tivoboy

Active Member

Seems like it would be complimentary, probably why they are located in NV.How do they compare/compete with Redwood Materials?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Seems like it would be complimentary, probably why they are located in NV.How do they compare/compete with Redwood Materials?

They use a different process, non-melting, if I recall correctly. So they use less energy than Redwood. I'm sure there are other things that stand out, but that's the one I remember from the top of my head.How do they compare/compete with Redwood Materials?

How do they compare/compete with Redwood Materials?

I just skimmed through their June 30, 2023 yearly report. At the time they had $2.3M in the bank and had just spent a bunch of money and shares to acquire a recycling company and Nevada lithium mining rights. It will take them on the order of 5 years to make any money from the lithium mining. To date, they haven't demonstrated any recycling output. Recycling is complicated and hard to do profitably. You almost need specific processes for each type of feedstock. Recycling consumer batteries vs EV batteries is worlds apart. And in the end, you have some commodity that needs to be graded for purity and sold for relatively cheap.Redwood seems to only do recycling. ABTC is recycling and mining with one of the largest inferred lithium deposits in the world.

In regards to the recycling:

While I don't know too much about Redwood, I believe the main difference in ABTC is their recycling technology.

* Doesn't use high temperature operations.

* Has a higher recovery rate.

* Low capital costs through avoidance of high-temperature operations and minimal generation of waste.

* Partnership with BASF (won awards and DOE grant money based on recycling tech). etc

But the bigger difference is the ABTC primary extraction technology. From their website "ABTC has been designing and optimizing our internally developed sustainable lithium extraction process for the manufacturing of battery cathode grade lithium hydroxide from Nevada-based sedimentary claystone primary resources. We currently are in the final stages of our lithium exploration program for our Tonopah Flats Lithium Exploration Project and have identified significant lithium mineralization covering a large portion of the project area."

They have just recently uplisted to NASDAQ and I wish I had just discovered them now as the stock has been pretty beat up with them being pre-revenue. However, IMO they are way more de-risked now than when I started investing...ultimately, they need to show revenue and a clear path to growth and I think they are finally getting to that stage with the commencement of their recycling facility and progress on their lithium deposit extraction.

One of my core holdings.Any good stocks in this space?

another suggested stock in this thread. We should change the thread to "other stock to short"

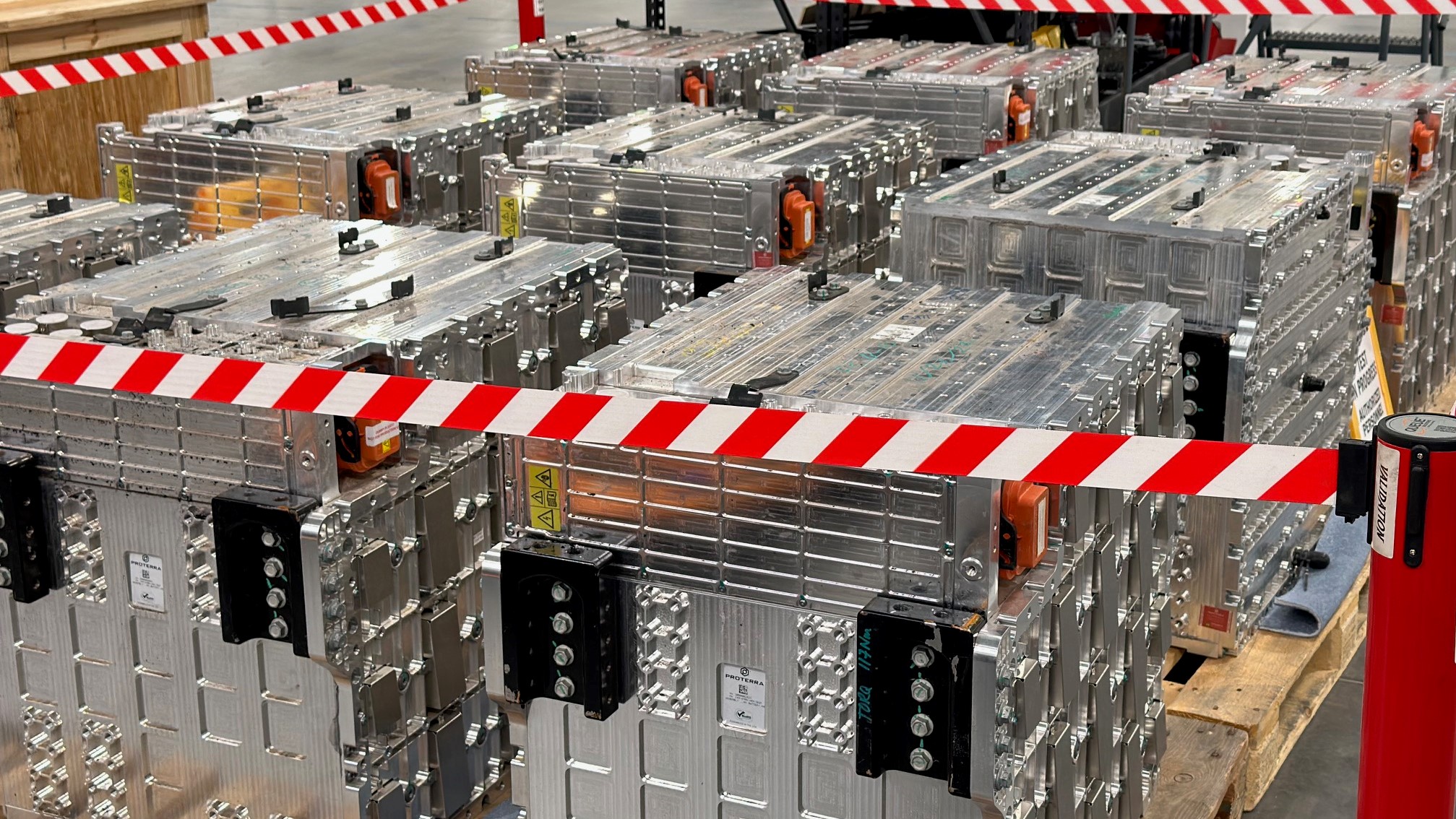

Electric Vehicle Tech Manufacturer Proterra Files for Bankruptcy

www.freightwaves.com

www.freightwaves.com

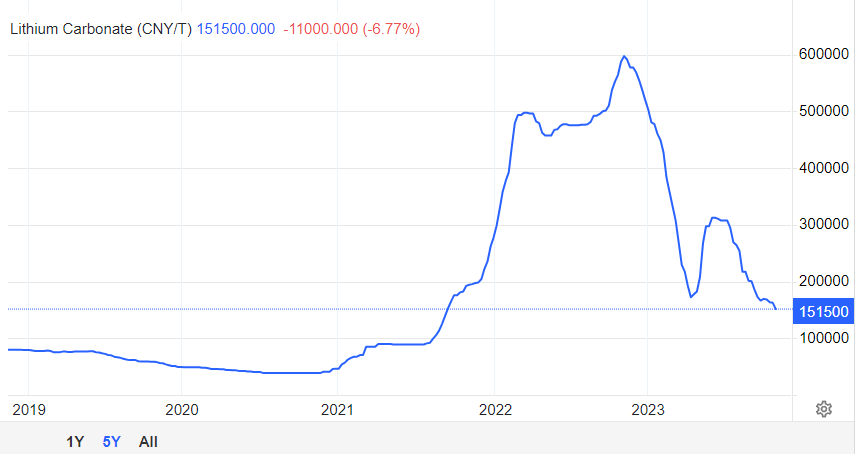

The Electric Viking just did a video on Lithium supplies Yesterday and why car pricing is going down.I lay out my thesis to buy any stock related to lithium here:

The Resource Angle

In listening to the other analysts at that conference, its interesting that they've commented that Tesla just doesn't seem to be interested in doing ANY equity investments in mining. Hard rock, brine or DLE. Instead all they do is make occasional offtake agreements (ie. purchase contracts).teslamotorsclub.com

Link? I looked at his channel and couldn’t find it.The Electric Viking just did a video on Lithium supplies Yesterday and why car pricing is going down.

Thanks for the tip about Samsara! Their products look useful and I think they make sense.They almost turned profitable this past quarter, but they for sure will this current quarter. Stock price up 45% since I posted this.

he tip about Samsara! Their products look useful and I think they make sense.

I also bought a few hundred shares and will certainly hold on to them for a while, the company still seems to be growi

Why market correction next year? I am thinking market will be up by end of year compared to now.Happy end of the year all !

For the record, I’ve sold my entire Spotify position. Bought around $125 last spring and mentioned it on this tread. Bought more around $173.

I think 1st half of next year, we may get a broad market correction. I plan to rebuy in the new year as a long term hold. Still holding my Tesla shares of course, sold none.

Hard to time the market, but the writing seems to be on the wall.

Again best to all of you, and see you in the new year. 2024 will be entertaining if nothing else!

Why market correction next year? I am thinking market will be up by end of year compared to now.