Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

Hi @luvb2b I get different Q1 and Q2 dpo and dio results when deriving straight off the Qs.

I use a rolling quarterly AP average and net the quarterly change in inventory. What's your calc?

For example, 6/30 dpo:

[(6/30AP + 3/31AP)/2] / [(6/30COGS + 6/30Inv - 3/31Inv)/91]

i'm using payables / ( cogs /(365/4))

Great modeling. QQ does the gross margin for model 3 seem a bit high. I thought they were trying to get to 16% at some point in the qtr but now for the whole qtr.

Headwinds to company est:

-not at 6k per week

-Logistics nightmare

Tailwinds to company est:

-dual motor %

-M3P %

Maybe I missed part of the thread where this was discussed.

agree it's an open question, and some of it depends on where you start your q2 estimate. but my gross margin walk would go like this:

4.5% q2 gross margin + 4.5% pickup from depreciation math + 1% from higher asp/mix + 6% efficiency gains = 16%

the 4.5% from depreciation math was outlined further back in this thread. efficiency gains in the past have been much better than 6% per quarter, but of course i would expect less efficiency gains over time. last quarter (18q1 to 18q2) i would rough out the efficiency gains in the range of 10-15%.

luvb2b, really great work on your forecast for Q3/Q4...

I appreciate how much work was involved in setting it up, and then continuing to update it...

As you may notice, this is my first post, and yes, your post made me sign up! So well done!!

Anyway, the reason I'm posting is, there are two things I'm concerned about on your projections...

The first one, ZEV credits, is a small one, but the SG&A, I think there's no way that can be even close...

ZEV credits:

I think those will turn out to be $0...

I could be wrong, but there was an interesting thread - two threads, actually - on Twitter regarding these...

Anyway, he sold me, but at the very least, worth a read even if you choose to disagree..

Hoping you can read these threads - (don't know if you have a Twitter account)

People's Grain on Twitter

People's Grain on Twitter

on zev credits i know next to nothing so i cannot directly refute anything the guy says. i would note that this writer says they will have credits with a maximum value of 1-1.5b (going from memory of late night flip thru so pardon if wrong). he also mentions there are other markets where credits are created besides california. speaking of experts, this guy is apparently a grain trader - from my time at the cbot i would say probably he is no expert either.

anyway assume it's 1-1.5b of credits unloaded at 10c on the dollar, and that's 100-150m in zev's. i am quite sure the zev market is finite and they won't get the values they got before, but i also think at a nicely discounted price they will find their buyers. 100m is a big swing on the bottom line, but i don't think it's an excessively optimistic guess either.

@luvb2b When your buy the car, there's a destination and doc fee of $1200. This is not part of the ASP I suppose. Is that right?

not 100% sure but i think it is. i've seen other people's models around asp and that seems to be included.

Thanks for your Feedback !

Mathematically you are Right.

But from an Accounting perspective the common equity is Changed by the P&L result (+60.112) , changes in common stock (I am not Aware of) and other comprehensive loss / income that is normally not significant.

Therefore from my Point of view I do not understand the increase of common equity.

Would be great to get some insights here.

Cheers

you're right equity moves should go off of changes to net income. there are effects from raising equity capital where equity can increase without changes in net income. in tesla's accounting going back 4 quarters net income has been -2.7b and equity has changed by only -2.2b.

as far as the model goes, the balance sheet is not fully integrated into the income statement in the way you are expecting. i'm modeling individual balance sheet items and then summing but not enforcing a check vs. the income statement. it's very hard to model something to this level of detail in a company this complex and keep everything internally consistent. i think the correct interpretation of your comment is that i have most likely underestimated some liability items - perhaps by an aggregate amount of 800m-1b.

i think your concern is valid and i've adjusted up various liability items and adjusted down some asset items. the next update you may find it's a better representation of common equity (thought admittedly looks like it may still be going high).

lots of questions/comments on sg&a from @Smokey4141 @brian45011 @NateB @generalenthu so let me share some details on my sg&a modeling. i do have an error here as the stock based comp in cogs is only capturing stock-based comp in automotive cogs. the actual stock based comp in cogs would include non-auto stock based comp in cogs as well. as i'm trying to spend less time here i've not corrected but should be good enough to get an idea of how i was thinking about it.

tesla recently started guiding on some metric called "non-gaap opex" commenting on low single digit growth. i am guessing non-gaap opex = opex - one time items - stock based comp in opex. stock based comp in opex i take to mean stock based comp - stock based comp in cogs.

18q2 had some cost cutting etc and non-gaap opex grew by 2.8%. this quarter will get the full benefit of cost cuts made last quarter, but also has a lot of hiring expansion for logistics. i took their guide as reasonable and applied a 3.1% change to non-gaap opex. the highest growth we've seen in non-gaap opex the last 5 quarters is 10.4%. that would yield a gaap opex estimate of 1.225b as the highest sensible guess using this methodology.

i'm comfortable with my 3.1% increase. tesla has often surprised to the upside on opex though so can't argue much with those who want to aim higher.

[TD2]

luv q4-18e

[/TD2][TD2]

luv q3-18e

[/TD2][TD2]

Jun-18

[/TD2][TD2]

Mar-18

[/TD2]

[TD2]

1,185,000

[/TD2][TD2]

1,155,000

[/TD2][TD2]

1,136,888

[/TD2][TD2]

1,053,500

[/TD2]

[TD2]

208,000

[/TD2][TD2]

200,000

[/TD2][TD2]

197,344

[/TD2][TD2]

141,639

[/TD2]

[TD2]

31,000

[/TD2][TD2]

27,000

[/TD2][TD2]

13,198

[/TD2][TD2]

15,078

[/TD2]

[TD2]

1,008,000

[/TD2][TD2]

982,000

[/TD2][TD2]

952,742

[/TD2][TD2]

926,939

[/TD2]

[TD2]2.6%[/TD2][TD2]3.1%[/TD2][TD2]2.8%[/TD2][TD2]0.9%[/TD2]

tesla recently started guiding on some metric called "non-gaap opex" commenting on low single digit growth. i am guessing non-gaap opex = opex - one time items - stock based comp in opex. stock based comp in opex i take to mean stock based comp - stock based comp in cogs.

18q2 had some cost cutting etc and non-gaap opex grew by 2.8%. this quarter will get the full benefit of cost cuts made last quarter, but also has a lot of hiring expansion for logistics. i took their guide as reasonable and applied a 3.1% change to non-gaap opex. the highest growth we've seen in non-gaap opex the last 5 quarters is 10.4%. that would yield a gaap opex estimate of 1.225b as the highest sensible guess using this methodology.

i'm comfortable with my 3.1% increase. tesla has often surprised to the upside on opex though so can't argue much with those who want to aim higher.

| … |

| total opex - one time items |

| stock based comp |

| stock based comp in cogs |

| non-gaap opex |

| non-gaap opex qoq %chg |

i made a few adjustments and corrections based on comments received. one meaningful correction is i had leased s/x vehicles too low at 7% - this causes revenue to skew higher. another correction was i had depreciation too low in the cash flow statement. adjusted balance sheet for comments about common equity varying too much vs. net income. moved the sec settlement into q4 per brian.

thanks for all your comments.

i also want to kick myself for thinking analysts would adjust their estimates higher. most analysts are out with notes today and they all seem to have the same negative ratings as usual. i feel dumb for thinking they would get to the same page as me.

sorry have no idea how to eliminate whitespace below.

[TD2]

luv q4-18e

[/TD2][TD2]

luv q3-18e

[/TD2][TD2]

Jun-18

[/TD2][TD2]

Mar-18

[/TD2]

[TD2]15,000[/TD2][TD2]14,470[/TD2][TD2]10,939[/TD2][TD2]11,738[/TD2]

[TD2]13,000[/TD2][TD2]13,190[/TD2][TD2]11,380[/TD2][TD2]10,077[/TD2]

[TD2]

28,000

[/TD2][TD2]

27,660

[/TD2][TD2]

22,319

[/TD2][TD2]

21,815

[/TD2]

[TD2]

60,000

[/TD2][TD2]

55,840

[/TD2][TD2]

18,449

[/TD2][TD2]

8,182

[/TD2]

[TD2]

60,000

[/TD2][TD2]

53,239

[/TD2][TD2]

28,578

[/TD2][TD2]

9,766

[/TD2]

[TD2]

0.11

[/TD2][TD2]

0.11

[/TD2][TD2]

0.11

[/TD2][TD2]

0.11

[/TD2]

[TD2]

103.00

[/TD2][TD2]

104.00

[/TD2][TD2]

105.14

[/TD2][TD2]

105.42

[/TD2]

[TD2]

58.00

[/TD2][TD2]

59.00

[/TD2][TD2]

55.80

[/TD2][TD2]

56.80

[/TD2]

[TD2]2,566,760[/TD2][TD2]2,560,210[/TD2][TD2]2,088,411[/TD2][TD2]2,046,829[/TD2]

[TD2]3,480,000[/TD2][TD2]3,294,560[/TD2][TD2]1,029,454[/TD2][TD2]464,738[/TD2]

[TD2]213,652[/TD2][TD2]209,683[/TD2][TD2]239,816[/TD2][TD2]173,436[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]100,000[/TD2][TD2]100,000[/TD2][TD2]0[/TD2][TD2]50,314[/TD2]

[TD2]

6,360,412

[/TD2][TD2]

6,164,452

[/TD2][TD2]

3,357,681

[/TD2][TD2]

2,735,317

[/TD2]

[TD2]185,500[/TD2][TD2]140,450[/TD2][TD2]111,651[/TD2][TD2]185,022[/TD2]

[TD2]237,600[/TD2][TD2]231,000[/TD2][TD2]262,757[/TD2][TD2]225,000[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]300,000[/TD2][TD2]300,000[/TD2][TD2]270,142[/TD2][TD2]263,412[/TD2]

[TD2]

7,083,512

[/TD2][TD2]

6,835,902

[/TD2][TD2]

4,002,231

[/TD2][TD2]

3,408,751

[/TD2]

[TD2]1,897,237[/TD2][TD2]1,892,018[/TD2][TD2]1,546,610[/TD2][TD2]1,517,446[/TD2]

[TD2]2,714,400[/TD2][TD2]2,767,430[/TD2][TD2]983,129[/TD2][TD2]573,951[/TD2]

[TD2]132,465[/TD2][TD2]130,003[/TD2][TD2]136,915[/TD2][TD2]104,496[/TD2]

[TD2]

4,744,101

[/TD2][TD2]

4,789,452

[/TD2][TD2]

2,666,654

[/TD2][TD2]

2,195,893

[/TD2]

[TD2]185,500[/TD2][TD2]147,473[/TD2][TD2]146,343[/TD2][TD2]217,863[/TD2]

[TD2]166,320[/TD2][TD2]161,700[/TD2][TD2]183,930[/TD2][TD2]157,500[/TD2]

[TD2]10,999[/TD2][TD2]10,999[/TD2][TD2]11,000[/TD2][TD2]11,000[/TD2]

[TD2]375,000[/TD2][TD2]384,000[/TD2][TD2]375,374[/TD2][TD2]369,969[/TD2]

[TD2]

5,481,920

[/TD2][TD2]

5,493,623

[/TD2][TD2]

3,383,301

[/TD2][TD2]

2,952,225

[/TD2]

[TD2]

1,601,592

[/TD2][TD2]

1,342,279

[/TD2][TD2]

618,930

[/TD2][TD2]

456,526

[/TD2]

[TD2]29.5%[/TD2][TD2]29.5%[/TD2][TD2]27.7%[/TD2][TD2]28.6%[/TD2]

[TD2]27.0%[/TD2][TD2]27.0%[/TD2][TD2]27.7%[/TD2][TD2]26.9%[/TD2]

[TD2]22.0%[/TD2][TD2]16.0%[/TD2][TD2]4.5%[/TD2][TD2]-23.5%[/TD2]

[TD2]24.2%[/TD2][TD2]21.0%[/TD2][TD2]20.6%[/TD2][TD2]18.2%[/TD2]

[TD2]0.0%[/TD2][TD2]-5.0%[/TD2][TD2]-31.1%[/TD2][TD2]-17.7%[/TD2]

[TD2]30.0%[/TD2][TD2]30.0%[/TD2][TD2]30.0%[/TD2][TD2]30.0%[/TD2]

[TD2]-100.0%[/TD2][TD2]-100.0%[/TD2][TD2]-100.0%[/TD2][TD2]-100.0%[/TD2]

[TD2]-25.0%[/TD2][TD2]-28.0%[/TD2][TD2]-39.0%[/TD2][TD2]-40.5%[/TD2]

[TD2]360,000[/TD2][TD2]350,000[/TD2][TD2]341,129[/TD2][TD2]322,096[/TD2]

[TD2]630,000[/TD2][TD2]620,000[/TD2][TD2]610,759[/TD2][TD2]551,404[/TD2]

[TD2]20,000[/TD2][TD2]0[/TD2][TD2]103,434[/TD2][TD2]0[/TD2]

[TD2]50,000[/TD2][TD2]45,000[/TD2][TD2]45,000[/TD2][TD2]45,000[/TD2]

[TD2]145,000[/TD2][TD2]140,000[/TD2][TD2]140,000[/TD2][TD2]135,000[/TD2]

[TD2]

1,205,000

[/TD2][TD2]

1,155,000

[/TD2][TD2]

1,240,322

[/TD2][TD2]

1,053,500

[/TD2]

[TD2]

396,592

[/TD2][TD2]

187,279

[/TD2][TD2]

-621,392

[/TD2][TD2]

-596,974

[/TD2]

[TD2]6,000[/TD2][TD2]6,000[/TD2][TD2]5,064[/TD2][TD2]5,214[/TD2]

[TD2]-107,000[/TD2][TD2]-107,000[/TD2][TD2]-110,582[/TD2][TD2]-102,546[/TD2]

[TD2]-53,000[/TD2][TD2]-53,000[/TD2][TD2]-53,000[/TD2][TD2]-47,000[/TD2]

[TD2]-12,000[/TD2][TD2]-12,000[/TD2][TD2]50,911[/TD2][TD2]-37,716[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]

230,592

[/TD2][TD2]

21,279

[/TD2][TD2]

-728,999

[/TD2][TD2]

-779,022

[/TD2]

[TD2]19,999[/TD2][TD2]19,999[/TD2][TD2]13,707[/TD2][TD2]5,605[/TD2]

[TD2]

210,593

[/TD2][TD2]

1,280

[/TD2][TD2]

-742,706

[/TD2][TD2]

-784,627

[/TD2]

[TD2]-50,001[/TD2][TD2]-50,001[/TD2][TD2]-25,167[/TD2][TD2]-75,076[/TD2]

[TD2]

260,594

[/TD2][TD2]

51,281

[/TD2][TD2]

-717,539

[/TD2][TD2]

-709,551

[/TD2]

[TD2]172,000[/TD2][TD2]170,900[/TD2][TD2]169,997[/TD2][TD2]169,146[/TD2]

[TD2]183,000[/TD2][TD2]181,900[/TD2][TD2]169,997[/TD2][TD2]169,146[/TD2]

[TD2]

1.42

[/TD2][TD2]

0.28

[/TD2][TD2]

-4.22

[/TD2][TD2]

-4.19

[/TD2]

[TD2]260,594[/TD2][TD2]51,281[/TD2][TD2]-717,539[/TD2][TD2]-709,551[/TD2]

[TD2]208,000[/TD2][TD2]200,000[/TD2][TD2]197,344[/TD2][TD2]141,639[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]468,594[/TD2][TD2]251,281[/TD2][TD2]-520,195[/TD2][TD2]-567,912[/TD2]

[TD2]

2.56

[/TD2][TD2]

1.38

[/TD2][TD2]

-3.06

[/TD2][TD2]

-3.36

[/TD2]

[TD2]

72.00

[/TD2][TD2]

80.00

[/TD2][TD2]

89.67

[/TD2][TD2]

79.31

[/TD2]

[TD2]

77.00

[/TD2][TD2]

81.00

[/TD2][TD2]

81.73

[/TD2][TD2]

80.47

[/TD2]

[TD2]3,410,108[/TD2][TD2]2,868,614[/TD2][TD2]2,236,424[/TD2][TD2]2,665,673[/TD2]

[TD2]150,000[/TD2][TD2]130,000[/TD2][TD2]146,822[/TD2][TD2]120,194[/TD2]

[TD2]1,164,413[/TD2][TD2]1,123,710[/TD2][TD2]569,874[/TD2][TD2]652,848[/TD2]

[TD2]4,325,460[/TD2][TD2]4,816,327[/TD2][TD2]3,324,643[/TD2][TD2]2,565,826[/TD2]

[TD2]381,125[/TD2][TD2]364,418[/TD2][TD2]422,034[/TD2][TD2]379,379[/TD2]

[TD2]

9,431,106

[/TD2][TD2]

9,303,070

[/TD2][TD2]

6,699,797

[/TD2][TD2]

6,383,920

[/TD2]

[TD2]2,388,916[/TD2][TD2]2,344,277[/TD2][TD2]2,282,047[/TD2][TD2]2,315,124[/TD2]

[TD2]6,333,264[/TD2][TD2]6,336,631[/TD2][TD2]6,340,031[/TD2][TD2]6,346,374[/TD2]

[TD2]11,933,736[/TD2][TD2]11,404,808[/TD2][TD2]10,969,348[/TD2][TD2]10,519,226[/TD2]

[TD2]320,000[/TD2][TD2]320,000[/TD2][TD2]300,406[/TD2][TD2]346,428[/TD2]

[TD2]60,237[/TD2][TD2]60,237[/TD2][TD2]64,284[/TD2][TD2]61,284[/TD2]

[TD2]420,841[/TD2][TD2]427,841[/TD2][TD2]434,841[/TD2][TD2]449,754[/TD2]

[TD2]400,000[/TD2][TD2]400,000[/TD2][TD2]399,992[/TD2][TD2]433,841[/TD2]

[TD2]273,123[/TD2][TD2]273,123[/TD2][TD2]419,254[/TD2][TD2]415,478[/TD2]

[TD2]

31,561,224

[/TD2][TD2]

30,869,987

[/TD2][TD2]

27,910,000

[/TD2][TD2]

27,271,429

[/TD2]

[TD2]4,625,839[/TD2][TD2]4,876,531[/TD2][TD2]3,030,493[/TD2][TD2]2,603,498[/TD2]

[TD2]2,410,000[/TD2][TD2]2,252,250[/TD2][TD2]1,814,979[/TD2][TD2]1,898,431[/TD2]

[TD2]573,340[/TD2][TD2]562,627[/TD2][TD2]576,321[/TD2][TD2]536,465[/TD2]

[TD2]600,000[/TD2][TD2]600,000[/TD2][TD2]674,255[/TD2][TD2]629,112[/TD2]

[TD2]965,000[/TD2][TD2]965,000[/TD2][TD2]942,129[/TD2][TD2]984,823[/TD2]

[TD2]1,500,000[/TD2][TD2]1,500,000[/TD2][TD2]2,020,685[/TD2][TD2]1,915,530[/TD2]

[TD2]100,000[/TD2][TD2]100,000[/TD2][TD2]82,500[/TD2][TD2]82,500[/TD2]

[TD2]

10,774,179

[/TD2][TD2]

10,856,408

[/TD2][TD2]

9,141,362

[/TD2][TD2]

8,650,359

[/TD2]

[TD2]9,600,000[/TD2][TD2]9,600,000[/TD2][TD2]9,510,696[/TD2][TD2]8,761,070[/TD2]

[TD2]100[/TD2][TD2]100[/TD2][TD2]100[/TD2][TD2]100[/TD2]

[TD2]2,519[/TD2][TD2]2,519[/TD2][TD2]2,594[/TD2][TD2]2,556[/TD2]

[TD2]836,121[/TD2][TD2]820,497[/TD2][TD2]795,820[/TD2][TD2]818,250[/TD2]

[TD2]650,000[/TD2][TD2]670,000[/TD2][TD2]584,857[/TD2][TD2]756,800[/TD2]

[TD2]3,313,750[/TD2][TD2]3,118,500[/TD2][TD2]2,607,458[/TD2][TD2]2,561,886[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]

25,176,669

[/TD2][TD2]

25,068,024

[/TD2][TD2]

22,642,887

[/TD2][TD2]

21,551,021

[/TD2]

[TD2]540,000[/TD2][TD2]540,000[/TD2][TD2]539,536[/TD2][TD2]405,835[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]2[/TD2]

[TD2]900,000[/TD2][TD2]900,000[/TD2][TD2]821,156[/TD2][TD2]863,876[/TD2]

[TD2]

4,944,555

[/TD2][TD2]

4,361,963

[/TD2][TD2]

3,906,421

[/TD2][TD2]

4,450,695

[/TD2]

[TD2]210,593[/TD2][TD2]1,280[/TD2][TD2]-742,706[/TD2][TD2]-784,627[/TD2]

[TD2]501,217[/TD2][TD2]479,002[/TD2][TD2]485,255[/TD2][TD2]416,233[/TD2]

[TD2]208,000[/TD2][TD2]200,000[/TD2][TD2]197,344[/TD2][TD2]141,639[/TD2]

[TD2]35,000[/TD2][TD2]35,000[/TD2][TD2]35,074[/TD2][TD2]39,345[/TD2]

[TD2]48,163[/TD2][TD2]33,246[/TD2][TD2]27,552[/TD2][TD2]18,546[/TD2]

[TD2]45,000[/TD2][TD2]45,000[/TD2][TD2]66,613[/TD2][TD2]52,237[/TD2]

[TD2]25,000[/TD2][TD2]25,000[/TD2][TD2]-41,476[/TD2][TD2]47,661[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]9,669[/TD2][TD2]-3,984[/TD2]

[TD2]-40,703[/TD2][TD2]-553,836[/TD2][TD2]70,633[/TD2][TD2]-169,142[/TD2]

[TD2]446,228[/TD2][TD2]-1,553,914[/TD2][TD2]-822,487[/TD2][TD2]-419,277[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]-45,193[/TD2][TD2]-50,001[/TD2]

[TD2]-15,000[/TD2][TD2]-15,000[/TD2][TD2]-1,863[/TD2][TD2]-57,583[/TD2]

[TD2]-142,942[/TD2][TD2]2,233,309[/TD2][TD2]591,737[/TD2][TD2]317,983[/TD2]

[TD2]75,000[/TD2][TD2]65,000[/TD2][TD2]61,702[/TD2][TD2]45,795[/TD2]

[TD2]0[/TD2][TD2]22,871[/TD2][TD2]-24,439[/TD2][TD2]67,359[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]42,484[/TD2][TD2]-60,560[/TD2]

[TD2]

1,395,556

[/TD2][TD2]

1,016,958

[/TD2][TD2]

-129,664

[/TD2][TD2]

-398,376

[/TD2]

[TD2]-700,000[/TD2][TD2]-600,000[/TD2][TD2]-609,813[/TD2][TD2]-655,662[/TD2]

[TD2]-60,000[/TD2][TD2]-60,000[/TD2][TD2]-67,400[/TD2][TD2]-72,975[/TD2]

[TD2]

-760,000

[/TD2][TD2]

-660,000

[/TD2][TD2]

-682,817

[/TD2][TD2]

-728,637

[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]100,000[/TD2][TD2]100,000[/TD2][TD2]1,267,746[/TD2][TD2]1,775,481[/TD2]

[TD2]-400,000[/TD2][TD2]0[/TD2][TD2]-879,328[/TD2][TD2]-1,389,388[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]-17,500[/TD2]

[TD2]100,000[/TD2][TD2]100,000[/TD2][TD2]-113,426[/TD2][TD2]-87,092[/TD2]

[TD2]75,000[/TD2][TD2]75,000[/TD2][TD2]31,053[/TD2][TD2]94,018[/TD2]

[TD2]-30,000[/TD2][TD2]-30,000[/TD2][TD2]-29,395[/TD2][TD2]-18,787[/TD2]

[TD2]-12,000[/TD2][TD2]-12,000[/TD2][TD2]-758[/TD2][TD2]-2,913[/TD2]

[TD2]75,000[/TD2][TD2]75,000[/TD2][TD2]179,333[/TD2][TD2]73,704[/TD2]

[TD2]-50,000[/TD2][TD2]-50,000[/TD2][TD2]-56,603[/TD2][TD2]-52,942[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]-2,921[/TD2]

[TD2]

-142,000

[/TD2][TD2]

258,000

[/TD2][TD2]

398,622

[/TD2][TD2]

371,660

[/TD2]

[TD2]47,937[/TD2][TD2]17,232[/TD2][TD2]-22,611[/TD2][TD2]10,102[/TD2]

[TD2]

541,493

[/TD2][TD2]

632,190

[/TD2][TD2]

-436,470

[/TD2][TD2]

-745,251

[/TD2]

[TD2]

2,868,614

[/TD2][TD2]

2,236,424

[/TD2][TD2]

2,665,673

[/TD2][TD2]

3,367,914

[/TD2]

[TD2]

3,410,108

[/TD2][TD2]

2,868,614

[/TD2][TD2]

2,236,424

[/TD2][TD2]

2,665,673

[/TD2]

thanks for all your comments.

i also want to kick myself for thinking analysts would adjust their estimates higher. most analysts are out with notes today and they all seem to have the same negative ratings as usual. i feel dumb for thinking they would get to the same page as me.

sorry have no idea how to eliminate whitespace below.

| … |

| s deliveries |

| x deliveries |

| s+x deliveries |

| 3 deliveries |

| 3 production |

| lease s/x % veh |

| avg price s+x |

| avg price model 3 |

| revenue |

| auto sales ex 3 |

| auto sales mod 3 |

| auto leasing |

| 1 time autopilot |

| zev credits |

| total auto |

| energy storage |

| solarcity |

| grohmann |

| services/other |

| total revenue |

| cost of revenue |

| auto sales ex 3 |

| auto sales mod 3 |

| auto leasing |

| total auto |

| energy storage |

| solarcity |

| grohmann |

| services & other |

| total cost of rev |

| gross profit |

| auto gaap ex 3 gm |

| auto-zev ex 3 gm |

| model 3 gm |

| auto-zev incl 3 gm |

| storage gm |

| scty gm |

| grohmann gm |

| services gm |

| opex |

| tesla r&d |

| tesla sg&a |

| 1 time costs |

| solarcity r&d |

| solarcity sg&a |

| total opex |

| op income |

| interest inc |

| interest exp |

| scty interest |

| other income exp |

| 1time scty gain |

| pretax income |

| income tax |

| net income |

| non-cont int. |

| net inc to common |

| basic shares |

| diluted shares |

| diluted gaap eps |

| gaap net income |

| + stock based comp |

| + one time scty |

| non-gaap net income |

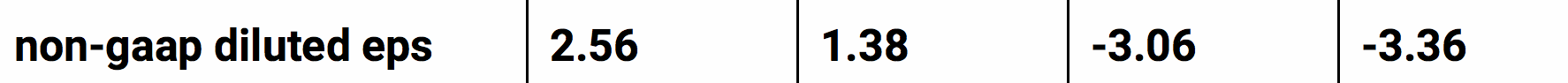

| non-gaap diluted eps |

| dio |

| dpo |

| balance sheet |

| current assets |

| cash & eq. |

| restricted cash |

| accts rcvbl |

| inventory |

| prepaids+other |

| total current assets |

| op lease vehicles |

| solar energy sys |

| pp&e |

| intangible assets |

| goodwill |

| mypower rcvbls |

| restricted cash |

| other assets |

| total assets |

| current liabiliites |

| accts payable |

| accrued liabs+other |

| deferred revenue |

| resale value guar |

| cust deposits |

| curr debt+leases |

| curr solar bonds |

| total current liabs |

| lt debt+leases |

| solar bonds |

| rel party conv debt |

| deferred revenue |

| resale value guar |

| other lt liabilities |

| comm stk warrants |

| capital lease oblg |

| total liabilities |

| commits/contings |

| rdmbl ncis in subs |

| conv senior notes |

| nci in subsidiaries |

| common equity |

| cash flow statement |

| cash flows from ops |

| net loss |

| dep/amortization |

| stock-based comp |

| am of debt discount |

| inv write-down |

| loss on disposals |

| forex loss (gain) |

| loss on acq scty |

| non-cash int/other |

| chgs in op as/lb |

| accts rcbl |

| inv / op leases |

| prepaids/other ca |

| mypower rcvbls + other |

| accts pybl/accr liabs |

| deferred revenue |

| customer deposits |

| other lt liabs |

| net cash from ops |

| cash flows from inv |

| pp&e purchases |

| purchase solar sys |

| net cash from inv |

| cash flows from fin |

| stock issued |

| debt issued |

| debt repayments |

| rel pty solar repaids |

| coll lease borrowing |

| stock option excrs |

| capital lease paids |

| stock+debt issue cost |

| investment by nci in subs |

| dist to nci in subs |

| buyouts of nci in subs |

| net cash from fin |

| forex effect |

| net change in cash |

| cash & eq start |

| cash & eq end |

Fact Checking

Well-Known Member

I suspect the any over/under on the destination/document fee vs cost for performing those services would be charged to SG&A.

Not sure about that, their wording for cost of automotive includes delivery and logistics, plus the doc fee is part of ASP, so in automotive sales.

At 83.5k deliveries it would be ~125m, so certainly not peanuts.

Smokey4141

Banned

Can’t really take that Twitter thread seriously with conclusions like this mixed in:

“19/ Furthermore, the OEMs should smell blood in the water. It doesn't take a rocket scientist and a Deepak to realize that if they don't purchase any Tesla credits for a while, they will inflict mega pain on Musk and Co. In fact, it could push them to bankruptcy.”

Anyone who thinks Tesla is relying on ZEV credits to stay solvent is deluded.

That's cool... Just curious on luv2b2's thoughts...

And you're right! ZEV credits will not allow them to stay solvent...

Smokey4141

Banned

Thanks for your post! You made me think more about SG&A growth. Luckily we have a precedent to evaluate the assertion that "there's no possible way sales tripled and SG&A barely budged..." Somehow, in Q3 2016, Tesla was able to increase deliveries to 24,800 from 14,400 in Q2 2016 with minimal increase in SG&A (from $321 mil to $337 mil). This was a factor of 1.7 increase in deliveries (as opposed to the 2x increase this year, counting all models). In Q3 2016, Tesla was pulling out all of the stops to show a single-quarter profit (as they are this quarter), so they almost certainly did some one-time shuffling of expenses that was not sustainable. But it is not "impossible" to offset increased paperwork and detailing expenses with a combination of cost-cutting measures (9% layoffs at the end of Q2) and probably some accounting tricks. So I think that it is possible that SG&A stayed close to flat this quarter, although in this case we should pay real attention to Q4 SG&A, to assess the relative importance one-time vs. sustainable cost savings.

On the other hand, another data point we have is that SG&A increased by $65 mil in Q2 2018, while deliveries increased by 10,800. Very naively interpreted, this would imply a marginal SG&A increase of $6,000 per car, which, if applied this quarter, would imply an extra $258 mil SG&A on 42,700 extra deliveries. If this were true, combined with reduced ZEV credits, Tesla would probably not even be operating profit positive. Elon bizarrely seems to have hinted that Tesla did achieve "OPP" by posting this video on twitter on Oct 1. So my guess is that SG&A increase was less than $100 mil, but that Tesla did not achieve positive net income this quarter. At least one of the attempted one-time accounting "rearrangements" that might have pushed Tesla to net profitability this quarter (recognition of additional "enhanced autopilot" revenue from the last ~2 years, due to release of fully automated lane changes) did not quite get done in time, but should help Q4.

That's a really fair and thought-out response...

Food for thought for me too...

I appreciate that... Thank you NateB!

brian45011

Active Member

My bad:Not sure about that, their wording for cost of automotive includes delivery and logistics, plus the doc fee is part of ASP, so in automotive sales.

At 83.5k deliveries it would be ~125m, so certainly not peanuts.

"Cost of automotive revenue includes direct parts, material and labor costs, manufacturing overhead (including amortized tooling costs), shipping and logistic costs, vehicle internet connectivity costs, allocations of electricity and infrastructure costs related to our Supercharger network and reserves for estimated warranty expenses. Cost of automotive revenue also includes adjustments to warranty expense and charges to write-down the carrying value of our inventory when it exceeds its estimated net realizable value and to provide for on-hand inventory that is either obsolete or in excess of forecasted demand".

Smokey4141

Banned

i made a few adjustments and corrections based on comments received. one meaningful correction is i had leased s/x vehicles too low at 7% - this causes revenue to skew higher. another correction was i had depreciation too low in the cash flow statement. adjusted balance sheet for comments about common equity varying too much vs. net income. moved the sec settlement into q4 per brian.

thanks for all your comments.

i also want to kick myself for thinking analysts would adjust their estimates higher. most analysts are out with notes today and they all seem to have the same negative ratings as usual. i feel dumb for thinking they would get to the same page as me.

Luvb2b, thank you again VERY much for your thoughtful response...

It's gonna be close either way as to profitability, but whichever way it goes, I really appreciate your work here...

Obviously I'm new here, but consider me a fan...

Thanks again...

neroden

Model S Owner and Frustrated Tesla Fan

It's becoming clear that most Wall Street analysts are simply saying what their companies want them to say, or repeating stuff they heard from market manipulators, or just making stuff up, rather than doing analysis.

Regardless of whether Tesla shows a net profit in Q3 or is slighly below breakeven, it seems inescapable that they'll be free-cash-flow positive. That's going to wake some people up from their slumber, as it destroys the primary short-seller thesis (the idea that Tesla can run out of capital).

Regardless of whether Tesla shows a net profit in Q3 or is slighly below breakeven, it seems inescapable that they'll be free-cash-flow positive. That's going to wake some people up from their slumber, as it destroys the primary short-seller thesis (the idea that Tesla can run out of capital).

adiggs

Well-Known Member

It's becoming clear that most Wall Street analysts are simply saying what their companies want them to say, or repeating stuff they heard from market manipulators, or just making stuff up, rather than doing analysis.

Regardless of whether Tesla shows a net profit in Q3 or is slighly below breakeven, it seems inescapable that they'll be free-cash-flow positive. That's going to wake some people up from their slumber, as it destroys the primary short-seller thesis (the idea that Tesla can run out of capital).

I agree with the sentiment (and am in fact investing based on it). Considering the overall media environment, I don't expect the short thesis based on it to be destroyed until Q4 results though. After the Q3 earnings, the story will change to "it's an outlier" and the thesis will stay close to the same as before the Q3 results. We will need a second (and growing) quarter of positive cash flow to really change that particular thesis.

Another thing I already started hearing on twitter is how accounts payable will grow and all the generated cash is fake. Conveniently ignoring guidance, inventory and receivable growth.

Esme Es Mejor

Member

Another thing I already started hearing on twitter is how accounts payable will grow and all the generated cash is fake. Conveniently ignoring guidance, inventory and receivable growth.

Do they not understand that accounts payable is shrinking as a percentage of revenue?

I don't know what it will take for them to change their minds. I assume that after a large Q3 profit they will say it was a one time fluke. After even larger Q4 profits they will say that Tesla still has lost more money than they have made the last year. After huge Q1 profits they will say that Tesla still have lost more money than they have done since IPO even though they have had a monopoly and soon the real car manufacturers will come ear their pie. After another big Q2 profit they will say that Tesla is still overvalued.I agree with the sentiment (and am in fact investing based on it). Considering the overall media environment, I don't expect the short thesis based on it to be destroyed until Q4 results though. After the Q3 earnings, the story will change to "it's an outlier" and the thesis will stay close to the same as before the Q3 results. We will need a second (and growing) quarter of positive cash flow to really change that particular thesis.

I have seen so many moving of goal posts. I now expect to have to hold my shares for a very long time and be told how wrong I was, but I still think it is a good and correct investment that eventually will make me rich. I can stay rational longer than the shorts can stay solvent!

It's becoming clear that most Wall Street analysts are simply saying what their companies want them to say, or repeating stuff they heard from market manipulators, or just making stuff up, rather than doing analysis.

Regardless of whether Tesla shows a net profit in Q3 or is slighly below breakeven, it seems inescapable that they'll be free-cash-flow positive. That's going to wake some people up from their slumber, as it destroys the primary short-seller thesis (the idea that Tesla can run out of capital).

the investment banks don’t really have much skin in the game (at least reported by end of each filing period) or for ‘research’ outfits, you can tell a little bit about the angle by their other rec’s

most are seemingly transparent on the surface. but who knows what goes on behind the scenes in between filings, i think we can all guess. some examples below

using rankings and holdings in bloomberg terminal

cowen - no holdings

underperform 200 target

- but outperform in fuelcell energy, plug power, sunpower, first solar, solaredge,

morningstar - no hold

sell- 179 target

- but buy for GM, ford, lithia motors, autonation...hold on honda, carmax, toyota

barclays - long 175k ( -400k since prior period)

underweight 210 PT

pretty neutral on other competitives

equal weight ford, overweight GM,

nord LB - sell 220PT

- BUY porsche, bmw, VW, renault,

- hold daimler, toyota

JPM - underweight 195PT

long 644k ( -125 since prior period)

overweight ford, magna, avis, gm, and a bunch of tire companies

neutral ferrari

needham -

underperform

no holdings, no comp

goldman - sell cautious

974k ( -81k since prior period)

210 PT

neutral gm, ford, harley, autonation

sell magna,

buy delphi

Last edited:

NoDo they not understand that accounts payable is shrinking as a percentage of revenue?

Smokey4141

Banned

Do they not understand that accounts payable is shrinking as a percentage of revenue?

That really IS a good observation....

And as long as that continues, there's a chance... *So you're saying there's a chance...* ;-)

That said, as soon as that turns and starts going up (AP/Revenue), the growth story is ~over~...

And when the growth story is over.....~It's~ over....

I expect I'll get flamed and down-voted for that, but......think about it...

That really IS a good observation....

And as long as that continues, there's a chance... *So you're saying there's a chance...* ;-)

That said, as soon as that turns and starts going up (AP/Revenue), the growth story is ~over~...

And when the growth story is over.....~It's~ over....

I expect I'll get flamed and down-voted for that, but......think about it...

Huh?

For a fixed return, AP/Revenue is constant-ish (AP being predominantly parts). If both grow, the company is growing. Even if the ratio goes up, the company can be growing.

Rough example:

Revenue up 20%, AP up 25%

Revenue: 100 -> 120

AP: 50 -> 62.5

old ratio: 0.5: return 50

new ratio:0.52: return 57.5 growth...

Buckminster

Well-Known Member

Thanks to all especially luvb2b for this. Based on the EPS figures, am I right in saying that finance sites will state a positive PE ratio in mid April 19 following Q1 earnings release? Q1 needs to be at least -0.88 to balance out 2.56, 1.38 and -3.06. Would this be the same date for S&P 500 inclusion?

Similar threads

- Replies

- 192

- Views

- 20K

- Replies

- 41

- Views

- 7K