The transition will be very different based on location. In some European countries and California ICE sales could plummet in less than 5 years. In Norway it's already happening. The various rebates provided by goverments does make a difference. EV transition would be slower without them. Politicans are doing something right even though they should be doing a lot more.

Damn, I whish that Sweden had some spare billions from an oil fund like the Norwegians have. Instead we have Volvo churning out diesels like there's no tomorrow with no EV's in sight despite all the promises.

Eventually, when it becomes obvious to a critical mass of people that ICE automobiles are heading toward impending obsolescence, the depreciation rate on ICE automobiles will begin to increase dramatically and it will tank ICE sales.

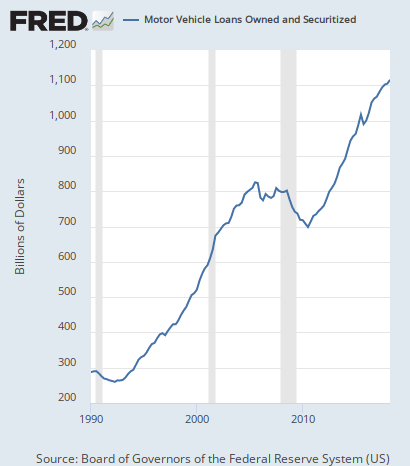

The collateralization model of automobile financing is dependent on a certain depreciation rate, so that at any given time most loans are not underwater. If depreciation starts to increase massively, say goodbye to no down financing, low APR, and longer term debt notes (ie 72 months), Trade-in value collapses, etc.

Put simply, the amount of ICE car that a perspective new car buyer can purchase with a set level of monthly payments will plummet as the "amount" of EV they can buy goes up and up. A lot of people getting put upside-down on ICE debt will leave bad tastes in their mouths for ICE automobiles. I personally believe this will create a small financial crisis in the not-to-distant future.

I think this will begin at around EV sales of ~3 million a year, and it will tank overall US sales to around 9-10 million a year (from 16 million).

Autonomous cars are also a monkey wrench that could turbocharge this effect, because one autonomous car can replace several owned cars, leading to a giant surplus of used ICE vehicles (And autonomous ICE cars are uncompetitive from day one). This is why I also think that sales will stay at the 9-10 million range, as a good chunk of those will be fleet autonomous cars replacing the capacity of several personally owned ones.

A lot of people don't realize how market reflexivity can massively increase the death spirals of old technology.

The total demand for motor vehicles will drop worldwide by about half, IMHO. Less so in developing countries because low-cost autonomous ridesharing will lower the cost ceiling of transportation and grow the user base by larger amount than the drop in individually owned demand decreases it. Large exporter of ICE automobiles will probably get rekt economically in this circumstance (Japan, Germany, etc.).

My own personal opinion is that the car market of the 2030s will resemble the phone market of today. Tesla will occupy Apple's spot, it will control it's supply lines and software, and dominate the higher end of the market, and the lower end of the market will be dominated by cheap Chinese EVs using third-party (Google, Apple, etc.) software.

Ross GerberVerified account @GerberKawasaki

Ross GerberVerified account @GerberKawasaki