Hmmm, what could this "hydranet" be that Elon is teasing on Twitter (on the short video) ....

Neural Networks

Elon Musk on Twitter

Neural Networks

Elon Musk on Twitter

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I think the term you're searching for is "rationalization."

It's hard to accept the fact that the bears have been right for the last move in stock price. They may be emboldened by the drop and stay short, just the way longs thought the price was headed to the sky when it was in the 380s.

All I'm saying is that selling in the 380s and buying back in at current levels would have been a very good move. Long-term investors with unrealistic expectations missed that opportunity.

....

I remember a few years ago, Warren Buffett said the nation could be ruined if we continue to have huge trade deficit without action (something like that). His suggestion was to implement a credit system. Importers have to buy credits from exporters to import equivalent amount of products. So trade will automatically be balanced and it doesn't violate trade rules.

I thought Buffett's suggestion is a great idea. Why nobody talk about it?

Isn't the US$ a sort of credit system being used? Why put another layer of complexity on it? The trade deficit is not a problem as long as the chinese keep buying US debt.

Occasionally they will have to adjust their currency. Then the real costs will be reflected and the party might come to an end.

Were the bears right or just lucky? I can't remember every BS piece of "news" that came out during the 380-245 drop but other than ramp being slower than expected everything has been fine..

I understand some investors suffered during this round of short attack. The best revenge against them is to implement a sound plan, don't let them get you again. Every time you lose money, the money went to their accounts.

If we all act right, they won't be able to make money. They would actually lose money: borrowing interest, money to "PR companies", money to media (paying them to write attack articles), opportunity cost, etc.

My approach is buy and hold only, keep adding with new cash. If this goes to $500 tomorrow, I am not selling. I will hold for 10 years and see what they can do.

Say what?no chance.

Started at around $310, wont even think of covering before 100$

The little short squeeze try yesterday is already over again. There will be no more growth in china

As soon as the market realizes that yesterdays report was a catastrophe, tesla will continue downward.

Even former uber-bull Adam Jonas doesnt believe Musks BS about no capital needed and still expects at least a 2,5b raise.

Or Autopilot's psychosomatic blindness...

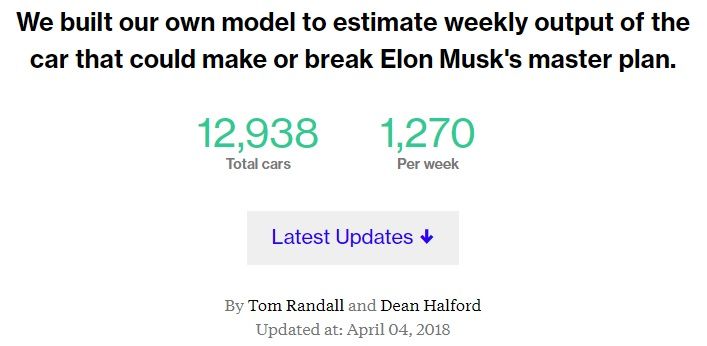

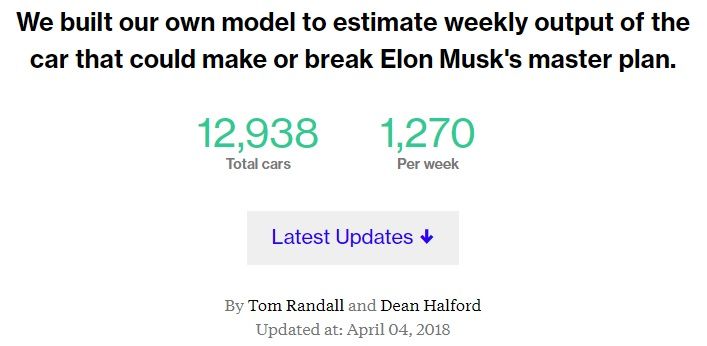

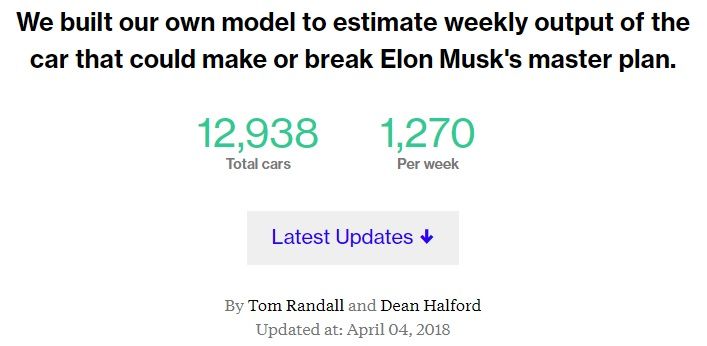

Bloomberg updated their model today:

So the press release that Tesla put out yesterday stated the following: "In the past seven days, Tesla produced 2,020 Model 3 vehicles. In the next seven days, we expect to produce 2,000 Model S and X vehicles and 2,000 Model 3 vehicles."

I guess the folks at Bloomberg have higher confidence in the model than actual reality. Hey, when the facts disagree with your perception of reality, you really shouldn't let the facts get in the way !

RT

I prefer to incrementally buy on margin when I think it's a ridiculously good buy, and then incrementally sell when I'm no longer comfortable with saying Tesla is a good short term buy.This. No margin. No options. Just buy the dips and hold.

Then why don't they shift the date on x-axis back by 2-3 weeks then? If they really want to be honest about what their model is actually showing?Its just backwards looking. Really about 3 weeks backward. They added a projection on one of the other graphs which is actually pretty accurate.

If(When) gas prices rise 15-20% between now and summer of 2019, I wonder how this will affect those who want to shift to more fuel efficient vehicles? Will they have the PHEVs ready by that point and be able to scale them up? Or will they lose further market share at that point?GM, Ford to drop 4 car nameplates, report says

Chevrolet and Ford Division to discontinue subcompact and full size passenger cars in the USA in favor of pickups, SUVs,and CUVs. Ford Division may also discontinue midsize Fusion.

Bloomberg updated their model today:

So the press release that Tesla put out yesterday stated the following: "In the past seven days, Tesla produced 2,020 Model 3 vehicles. In the next seven days, we expect to produce 2,000 Model S and X vehicles and 2,000 Model 3 vehicles."

I guess the folks at Bloomberg have higher confidence in the model than actual reality. Hey, when the facts disagree with your perception of reality, you really shouldn't let the facts get in the way !

RT

If(When) gas prices rise 15-20% between now and summer of 2019, I wonder how this will affect those who want to shift to more fuel efficient vehicles? Will they have the PHEVs ready by that point and be able to scale them up? Or will they lose further market share at that point?

Then why don't they shift the date on x-axis back by 2-3 weeks then? If they really want to be honest about what their model is actually showing?