But is there any benefit buying via that program vs. just ordering on the website apart from no deposit? As far as I can tell on the German website it's just the standard benefits for EVs and company cars.Another demand lever gets pulled: Corporate fleet sales

Tesla launches its corporate fleet program, claims Model S and X are ‘perfect company cars’

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Doing business in China  Any guess's as to how many cars have been damaged in China over the last couple of years?

Any guess's as to how many cars have been damaged in China over the last couple of years?

Tesla Model Xs fall off Chinese transport truck that broke apart during loading

Tesla Model Xs fall off Chinese transport truck that broke apart during loading

Last edited:

no, but maybe it was...Doing business in ChinaAny guess's as to how many cars have been damaged in China over the last couple of years?

Fast and Furious

The destruction in the 'Fast and Furious' movies would have cost more than $500m in real life

dirtyofries

Member

Doing business in ChinaAny guess's as to how many cars have been damaged in China over the last couple of years?

Tesla Model Xs fall off Chinese transport truck that broke apart during loading

View attachment 219987 View attachment 219988

That hurts to look at.

SunCatcher

Member

Doing business in ChinaAny guess's as to how many cars have been damaged in China over the last couple of years?

Tesla Model Xs fall off Chinese transport truck that broke apart during loading

View attachment 219987 View attachment 219988

I'd hold a candlelight vigil over that there.

racer26

Active Member

FredTMC

Model S VIN #4925

Yeah. Just read it. Driver wasn't paying attention apparently.

dirtyofries

Member

Yeah. Just read it. Driver wasn't paying attention apparently.

Yeah, AP didn't do it. Another misstatement.

racer26

Active Member

Am I the only one starting to get amused by the market not reacting to stories like that anymore?

Like hey, people do dumb things in cars all the time. Most of the time its not newsworthy.

Like hey, people do dumb things in cars all the time. Most of the time its not newsworthy.

I forwarded this to the Illinois governor and the two legislators who represent me in Springfield: California Forges Ahead with Clean Cars Rules

racer26

Active Member

From watching the live feed from SpaceFlight Now, looks like a nominal static fire of SES-10.

Paracelsus

Active Member

nuther Trump committee for EM

The (son-in-law)Kushner SWAT team - new Innovation Office

Trump taps Kushner to lead a SWAT team to fix government with business ideas

Interesting Highlights (but all of it a recommended read)

"

The White House Office of American Innovation, to be led by Jared Kushner, the president’s son-in-law and senior adviser.............

"

While the press will likely have a field day with everything that surrounds this, I must admit I see this has having the potential to be a very positive move. Not only does Kushner embrace technology, but both he and his executive officer (Ivanka) embrace the need to aggressively combat Climate Change (recall the recent spat between Ivanka and Bannon over this - which greatly displeased the POTUS..........and having a daughter I am pretty certain whose side he might be on if push came to shove). So this offers the potential for the Administration to take steps to move on Climate Change using technology without needing the support of their own party or even the Democrats that continue to support fracking, etc.

The irony in all this is that although this Administration continues to disappoint in its environmental and technical messages, surprises like this keep happening that continue to propel opportunities for Tesla Motors, Tesla Energy, and SpaceX - all of which are environmentally positive. I have literally come to the conclusion that it might be a sound way to invest by simply looking for the exact opposite opportunities/themes of the message in any Administration in recent times and ignore all the rest of the the noise as just more static.

dirtyofries

Member

While the press will likely have a field day with everything that surrounds this, I must admit I see this has having the potential to be a very positive move. Not only does Kushner embrace technology, but both he and his executive officer (Ivanka) embrace the need to aggressively combat Climate Change (recall the recent spat between Ivanka and Bannon over this - which greatly displeased the POTUS..........and having a daughter I am pretty certain whose side he might be on if push came to shove). So this offers the potential for the Administration to take steps to move on Climate Change using technology without needing the support of their own party or even the Democrats that continue to support fracking, etc.

The irony in all this is that although this Administration continues to disappoint in its environmental and technical messages, surprises like this keep happening that continue to propel opportunities for Tesla Motors, Tesla Energy, and SpaceX - all of which are environmentally positive. I have literally come to the conclusion that it might be a sound way to invest by simply looking for the exact opposite opportunities/themes of the message in any Administration in recent times and ignore all the rest of the the noise as just more static.

I agree with your sentiments.

I'm a bit concerned about Mr. Kushner's time, given he's been assigned the tasks of:

Fixing the Middle East

Fixing the Federal Gov't

Fixing Business?

All while testifying to Senate committees.

yeah- agree. Although I dislike the continued nepotism and related- I saw this as a positive. And actually think it's a good idea although not likely to be effective given the surrounding circumstances - I still like it conceptually--While the press will likely have a field day with everything that surrounds this, I must admit I see this has having the potential to be a very positive move. Not only does Kushner embrace technology, but both he and his executive officer (Ivanka) embrace the need to aggressively combat Climate Change (recall the recent spat between Ivanka and Bannon over this - which greatly displeased the POTUS..........and having a daughter I am pretty certain whose side he might be on if push came to shove). So this offers the potential for the Administration to take steps to move on Climate Change using technology without needing the support of their own party or even the Democrats that continue to support fracking, etc.

Last edited:

and targeting Thursday for launchFrom watching the live feed from SpaceFlight Now, looks like a nominal static fire of SES-10.

SpaceX

Static fire test complete. Targeting Thursday, March 30 for Falcon 9 launch of SES-10. pic.twitter.com/0tZ7u6gngI

Mar 27, 2017, 2:26 PM

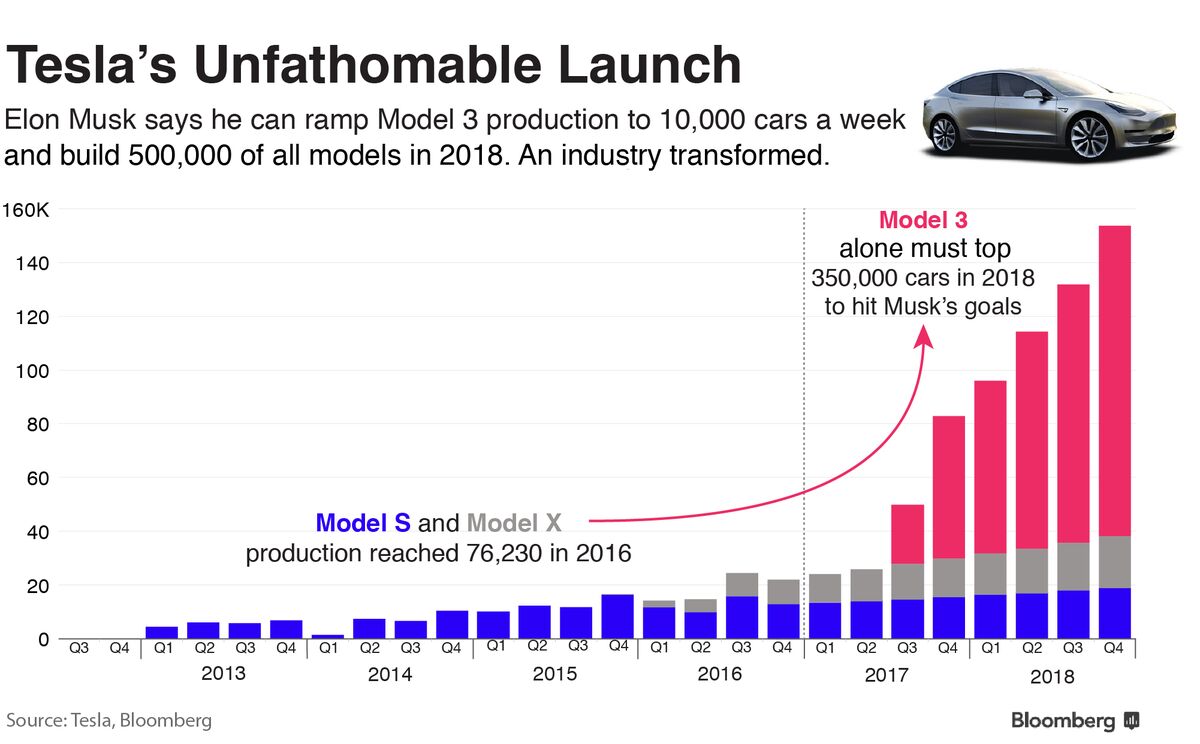

Data point. So our Model X "went into production" on Thursday. Just saturday I got an email from Tesla saying it was completed and being set up to be shipped for delivery. That ramp doesn't seem so implausible to me...

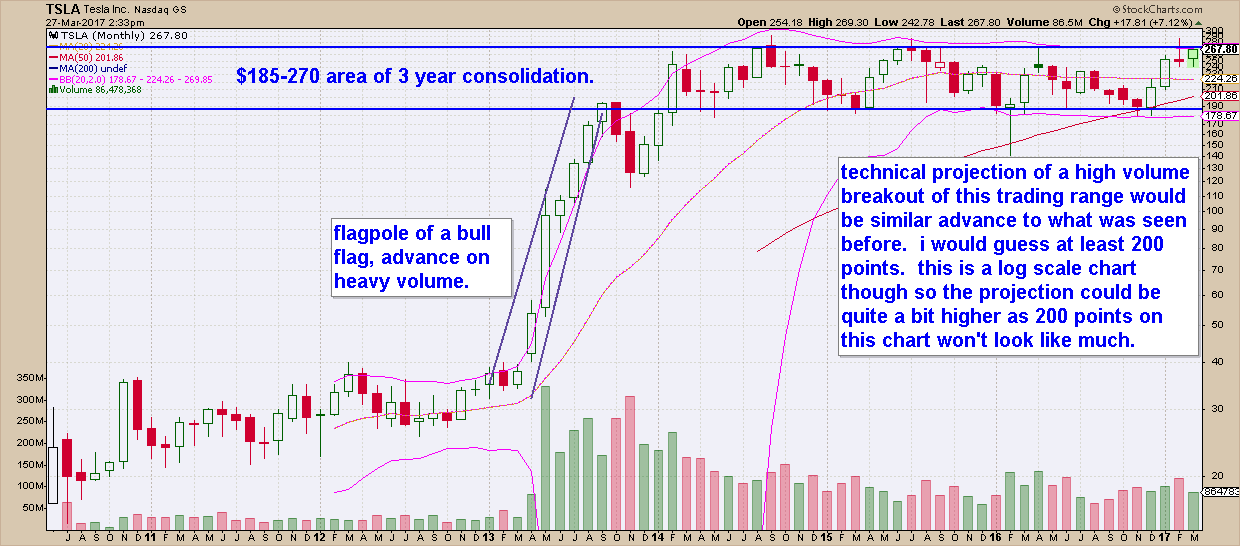

some interesting notes on price action.

1 the price range over the last month has compressed down to < 10% of the share price. this i think is the lowest level since last october and indicates price has found some stability in this 242-262 range.

2 tesla made a new 1 month trading low the day goldman downgraded to sell, feb. 27. today march 27 tesla is making a new 1 month high. if you go back and review all the new one month lows since late 2013, you will see that tesla always made several more fresh 1 month lows before recovering to a 1 month high. so this little action of making a 1 month low and then quickly recovering to a 1 month high, it's not something that's been seen in at least 3 years. this indicates to me a different type of strength to this trend than the trends of the past few years.

3 i've read commentary from other users about the monthly chart setup (maybe @jesselivenomore ). i attached that monthly chart, which looks like an extended bull flag in the making. the narrow (in a log sense) range of the last 3 years implies that a breakout above the range could be quite powerful.

correction, monthly chart was posted by @austinEV - link - mine is practically plagiarizing him

4 the price action is lined up with the fundamental developments of the tesla energy and roof launch and the model 3 ramp.

5 compared to my last involvement with this stock in 2013, this time around awareness seems much higher. i remember elon's twitter account having i think 100k followers back in late 2012/early 2013. this time around he's at 7.5 million. it's almost two orders of magnitude difference.

6 i don't think there's another company running over $5 billion in annual revenue that is on pace to double (or triple) it's revenue run rate over the coming 18-24 months.

7 if they can ever turn a profit for a few quarters, there will be a near certain s&p 500 addition in the future as tesla is one of the largest american companies not in the s&p 500. to see how much that can affect a stock, look at what happened to ulta, which had a much smaller weight than tesla would have. at that point, just about every person with a 401k will be investing in tesla.

4-7 above are the fundamental factors that would drive a dramatic breakout of this 3 year range. the hardest thing for me and what i try to remind myself every day is that the time scale is playing out in months, not days or weeks. so the trade has to be managed carefully to make sure it doesn't wear out one's ability to hang on to an outsized position.

1 the price range over the last month has compressed down to < 10% of the share price. this i think is the lowest level since last october and indicates price has found some stability in this 242-262 range.

2 tesla made a new 1 month trading low the day goldman downgraded to sell, feb. 27. today march 27 tesla is making a new 1 month high. if you go back and review all the new one month lows since late 2013, you will see that tesla always made several more fresh 1 month lows before recovering to a 1 month high. so this little action of making a 1 month low and then quickly recovering to a 1 month high, it's not something that's been seen in at least 3 years. this indicates to me a different type of strength to this trend than the trends of the past few years.

3 i've read commentary from other users about the monthly chart setup (maybe @jesselivenomore ). i attached that monthly chart, which looks like an extended bull flag in the making. the narrow (in a log sense) range of the last 3 years implies that a breakout above the range could be quite powerful.

correction, monthly chart was posted by @austinEV - link - mine is practically plagiarizing him

4 the price action is lined up with the fundamental developments of the tesla energy and roof launch and the model 3 ramp.

5 compared to my last involvement with this stock in 2013, this time around awareness seems much higher. i remember elon's twitter account having i think 100k followers back in late 2012/early 2013. this time around he's at 7.5 million. it's almost two orders of magnitude difference.

6 i don't think there's another company running over $5 billion in annual revenue that is on pace to double (or triple) it's revenue run rate over the coming 18-24 months.

7 if they can ever turn a profit for a few quarters, there will be a near certain s&p 500 addition in the future as tesla is one of the largest american companies not in the s&p 500. to see how much that can affect a stock, look at what happened to ulta, which had a much smaller weight than tesla would have. at that point, just about every person with a 401k will be investing in tesla.

4-7 above are the fundamental factors that would drive a dramatic breakout of this 3 year range. the hardest thing for me and what i try to remind myself every day is that the time scale is playing out in months, not days or weeks. so the trade has to be managed carefully to make sure it doesn't wear out one's ability to hang on to an outsized position.

Last edited:

Paracelsus

Active Member

I agree with your sentiments.

I'm a bit concerned about Mr. Kushner's time, given he's been assigned the tasks of:

Fixing the Middle East

Fixing the Federal Gov't

Fixing Business?

All while testifying to Senate committees.

Let us hope he has enough humility to delegate when possible to non-career politicians that share a similar vision as he and Ivanka share regarding our hopes for the environment, and the technologies that support that effort. It would take little more than that to overcome the challenges of a schedule that is too full, but there always seems to be a rather short supply of humility in DC

End of quarter window dressing should be underway during the remainder of this week. That’s the tendency of money managers to prune away losing stocks and load up on winning stocks before a quarter ends. The snapshot of their portfolios at a quarter’s end then makes them appear to have been smart all quarter long. It may seem silly, but it often prevents their investors from questioning their choices.

TSLA is up 25% so far in the first quarter. It would likely be a beneficiary of window dressing.

TSLA is up 25% so far in the first quarter. It would likely be a beneficiary of window dressing.

- Status

- Not open for further replies.

Similar threads

- Replies

- 7

- Views

- 753

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 458K

- Views

- 50M

- Locked

- Replies

- 27K

- Views

- 3M