Norbert

TSLA will win

I'm no tax expert, but I think the first step to have overly rich people pay more taxes is to limit or remove the loopholes they are using to avoid paying taxes.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I'm no tax expert, but I think the first step to have overly rich people pay more taxes is to limit or remove the loopholes they are using to avoid paying taxes.

You don't have to be a tax expert to know those loopholes were put in place specifically by the people who are trying to avoid paying these taxes in the first place. The president doesn't get to fix the tax code, Congress does and this type of change rarely happens.

The case against Trump looking stronger all the time

Note that the law of the land isn't strictly the Constitution, it's the case law of how the Supreme Court has interpreted the Constitution.

So, a President and a cooperating Senate can indirectly change how the Supreme Court interprets the Constitution through court packing.

And, constitutionality is not clear-cut on wealth taxes.

I'm no tax expert, but I think the first step to have overly rich people pay more taxes is to limit or remove the loopholes they are using to avoid paying taxes.

Not possible. If somehow you were miraculously able to "close" those, these people would simply leave the country and take their money with them. They have already shown they will leave high-tax states for lower-tax ones to avoid 7-13% in state income taxes. You honestly think they won't do more than that because someone threatens them with higher federal taxes? POOF - they will be gone in a heartbeat and there isn't a thing Uncle Sam can do. Mark my words - they love their money more than this country.

When it comes to matters where money is being taken out of one’s pocket, even tree-hugging Democrats become right leaning.

Medicare for all will convert some on the left to the right.

Most Democrats and many Republicans are very much in favor of Medicare for All because they understand that they will have more money left in their pockets at the end of the year when Medicare for All is finally passed, because while their taxes will go up, it will be more than offset by the reduction in their insurance and out-of-pocket medical expenses.

Uncle Sam is not so clueless as you are suggesting with your skedaddling of a wealthy expat. It is very difficult to avoid the long arm of the IRS.

Hopefully some comparisons with the UK will be helpful @bkp_duke since yesterday was their 73 anniversary of a Medicare for All-style system. Also I will include the link to the Medicare-for-All financing documents which should connect you to any of the studies you might be looking for through the citations. Hope this is helpful.

View attachment 474330

View attachment 474332

And here is the link:

https://www.sanders.senate.gov/down...4ADD-8C1F-0DEDC8D45BC1&download=1&inline=file

Oops, so much for one of those socialized medicine models that everyone is saying we should model after.

The above UK report (from the governing UK entity) is abismal.

80% or so of patients able to see a specialist within 2 months? When I was practicing if my staff didn't get a referral in within 2 weeks, heads would roll.

The report on cancer treatment is abysmal.

This is a supply and demand problem, and it is amazing how hard those are to deal with when you hamstring the free market.

People should study history. We've had top marginal rates from 0% to 90% and variety of loopholes in our history yet the effective rate is always around 20%. Why? Because of human nature. Taxes change behavior.View attachment 474304

This could simply imply that a larger share of the taxes paid were by the less wealthy over time. Which, you know, wound match the rising disparity in wealth over decades.

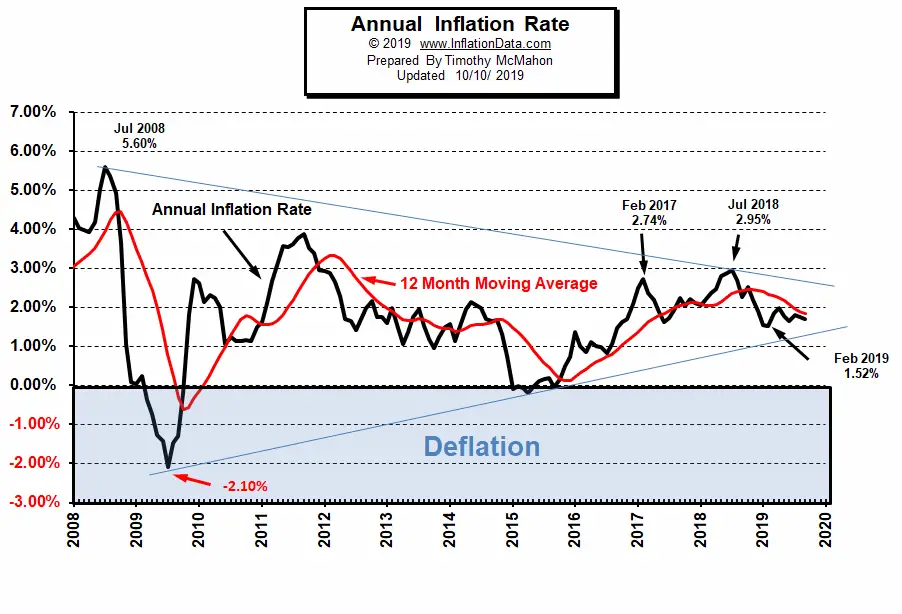

Inflation rates are relatively lowThe Fed with its quantative easing and zero interest rate policy stimulates inflation which raises the price of assets like real estate and stocks while also increasing the cost of living by driving up prices of basic commodities and rents.

I don't see a lot of rich people moving from California to Alaska. The rich could save a lot of money by not living in high value neighborhoods within their states now, but they don't do that. The idea that they would leave the country in droves because of a 1-6% wealth tax is ridiculous.If somehow you were miraculously able to "close" those, these people would simply leave the country and take their money with them. They have already shown they will leave high-tax states for lower-tax ones to avoid 7-13% in state income taxes.