I think we will close above 295. But why they try this hard today to cap 296? 4 times today the SP was over 296 but got push down right away. Anyone?

Now that the trading is over for this week, I would appreciate if someone could to try to explain an honest novice question regarding this selling.

If I understand the above post correctly, it implies that some unknown trader is deliberately selling significant amounts of stock within a short time, with the reasonable expectation that this sudden extra supply will cause the SP to drop. It seems to also be an accepted understanding here, that the bulk selling happens while the SP is trending upwards, disrupting that trend.

This trading pattern is thus described to me in a way that implies that it is a deliberate money losing activity (since it should be preferable to not sell the stock while it is trending upwards).

The trader can hardly expect to be able to resupply (i.e. buy back the same stock) within the same time frame because that extra demand would cause the price to go back up, thus negating the whole (implied) premise of the bulk selling.

So there must be a trader out there, who in advance and in small portions (to not cause the SP to increase) buys up a significant amount of stock, just to be ready to dump it, right when it seems like a good idea to hold on to it.

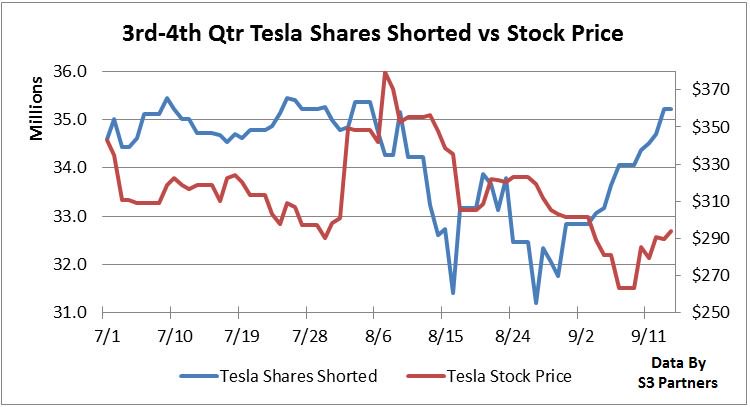

Or is it a trader with some serious collateral that short sells the large amounts of stock, causing the SP to fall, after which they can hope to buy it back at the new lower price (but running the risk of not managing that and instead having to cover at a loss)?

Since stock trading is all about making money, who would engage in such a seemingly suboptimal trading scheme?

I will speculate myself, that it could be someone who is willing to risk sacrificing money while trading TSLA, in order to win (or avoid losing more) in a different arena, maybe a different stock that stands to incur greater losses should the TSLA SP increase too much.

Any actually informed guesses (unlike my own) to this conspicuous selling would be appreciated.

Thanks.