Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I think flow means today's volume while positioning is OI. So people are holding more puts than calls but today they're buying (back) calls, probably to take profit before a long weekend.

jeewee3000

Active Member

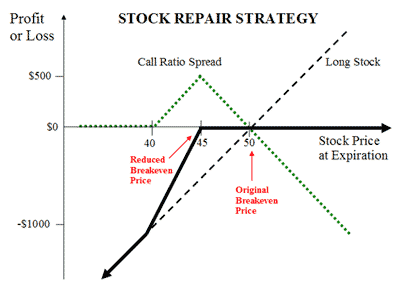

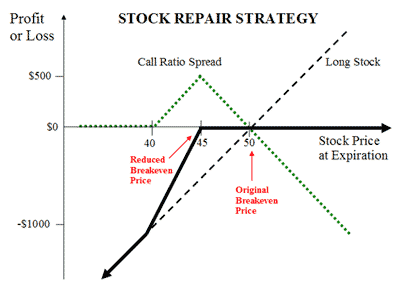

@Yoona : regarding stock repair strategy (in your The Wheel chart), you say in the stock repair step: "if stock up, exercise +c, assignment on 2x -c , result: no stock".

You have 200 shares before this step.

The sold calls result in the shares being called away at the strike of the sold calls.

But doesn't exercising the bought call ($800 in your example) mean you end up with 100 shares @ $80.000 ? Or do you mean you just sell the bought call for profit?

I'll have to do more maths on this, but does this always get you back to cost basis? (No need to reply, I'll check it out in detail when I have more time. Thanks for sharing your chart anyway)

You have 200 shares before this step.

The sold calls result in the shares being called away at the strike of the sold calls.

But doesn't exercising the bought call ($800 in your example) mean you end up with 100 shares @ $80.000 ? Or do you mean you just sell the bought call for profit?

I'll have to do more maths on this, but does this always get you back to cost basis? (No need to reply, I'll check it out in detail when I have more time. Thanks for sharing your chart anyway)

Yeah, it's a bit the same yes, but not quite as intense. The last time I bought a non-Tesla I haggled for some free upgrades and got themDoes Belgium have a more sane car sales system than the US? As in you have a sticker price, but what you pay comes down to your negotiating skills and the particular dealer you go to?

Here the price transparency with Tesla (even if the price is volatile) is generally a breath of fresh air for new customers.

stock repair is always +cx1 and -cx2@Yoona : regarding stock repair strategy (in your The Wheel chart), you say in the stock repair step: "if stock up, exercise +c, assignment on 2x -c , result: no stock".

You have 200 shares before this step.

The sold calls result in the shares being called away at the strike of the sold calls.

But doesn't exercising the bought call ($800 in your example) mean you end up with 100 shares @ $80.000 ? Or do you mean you just sell the bought call for profit?

I'll have to do more maths on this, but does this always get you back to cost basis? (No need to reply, I'll check it out in detail when I have more time. Thanks for sharing your chart anyway)

the 1st -c is the original CC (with stock)

the 2nd -c is paired with the +c (to make sure nothing is naked)

hence, stock repair is 2 covered calls (long + synthetic)

in my wheel, it would be

- +cx2 -cx4 if i implement the straddle step, or

- +cx1 -cx2 if i skip the straddle step

Stock Repair Strategy

You did your homework, picked a great stock, totally undervalued and ready for a nice price rise. However, after you bought the stock, the damn thing goes and drops 20%. So what do you do now?

Stock Repair Strategy Guide [Setup, Entry, Adjustment, Exit]

Stock repair is an options strategy used to help recover losses from a long stock position. Learn more with Option Alpha's free strategy guide.

"187.6"??Added back 30% of what I took off the table yesterday around 187.6, 170/165 put spreads exp 6/7. Will add more next week if the cost makes sense.

so very sorry to be the bearer of bad news@Yoona when you get a chance can you take a look and share your thoughts on TSLA for next week and after? Some mixed signals and curious what you’re seeing.

Thanks

we've seen this happen before, where we were given a large red gamma warning more than 1 month in advance that the stock would drop big:

we were warned as early as Feb 5 that ~150 was coming up:

so very sorry to be the bearer of bad news

View attachment 1050145

View attachment 1050148

we've seen this happen before, where we were given a large red gamma warning more than 1 month in advance that the stock would drop big:

Thanks.

1) What about the next week and two? So many green GEX bars imply bullish but I’ve also seen market ignore that too and do the opposite.

Pop and drop next week?

2) Are you suggesting 6/21 a hint of <100

Last edited:

Maybe, maybe not. Remember the below trade someone had made (which has certainly intrigued me far more than it warrants)? As of right now, Fidelity is quoting those options at $0.71, not the $7.71 that were paid, for a $2.1M loss / 90.8% loss (if still held, of course).

Bottom line...sometimes someone placing a large call buy order is just someone placing a large call buy order based on no more knowledge / information / ability-to-assess as the rest of us...maybe just someone hoping to get lucky or something.

Sold a ITM NVDA put when you said it was bound for a break outstock repair is always +cx1 and -cx2

the 1st -c is the original CC (with stock)

the 2nd -c is paired with the +c (to make sure nothing is naked)

hence, stock repair is 2 covered calls (long + synthetic)

in my wheel, it would be

correct, "this always get you back to cost basis" so grand total is 0 income BUT THERE IS A HIDDEN TRICK: if the credit of -cx2 is greater than the cost of +c1, you get a weekly income and that income gets even bigger if you leg in the +cx1 (buy at dip) and -cx2 (sell at peak)

- +cx2 -cx4 if i implement the straddle step, or

- +cx1 -cx2 if i skip the straddle step

Stock Repair Strategy

You did your homework, picked a great stock, totally undervalued and ready for a nice price rise. However, after you bought the stock, the damn thing goes and drops 20%. So what do you do now?optionstradingiq.com

Stock Repair Strategy Guide [Setup, Entry, Adjustment, Exit]

Stock repair is an options strategy used to help recover losses from a long stock position. Learn more with Option Alpha's free strategy guide.optionalpha.com

Can I send you 10% of my profits

Thank you

Attachments

Sell, more fool me for not treating this week's 25x -c170's yesterday - I had a limit sell into close, which missed by 5c, should have sold at market, would have been laughing today!

Anyway, so not trying to decide the best course of action, to roll:

- lot to next week -c170 for +$1 per contract

- roll to next week 22x contracts versus 25x for break-even

- 6/21 -c180 for a small debit

Have been waiting to see if we get a pull back to Max Pain 177.5 at any point, but it has been very stubborn today, despite the low volume, maybe it will come before close...

Anyway, so not trying to decide the best course of action, to roll:

- lot to next week -c170 for +$1 per contract

- roll to next week 22x contracts versus 25x for break-even

- 6/21 -c180 for a small debit

Have been waiting to see if we get a pull back to Max Pain 177.5 at any point, but it has been very stubborn today, despite the low volume, maybe it will come before close...

"A close above $179.42 neutralizes the sell signal and can see $195.44 by end of next week."$160.25 in play below $170.99. Above $170.99 can see $179.42 which can be shorted back to $170.99-160.25. A close above $179.42 neutralizes the sell signal and can see $195.44 by end of next week.

Watch/Listen at 1.75x speed:

View attachment 1049914

And here we are at $179.92 already...

4:02 PM EST edit: Perhaps I got myself all worked up for nothing, having closed today at $179.24...

Last edited:

Next few weeks are going to be uniquely difficult to sniff and trade direction. Opportunity sits right in the volatility, yet can easily slip right through our fingers.

thenewguy1979

"The" Dog

Maybe Maybe we are hitting that super rare scenarios where TSLA just pump to the Moon........carry by Market Euphoria and AI AI AI?

My Put Spread 165/160 are at 1/3 values now. But Exp are still out there and cost are low. Will hold for now.

Meanwhile, riding the NVDA and AAPL bandwagon for next few weeks. NVDA 1100+ anyone. Wicked did outline a potential of 1180 in 2-3 weeks, as long as 1034 HOLD.

Sold 1020 PUTS for 6/7 for NVDA

Bought 192.5 CALL for 5/31 for AAPL

Different stroke for different stoke....

My Put Spread 165/160 are at 1/3 values now. But Exp are still out there and cost are low. Will hold for now.

Meanwhile, riding the NVDA and AAPL bandwagon for next few weeks. NVDA 1100+ anyone. Wicked did outline a potential of 1180 in 2-3 weeks, as long as 1034 HOLD.

Sold 1020 PUTS for 6/7 for NVDA

Bought 192.5 CALL for 5/31 for AAPL

Different stroke for different stoke....

Last edited:

No STOCH>60 on the 1-hr, implies strength is not to be believed:

STOCH-48

Daily also lost STOCH >60:

STOCH-41

STOCH-48

Daily also lost STOCH >60:

STOCH-41

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K