Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Maybe if it happens in isolation but the entire market reacted to somethingSomebody knows something..?

Or is it only the case when stock moves upwards?

/s

Even Carvana dropped from being up 37% earlier today... To think that stock is up 1,200% in 7 months.

Hopefully the margins will be the focus. Capex spending should be understood.TLSA is doing a lot with their our money right now, finishing Berlin, Texas, starting Mexico, CT start costs, highland costs, wow

Thinking the numbers will be tighter

Zaddy Daddy

Member

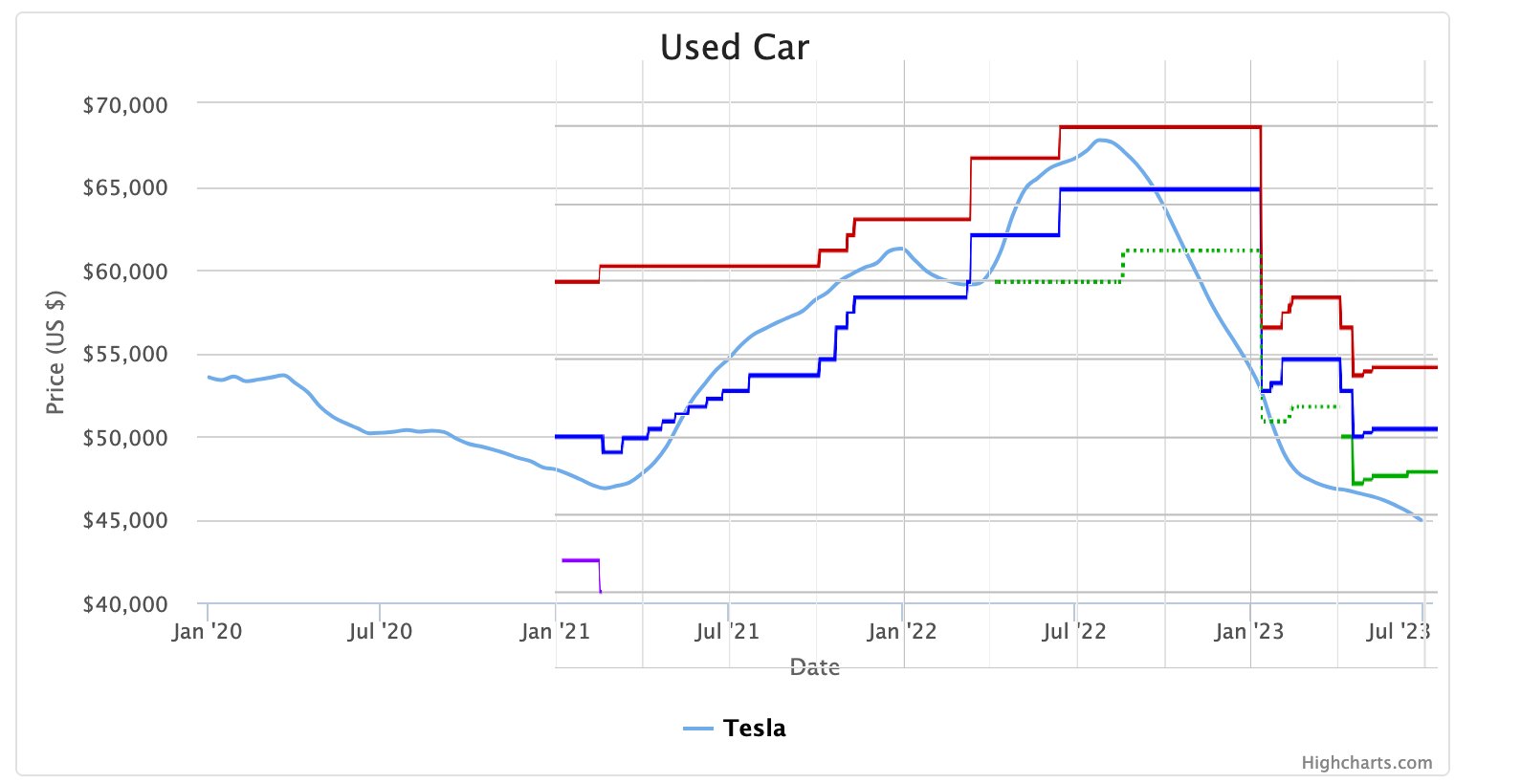

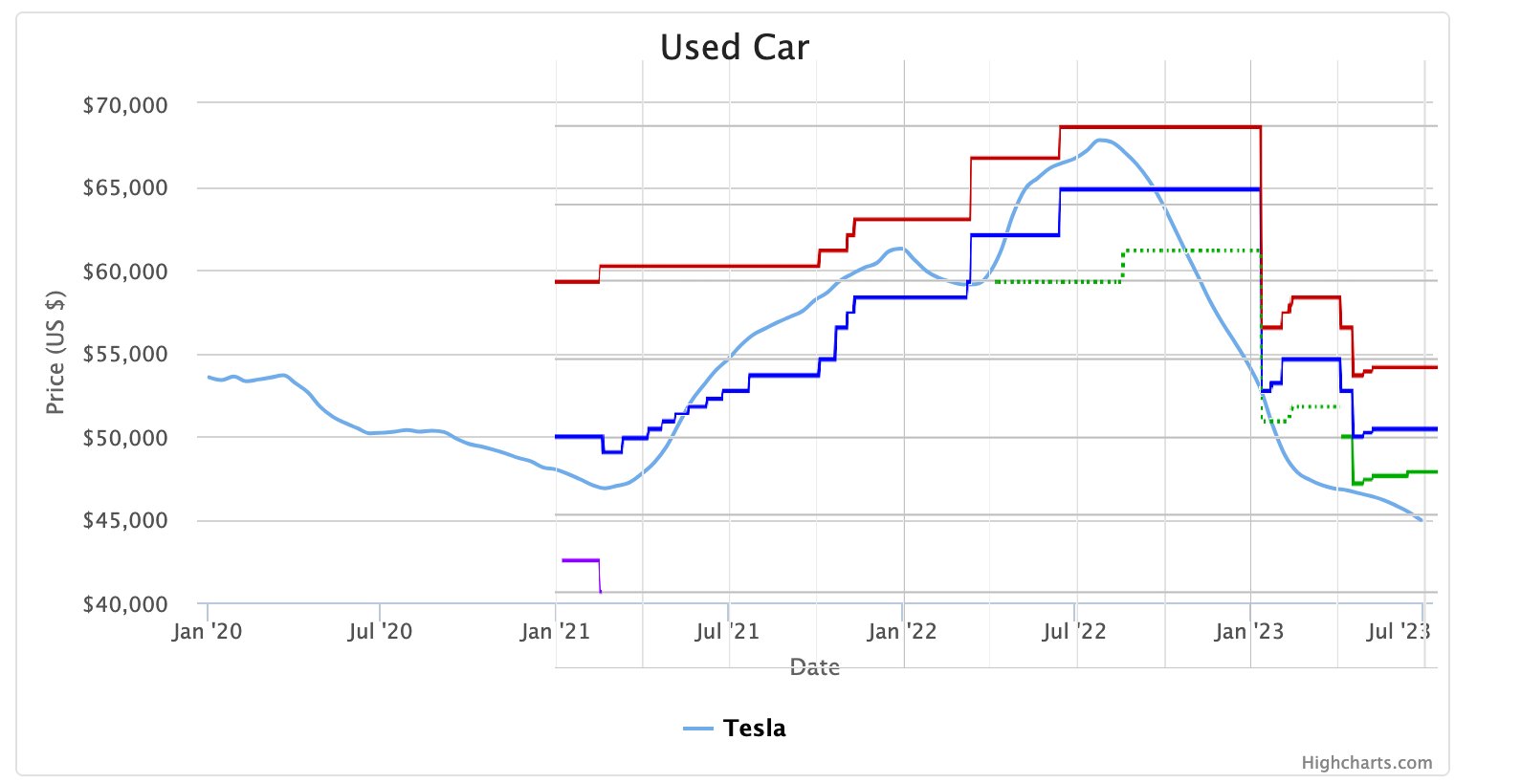

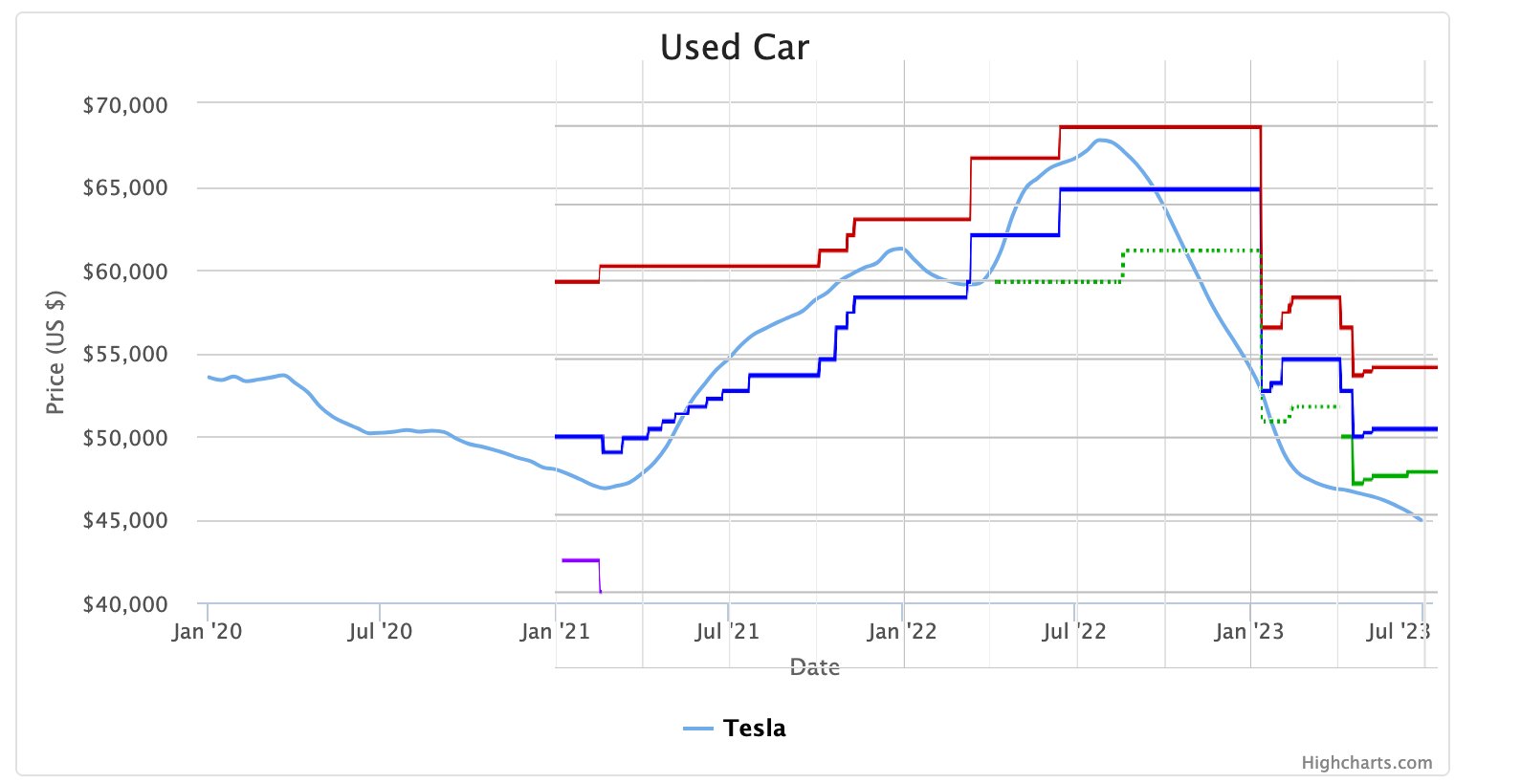

It seems obvious that used car prices and new car prices correlate...

Correlation is not causation however. Have you considered that used car prices are bound to drop in line with new car prices dropping? There was a big price drop on new Model Y in January which probably led to the decline here. Same in April - so looks more like the used car prices dropping follows new car pricing, rather than vice-versa.

Did you see my last post? Used car prices for Tesla don't rise / fall after price cuts, they happen at the same time if not earlier. All you have to do is look at the 2nd half of 2022 plunge in Tesla used car prices that happened way before any price cuts.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

All those irresponsibly fear mongering are awfully quiet nowadays "Deflation"

I didn't imply causation, nor is it needed. I am implying both affected by another variable - demand - which itself is affected by myriad of items, primarily including the unprecendented rapid rise in interest rates (just as Elon acknowledge in the past week has effect on auto demand).

Let me be clear, I am a long-term bull. I watched this forum for years but only signed up after realizing not enough voices were heard on some issues, like the epic collapse of demand in the 2nd half of 2022. I mean this forum mostly ignored any warnings or signs of potential decline in demand, which ulimately led to massive downward revisions to 2023 earnings estimates, then massive downward pressure (more than macro) on the share price. I personally think we should be aware of such issues. This is not instigating FUD.

IMO the market is aware of this, and mostly waiting to see how much COGs can be reduced. This, and energy revenue and margin growth progress.

2daMoon

Mostly Harmless

Did you see my last post? Used car prices for Tesla don't rise / fall after price cuts, they happen at the same time if not earlier. All you have to do is look at the 2nd half of 2022 plunge in Tesla used car prices that happened way before any price cuts.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

All those irresponsibly fear mongering are awfully quiet nowadays "Deflation"teslamotorsclub.com

I didn't imply causation, nor is it needed. I am implying both affected by another variable - demand - which itself is affected by myriad of items, primarily including the unprecendented rapid rise in interest rates (just as Elon acknowledge in the past week has effect on auto demand).

Let me be clear, I am a long-term bull. I watched this forum for years but only signed up after realizing not enough voices were heard on some issues, like the epic collapse of demand in the 2nd half of 2022. I mean this forum mostly ignored any warnings or signs of potential decline in demand, which ulimately led to massive downward revisions to 2023 earnings estimates, then massive downward pressure (more than macro) on the share price. I personally think we should be aware of such issues. This is not instigating FUD.

IMO the market is aware of this, and mostly waiting to see how much COGs can be reduced. This, and energy revenue and margin growth progress.

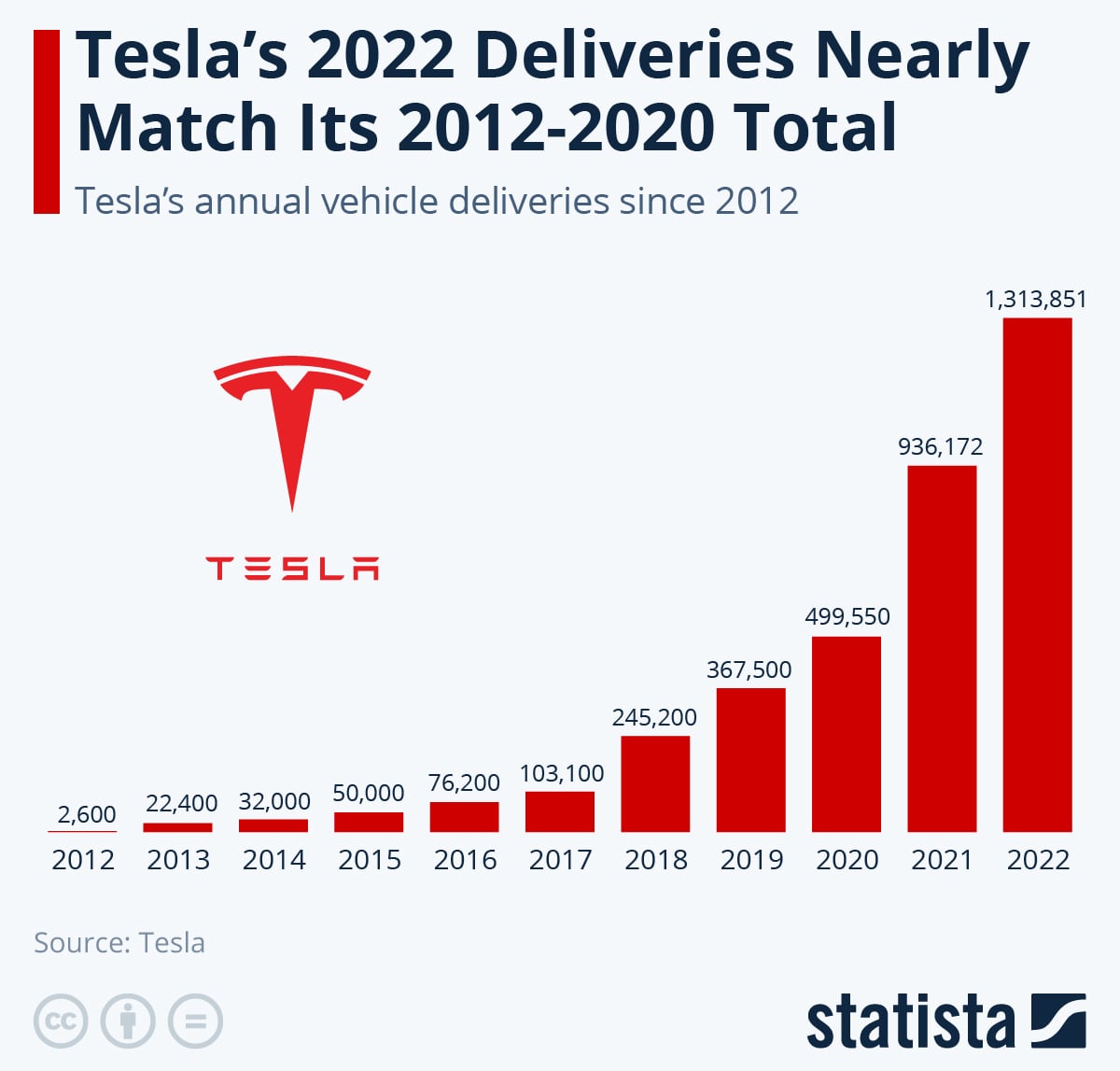

Just to be certain we are on the same page here, is this the same 2022 that you are referencing as having a decline in deliveries?

It is clear that we should all be quite concerned.

What isn't clear is exactly what it is that we should be concerned about.

Last edited:

Epic you say.... I am sure there are some cherry-picked stats you could find...please show us.like the epic collapse of demand in the 2nd half of 2022

This is what "the epic collapse of demand" looks like in graphical format:not enough voices were heard on some issues, like the epic collapse of demand in the 2nd half of 2022.

When analysts do forecasts with a focus on unit margins during a growth period, are they also including the cost reductions associated with Wrights Law due to this increased volume? If they don't, predicted margins could be underestimated?

bkp_duke

Well-Known Member

Did you see my last post? Used car prices for Tesla don't rise / fall after price cuts, they happen at the same time if not earlier. All you have to do is look at the 2nd half of 2022 plunge in Tesla used car prices that happened way before any price cuts.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

All those irresponsibly fear mongering are awfully quiet nowadays "Deflation"teslamotorsclub.com

I didn't imply causation, nor is it needed. I am implying both affected by another variable - demand - which itself is affected by myriad of items, primarily including the unprecendented rapid rise in interest rates (just as Elon acknowledge in the past week has effect on auto demand).

Let me be clear, I am a long-term bull. I watched this forum for years but only signed up after realizing not enough voices were heard on some issues, like the epic collapse of demand in the 2nd half of 2022. I mean this forum mostly ignored any warnings or signs of potential decline in demand, which ulimately led to massive downward revisions to 2023 earnings estimates, then massive downward pressure (more than macro) on the share price. I personally think we should be aware of such issues. This is not instigating FUD.

IMO the market is aware of this, and mostly waiting to see how much COGs can be reduced. This, and energy revenue and margin growth progress.

People that keep saying "demand" and "problems", at least by what their posts show, have an over-simplified concept of demand. I.e. demand = X, and anything below X is a problem.

Demand is a curve. It changes GREATLY when a product's price changes, and it's NOT LINEAR. This is all Econ 101, but most people seem to completely forget that.

Demand is also NOT EQUAL in different countries, locations, etc. Rob M gets this, when he talks about "demand pockets", etc.

At 70k, there is an exponentially smaller number of people that will buy a Model Y, than those that will at 50k. Not linear, exponential. And once that 70k buying group is saturated, since Tesla continues to expand production with ramping factories, there is only one option - lower price to increase the number of "buckets of buyers" willing to buy your product. It's as simple as that. Tesla knows this, and has stated openly they will follow that price curve DOWN as costs drop (or before costs drop, even). The single major price drop in Q1 was genius by Tesla, because it signaled to everyone that "this is the big one, if you want, buy now, prices will not be dropping constantly every week/month". All the other fluctuations since then have just effectively been noise.

Also - you are completely not mentioning the MASSIVE run-up in used car prices in the previous 2 years. Prices, used and new, literally had no where to go but down, because wages certainly have not tracked with auto prices.

Like clockwork...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3GNPK2C6OVLPVJISKSUPGB5VOY.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3GNPK2C6OVLPVJISKSUPGB5VOY.jpg)

Tesla to hand over Musk's emails to JPMorgan in lawsuit over 2018 tweet

JPMorgan Chase will get to review some of Elon Musk's emails as it pursues a lawsuit against Tesla over a bond contract dispute that arose after Musk tweeted he might take his electric car company private.

Tesla to hand over Musk's emails to JPMorgan in lawsuit over 2018 tweet

2daMoon

Mostly Harmless

The one thing I find most surprising about posts by @Zaddy Daddy is the stark absence of the term "essentially" which speaks volumes toward their being, essentially, unaffiliated with GJ's research team.

Last edited:

Knightshade

Well-Known Member

People that keep saying "demand" and "problems", at least by what their posts show, have an over-simplified concept of demand. I.e. demand = X, and anything below X is a problem.

Demand is a curve. It changes GREATLY when a product's price changes, and it's NOT LINEAR. This is all Econ 101, but most people seem to completely forget that.

Sure, and one of my favorite phrases on this is "There are no bad products, just bad prices"

That said- there certainly WERE folks in here who kept projecting 25-30% margins uninterrupted years into the future- seemingly expecting unlimited demand WITHOUT reducing prices more than 1:1 against costs while still growing sales 50% YoY on average- and that has not turned out to be the case- so that seems like a fair criticism.

Doesn't mean you haven't got plenty of folks who go way beyond fair on the point though.

Last edited:

Zaddy Daddy

Member

People that keep saying "demand" and "problems", at least by what their posts show, have an over-simplified concept of demand. I.e. demand = X, and anything below X is a problem.

Demand is a curve. It changes GREATLY when a product's price changes, and it's NOT LINEAR. This is all Econ 101, but most people seem to completely forget that.

Demand is also NOT EQUAL in different countries, locations, etc. Rob M gets this, when he talks about "demand pockets", etc.

At 70k, there is an exponentially smaller number of people that will buy a Model Y, than those that will at 50k. Not linear, exponential. And once that 70k buying group is saturated, since Tesla continues to expand production with ramping factories, there is only one option - lower price to increase the number of "buckets of buyers" willing to buy your product. It's as simple as that. Tesla knows this, and has stated openly they will follow that price curve DOWN as costs drop (or before costs drop, even). The single major price drop in Q1 was genius by Tesla, because it signaled to everyone that "this is the big one, if you want, buy now, prices will not be dropping constantly every week/month". All the other fluctuations since then have just effectively been noise.

Also - you are completely not mentioning the MASSIVE run-up in used car prices in the previous 2 years. Prices, used and new, literally had no where to go but down, because wages certainly have not tracked with auto prices.

Yes I agree with all of that. And the link I provided showed the run up in used car prices - which was EXACTLY in line with Tesla raising new car prices.

People here are triggered by the word "demand". Fine, overall demand continues to grow. However, purchasing power pressure continues to go up apparently. We are actually talking about how much people are willing to pay for a Tesla right now. Plots of impressive volume growth are tone-def.

The point brought up was the idea that margins are hitting bottom in Q2 earnings then going up from here. I pointed to some data that may hint to the contrary. All the posts responding to my posts don't address this topic (when margins will go up) at all.

2daMoon

Mostly Harmless

Yes I agree with all of that. And the link I provided showed the run up in used car prices - which was EXACTLY in line with Tesla raising new car prices.

People here are triggered by the word "demand". Fine, overall demand continues to grow. However, purchasing power pressure continues to go up apparently. We are actually talking about how much people are willing to pay for a Tesla right now. Plots of impressive volume growth are tone-def.

The point brought up was the idea that margins are hitting bottom in Q2 earnings then going up from here. I pointed to some data that may hint to the contrary. All the posts responding to my posts don't address this topic (when margins will go up) at all.

I would like to address that directly and to the point.

We'll just have to wait and see.

Ain't got no crystal ball.

Don't worry, be happy.

Lets be realistic, margins will likely be either lower than Q1 or even with Q1 tonight. At this point no one should be surprised to see this.

However, the new factories are ramping, production & deliveries are increasing, the Cybertruck is imminent, COGS should be reducing soon if they aren't already, and the economy is improving and should turn the corner in the next 6-12 months.. Tonight will most likely be the bottom of the barrel, our worst quarter for a long time, so if it comes under expectations then we got it out of the way now. And if we beat then things are going even better than expected.

Either way, the future is super bright and long term this is just a cobblestone along the path to becoming the world's largest company by marketcap. It's important to keep that in mind.

However, the new factories are ramping, production & deliveries are increasing, the Cybertruck is imminent, COGS should be reducing soon if they aren't already, and the economy is improving and should turn the corner in the next 6-12 months.. Tonight will most likely be the bottom of the barrel, our worst quarter for a long time, so if it comes under expectations then we got it out of the way now. And if we beat then things are going even better than expected.

Either way, the future is super bright and long term this is just a cobblestone along the path to becoming the world's largest company by marketcap. It's important to keep that in mind.

Tesla has access to a lot more info that I/we do, and I'm sure that if they were seeing an "epic collapse of demand" they wouldn't be submitting plans to double their factories in both Shanghai and Germany. Yes, the economy is tough right now, and yes, interest rates are too high, but I'm seeing more Teslas on the road now than ever before, and I have more friends either driving them or interested in buying one that ever before.the epic collapse of demand in the 2nd half of 2022

Did you see my last post? Used car prices for Tesla don't rise / fall after price cuts, they happen at the same time if not earlier. All you have to do is look at the 2nd half of 2022 plunge in Tesla used car prices that happened way before any price cuts.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

All those irresponsibly fear mongering are awfully quiet nowadays "Deflation"teslamotorsclub.com

I didn't imply causation, nor is it needed. I am implying both affected by another variable - demand - which itself is affected by myriad of items, primarily including the unprecendented rapid rise in interest rates (just as Elon acknowledge in the past week has effect on auto demand).

Let me be clear, I am a long-term bull. I watched this forum for years but only signed up after realizing not enough voices were heard on some issues, like the epic collapse of demand in the 2nd half of 2022. I mean this forum mostly ignored any warnings or signs of potential decline in demand, which ulimately led to massive downward revisions to 2023 earnings estimates, then massive downward pressure (more than macro) on the share price. I personally think we should be aware of such issues. This is not instigating FUD.

IMO the market is aware of this, and mostly waiting to see how much COGs can be reduced. This, and energy revenue and margin growth progress.

By mid-late 2022, wasn't just about everybody aware that new Tesla buyers would soon be eligible for the $7,500 tax credit again starting January 2023?

Sounds like good justification for used Tesla prices in the US to start dropping in late 2022 (why buy used at top-dollar "today" when we can get new with a tax credit in a few months?).

Also sounds like good justification for US-specific new sales to slow a bit in 2022 as people waited for the credit -- I'm not sure if they actually did slow in the US, but we do know that Tesla managed to continue to grow sales globally through 2022 and into 2023, so at worst Tesla just had to shift around some imports/exports in some regions.

And, given that Tesla is the only manufacturer producing 100% EVs, the re-start of the tax credit sounds like a good reason why Tesla's used car prices would drop more than other manufacturers. Tesla is the only manufacturer where almost 100% of their new cars in the US suddenly became eligible for a $7,500 tax credit, which would naturally drop the price of the used cars too.

*Edited for spelling/grammar

Last edited:

OTOH, if there was ever a time to snare a bunch of over-zealous shorts, this could literally fry some hair.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M