Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

2daMoon

Mostly Harmless

As for the target practice CT, it would have been really kewl if they had carefully aimed to spelled out Cybertruck in the futuristic style used in the logo.

Maybe Optimus Sub Prime could have managed that trick with the sub-machine gun?

Perhaps we will see the limited edition slugs, each encased in a transparent material, soon being sold in the Tesla store?

Maybe Optimus Sub Prime could have managed that trick with the sub-machine gun?

Perhaps we will see the limited edition slugs, each encased in a transparent material, soon being sold in the Tesla store?

Not enough credit is given to #Tesla ATM. They’re hitting some seriously epic milestones:

- Best selling car worldwide

- 5 million sales total, 1 million in Europe, - 4680 production milestones with new cell

- Doubling of AI supercomputing in a single quarter

- FSD 12 being full neural network

-Energy margins being way above expectations, 90% energy growth YoY.

- Supercharger becoming the de facto standard in America.

- Best priced EVs for quality and features.

- Optimus seeing way better than expected

WS can complaint all they want, they simply lack the understanding.

I hope they just sell, they can FOMO in later, we know how this tune goes.

Yep, Tesla the company is doing extremely well. The long term thesis is still very much intact and growing stronger every week.

ShareLofty

Member

If Tesla isn’t going to spend their ever increasing cash hoard on building GigaMexico then Uncle Leo would like a stock buy back please.The decision to delay Giga Mexico and gently ramp Berlin and Austin is surprising to me. Only a couple of quarters ago the guidance was that production growth would continue at maximum speed. I think Elon had said something like "pedal to the metal, rain or shine". Why such a major change of direction now? Tesla also has even more liquidity now than when he said that. Further, if affordability is the primary challenge, wouldn't that increase the importance of Gen 3 production in Monterrey?

Almost a decade ago (>8 yrs) my P85D was at Tesla to install Ludicrous. I was in an airport in France walking to board my flight when I had a message that they'd lost my key fob and needed me to authorize non-key driving, which i did during my walk down the boarding gate. Since the beginning Tesla has done improbably good things, often with no notice.Just got a notification, Software update 2023.27.7/FSD Beta v11.4.7.3 now available. So I pushed the button.

Car is at home in Seattle.

I'm in Italy.

You just gotta think there's something special about this company, don't you?

Now with a sellers festival underway it is good to remind ourselves, isn't it?

HODL

Elon's been scarred by 2008 .... it seems obvious that buy back ain't happening until interest rates are down again ...If Tesla isn’t going to spend their ever increasing cash hoard on building GigaMexico then Uncle Leo would like a stock buy back please.

Not sure why they can't try stoking demand by selling Ads though .... it would even benefit Twitter. Just try it and use AB test, data etc to prove the naysayers wrong ...

Last edited:

you all know the stock is not gonna bottom until names start flying and at least 3 people threaten to leave, right? What is all this optimism nonsense Im seeing? Come on. We have roughly 36 hours to make up for lost grounds. How about that operating margin huh? Whats up with that?

Last edited:

dhanson865

Well-Known Member

Nice post, but this statement simply isn't true. I think you got confused by TTM delivery numbers.

Deliveries this year have so far been 1,324,074. So to get to the 50% CAGR number of 1,686,309, Tesla has to deliver 362,235 vehicles in Q4. That should be easy, all things considered. They've delivered more than that in each of the last four quarters.

I read it as 2023 Q3 YTD even though it clearly says 2023 Q3 TTM. When I first saw it that was the only logical 2023 Q3 bar that made sense to me. I never considered switching to TTM instead of showing partial year or partial + estimated.

I do think it could have been made more clear on the chart that 2023 wasn't actual numbers or a prediction.

He could have put the 4 quarters in blocks for the 2023 column and labeled them (or put the 3 quarters of 2023 in a block and the 1 quarter for 2022 in a separate block). It would have been uglier but there would have been no confusion.

It would be simpler to add a text disclaimer to the bottom. A full sentence saying that the 2023 numbers aren't actual.

Last edited:

It true, double game over for everybody else.The Electric Viking is out on UTUBE saying Tesla has filed papers in Holland for a Ludicrous version of the Model 3. Anybody know if this is true or hot air?

I dont think yoiu have to be a macroeconomics nerd to get the impression that interest rates are high, and will not stay high forever. If I had to finance a new car, and it was not SUPER urgent, I would definitely hold off on buying one for as long as I could.

Same with houses. I know 4 people trying to sell houses in our village (a record!) and none are moving. There is zero interest. People are not nuts, they can do basic math, or they know someone who can. Cars and Houses are the two biggest purchases for most people. The decisions they make on those purchases define their medium term standard of living.

I don't think its at all surprising that new car sales are struggling in this environment.

I also think this screws over ICE makers EVEN MORE! If you are *not sure* about taking the plunge for an EV, but tempted to delay your purchase by 6 months anyway due to interest rates and an uncertain economy, then you may also think that by then you might be in a position to get an EV instead of another ICE car. The tech will be better, and cheaper, and you might have saved some cash while you wait.

I'm very much looking forward to Q3 and Q4 reports from the legacy car companies. Some interesting comparisons with Tesla's finances are only days or weeks away. Then cybertruck!

I disagree because interest rates are not high. They are more or less back to what they were for over a decade before the 2008 financial crisis. For the last 15 years interest rates have been historically low. First due to the financial crisis, then they started creeping up again until COVID smacked them back down. They are obviously higher than what we have become used to the last dozen years or so, but I would not consider them to be high in a historical sense.

Last edited:

True, but you are not going back far enough. While volatile for periods, about 3.5 to 4% would be more normal than about the 5.5%+ we have today: https://advisor.visualcapitalist.com/us-interest-rates/I disagree because interest rates are not high. They are more or less back to what they were for over a decade before the 2008 financial crisis. For the last 15 years interest rates have been historically low. First due to the financial crisis, then they started creeping up again until COVID smacked them back down. They are obviously higher than what we have become used to the last dozen years or so, but I would not consider them to be high in a historical sense.

View attachment 984121

KBF

Model X owner (formerly Cdn Signature Model S)

Do you have a chart that would show per capita indebtedness? I haven't seen the stats directly, but from what I understand, due to the historically low interest rates over the past dozen years, the average citizen is far more in debt than in the past.I disagree because interest rates are not high. They are more or less back to what they were for over a decade before the 2008 financial crisis. For the last 15 years interest rates have been historically low. First due to the financial crisis, then they started creeping up again until COVID smacked them back down. They are obviously higher than what we have become used to the last dozen years or so, but I would not consider them to be high in a historical sense.

View attachment 984121

My thought is that while the actual rates are not at historical highs, the impact at these levels may be equivalent to a much higher historical rate. (So you both could be correct)

GhostSkater

Member

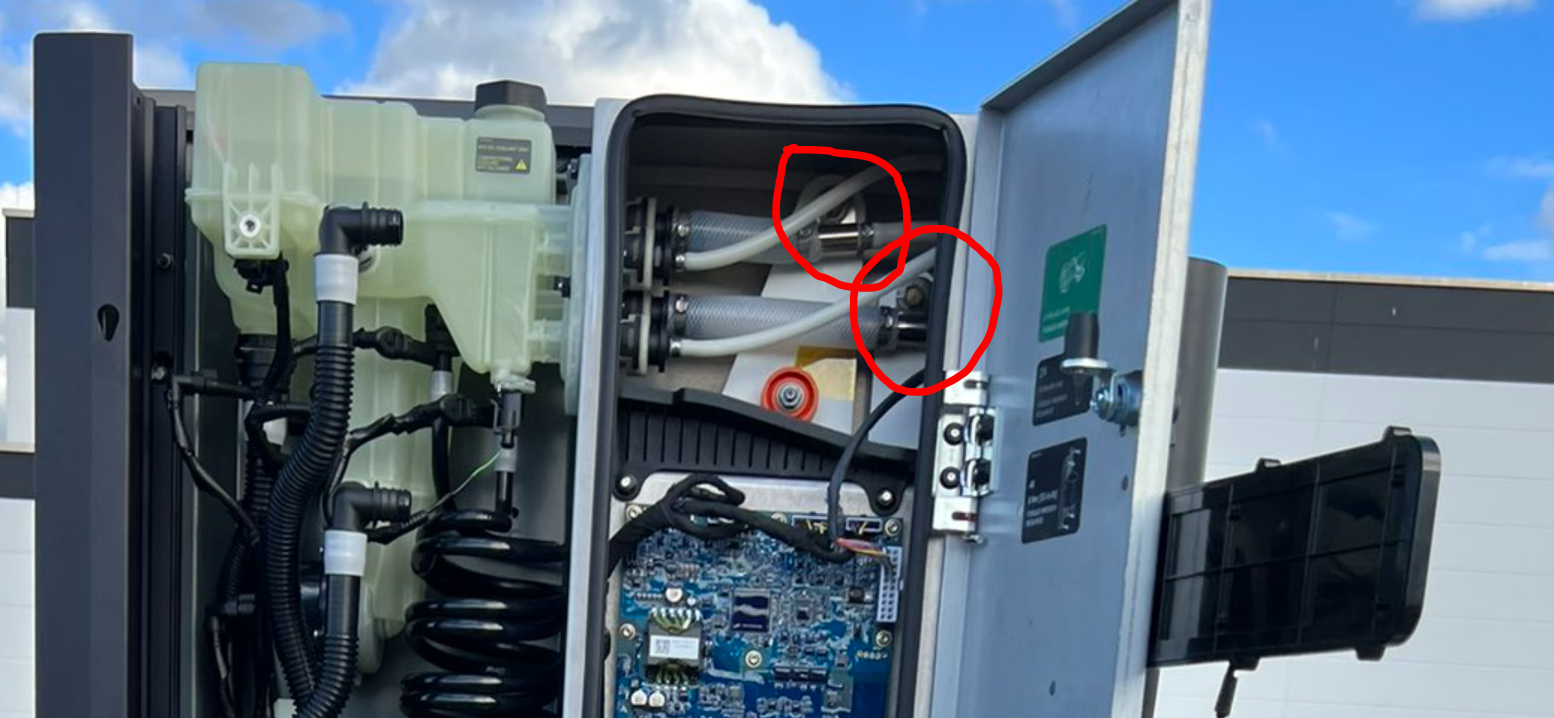

Pretty cool pic of the V4 Supercharger stalls, you can see where the immersion cooling cable ends and is connected to the bus bars

Small white tubes are the inlet that goes to the handle and the thick ones are the return which comes from inside the HV conductors

Small white tubes are the inlet that goes to the handle and the thick ones are the return which comes from inside the HV conductors

B

betstarship

Guest

I disagree because interest rates are not high. They are more or less back to what they were for over a decade before the 2008 financial crisis. For the last 15 years interest rates have been historically low. First due to the financial crisis, then they started creeping up again until COVID smacked them back down. They are obviously higher than what we have become used to the last dozen years or so, but I would not consider them to be high in a historical sense.

View attachment 984121

From what I can tell, the ones in a tizzy over it are the ones that want to get rich quick - especially in the media

Words of HABIT

Active Member

Are you sure that is ballistics testing, or is it simply Franz playing handball against the Cybertruck.

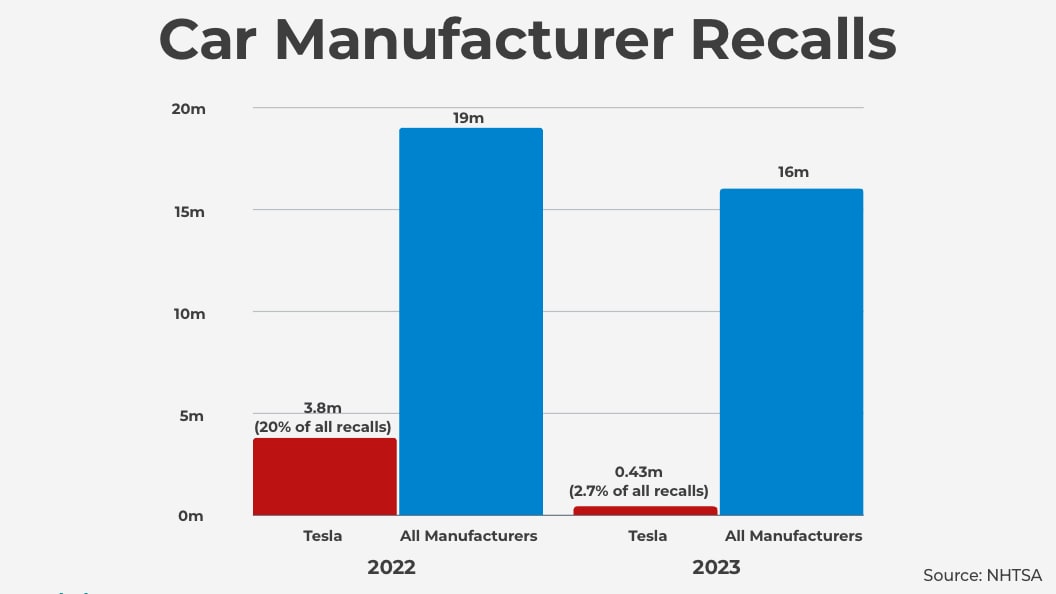

Tesla's Dramatic Decline in Recalls: From Millions to Thousands

Explore how Tesla's significant reduction in recalls showcases its commitment to quality and innovation, setting new standards in the electric vehicle industry.

jkirkwood001

Active Member

It's almost the other way round. I mean, I can vacuum my home (iRobot) or open my garage door from another country too, and that's only products that cost a couple of hundred dollars (and iRobot also auto-updates OTA). What's so surprising is how legacy OEMs, with their highly outsourced supply chain and poor innovation, are unable to master remote control like Tesla (or is it so surprising?).Just got a notification, Software update 2023.27.7/FSD Beta v11.4.7.3 now available. So I pushed the button.

Car is at home in Seattle.

I'm in Italy.

You just gotta think there's something special about this company, don't you?

Last edited:

Maybe Optimus Sub Prime could have managed that trick with the sub-machine gun?

Maybe, but I wouldn't want to be in the vicinity. Probably not the sort of imagery they'd want for Optimus just yet.

If robotaxis exist by then and the ROIC on a robotaxi really is close to 12 months then Tesla printing a bunch of robotaxis they own outright would be a much better use of money than dividends or buybacks.Elon's been scarred by 2008 .... it seems obvious that buy back ain't happening until interest rates are down again ...

Not sure why they can't try stoking demand by selling Ads though .... it would even benefit Twitter. Just try it and use AB test, data etc to prove the naysayers wrong ...

Edit: Also true of optimus

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M