JHM

your analysis does not go back far enough, it is a temporal blip.

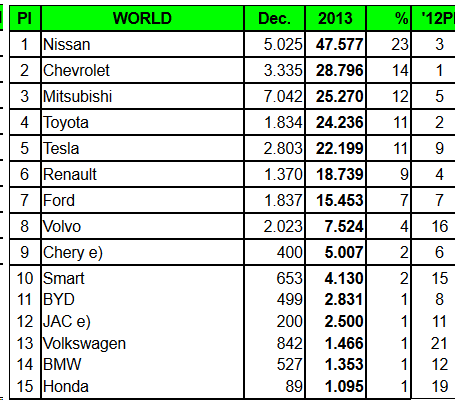

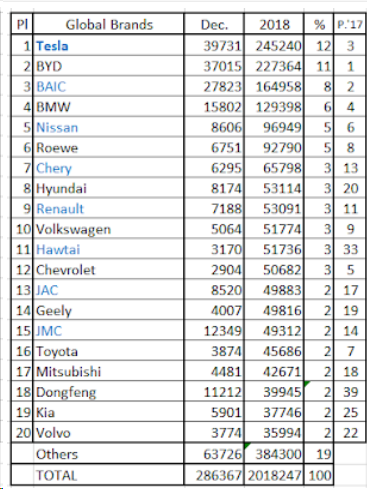

From 2010 to date the trend is strongly reducing market share for the top 3 electrified vehicle makers. This is the China effect, only Tesla is holding market share on a global basis.

the state is play is still very early, that is, individual production jumps from new models have a large effect, this year there will be a major growth in China, as well as the 60kWh class from Kia, Nissan and Hyundai.

China will probably grow to 2 million new energy vehicles for this year's sale. so if China grows to 2 million and ROW grows 50% to 1.65 million, total NEV production for 2019 will be 3.65 million. Tesla will need 440,000 vehicles produced this year just to maintain market share. Can Tesla do that? perhaps, I would predict closer to 400,000 Tesla vehicles, so back to 11% market share.

your analysis does not go back far enough, it is a temporal blip.

From 2010 to date the trend is strongly reducing market share for the top 3 electrified vehicle makers. This is the China effect, only Tesla is holding market share on a global basis.

the state is play is still very early, that is, individual production jumps from new models have a large effect, this year there will be a major growth in China, as well as the 60kWh class from Kia, Nissan and Hyundai.

China will probably grow to 2 million new energy vehicles for this year's sale. so if China grows to 2 million and ROW grows 50% to 1.65 million, total NEV production for 2019 will be 3.65 million. Tesla will need 440,000 vehicles produced this year just to maintain market share. Can Tesla do that? perhaps, I would predict closer to 400,000 Tesla vehicles, so back to 11% market share.