I would think, when getting to retirement age, the thing to do would be to liquidate enough to establish a reliable income stream. At that point you can’t really have your entire net worth tied up in a volatile stock, no matter how much you believe in it.Great all-encompassing post. I am mystified when people speak of "cashing out" - like, to do what with the money? Wallow in it like Scrooge McDuck in his vault? Where will you keep it once you take it out of TSLA? I'm all in, because I can't think of a better place to put it, that would have to be a place with high growth that is immune to force majeure effects - is there even such a place?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

No. Not in my opinion. The base 250 mile CT version was probably LFP. Now that model may never be made, or may not be made for a few years, but no reason why things need to be 4680. The semi could be built with 2170 or 4680 but obviously will cost more with 2170. And yes, designing both 4680 and 2170 versions is wasteful of engineering resources.Isn't the Semi (alone with CT) designed specifically to use ONLY the 4680 cells?

They have been validating Semi prototypes for 6 years now and I'm pretty sure most of them are rocking the 2170s. The actual 4680 cells only exist for a little over a year. I'm sure Tesla started a team to develop the 4680s maybe 4-5 years ago but it didn't exist back then...unless you think Tesla started developing 4680s since the Model X debut.Isn't the Semi (alone with CT) designed specifically to use ONLY the 4680 cells?

More evidence that it has nothing to do with the tax credit. And if a refresh is coming, then why isn't the performance version of the M3 shut down?FYI Model 3 LR in Taiwan is also unavailable to order. Taiwan gets all the Tesla vehicles from Fremont and everyone should know the reasons already.

hacer

Active Member

As long as the % propulsion efficiency is the same at both speeds for a given powertrain, then the % range loss is equal to 1 - old speed/new speed.

...

What is power of wind drag assuming rolling resistance is negligible?

The trouble with your analysis is that you assume (incorrectly) that rolling resistance is negligible. A loaded class 8 truck is quite heavy and rolling resistance is proportional to weight. This DOT paper on rolling resistance for class 8 trucks shows that at 64 MPH, the power required to overcome rolling resistance is almost equal to the power required to overcome wind resistance. That paper also shows that, for the truck they measured, the engine efficiency at 64 MPH was 0.35 vs 0.29 at 30 MPH (fig 6.5 in the paper). The efficiency depends on several factors but one of them is friction in the transmission which is significantly less in higher gears. Because of that it's not so easy to use such simple equations when trying to compare fuel costs between engine and EV trucks; the EV is simpler and much easier to model. The engine and transmission combination is much more trouble to model accurately. But you might reach wrong conclusions modeling them in a trivial way. No doubt the big picture is still EV=less operating costs, especially when EV's avoid the fuel tax.

OTI would think, when getting to retirement age, the thing to do would be to liquidate enough to establish a reliable income stream. At that point you can’t really have your entire net worth tied up in a volatile stock, no matter how much you believe in it.

Having been retired for 2 years now, I have watched my “all in” position grow 7x in just over two years. I was in the automotive industry for my entire life and received factory training from four different OEM‘s. I was at Saturn when GM decided that the China market for Buick was more important than the domestic market for the new hybrid Vue that was demonstrated at our dealership and that I received training for.

The various posters to this forum that have and still provide unique insight to this company have been invaluable to my wife and myself.

My experience in retirement started out with selling enough stock to last one year. I was going to do this to “have a reliable income stream”.

What I have found is now I just take a monthly ”draw” to cover living expenses (Due to our TSLA investment we actually have a better lifestyle now).

Even if we lost 3/4 of our investment, we would still be able to live comfortably.

Back to Tesla.

We watch almost daily the progress of the three factories, watch/listen to every quarterly, annual and special event.

Tesla, in our opinion, is the safest place to put our retirement savings.

Tesla paid for our Model Y, paid for our trip to Europe, paid for 4 sets of braces for the grandkids. We have a solar roof and an electric pontoon boat on order that we will be paying cash for.

The funny thing is the more money we take out and “spread around “ the bigger our pile grows.

(Not to mention the donations to various originations.)

Everyone has a different tolerance for volatility.

Interesting news - could it have been the significant factor maintaining the SP up recently?

" Breaking News: Natixis - one of largest fund in the world with AUM of $1.4 trillion recently bought 15 million shs of $TSLA value $13.5b"

Edit: looked up Natixis, part of BPCE " .. Groupe BPCE is the second-largest banking group in France. Through its 100,000 staff, the group serves 36 million customers - individuals, professionals, companies, investors and local government bodies - around the world. It operates in the retail bnaking and insurance fields in France via its wwo major networks, Banque Populaire and Caisse d'Epargne, along with Banque Palatine and Oney. It also pursues its actvities worldwide with the asset & wealth management services provided by Natixis Investment Managers and the wholesale banking expertise of Natixis Corporate & Investment Banking. " .. Though Natixis plays the ESG game, at least they don't need to abide by the silly Moody's / S&P Global credit ratings which prevent large US institutions from investing in Tesla..

Another "weird" (not really, if you think about it) aspect of Tesla - being slowed down, nearly bankrupted by our own "government & financial elites", only to be rescued by China. And still being ignored as much as possible by our POTUS.

Would put them in 5th place of largest institutional holders:

Tesla, Inc. (TSLA) Stock Major Holders - Yahoo Finance

Find out the direct holders, institutional holders and mutual fund holders for Tesla, Inc. (TSLA).

Would put them in 5th place of largest institutional holders:

Tesla, Inc. (TSLA) Stock Major Holders - Yahoo Finance

Find out the direct holders, institutional holders and mutual fund holders for Tesla, Inc. (TSLA).finance.yahoo.com

Lightweights.

I think we knew, but MegaPack XL factory at Lathrop, CATL LFP at Shanghai and US.

Elon is finally becoming Iron Man in real life

I'm so confused then, because they keep telling us they have enough battery supply for the rest of the year....why close down one model for another then?My guess, the type of batteries in the lr awd are going into semi, mY, and performance 3s. They will continue to allocate what they can for the backlog for the m3 lr but then allocate the rest to semi mass manufacturing until 4680s can reduce MYs need for 2170s.

The closure of the m3 lr awd came just a day after Elon said Semi shipping this year.

Closing Canada orders suggest it has nothing to do with the tax credit, and not closing SR+ suggest its related to batteries. Not closing the model Y or X ordering suggest it had nothing to do with back logs.

My guess that there's not enough 2170s for Semis if they leave m3 awd lr orders open fits the "too much demand" narrative. I think they are going to reduce m3 awd lr production by allocating a portion to Semis and perhaps even transfer some line workers to semi.

The obvious ones are Geely owning controlling interest in Volvo etc but there are also Lotus, MG. Also,suppliers such as Pirelli and IDRA. No controlling interests are too numerous to List.Understood. @unk45 . I was thinking more a Chinese BEV manufacturer buying a controlling interest in a Western OEM.…

It's been a long time since I worked for an automotive Tier 1, so I may be misinformed.

MC3OZ

Active Member

I'm so confused then, because they keep telling us they have enough battery supply for the rest of the year....why close down one model for another then?

There are enough batteries to make the required number of Model 3s, but not enough to make enough LR Model 3s.

IMO this is partly related to the start of Semi production.

As Elon indicated the order backlog is another contributing factor.

Maybe, but the way they phrased their generalized statement made it seem like they had enough for all products and don't worry about it....There are enough batteries to make the required number of Model 3s, but not enough to make LR Model 3s.

IMO this is related to the start of Semi production.

10 days old but haven´t seen it posted:

europe.autonews.com

europe.autonews.com

The Tesla Model Y was Europe's best-selling premium midsize SUV in the first half, beating German rivals including the segment's former leader, the Mercedes-Benz GLC.

Tesla overtakes Mercedes in key premium midsize SUV segment

The Model Y overtook the GLC in the first half and could finish the year as Europe's No. 1-selling premium vehicle overall.

Someone should tell them they got the name wrong, tesla dropped the „motors“ in 2017

What I would love to see is tesla, after s\x flagships got plaid, let the lower tier get ludacris - give us sub 3sec model 3 that also can pull until 300km\h.More evidence that it has nothing to do with the tax credit. And if a refresh is coming, then why isn't the performance version of the M3 shut down?

Let’s mock the Germans performance middelclass for good

More evidence that it has nothing to do with the tax credit. And if a refresh is coming, then why isn't the performance version of the M3 shut down?

Why do you guys think M3 production has shut down?

I have this tweet from Elon

...about not accepting M3 LR orders. But how do you get from here to conclude they have shut down production? Is there a press release I have missed?

I am reading it like they are doing the opposite - trying to ramp production even further to shorten the waitlist.

This is a genuine question btw.

Pezpunk

Active Member

Very good and well thought out post, Stealth. To pull the "health and age" thread a bit more I would point out is that many believe "time>money" (at least once you have a reasonable sum of the latter). Over on another forum I am on, folks call it "OMY"ing. This occurs when they have enough money to retire, but then work "One More Year" (aka OMY) to be sure...and then that turns into two more years...and then three more years, etc. While some are glad they did stockpile a bit more, many look back in regret because the one thing that money can't buy is more years...especially more HEALTHY years. More healthy years to "do stuff", more years to spend with family and loved ones, etc. It's always a balancing act....if only my crystal ball were working better I'd know my own "balance" point!

Everyone's number will vary wildly based on age, debt, kids, location, lifestyle, and other factors. For me, at age 46 with a wife and two kids in a pretty expensive part of the country, the number was ~$10 million. So earlier this year when I hit my number, and coincidentally my job suddenly turned extremely sour, I said goodbye. Set up a 72T SEPP, since the bulk of my savings were in an IRA. It's been great so far. I've been focusing on personal projects I had backburnered for years, and I suddenly have way more freedom to spend time with the kids and travel spontaneously. No complaints so far.

I definitely feel like this freedom today, while i'm young and healthy and energetic, and while my kids are living here under my roof, is incredibly valuable to me - more valuable than the same freedom would be at 65, with my kids likely busy with families of their own.

I interpret Elon's tweet as re-enabling ordering, not production. They will keep producing to try to burn down the backlog, but need to suspend ordering until they can increase production rate.Why do you guys think M3 production has shut down?

I have this tweet from Elon

View attachment 840808

...about not accepting M3 LR orders. But how do you get from here to conclude they have shut down production? Is there a press release I have missed?

I am reading it like they are doing the opposite - trying to ramp production even further to shorten the waitlist.

This is a genuine question btw.

edit: what @EVMeister said.

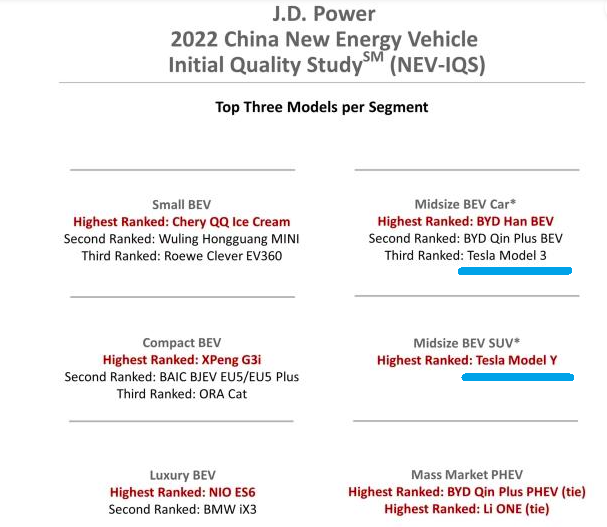

JD Power ranked New Energy vehicles in China

Awarded:

* Highest Rank to Tesla MY - in Midsize BEV SUV segment, and

* Third Rank to Tesla M3 - in Midsize BEV car segment

SHANGHAI: 4 Aug.2022 - Quality of New Energy Vehicles (NEVs) Made by China Startups Maintains Leading Edge, J.D. Power Finds

The article said BEV startups in general have higher quality than BEVs made by legacy OEMs in China.

Awarded:

* Highest Rank to Tesla MY - in Midsize BEV SUV segment, and

* Third Rank to Tesla M3 - in Midsize BEV car segment

SHANGHAI: 4 Aug.2022 - Quality of New Energy Vehicles (NEVs) Made by China Startups Maintains Leading Edge, J.D. Power Finds

The article said BEV startups in general have higher quality than BEVs made by legacy OEMs in China.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M