Is everyone tired of hearing about Fischer-Tropsch synthesis from me yet?

Too bad, here's some more from Boeing's

2022 sustainability report as well as the United Arab Emirates Ministry of Energy and Infrastructure's 2022

Power to Liquid Roadmap which was developed in consultation with Boeing. Please note that this is the freaking UAE. Oil & gas is their largest economic sector and they're an OPEC member, and even they are saying this is coming. The report also gets into some of the efforts occurring in other countries. This is not just a greenwashing propaganda publication; it's legitimate technical and economic feasibility analysis and is accurate, as far as I can tell.

Battery- and hydrogen-powered aviation technologies are in development, of course, but sustainable aviation fuel (SAF) will be of critical importance for two reasons:

1) There are thousands of kerosene-fueled jets in the global fleet that will remain operational for decades to come

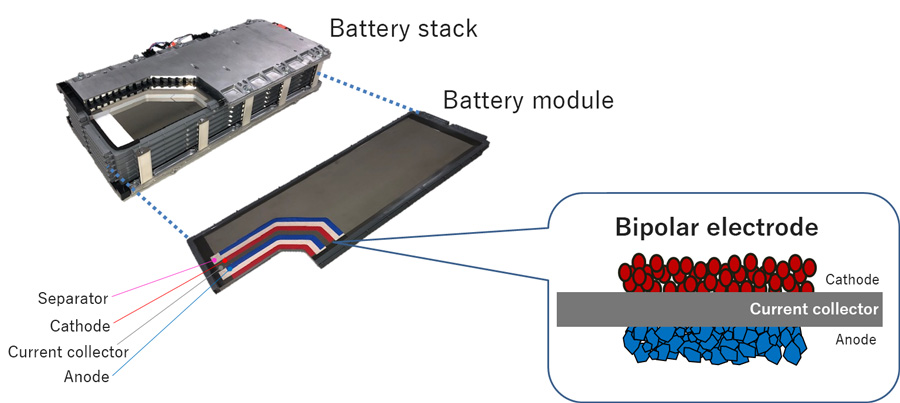

2) Long-haul intercontinental flights will be unlikely to be viable with battery or H2 propulsion architectures for *at least* 20-30 years at present rates of improvement (even if we're optimistic about the progress of suitable batteries reaching let's say 500 Wh/kg energy density, it takes approximately a decade to design, certify, and ramp up production of a new large commercial aircraft design)

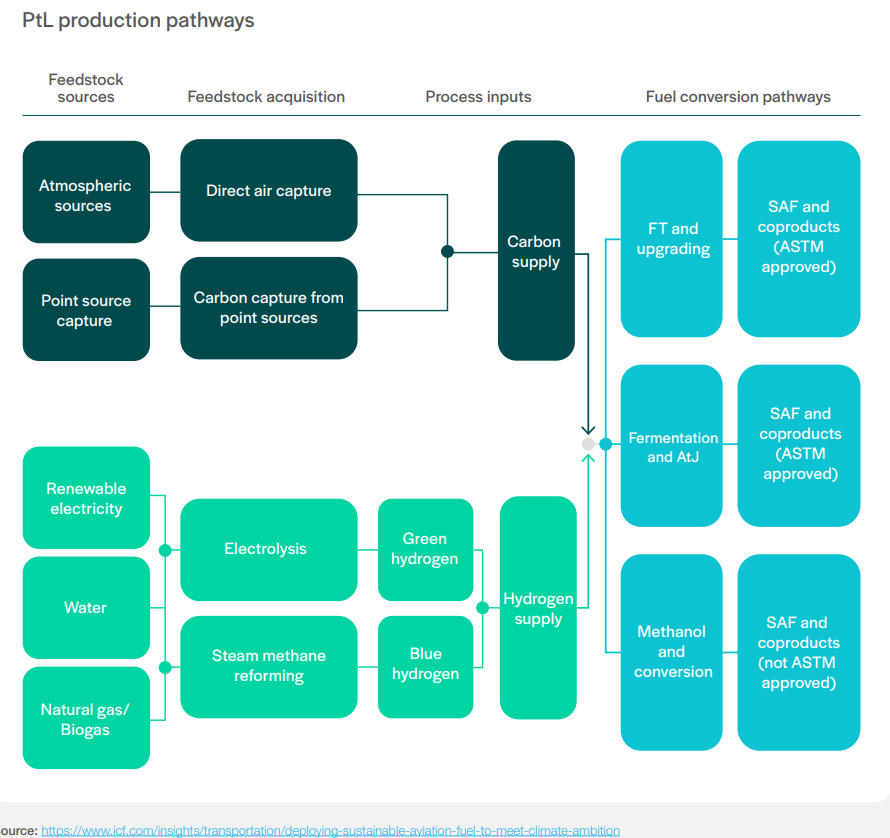

SAF will probably comes from many sources including biomass waste from other economic sectors, but that won't be sufficient to meet the overall need. A lot of SAF is planned to come from power-to-liquids (PtL) processes which are powered by renewables. That's where FT synthesis comes in, as Tesla noted in Master Plan Part 3.

Here’s how it’s made:

• Electricity is applied to the water (H2O). The hydrogen is collected and the oxygen is set aside.

• The hydrogen is mixed with the carbon dioxide in a reactor until it matures.

• The liquid is removed from the reactor, which results in PtL jet fuel.

Resources needed: This PtL relies on two things in the UAE: tapping into the UAE’s abundant sources of renewable energy (intense sunshine and sustained winds), as well as its ability to capture carbon dioxide from the air or from point sources such as industrial waste gases

The UAE report shows that it would be ambitious but feasible for the country to produce as much as 11 million tons of PtL SAF by 2050 — equivalent to approximately 70% of national jet fuel consumption.

Excerpts from the UAE PtL report:

The aviation industry will need to use alternative approaches to decarbonize the remaining emissions, and the power-to-liquid approach will be crucial. PtL is a broad term used to refer to the production of liquid fuels using renewable energy. There are several ways this can be done. It generally includes using renewable electricity to produce hydrogen and capturing carbon from a source that is already part of the carbon cycle. The hydrogen and carbon are processed into syngas [mixture of carbon monoxide and hydrogen] and then used to produce liquid fuels. The resulting products must then be converted, upgraded, and separated into jet fuel (SAF), with a portion of naphtha and diesel also produced. The SAF can be blended with conventional jet fuel and be used in aircraft without modification.

There are several strong tailwinds for PtL development. The cost of renewable energy has decreased at an astonishing rate over the last decade, with International Renewable Energy Agency (IRENA) estimating that solar photovoltaic (PV) and onshore wind have reduced in levelized cost of electricity (LCOE) by 85% and 56%, respectively. Both are now less expensive than fossil fuels. Investments over $500 billion into developing a clean hydrogen industry were announced in 2021, and the United Arab Emirates has pioneered developments, with an ambitious Hydrogen Leadership Roadmap to capture 25% of the global clean hydrogen market by 2030. The same technologies currently being developed and deployed to convert biomass into SAF can be used to convert PtL feedstocks into SAF, de-risking and reducing the cost of the conversion process.

Renewable energy is typically the single largest cost for PtL production. The energy is primarily used for green hydrogen production through electrolysis, with further use for desalination before electrolysis and for carbon capture. The United Arab Emirates has led the rise in renewable energy capacity in the Middle East over the last 15 years through research and development (R&D), policies, investment and deployment. The United Arab Emirates has over half (58%) of the market share of the operational and in-the-pipeline solar projects in the Middle East and North Africa (MENA). Supported by the abundant and intense solar radiation, the Emirates has one of the lowest auction prices for a single project in the world at $0.135 per kilowatt hour (kWh).

This is going to drive a lot of demand for solar, wind and battery power (Tesla estimated 5 PWh/year of incremental electricity for SAF in the Master Plan) while also further contributing to accelerating the demise of the mine-and-burn oil economy. Jet fuel will be synthesized from nothing more than CO2, H20, and clean electricity.