Option Sniper isn't always correct. But he's pretty goodWhat's this battle at $264/265 all about? I see that Option Sniper notes it as critical. Pulitzer doesn't mention it at all. Getting above yesterday's open? Seems like a nicely positive day regardless that it's hard to understand how it will cause a huge fade if not closing over $264. Any thoughts?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

"Yeah, our default plan is we pay – we start paying off our debts. I don't mean refi-ing them, I mean paying them off. For example, there's a convert that's coming due soon, a couple hundred million, (42:13) $900 million, (41:28) something like that. We expect to pay that off with internally generated cash flow."

@brian45011 do you believe they will be able to do this?

@adaptabl clearly doesn’t, based upon yet another snarky “funny” rating.

but then again, adaptabl hasn’t contributed one sliver of meaningful information to this forum. worthless. unless we’re just not worthy of adaptabl’s analytical prowess?

Last edited:

bdy0627

Active Member

Great info. Thanks. It seems that often stocks dip down close to a key support level at the range low but don't quite get there. The perfect set up would be hitting it and bouncing, but often they just get close and bounce, assuming they bounce. A nice bounce just above the support level seems ok to me.I like to combine his input with others. We had a low of 244 in spring so getting close to this yesterday at 249 is almost a double bottom (almost, not exactly it but really close). getting to a double bottom indicates a price price movement of some magnitude incoming. As someone else stated on the forum, getting down pass that 244 barrier would lead to something in the 220ish (if that holds). So 264 is only a target needed to achieve if you want to play short term movement. I feel I have to add that option_sniper said ''remember it needs to close above 264 to confirm a bottom otherwise still chance to down big''. ''Still chance'' means that the short term price movement from a technical perspective is not doomed if we don't close above 264, but that 264 IS a strong indicator that we are clear to move up.

So if there is a short/long fight today for the price action not to go down again to 255, 250 244 and bellow, my humble take about his comment is that we have to win this 264 battle or we will face a possibility for next days to go back and test the bottom again (244) where there will be another battle to know if we break down.

Tslynk67

Well-Known Member

Tend to agree except $315 is above the battleground $310ish level. I think it either chops between $300-310 or if it gets above that level, then it probably doesn't stop at $315. That would surprise me a little at this point but not a lot.

You could be right, plus you always have to factor in that I know absolutely nothing - in the 2.5 years I've been hanging around here, I haven't predicted anything correctly

I expect the SEC matter to be resolved by end of the week - either they'll write the statement and that's that, or the judge will adapt the settlement one way or the other - given precedents, ought to be in Elon's favour. In ay case, resolving it should add 10% bak to SP.

I think it will be longer than that... Not to mention the possible other SEC investigations that may or may not be in process.

Buckminster

Well-Known Member

Are we in a parallel universe versus the rest of the world?

(Rick and Morty for Elon watching over us)

So shorts have turned the entire world to their will via terrible media - I get that.

However, what I can't account for is proper investors. There are more than enough to have pushed TSLA up further than this. They are mostly not stupid, they want money, they have analysis skills and have read the Macquarie analyst’s recent note etc. Some of the more diligent will have even reviewed Luvb2b's model and tried to find out what is wrong with it. We are inherently a subjective bunch trying to be as objective as possible. Are we missing something? I have felt like this for sometime but this earnings release is surely when it comes to a head.

Elon's tweets and everything else is in the noise in terms of long term SP - either we are right or we are wrong.

So shorts have turned the entire world to their will via terrible media - I get that.

However, what I can't account for is proper investors. There are more than enough to have pushed TSLA up further than this. They are mostly not stupid, they want money, they have analysis skills and have read the Macquarie analyst’s recent note etc. Some of the more diligent will have even reviewed Luvb2b's model and tried to find out what is wrong with it. We are inherently a subjective bunch trying to be as objective as possible. Are we missing something? I have felt like this for sometime but this earnings release is surely when it comes to a head.

Elon's tweets and everything else is in the noise in terms of long term SP - either we are right or we are wrong.

SpudLime

Active Member

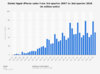

So each time a new iPhone comes out there are people line up outside of the store waiting for hours to get the phone. And after the line disappeared did iPhone sales fall off a cliff?

In a word, yes.

Attachments

In a word, yes.

Um...

That dataset just looks like people are more prone to purchase expensive electronic devices in Q4...the exact same pattern that nearly all consumer electronics follow.

Unfortunately the link isn't working for me. So I take it affected vehicles are not allowed to be driven on certain Berlin roads? What is the expected impact?

Tesla owners smiling while enjoying the acceleration of their vehicles?

Are we in a parallel universe versus the rest of the world?

(Rick and Morty for Elon watching over us)

So shorts have turned the entire world to their will via terrible media - I get that.

However, what I can't account for is proper investors. There are more than enough to have pushed TSLA up further than this. They are mostly not stupid, they want money, they have analysis skills and have read the Macquarie analyst’s recent note etc. Some of the more diligent will have even reviewed Luvb2b's model and tried to find out what is wrong with it. We are inherently a subjective bunch trying to be as objective as possible. Are we missing something? I have felt like this for sometime but this earnings release is surely when it comes to a head.

Elon's tweets and everything else is in the noise in terms of long term SP - either we are right or we are wrong.

Longs only have so much money. Once we buy as much TSLA as we can, we no longer influence the stock price.

The SP movement is then based only on the actions of non-multi-year holders.

My wondering is how many shares are really in play, and how many times they trade hands to get to the day's volume.

CT changes it’s EV rebate on the fly from 60,000 msrp before options to 50,000

affects dual motor tesla, bmw e, volvo something or other

BEV dropped from 3k to 2k

PHEV from 2k to 1k

FCEV unchanged at 5k (not sure a FCEV is even registered in Ct)

DEEP: CHEAPR - FAQ

at glance it looks like equal opportunity attack, but it’s clearly targeting tesla. bmw volvo don’t give a damn about their partial hybrids. they are sitting on inventory since the dual motor model 3 (no longer eligible for state rebate) is cleaning their clocks the last two months)

CT circling the drain on the way to BK..

still “illegal” to have a tesla showroom in this corrupt and directionless state. tax base eroding, people and business leaving in droves. we were able to backfill some of it, but it’s not where it was before 2008, and the pop is transient near the ny border (more new renters than new buyers)

another state in denial, staring into the abyss, while the corrupt politicians grab every nickel they can while still in power. pathetic.

affects dual motor tesla, bmw e, volvo something or other

BEV dropped from 3k to 2k

PHEV from 2k to 1k

FCEV unchanged at 5k (not sure a FCEV is even registered in Ct)

DEEP: CHEAPR - FAQ

at glance it looks like equal opportunity attack, but it’s clearly targeting tesla. bmw volvo don’t give a damn about their partial hybrids. they are sitting on inventory since the dual motor model 3 (no longer eligible for state rebate) is cleaning their clocks the last two months)

CT circling the drain on the way to BK..

still “illegal” to have a tesla showroom in this corrupt and directionless state. tax base eroding, people and business leaving in droves. we were able to backfill some of it, but it’s not where it was before 2008, and the pop is transient near the ny border (more new renters than new buyers)

another state in denial, staring into the abyss, while the corrupt politicians grab every nickel they can while still in power. pathetic.

dqd88

Member

Currently there are macro factors pressuring prices - trump-china, int rate rise, and mid term elections - that's suppressing prices across the board. Then w/ Tesla there's the tweets and SEC. Remove those things and the SP is prob > $300.Are we in a parallel universe versus the rest of the world?

(Rick and Morty for Elon watching over us)

So shorts have turned the entire world to their will via terrible media - I get that.

However, what I can't account for is proper investors. There are more than enough to have pushed TSLA up further than this. They are mostly not stupid, they want money, they have analysis skills and have read the Macquarie analyst’s recent note etc. Some of the more diligent will have even reviewed Luvb2b's model and tried to find out what is wrong with it. We are inherently a subjective bunch trying to be as objective as possible. Are we missing something? I have felt like this for sometime but this earnings release is surely when it comes to a head.

Elon's tweets and everything else is in the noise in terms of long term SP - either we are right or we are wrong.

I think also, psychology plays a big role. Many people sell, not because of any inherent change to the fundamentals, but solely because they think others will sell.

Now we're all gonna regret not buying at 250.

I decided not to buy around 250 due to the record (approximate) number of shares available for shorting, which could have been short sold to depress the SP. Well, that and the fact that I have to use any dust found at the bottom of the powder keg sparingly...

Does anyone know what actually happened in Shortville overnight, with IB's number dropping by close to two million shares?

pyromatter

Member

Bloomberg - Are you a robot?

Tesla Inc. failed to pay $655,000 to Nevada’s Unemployment Compensation Fund, the state alleges in a lawsuit filed in Las Vegas on Monday.

According to a liability statement filed with the state court, Tesla underpaid for both the quarter ended March 31 and the quarter ended June 30, when the carmaker had $68 million and $55 million in taxable wages, respectively.

Tesla Inc. failed to pay $655,000 to Nevada’s Unemployment Compensation Fund, the state alleges in a lawsuit filed in Las Vegas on Monday.

According to a liability statement filed with the state court, Tesla underpaid for both the quarter ended March 31 and the quarter ended June 30, when the carmaker had $68 million and $55 million in taxable wages, respectively.

JB has been maintaining a low pubic profile,

Yes, I fully expect him not to appear as the subject of a book titled 'Full disclosure'.

Intl Professor / Entomology Professor

We often use metaphors from other systems to understand our own, albeit, argument by analogy distrusted by Musk. Hence a swarm of shorts or a gaggle of longs. In international politics the best are from child behavior. Now that is reminiscent of Congress as well. The saving grace for children, however, is their endless curiosity. Like cats, my dear Krugerrand.

tivoboy

Active Member

Hmm, underpaying withholding taxes and UC fees is usually the purview of startups.. in the 2000/2001 years.Bloomberg - Are you a robot?

Tesla Inc. failed to pay $655,000 to Nevada’s Unemployment Compensation Fund, the state alleges in a lawsuit filed in Las Vegas on Monday.

According to a liability statement filed with the state court, Tesla underpaid for both the quarter ended March 31 and the quarter ended June 30, when the carmaker had $68 million and $55 million in taxable wages, respectively.

@brian45011 do you believe they will be able to do this?

@adaptabl clearly doesn’t, based upon yet another snarky “funny” rating.

but then again, adaptabl hasn’t contributed one sliver of meaningful information to this forum. worthless. unless we’re just not worthy of adaptabl’s analytical prowess?

I really think it will be a long time before Tesla generates free working capital. It looks like Tesla is a close to it's maximum production volume possible in it's current plant. The sales values are at close to maximum right now as Tesla transitions into more value priced cars. Expenses will continue to rise to support the increased number of cars sold as warranty cost increase. There is a significant amount of debt to service and as interest rates increase that will also put more pressure in earnings. There is need for investment in new plants and R and D. Maybe I am wrong but it is my belief.

humbaba

sleeping until $7000

Bloomberg - Are you a robot?

Tesla Inc. failed to pay $655,000 to Nevada’s Unemployment Compensation Fund, the state alleges in a lawsuit filed in Las Vegas on Monday.

According to a liability statement filed with the state court, Tesla underpaid for both the quarter ended March 31 and the quarter ended June 30, when the carmaker had $68 million and $55 million in taxable wages, respectively.

Its sad when my first thought on seeing that is, "is it real, or just more manufactured crap."

If there's any validity to the claim then the first presumption is that it was a paperwork mix up.

But I've been on the receiving end of state revenuer -- and they ignored my quoting the law chapter and verse and simply repeated that I owed back taxes. They didn't stop until I got a senator involved.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 137

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K