JRP3

Hyperactive Member

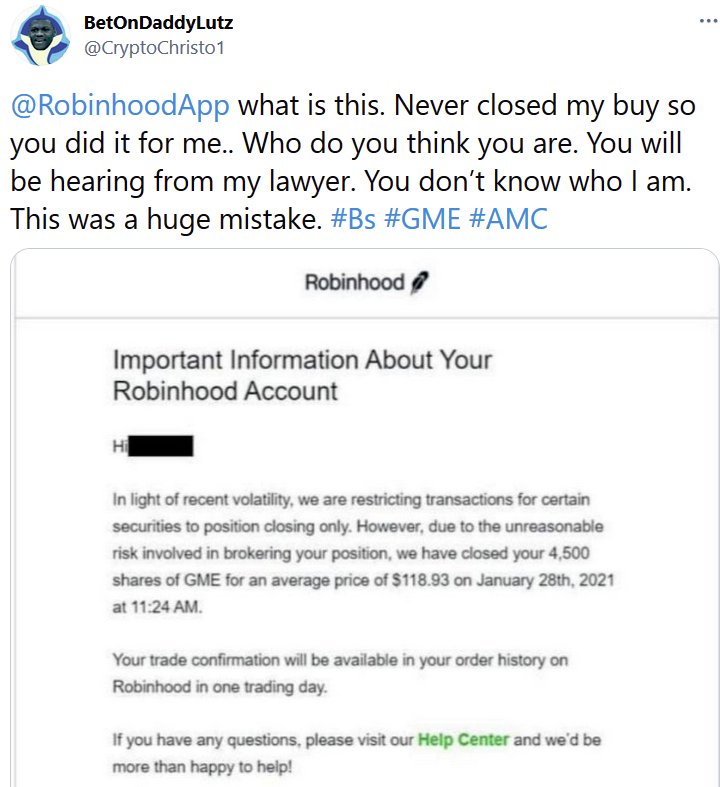

Don't know if this is for real but if it is...

https://twitter.com/CryptoChristo1/status/1354869498604621825?s=20

https://twitter.com/CryptoChristo1/status/1354869498604621825?s=20

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

"we will give margin to literally anyone to trade options etc." - RHDon't know if this is for real but if it is...

https://twitter.com/CryptoChristo1/status/1354869498604621825?s=20

View attachment 631702

Don't know if this is for real but if it is...

https://twitter.com/CryptoChristo1/status/1354869498604621825?s=20

View attachment 631702

Robinhood action might be related to this Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

I own GME because I like the stock. I want these predatory, parasitic shorts to get burned into the ground. Imagine not being content to just hope someone's dreams fail and celebrate by making money out of some poor schmuck's despair -- no that's not enough -- now let's try to actively destroy companies with lies and media FUD and financial shenanigans, put people out of work in the middle of a pandemic, and then pop the champagne bottles to celebrate the purchase of another beach house built on the back of someone's misery. Maybe snort a line or two off some hooker's bits if you did particularly well and destroyed someone's life that week. And if it all goes chest up, just actually break the law by shutting down stock trading -- make up some bull and say you're doing it to protect the little guy. The actual lie you choose won't matter, the fine you get in a few years' time will be a fraction of the money it saved you. Oh, call shorting price discovery if it makes you feel better. I'm riding GME all the way back down to 0 if necessary. It'll be worth it to give these bastards a black eye. I haven't forgiven them for nearly destroying Tesla and setting back the earth's environmental recovery by potentially decades all in the name of making a few dollars.

https://twitter.com/JoshuaPotash/status/1354854088509452290?s=20CNBC just brought a billionaire on who says this whole thing “is just a way of attacking wealthy people”

What happened today with brokerages not allowing buying of GME pissed me off so much. I was thinking of buying some puts on GME after this Friday but now? Nope. Not selling my GME stock either. This is now about class warfare. **** Citadel.

Also, Robinhood whistleblower - https://www.reddit.com/r/ClassActionRobinHood/comments/l723kf/robinhood_insider_information/

FYI, IBKR just admitted that they halted trading to protect the clearing houses. **** them.

https://twitter.com/CNBCClosingBell/status/1354889905403551745?s=20

I own GME because I like the stock. I want these predatory, parasitic shorts to get burned into the ground. Imagine not being content to just hope someone's dreams fail and celebrate by making money out of some poor schmuck's despair -- no that's not enough -- now let's try to actively destroy companies with lies and media FUD and financial shenanigans, put people out of work in the middle of a pandemic, and then pop the champagne bottles to celebrate the purchase of another beach house built on the back of someone's misery. Maybe snort a line or two off some hooker's bits if you did particularly well and destroyed someone's life that week. And if it all goes chest up, just actually break the law by shutting down stock trading -- make up some bull and say you're doing it to protect the little guy. The actual lie you choose won't matter, the fine you get in a few years' time will be a fraction of the money it saved you. Oh, call shorting price discovery if it makes you feel better. I'm riding GME all the way back down to 0 if necessary. It'll be worth it to give these bastards a black eye. I haven't forgiven them for nearly destroying Tesla and setting back the earth's environmental recovery by potentially decades all in the name of making a few dollars.

I guess that's possible. But even in that case, IBKR ****-ed me over to protect itself. That's just as bad. If they can't handle the game they shouldn't be in business. They should have considered this before letting shorts go over 100% of float sold short.This might be a slightly unpopular opinion, but I think there could be another reason for this.

Consider that Citadel is both a market maker (i.e., they can sell naked shorts) and an interested party in Melvin (the biggest GME short). We have also seen some obvious attempt to drive down the price by (what I assume) is shorting (naked or otherwise). One risk of buying a naked short (and you can't know if you are) is that they may not locate shares before settlement and then fail to deliver.

I wonder if some of the brokerages are feeling nervous about failures to deliver, given the unprecedented level of open short positions. Transactions take a few days to settle, and I suspect that many people are day trading GME right now. What does it look like to unwind (or compensate retail clients for) all the transactions that happen after one fail? Even if you buy from someone who can't sell a naked short, you have no way of knowing whether the shares they think they are selling actually exist.

In other words, I wonder if this is more about protecting the brokerage itself rather than the clearing houses.

I kinda loaded up on AMC calls. I figure this craziness should at least be able to peak at their 2018 high.GME back up 50% AH, AMC 45% looking interesting for tomorrow...

This might be a slightly unpopular opinion, but I think there could be another reason for this.

Consider that Citadel is both a market maker (i.e., they can sell naked shorts) and an interested party in Melvin (the biggest GME short). We have also seen some obvious attempt to drive down the price by (what I assume) is shorting (naked or otherwise). One risk of buying a naked short (and you can't know if you are) is that they may not locate shares before settlement and then fail to deliver.

I wonder if some of the brokerages are feeling nervous about failures to deliver, given the unprecedented level of open short positions. Transactions take a few days to settle, and I suspect that many people are day trading GME right now. What does it look like to unwind (or compensate retail clients for) all the transactions that happen after one fail? Even if you buy from someone who can't sell a naked short, you have no way of knowing whether the shares they think they are selling actually exist.

In other words, I wonder if this is more about protecting the brokerage itself rather than the clearing houses.

My response is that they didn't care about this risk while letting people short the stock to over 140%. I'm sick of certain interests in this country being protected while others are left swinging in the wind. I'm surprised we aren't seeing bailouts for these guys yet.you are right when it comes to IB, but nobody here wants to hear that. now theres a buzz about RH drawing on its credit lines...as i posted earlier this isnt jsut about GME and a few HFs getting a 30% haircut...thats just the tip of the iceberg....ther could be systemic risk. and youd better protect your firm if you want to stay in the game...but i understand the trader POV as well..i dont want to be told what i can do with my own cash