It flies for everyone with an IRA.Yeah, that's called a 'bank-account' tax, not income tax. And it won't fly in America.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

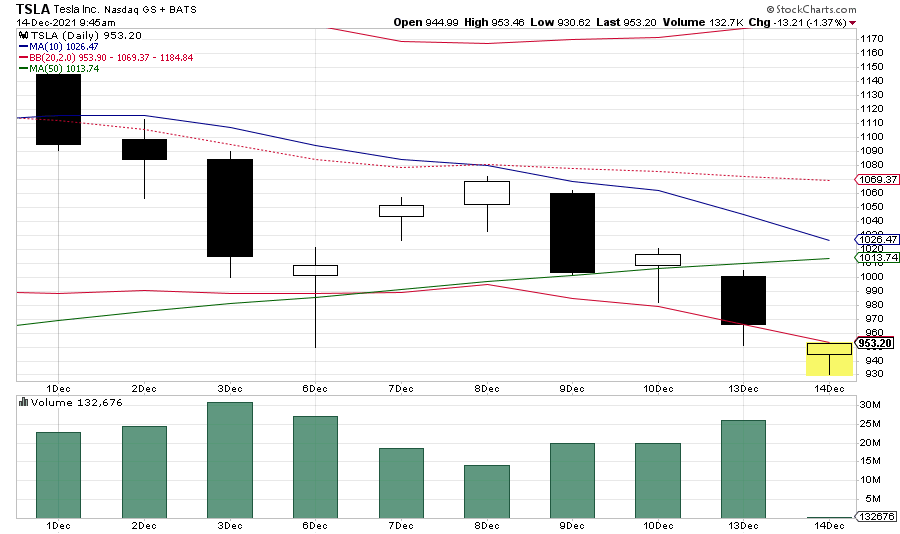

Well, back to the Lower-BB at 09:45 a.m. with strong volume (933K pre-Market + 3.0M in the 1st 15 min of the Main session).

If no 105b-1 sales today, and with the low already hitting $930 shortly after the Open, their may be some FOMO kicking in today. But keep in mind, the Lower-BB may also trigger some sell orders, and is almost certainly a line of resistance for shortzes and hedgies who wish to keep the drop going.

GLTA!

If no 105b-1 sales today, and with the low already hitting $930 shortly after the Open, their may be some FOMO kicking in today. But keep in mind, the Lower-BB may also trigger some sell orders, and is almost certainly a line of resistance for shortzes and hedgies who wish to keep the drop going.

GLTA!

henchman24

Active Member

Please could one of you experienced folk explain to my simple logical brain why is there always an obsession with gap-filling?

It really feels like an OCD thing more than anything!

Seriously, why is it That important to make sure every dollar is covered by a stock at some point during a trading day. Why does it matter if the stock gaps up or down, really?

This has been really bugging me!

Thanks!

:max_bytes(150000):strip_icc()/GettyImages-1414769694-2816dadb594f40559dfedaa4f87dfd33.jpg)

Gap Trading: How to Play the Gap

Disruptions in stock patterns are known as gaps. Learn how you can earn money by analyzing these disruptions in normal price patterns.

Common TA tactic that has a pretty decent success rate (that said TA is just a different form of numerology

TheTalkingMule

Distributed Energy Enthusiast

Hoping to have missed it by one time zone! If Elon is selling today, then this will get worse. If not, we'll quickly turn green as hedgies cover. That's my current theory. They're front-running and then will wait to see if legit 250k sell orders start popping up.Missed it by that much....

I'm on full @StarFoxisDown! alert mode. Ready to sell 200 shares and move into LEAPs if we drift further down. And of course a few Mar 2022 YOLOs

2daMoon

Mostly Harmless

Consider how the institution making the margin loan against the shares is being paid interest, and, is paying taxes on that interest earned as income. So, there already is tax being paid on a margin loan and the shareholder is funding that tax through payment of interest accrued.That's a good point. If you're using collateral to take value out of your holdings it should be treated as income. You are no longer just holding it. You are essentially using it as income to live off of. It would still make the tax percentage paid look miniscule but it would at least close that loophole for paying zero taxes.

Add to this how, eventually, the shareholder will either pay back the loan, or, (more likely) sell the shares to zero it out. When they sell, they will have realized the "income" they were already enjoying as a loan and will owe Cap Gains tax on that amount at that time.

It all comes out in the wash.

Last edited:

torifile

Member

Hand a technical trader a chart without a ticker symbol and they’d still tell you how they’d trade it. It doesn’t matter one bit to them what the company does.:max_bytes(150000):strip_icc()/GettyImages-1414769694-2816dadb594f40559dfedaa4f87dfd33.jpg)

Gap Trading: How to Play the Gap

Disruptions in stock patterns are known as gaps. Learn how you can earn money by analyzing these disruptions in normal price patterns.www.investopedia.com

Common TA tactic that has a pretty decent success rate (that said TA is just a different form of numerology) . Many gaps never get filled (signals a change in fundamentals as evaluated by the market), but when movement happens near gaps, they tend to be magnets.

Hock1

Member

This price action is puzzling as Tesla's future has never ever looked this good.

A backlog of many, many months (with some trims over one year out), price increases, two new factories, increasing battery supply, Semi & Cybertruck prototypes, etc. etc.

Record profits for 2022 are guaranteed. And this during a time when all other car makers are struggling.

In Q2, despite having sales much less than Ford and GM, Tesla showed it's operating efficiency by delivery Operating Income margin of 11% while Ford delivered 0% and GM 8%.

View attachment 744167

In Q3, not only did Tesla again deliver higher OpInc margins 15% (vs 4% and 6% for Ford and GM, respectively), they delivered more OpInc $$ with $2.0B vs Ford's $1.3B and GM $1.6B.

View attachment 744168

In Q4, I expect Tesla's OpInc margin to increase 17% with Operating Income of $2.8B.

The issue Legacy OEMs face, is that they will need to put new capital to work to establish their EV business meaning additional fixed costs while declining ICE sales will but a strain on the cost of production for these ICE vehicles as output declines potentially leading to stranded assets. I see restructuring charges in the future for Legacy auto.

All True. This particular extended downdraft is mostly a result of the manipulators knowing there is a large, captured seller in the market. I.e., nothing to do with valuation, IMO.This price action is puzzling as Tesla's future has never ever looked this good.

A backlog of many, many months (with some trims over one year out), price increases, two new factories, increasing battery supply, Semi & Cybertruck prototypes, etc. etc.

Record profits for 2022 are guaranteed. And this during a time when all other car makers are struggling.

In Q2, despite having sales much less than Ford and GM, Tesla showed it's operating efficiency by delivery Operating Income margin of 11% while Ford delivered 0% and GM 8%.

View attachment 744167

In Q3, not only did Tesla again deliver higher OpInc margins 15% (vs 4% and 6% for Ford and GM, respectively), they delivered more OpInc $$ with $2.0B vs Ford's $1.3B and GM $1.6B.

View attachment 744168

In Q4, I expect Tesla's OpInc margin to increase 17% with Operating Income of $2.8B.

The issue Legacy OEMs face, is that they will need to put new capital to work to establish their EV business meaning additional fixed costs while declining ICE sales will but a strain on the cost of production for these ICE vehicles as output declines potentially leading to stranded assets. I see restructuring charges in the future for Legacy auto.

Ah I'm a bit upset with myself, was watching and thought when it was down to 930 that we would see a quick raid into the low 900's and held off. I was looking at Jan 24 1000 LEAPS

Trying to hit the exact bottom for the day/week is futile. Make plans/research and just go for it

with IV dip and these prices I think we are in a good range for buying LEAPS ..

.. now need to twiddle by thumb and wait for a plethora of good news to come for 2022.

henchman24

Active Member

Hand a technical trader a chart without a ticker symbol and they’d still tell you how they’d trade it. It doesn’t matter one bit to them what the company does.

I think the key words in there are 'trade it.' Trade, not invest. They don't care about investing, but movements.

StealthP3D

Well-Known Member

Won’t whatever EM pays for 2021 have to be adjusted by the number of years covered? All the income for EM happened over years. Apples and apples and all.

Actually, this is where people get it wrong. Elon's income, like every American's income, is taxed when he makes the money. Building a valuable business is different from making money. You can't spend a 'business', you have to sell it before you can realize it's value.

The claim that taking a loan against the unrealized value of your business should be a taxable event, that's an argument one can reasonably make. If that should be a taxable event, the failing is with American legislators, not Elon Musk, he doesn't make the tax code and his borrowing against his shares has more to do with a reluctance to give up the likely gains rather than any tax avoidance strategy.

Income doesn't happen "over years" it happens when you get the paycheck. Otherwise you would have to tax college students for the value they have added to themselves by becoming educated. It's the payment that is taxable, not the creation of value. Hopefully, this never changes.

Last edited:

Artful Dodger

"Neko no me"

Ironically, that's my backup plan if this TSLA gig doesn't work out: "screen-door installer for submarines". /S

Cheers!

The Accountant

Active Member

2022 is still very much a work in progress but I am currently modeling $86.7B in sales on 1.5m deliveries (plus energy and services):

View attachment 744190

Note: the CEO award is a question mark for 2022. The 160m is the remainder of the current award program; I am not sure if a new program will be approved by the BoD in 2022 bring more expense to next year.

Forgot to mention that 2022 will see a $1 Billion benefit in GAAP EPS from:

1. CEO Award will be $656m less

2. Q1 and Q2 2021 had about $280m in inefficiency costs related S&X Refresh which we won't see in 2022

3. Interest Expense will be about $150m less in 2022

Benefits GAAP EPS by about $0,84 (after-tax).

I rage bought some Jan24 LEAPs $850 strike as IV has dropped; too good to pass up. I plan to sell calls on these after we peak again, hopefully a few weeks after earnings.

thx1139

Active Member

What if the shareholder doesnt pay it off and when the pass the shares are inherited by children and with step up basis the unrealized capital gains get wiped out. Children then sell to pay off the loan. Am I missing something? As with any tax regulation this can all kick in when the wealth of the individual is extremely high. Doesnt have to be everyone.Consider how the institution making the margin loan against the shares is being paid interest, and, is paying taxes on that interest earned as income. So, there already is tax being paid on a margin loan and the shareholder is funding that tax through payment of interest accrued.

Add to this how, eventually, the shareholder will either pay back the loan, or, (more likely) sell the shares to zero it out. When they sell, they will have realized the "income" they were already enjoying as a loan and will owe Cap Gains tax on that amount at that time.

It all comes out in the wash.

You are missing something. Debts have to be paid off before assets are distributed to the heirs, so taxes will be paid. And if you taxed the money withdrawn as a loan, do you credit the tax back when the loan is repaid? Or are you saying that they should be double taxed?What if the shareholder doesnt pay it off and when the pass the shares are inherited by children and with step up basis the unrealized capital gains get wiped out. Children then sell to pay off the loan. Am I missing something?

Xd85

Member

Q: Looking at all these other OEMs "investing 10s of $B" over next x years for electrification. Where are they getting funds from? Surely they're not generating FCF, operating margin and cash pile, are they?

StarFoxisDown!

Well-Known Member

Trying to hit the exact bottom for the day/week is futile. Make plans/research and just go for itwith every tick of the tape - there is a 50/50 possibility it will go up or down.

with IV dip and these prices I think we are in a good range for buying LEAPS ..

.. now need to twiddle by thumb and wait for a plethora of good news to come for 2022.

As someone that doesn't believe in "filling gaps", the stock is so close now to that 910 and considering there's still two more tranches out there to get us to around 85% done for Elon selling (which I think is the point that the stock shoots higher), I have to believe that there will be an attempt for 900 at some point later this week or next week to "fill the gap" lol.

Though to give context to my thought process, I was able to pick up 52 DITM LEAPS ranging from 500-700 strike prices, all with late 2023 expiration dates throughout 2021 which gets me to my share count goal. I was also able to pick up around 35 cheap far out of money LEAPS that even with this 30% pullback, are still up massively. So if I miss out here on some good priced LEAPS I'll be annoyed with myself, but it's not like it was move I needed to do to hit a share amount goal.

2019/2020 were amazing years of course, but the P/E contraction of 2021 allowed me to get LEAPS at a huge IV discount. I will forever be grateful for Wall St's stupidity

So I'm a bit picky. Anyone that is looking for share accumulation should absolutely be picking up LEAPS here, regardless of it the stock goes down to 900 this week or next. We literally a couple weeks away now from some major fireworks.

Well, it looks like today is the day we test that infamous TA-myth.Please could one of you experienced folk explain to my simple logical brain why is there always an obsession with gap-filling?

It really feels like an OCD thing more than anything!

Seriously, why is it That important to make sure every dollar is covered by a stock at some point during a trading day. Why does it matter if the stock gaps up or down, really?

This has been really bugging me!

Thanks!

So far, it is not looking good: TSLA opened ($945) inside the gap ($910-950) and touched down to a low ($930) of roughly the middle of the gap, then rose above the top.

It was mentioned yesterday on this thread, that the top of a gap can act as support until its broken, but when its broken it would fill all the way.

It has clearly been broken, but only filled half-way. If we close above the gap today without filling it, then the myth is busted.

thx1139

Active Member

Thanks for the clarity on how the step up basis works. Are we sure that is exactly how it is handled. As for double tax I have no problem with the tax paid being a non refundable credit when the loan is repaid.You are missing something. Debts have to be paid off before assets are distributed to the heirs, so taxes will be paid. And if you taxed the money withdrawn as a loan, do you credit the tax back when the loan is repaid? Or are you saying that they should be double taxed?

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K