Makes you wonder why he's driving for Uber, unless he works for Citadel and that's just a cover story

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

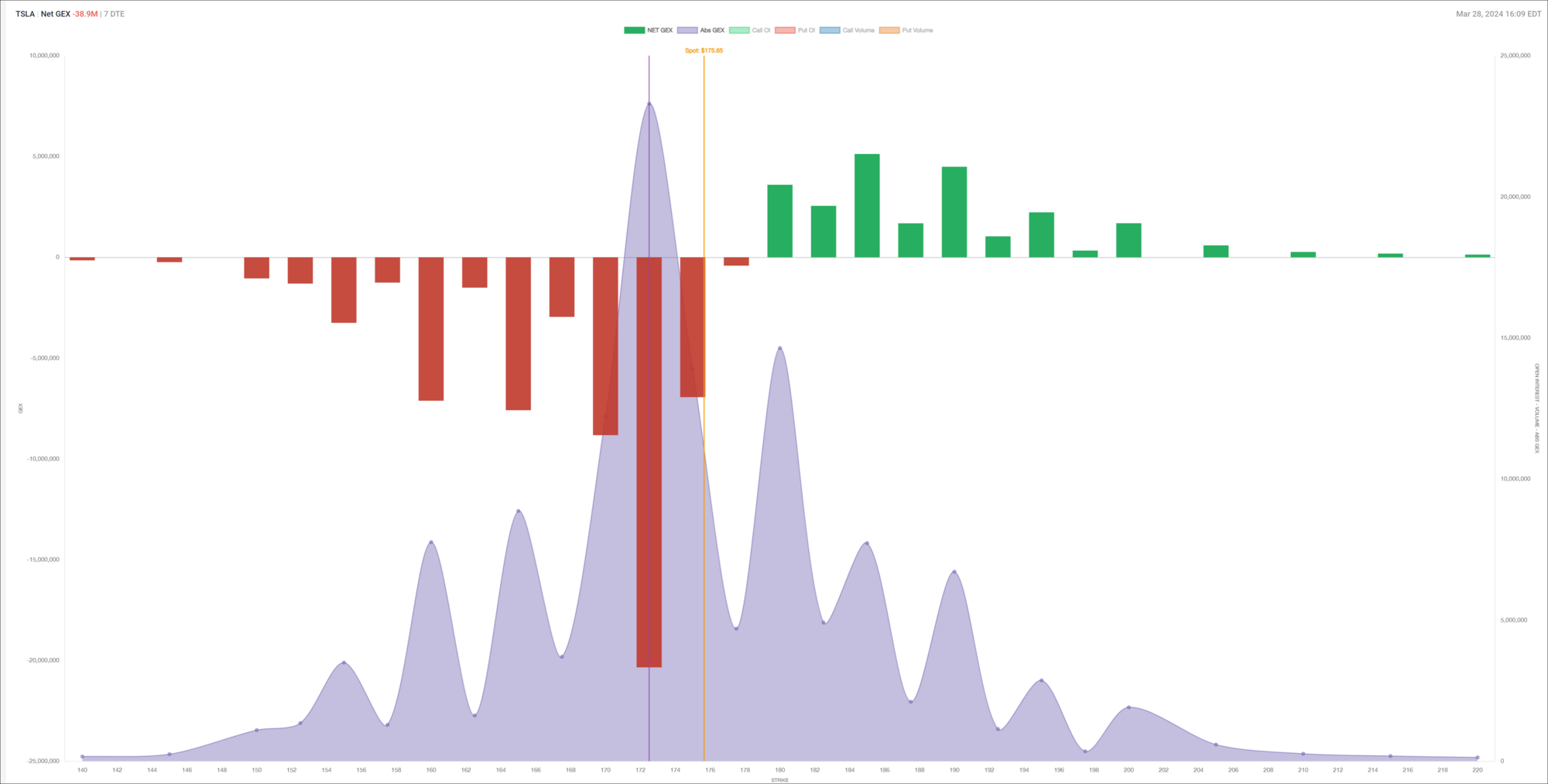

@Yoona I may have asked this before but I don't remember the reply. Have you found that -GEX walls (or high OI Put strikes), while bearish, are "protected" by MM from breech (as best they can) so they don't have to pay out and hence can act as a form of "support" for the market above it — in our case repel away when approaching $170 next week from above (see below). Similar to how tall +GEX walls repel down when moving toward it from below.

Last edited:

thenewguy1979

"The" Dog

Yoona like to work for UPS. Its a fad thingMakes you wonder why he's driving for Uber, unless he works for Citadel and that's just a cover story

Call are cheap, especially as we go beyond 200. So a few buck cheap plays can make thing interesting.

tivoboy

Active Member

There have always been rumors of about ppl who have setup PFOF for various companies setting up man in the middle attacks (why isn’t it ever a woman?), not to hijack but just to send a copy of the data somewhere ELSE other than just to the buyer of the PFOF information. It would certainly be HIGHLY valuable.Makes you wonder why he's driving for Uber, unless he works for Citadel and that's just a cover story

If i had that for A DAY, I’d be out.

-gex attracts, -vex repels@Yoona I may have asked this before but I don't remember the reply. Have you found that put walls, while bearish, are "protected" by MM from breech (as best they can) so they don't have to pay out and hence can act as a form of "support" above it — in our case repel away when approaching $170 next week from above (see below). Similar to how tall +GEX walls repel when arriving from below.

View attachment 1033145

+gex repels, +vex attracts

but if gex is tall, it becomes magnet

that's greeks

OI walls are different - sp doesn't magnet or gravitate into an OI wall

the exception is when we are approaching 0dte where tall gamma wall = tall OI wall

if sp is below but near a tall gamma wall, especially those with high OI, it will magnet into it going up (dealers buy shares)

if sp is above but near a tall gamma wall, especially those with high OI, it will magnet into it going down (dealers sell shares)

if sp has an unusually large momentum (ie EM selling, hertz), all walls fall, including OI; we've seen that many, many times where sp sliced through all greek/oi walls like hot knife on butter (as recently as the friday nvda crash); during times like that no TA supp/res is safe at all

from my limited experience, MM will protect an OI call wall more than an OI put wall; @Max Plaid has more experience than me on this

4/5 majority of market participants (gamma) are placing bets on 172.5, dealers (vanna) are preferring 160-185 range and skewed towards puts

last 11 minutes today are all puts (size >= $100k)

-gex attracts, -vex repels

+gex repels, +vex attracts

but if gex is tall, it becomes magnet

that's greeks

OI walls are different - sp doesn't magnet or gravitate into an OI wall

the exception is when we are approaching 0dte where tall gamma wall = tall OI wall

if sp is below but near a tall gamma wall, especially those with high OI, it will magnet into it going up (dealers buy shares)

if sp is above but near a tall gamma wall, especially those with high OI, it will magnet into it going down (dealers sell shares)

if sp has an unusually large momentum (ie EM selling, hertz), all walls fall, including OI; we've seen that many, many times where sp sliced through all greek/oi walls like hot knife on butter (as recently as the friday nvda crash); during times like that no TA supp/res is safe at all

from my limited experience, MM will protect an OI call wall more than an OI put wall; @Max Plaid has more experience than me on this

4/5 majority of market participants (gamma) are placing bets on 172.5, dealers (vanna) are preferring 160-185 range and skewed towards puts

View attachment 1033157

last 11 minutes today are all puts (size >= $100k)

View attachment 1033159

Thank you

The only things that could move the SP prior to or at earnings are announcement of a new gigafactory (like India), date announcement for next gen reveal or FSD licencing with a major OEM. Other than that, we'll see lower SP. Maybe I'm missing something, but I'm playing it safe as I think the India announcement is way crazy overdue.

EVNow

Well-Known Member

Anyone who talks about "MMs" driving the market is a conspiracy theorist and usually won't make much moneyMakes you wonder why he's driving for Uber, unless he works for Citadel and that's just a cover story

ps : You could say the same thing about people who give advice on YT. If they are good (and thus successful), why would they need to do it ?

Anyone who talks about "MMs" driving the market is a conspiracy theorist and usually won't make much money

Here’s how I split the difference:

A) The data observed from option flow is empirical and can be useful.

B) Ascribing the various flows to certain people or groups is a sideshow and unnecessary.

When they come together I pay attention to “A” and ignore “B.”

Last edited:

-gex attracts, -vex repels

+gex repels, +vex attracts

but if gex is tall, it becomes magnet

that's greeks

OI walls are different - sp doesn't magnet or gravitate into an OI wall

the exception is when we are approaching 0dte where tall gamma wall = tall OI wall

if sp is below but near a tall gamma wall, especially those with high OI, it will magnet into it going up (dealers buy shares)

if sp is above but near a tall gamma wall, especially those with high OI, it will magnet into it going down (dealers sell shares)

if sp has an unusually large momentum (ie EM selling, hertz), all walls fall, including OI; we've seen that many, many times where sp sliced through all greek/oi walls like hot knife on butter (as recently as the friday nvda crash); during times like that no TA supp/res is safe at all

from my limited experience, MM will protect an OI call wall more than an OI put wall; @Max Plaid has more experience than me on this

4/5 majority of market participants (gamma) are placing bets on 172.5, dealers (vanna) are preferring 160-185 range and skewed towards puts

View attachment 1033157

last 11 minutes today are all puts (size >= $100k)

View attachment 1033159

In support of what you’ve explained, I just got a nugget from a friend of a friend of a friend who works in the HF industry:

“Consider that tall 4/5 $170 -GEX bar as a massive zone of interest that should act as support. However, support can break, and in this case if it does then I would expect a lot of aggressive selling pressure. Never assume MMs care what will happen with price or where price will go, they don't really care especially on an individual stock as they have excellent balancing mechanisms for nearly all eventualities.

“Also, note this week was the end of the quarter. The options landscape for the next few weeks will likely to look pretty different starting next Monday once the options chain does its soft-reset.”

Oh I wasn't looking to sell that strikeWell this was my thinking, buy LEAP +p to cover the downside, sell weeklies against them at crazy IV to recuperate the costs in a few weeks, then you're left with some +puts for free to let run or sell against with zero risk

I'd never write naked against that, I like to make some edgy trades, but I'm not crazy!

I hadn't thought about selling puts against the put - that's good thinking - maybe I'll revisit

P&D contains production and delivery units information. That's all.even margins are not discussed in P&D right ? we will know only in Conf Call

The more I read this guy's Tweets, the more he just comes across as a good old-fashioned stock pumperVery interesting. Maybe the plan is to pull TSLA after P&D numbers and then run it up. It makes no sense to be betting on the bullish side but I guess it doesn't matter what retail thinks. I'm struggling to see how the numbers can be anywhere close to a surprise.

Got a good price on the 04/05 170$ puts to hedge my portfolio and I plan to keep them through P&D. Also have 04/12 -200C.

edit:

I mean if this is why the guy thinks 180-220 next week

We are a bi-polar group. Everyone was buying Puts because P&D bad and SP going to Zero (because Energy ramping, CT ramping, massive new FSD software, and Gen 2 mean nothing), but selling 197.5CC for next week for 0.5 is too risky....

I didn't like -c197.50 for next week, not because of risk, but I was looking to lock in higher premium before the SP dumps, so imagine you sell for 50c next week, SP drops to 160's after P&D, then you win the 50c, great, but then you need to write in the 180's the week after to get another 50c/$1, and as the SP drops those trades carry more and more risk, so better to write for more $$$ at a higher strike with a longer expiry

an interesting idea... i have -C185s and -C195s for next week. may hold them into monday for max decay, then roll some to the 4/28 C200s

Well it all was for nothing as the SP never got back to 177.50, TSLA looking super-weak yesterday on low volume

bmd00

Member

My number 1 rule for trading TSLA is to focus on the bigger picture. Even if TSLA goes to 188, 200, or even 220 in the following weeks, anyone who thinks we have seen the bottom is smoking crack. We are in a solid downtrend. This is obvious after we broke the red trendline in Oct and retested it and resistance in Nov and Dec.

Has the downtrend reversed? Not likely. We have yet to see a major reversal in the trend. We need a crescendo of bearish price action, heavy volume, and a sudden reversal. Look for increasing volume near the end of this downtrend and a significant weekly and daily reversal candle.

If we somehow head straight up from here without these things occurring and break above the long-term downtrend leading back to Nov 4th, 2021, then and only then can I assume the downtrend has broken. I see this as a chance but less than 1%.

I

Has the downtrend reversed? Not likely. We have yet to see a major reversal in the trend. We need a crescendo of bearish price action, heavy volume, and a sudden reversal. Look for increasing volume near the end of this downtrend and a significant weekly and daily reversal candle.

If we somehow head straight up from here without these things occurring and break above the long-term downtrend leading back to Nov 4th, 2021, then and only then can I assume the downtrend has broken. I see this as a chance but less than 1%.

I

Last edited:

This. I wrote some for 5/17 200-205 range which gives more premium plus time to maneuver if things go the wrong way.better to write for more $$$ at a higher strike with a longer expiry

Anecdata, finally got FSD v12 pushed to one of my vehicles this morning with 12.3.2.1. Take it from someone who's been very skeptical of FSD in the past: it's pretty damn good. Good enough that it will discourage me from selling any more long-dated leap CCs.

Agreed. Even if we are to take off META style it will not happen until earnings.My number 1 rule for trading TSLA is to focus on the bigger picture. Even if TSLA goes to 188, 200, or even 220 in the following weeks, anyone who thinks we have seen the bottom is smoking crack. We are in a solid downtrend. This is obvious after we broke the red trendline in Oct and retested it and resistance in Nov and Dec.

Has the downtrend reversed? Not likely. We have yet to see a major reversal in the trend. We need a crescendo of bearish price action, heavy volume, and a sudden reversal. Look for increasing volume near the end of this downtrend and a significant weekly and daily reversal candle.

If we somehow head straight up from here without these things occurring and break above the long-term downtrend leading back to Nov 4th, 2021, then and only then can I assume the downtrend has broken. I see this as a chance but less than 1%.

View attachment 1033294

Same. I’ve had 12.3.2.1 for a couple of days now and overall it is very confident and has solved some of my major problems. It still hesitates for stop signs and very cautious in parking lots but that’s not necessarily a negative. Step change from V11 for sure.Anecdata, finally got FSD v12 pushed to one of my vehicles this morning with 12.3.2.1. Take it from someone who's been very skeptical of FSD in the past: it's pretty damn good. Good enough that it will discourage me from selling any more long-dated leap CCs.

It is making me bullish enough that I might start deploying my cash if TSLA drops from here and keep catching falling knives until I run out of cash. My guess is we bottom out between P&D and ER.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K