ship FSD?" Elon: "When it is finished".

Don't worry. A civilization-changing work of art will be well worth the wait.

Cheers!

I'm pretty sure Michelangelo told the Pope "next year" a few times. And each year the work had grown and improved so much the Pope had no rational choice other than to let him continue.