I wonder if there is any activity at the factory? Asking for a friend...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Stretch2727

Engineer and Car Nut

I'm sure Elon reads TMC also.

So after reading the speculation on the Texas made Model Y stats..., he replies:

View attachment 791853

In other words:

Model Y with structured battery pack is software locked in every performance metric to avoid Osbourne effect

Interesting idea. It is odd there is 15% less "battery" capacity and no real efficiency improvement like on the SR RWD model.

Maybe sell an after purchase software upgrade at some point?

They probably want to avoid it competing with the Long Range for now as many will only want a Texas built car.

MD70

Member

Have Shanghai residents had their needs met? or is the issue getting more acute?

Residents can’t do anything, only one man’s opinion matters. So far the signs are he hasn’t realised the difference between the current and previous variants.

We could be looking at a shutdown lasting longer than one month which would wreck this quarters anticipated output.

Residents can’t do anything, only one man’s opinion matters. So far the signs are he hasn’t realised the difference between the current and previous variants.

We could be looking at a shutdown lasting longer than one month which would wreck this quarters anticipated output.

watch what you say you could get a pal sent your way… lolYou are going on record that it is likely / possible for all factories in Shanghai to be shut down for the next 11 weeks?

Sure, whatever you say, pal.

Thekiwi

Active Member

Given shipping times, European tesla deliveries will be the most impacted this quarter at this stage. ie the final 4 weeks of Shanghai production of a quarter would not reach Europe for delivery by quarter end. So the first 9 weeks / 63 days is what is available for European-destined production, and we have already lost 10 days of that.Sounds like Shanghai will remain in shutdown for a minimum of 14 more days.

also FYI - the number of people in China now under some form of Covid lockdown now exceeds 200 million. This is getting more widespread apparently. While that is not good for the population, it may possibly hasten a change of the zero-covid policy (although I wouldn’t hold my breath).

Last edited:

Thekiwi

Active Member

thesmokingman

Active Member

Well, at least we’re pals.watch what you say you could get a pal sent your way… lol

Artful Dodger

"Neko no me"

Elon: "The corporation (Twitter) needs to reduce staffing costs and increase freedom of speech!"

Board (rolling eyes): "We've looked at that repeatedly, and there's just no way to do both!"

Elon: "Here's a list of accounts to restore."

Better yet, DoJo gets a twitter feed. ID's all the bots in 30ms. Ends crypto spam with a steam hammer. Twitterverse rejoices.

Is this even somewhat peripheral to a young lass I once knew? She favored silk ropes.…

Not once in my life having been in a line with a velvet rope, I don't know all of the dynamics. But I can guess.

But that was in another country, and besides, the something something something.

Do not cross the King of Twitter.^^He doesn't ever forget does he?

dhanson865

Well-Known Member

What I love about Pierre’s estimates is that his path to $10B Tesla involves Tesla continuing to execute on their current path. No assumptions about Robotaxi, no assumptions about Optimus. He just looks at the current path.

His $10T number is the Tesla middle of the road scenario. No major disasters. No massive effect from their swing for the fences stuff.

I think Tesla will achieve some of their swing for the fences stuff, Robotaxi, Optimus, both, or some half-version of one or the other. And that is where the lottery ticket really hits.

Artful Dodger

"Neko no me"

Thanks. This is helpful for my future forecasts.

Are there any other raw material cost differences between a Std Y and LR Y besides the battery and motors (single motor vs dual)?

Made-in-Texas Std Model Y seems to be an AWD, so no savings in materials costs there. I'd suggest the $1.45/lb avg materials cost per @jbcarioca is a good 1st approximation for imput costs reduction. We do need to a confirmed weight difference from Fremont LR AWD, but since these are going out to customers now we shouldn't have to wait too long to find out.

I suggest big savings are also coming in labor / assembly hours, and capital costs per unit due to the lower factory robot count and simplified processes (ie: installing electrical wiring).

Cheers!

deshkart

Member

Concocting Inventory

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for...

alhambrapartners.com

alhambrapartners.com

TLDR: inventory build is happening in US - > due to lower consumer demand -> however, Fed is unnecessarily hawkish and end up raising rates into a recession.

If we see a couple months of lower Inflation readings, we should stop seeing “ I propose 10000000 point hike at next Fed meeting” by ppl like Bull(****)ard. This will basically change complete narrative that is making markets sell growth stocks to buy stocks like Costco and Walmart. Growth stocks may come back in favour.

Edit:

One more link with more data.

Speaking Volumes Rather Than Fast Rate Hikes

The price illusion. It is causing enormous confusion and difficulty, making the global economy out to be something it really isn’t. In fact, the whole situation is being viewed backward. What’s presumed from this is a red-hot economy causing consumer prices to skyrocket. In such a scenario,

alhambrapartners.com

alhambrapartners.com

That video is from 5 days ago and was already posted here.There appear to be growing riots in Shanghai

Buckminster

Well-Known Member

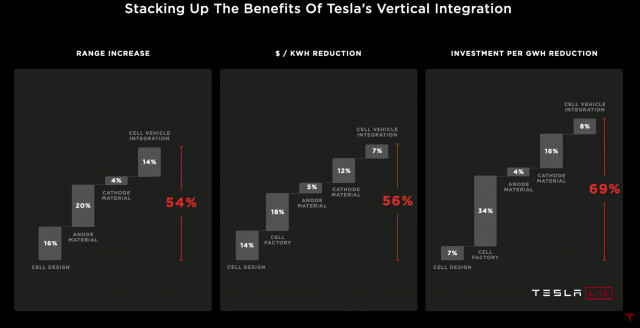

This is the first iteration of 4680s:

- Likely not pushing performance

- Could be software limiting in addition

- Possible that not all battery day features fully employed

- Many post battery day features inbound (Jeff Dahn etc. hasn't been sitting around the past 2 years)

mltv

Member

Expect more of this in the coming days due to China COVID situation: Not just he factory shutdown but to the supply chain. Cars can only produce as fast as the slowest part.

finance.yahoo.com

finance.yahoo.com

China EV maker Nio suspends production due to supply chain disruptions

Chinese electric vehicle (EV) maker Nio said on Saturday it has suspended production after the country's measures to contain the recent surge of COVID-19 cases disrupted operations at its suppliers. "Since March, due to reasons to do with the epidemic, the company's supplier partners in several...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M