yes.Pre-market not looking too bad. Could this be the beginning of the face ripping off rally?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

Looks like Mr. Bollinger is having a hard time to keep up

I'm not a chartist but I think that red line is supposed to be above the candle...

Bose-Einstein frame-dragging...

Agree. When does the combination of short covering plus FOMO come into play? Or have both already started?Maybe not, but surely some panic short covering. All depends on your definition of what a short squeeze is. My definition would include a lot of forced buying by brokers to cover positions. Don’t know if we can even know that number?

Eh.Not bad - but as impressive (and enjoyable) as this current move is I'm mindful of the simple fact that NOTHING HAS CHANGED. The business of Tesla is much the same as it was 1, 3, 6 months ago. Macro environment is evolving, but there was no rational reason for the extreme drop in SP. Efficient market theory my a$$. HODL (and congrats to everyone that bought from $200 down).

Talked about this yesterday. SP is in many ways a fear indicator. The market was irrationally fearful about Tesla. Earnings results and a masterful management call as assuaged those fears. There was also a huge amount of wealth lost due to high risk market moves. Margin calls being a big contributor to selling on the way down.

”In the Short-Run, the Market Is

bkp_duke

Well-Known Member

TSLA may be doing ok, but LCID must be better. /s

FFS the analysts are morons. Just checked the ticker, and makes ZERO sense with all the cars they have sitting on the lot unsold.

Artful Dodger

"Neko no me"

TSLA stop!

I don’t wanna rejoin ranks of super rich at expense of shorts

Wow, called the peak within 2 minutes. Impressive.

SageBrush

REJECT Fascism

Anyone with half a brain could have looked at Q3 financials and seen how much pricing power Tesla had.

I obviously agree with your argument since I posted a variation of the same earlier this week, but I'm curious how much gross and net profit you think remains per 3/Y cars after the price cut. My napkin math says under $5k gross profit per car, although expected to increase as supply chain improves.

Artful Dodger

"Neko no me"

congrats to everyone that bought from $200 down.

This is an excellent point. Uncle Leo is nolonger underwater with the $160 Put buys he made earlier this month. Maybe now he'll read less Q...

StealthP3D

Well-Known Member

This ... this is too fast. Making me nervous about a correction lol.

Corrections after big, fast moves are a given.

Why would that make you nervous?

While my long term shares are totally in tact, I sold off my more recent dip buying shares today at $144 based on my macro outlook and my expectations on the tone Elon will set on this call. ::ducks::

You're welcome kids!

It was like 2% of my holdings so fwatevz...I'm happy to see it rise.

Rumored buyout.TSLA may be doing ok, but LCID must be better. /s

I think the short covering started in AH trading the day of the earnings call. There was some huge AH activity on that evening as the big institutions were harvesting before they had to fight retail.Agree. When does the combination of short covering plus FOMO come into play? Or have both already started?

I’m not a TA guy, but I can read maps pretty well. I think we’re in the green square.

Edit: Just realized that within a 1 year period I bought within 5% of “Point of Maximum Financial Risk” and within 5% of “Point of Maximum Financial Opportunity”

Last edited:

Right now it seems like a buyback at 110 would have been a good idea.

Corrections after big, fast moves are a given.

Why would that make you nervous?

Because corrections can also be big. I'd rather see a constant march than be on a roller coaster ride

Are they nuts!! Lucid will be like a never ending money hole.

Funding secured.Are they nuts!! Lucid will be like a never ending money hole.

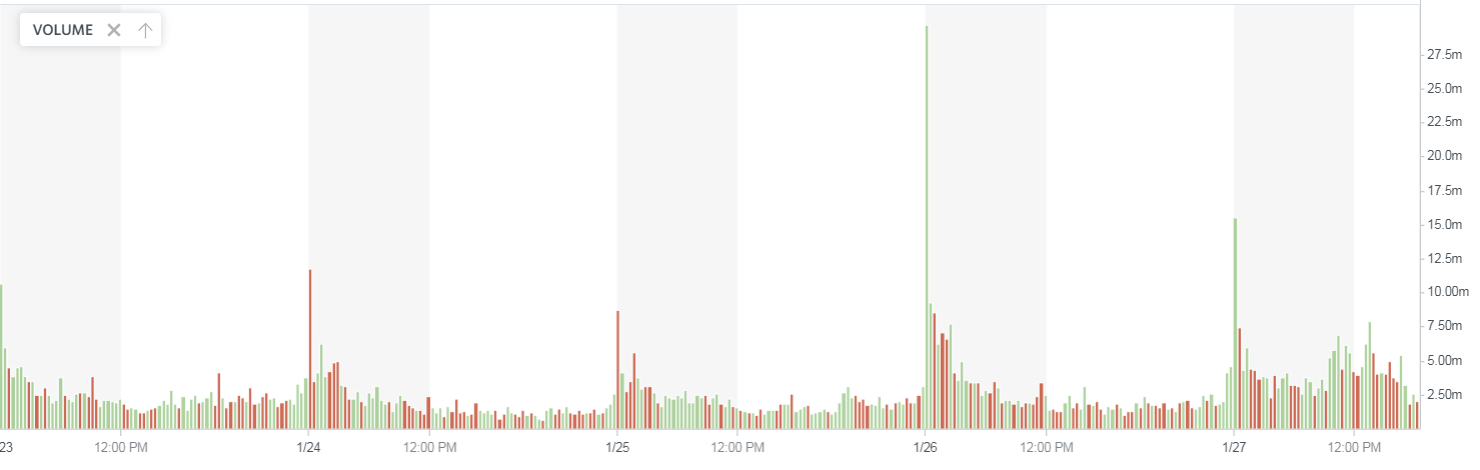

OK, is this a lot of Volume? 208,336,008

You haven't been here long, have you?I'd rather see a constant march than be on a roller coaster ride

I see you joined last April. Those of us with more than 10 years on TMC have seen this play out many times. Hang in there! HODL.

FSDtester#1

Craves Electrolytes

Did your attorney approve that post before you hit the post reply button?Funding secured.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M